In the last few days we have seen some correction in the Nifty50 and other indices.

Nifty50 from a peak of 18600 made a low of 17216 yesterday.

Nifty has broken the recent swing low of 17600. This has not happened often in the last 1.5 years.

Let us look at charts of some indices.

Nifty Midcap 100

- Nifty Midcap 100 a sharper bounce yesterday compared to Nifty.

- Holding above the swing lows of last 2-3 months.

- Holding above the trendline.

- Unlike the Nifty the Midcap Index is still holding up well.

Nifty Smallcap 100

- Nifty Smallcap 100 had a stronger bounce compared to Nifty 50

- Holding above the swing lows of last 2-3 months.

- Tested the trendline.

- Unlike the Nifty the Smallcap Index is still holding up well.

BSE Smallcap

- BSE Smallcap had a stronger bounce yesterday

- Holding above the swing lows.

- Breaks below the trendline.

- Holding better than Nifty.

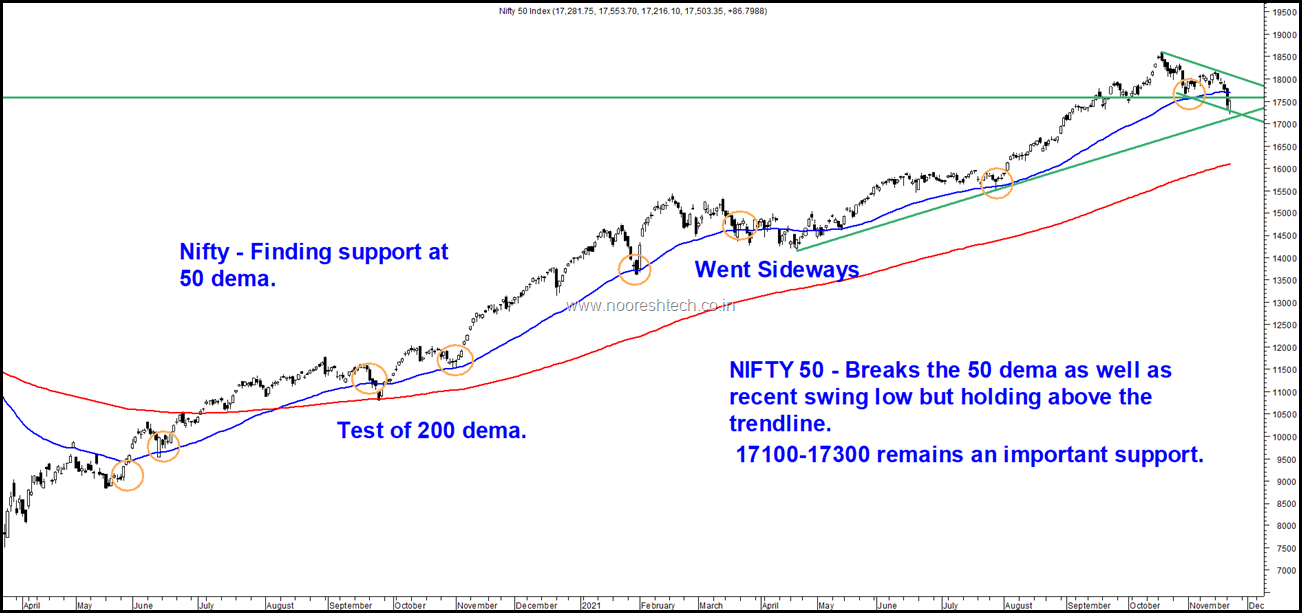

Nifty 50 – Technical View

- Nifty has closed below the recent swing low of 17600.

- Still holding above the trendline.

- 17100-17300 remains an important support.

- Over the last 1.5 years the 50 dema has acted as a good support as seen by the orange ellipses on the chart.

- A break below 50 dema happened in March 21 and it went into a sideways consolidation

- A break below 50 dema in September 2020 did a test of 200 dema.

- Given the global charts yet to breakdown and holding well we could expect a sideways consolidation rather than a test of 200 dema at 16k odd.

What Next ?

The chart below is with a lot of comments and covers a lot of cycles through last decade. Take some time to read through it.

The explanation of the chart actually needs a longer explanation or a video. Will do that some time in near future.

- In November 2020 there was a big catchup left in the broader markets. Do look at this article in November 2020 -

Nifty up But Stocks are Down !!. Time for Stocks to Catch Up in coming years.

- In November 2021 the BSE Smallcap Index is up 40-50% from the highs of 2018 and Nifty too is up 40-50% from the highs of 2020. The catch up is done.

- The Smallcap Indices have not overshot the Nifty in a big way if we look at a time frame of 3-5 years. Does not make sense to look at the move from lows of 2020 similar to 2013.

- 2010-2013 and 2018-2020 have a lot of similarity in terms of the Bear Cycle and then a Final Blow. Big Move in Nifty with Elections and then Smallcap Catchup.

- 2014-2015 and 2020-2021 look similar in terms of a catch up.

- There is a good possibility we go into a cycle similar to 2015 where the Nifty drifted lower or can stay sideways with relative outperformance in Smallcaps but not by a big margin.

- A lot of new sectors took leadership in 2015 and something like a Pharma peaked out. Time to go and look at 2015-2016 and think what sectors could lead and what could top out.

Conclusion

- Everything Going Up – Microcap, Smallcap, Midcap, LargeCaps and kachracaps seems to be over.

- It will keep getting very selective and new sectors could take leadership if we are in a similar cycle.

- One has to be extremely careful in some of the big beneficiaries of the covid related sectors – Pharma, Midcap Smallcap IT

- Another sector to be careful would be Speciality Chemicals which have had a 5 year cycle very similar to Pharma of 2010-2015. Could well top out or underperform for next couple of years.

- Simply put time to exit Speciality Chemicals is the view. It may or may not top out but no more can it be the best performer.

- The hunt for new leadership continues. It could come from sectors which have done nothing over last 10 years – Real Estate, Power, Infra etc.

TECHNICAL ANALYSIS TRAINING SESSION – Planning our Good Old Classroom Training Session of 2 days in Mumbai in December/January.

The Course Details - https://nooreshtech.co.in/technical-analysis-training/classroom-training

Price Rs 16000.

If interested mail on nooreshtech@analyseindia.com with preferred weekend dates ( will be easier to plan .) or whatsapp on 7977801488

For those who cannot make it the Online Course now has same curriculum.

Online Technical Analysis Video Course – A good time to now do it @Rs 6000 .

Smallcase Launch - Smallcase Launch–Top 10 Insider Trading, Top 10 Techno Funda, Top 10 Value & Thematic Smallcases.

LinkTree - Links to all our services and products - https://linktr.ee/NooreshTech ( Do checkout )

For any queries whatsapp 7977801488 pr mail nooreshtech@analyseindia.com