Head and Shoulders which is the most read and heard pattern in technical analysis and generally used at convenience by technical analysts around the world to justify their bias.

The pattern works better in conjunction with other conclusions else it ends up in wishful thinking many times :). I had posted an article on wishful thinking on Inverted HnS – Link

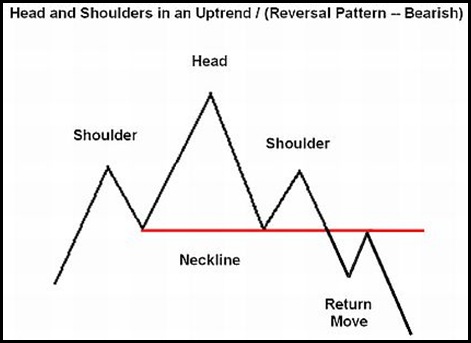

The pattern is as shown below

Its a belief that once a pattern is well known chances of the pattern failing is high or the targets being achieved too quickly before people jump on to it.

But in the above pattern what i have seen is many analyst use it with their convenience and independently of other formations to aid the possible conclusion.

Lets look into some possible wishful thinking alternatives.

Alternative 1

Things to note.

- > The left shoulder has taken a very long time and there seems to be no symmetry in the shoulders.

- > Also if we were to look a little back into history there are 3 shoulders on the left side.

- > The markets are still away from the neckline.

So for now expecting the formation to be completed then index should move to head size which is 3500-4000 points which comes to 13-14k target.

All in all its wishful thinking till we see prices showing direction.

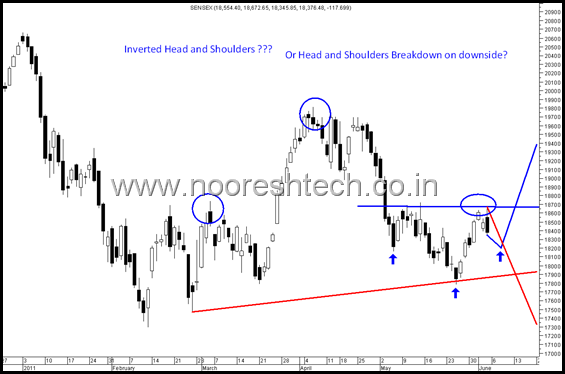

Alternative 2-3

Now in the above alternative we have a possible head and shoulders of smaller scale compared to previous one looking towards a downside breakdown.

At the same time there is a possible Inverted Head and Shoulders pointing to 19800 🙂

So the technical charts may look interesting with the projections and different interpretations but as a matter of fact it is just conveniently used to justify a biased approach.

I had even read a pattern on Dow predicting 4000 levels 😛 on possible right head being formed 😛 hilarious will try to find that chart on the net.

We have a different way of looking into Head and Shoulders even in target and time calculations 😛 which is tried and tested.

Have a look into the following two posts where i discussed the inverted head and shoulders which worked out very well.

https://nooreshtech.co.in/2009/07/what-do-you-wanna-see-see-what-market.html

Then again https://nooreshtech.co.in/wp-content/uploads/blogger/999-SensexInvertedHNS.png

For now a simpler way to look into the current formation is a nice long channel and a triangle compression which will happen over the next few months. ( This is again my interpretation )

- > The markets have been in a nice 2000-2400 point channel for a long time with a breakout move in Sept 2008.

- > Markets are forming a huge triangle which will compress over the next few months and finally lead to a breakout. Possible levels that time would be 19000-19300 and 17000-17300 broadly.

- > Till then play out the range look to buy at 17800 ( lower trendline 1 ) or at 17300 ( lower trendline 2 ) for bounce back trades.

- > On further bounce one may even shout at the top trendline.

The above views are mine and i have no bias towards either of the alternatives 🙂 but none of them are conclusive enough on the possible head and shoulders. But one conclusion is post June-July consolidation it could be an interesting 6-9 months of strong directional move.

TECHNICAL ANALYSIS TRAINING SESSION in Delhi/Mumbai/Pune planned in next 2 months. For more details call 09821237002 Kazim and Asif 09833666151 or mail to analyseindia@analyseindia.com.

If you would like to reach me mail me on nooreshtech@analyseindia.com

Cheers,

Happy Investing

Nooresh

June 6, 2011

IS you call on gold with Sl 20500 still valie

June 7, 2011

Sir, Everyday I eagerly wait for posts to arrive. Some of your posts like the one above helps to better understand concepts. Appreciate the time to take to write such educative posts and enlighten TA students like me.

June 7, 2011

Sir,

On the same lines of H&S, I want to confirm the formation of H&S on charts of Gail with neckline arnd 425.Will you say that the shoulders are in symmetry. Or is this just wishful thinking.

June 8, 2011

Nidhi,

I would suggest you use HnS patterns with other technical observations.

Also the effectiveness of HNS pattern has reduced with many false starts on it where full targets are not achieved. ONGC gave more of a range breakout at 285-290 which was a better technical entry also 280 levels got tested and then a move to 320 again.

Also one more thing is to look into risk-reward.

June 7, 2011

Sorry to bother you with one more doubt. On charts of ONGC there was a formation of a small Inverse H&S with neckline arnd 305. The right shoulder is formed arnd Jan’11, Head arnd Feb ’11 and left shoulder around April11. Well the IH&S worked to some extent and stock gave a breakout till 325. But from there it revisited its trendline and have pierced below that. Was the interpretation wrong or the pattern simply didnot work?

June 7, 2011

great article boss!!

again nice one from you..