Every week, I manually review almost all the NSE stocks one by one and create a list of stocks that look interesting. This further gets tracked for breakouts and filtered into The Idea Lab & Technical Traders Club

Ten Interesting Smallcap Charts on Radar

- Asahi India Glass

In a tight range. Breakout above 770-780

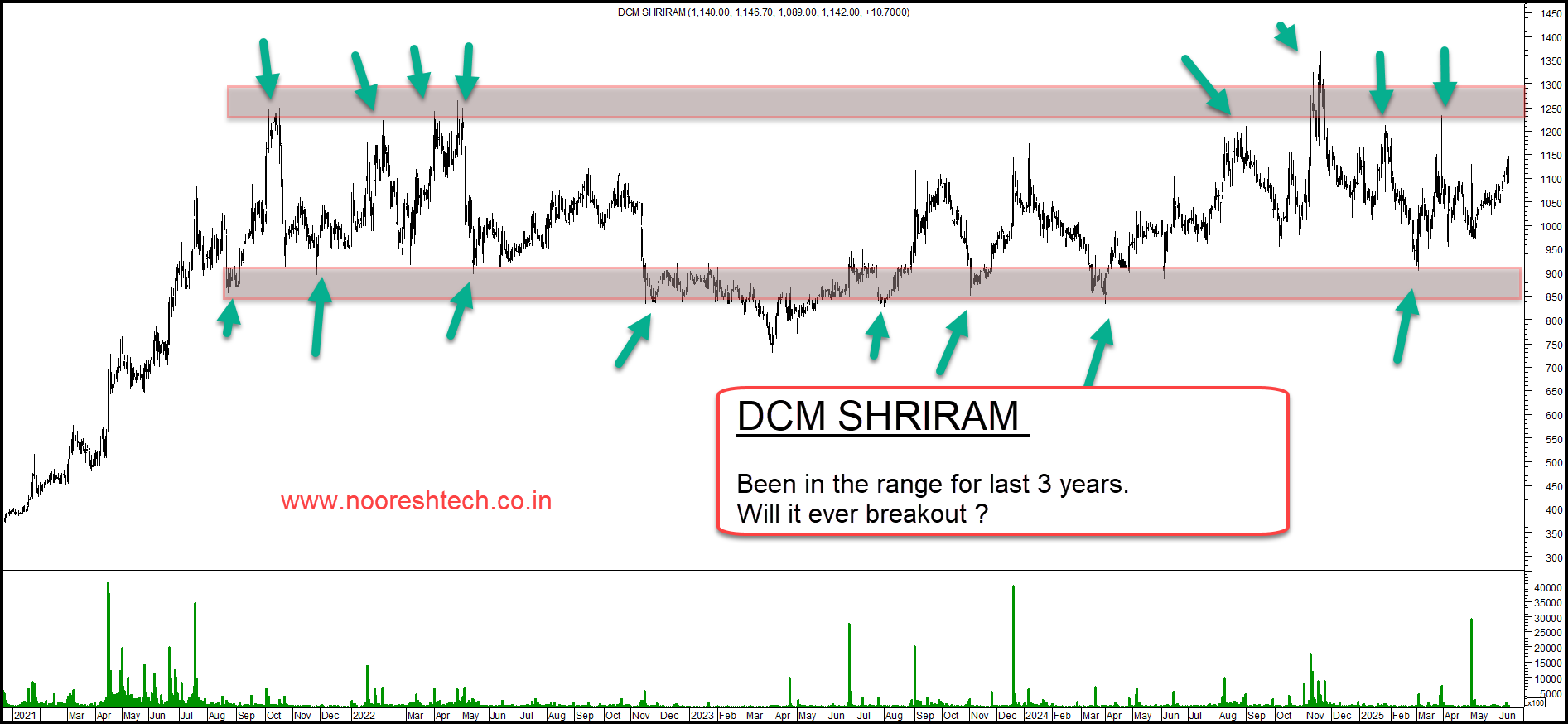

2) DCM Shriram

Been in the range for the last 3 years.

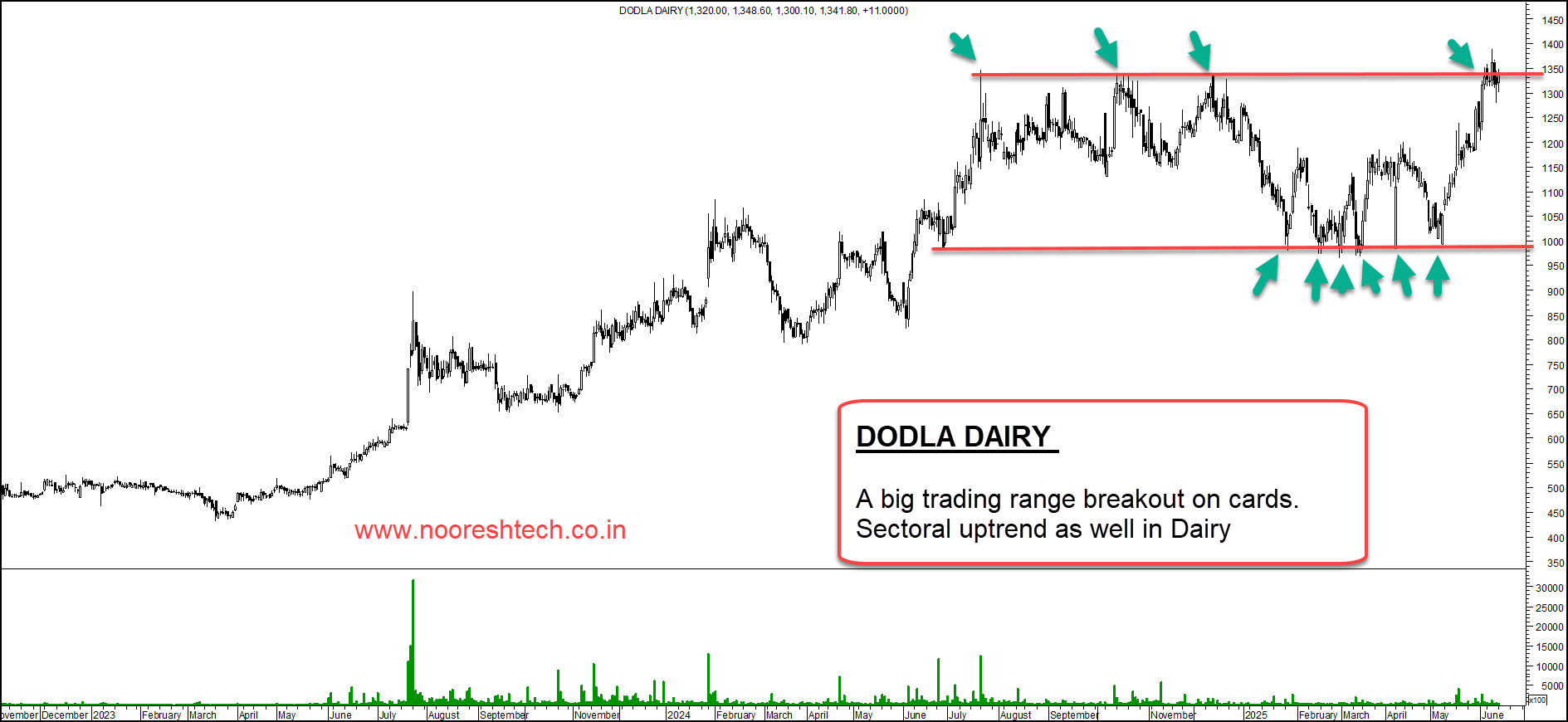

3) Dodla Dairy

A big trading range breakout on cards. Dairy Sector in an uptrend.

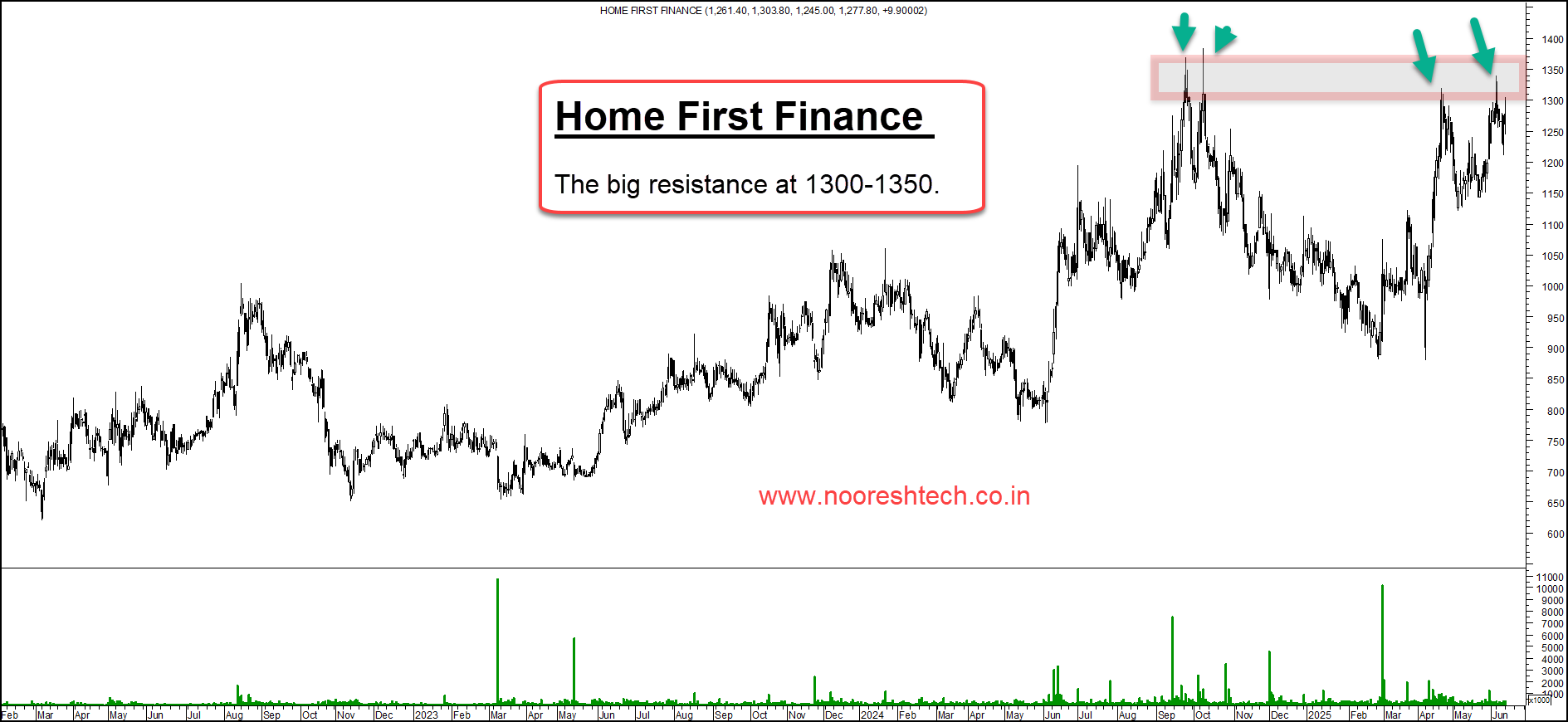

4) Home First Finance

The big resistance at 1300-1350

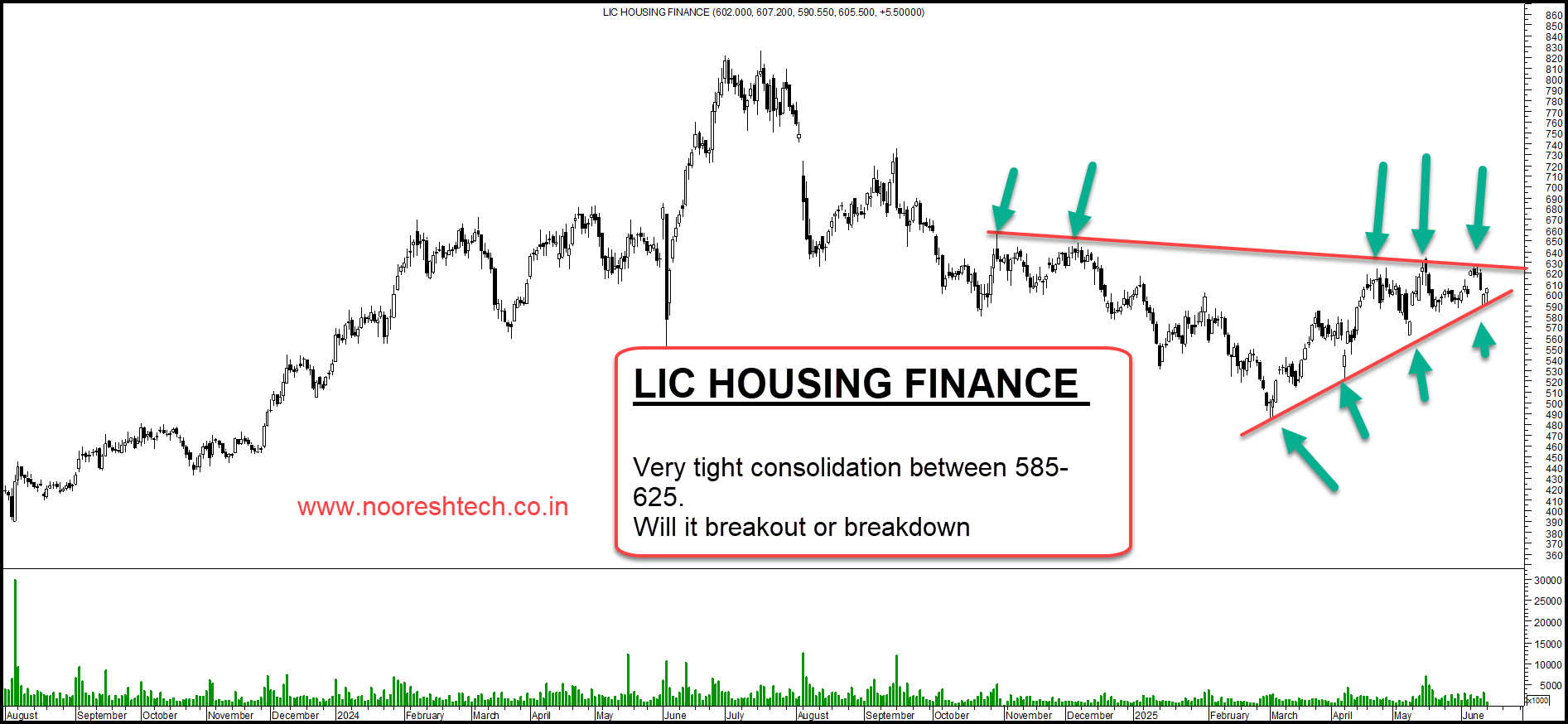

5) LIC Housing Finance

Very tight consolidation between 585-625.

6) Macrotech Developers ( Lodha )

Can it breakout of the range.

7) Parag Milk

Breaking out with volumes.

8) Royal Orchid Hotels

12-18 months trading band. Interesting combination with next-gen coming in and the Hotel sector in an uptrend.

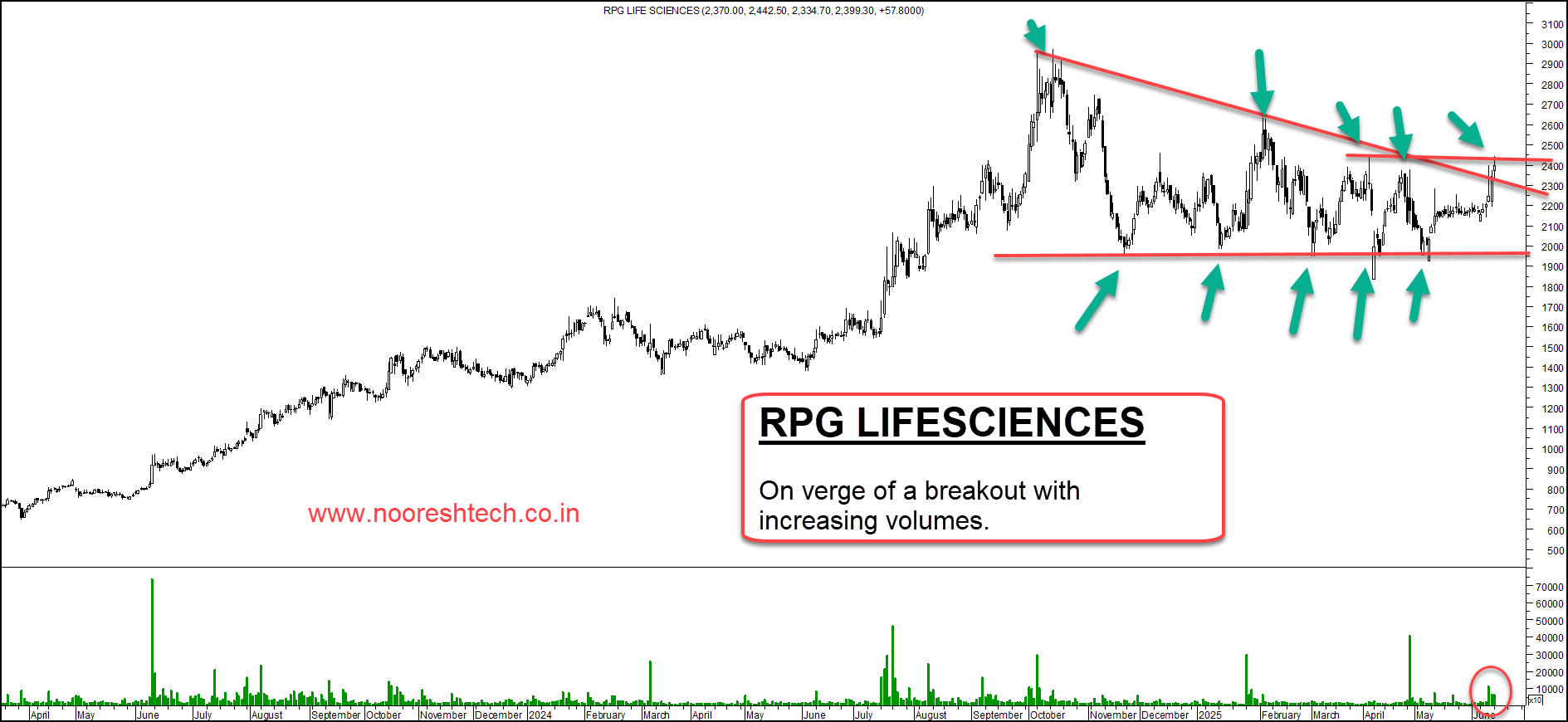

9) RPG Lifesciences

On verge of a breakout with increasing volumes.

10) Sunflag Iron

Interesting co with Holding Value in Lloyd Metals more than the Market Cap.

Mr. Nooresh Merani SEBI Registered Research Analyst INH000008075 Read Full Disclosure on

NooreshTech Research Services Overview

1. Technical Traders Club – Techno Funda Investing

- Two model portfolios: Trading Ideas (3–6 months) & Smallcap Folio (6–18 months)

- Maximum 10–12 open positions per portfolio

- Ideal for investors with a medium to long-term view

- Updates via WhatsApp, Email & Telegram

- Subscription: ₹15,340 (6 months) | ₹25,960 (12 months)

- Payment & Details: https://shorturl.at/Rz2fS

2. The Idea Lab – Momentum Trading

- Momentum-based short-term trades (15 days to 3 months)

- Maximum 30 open positions, equal weight approach

- Based purely on technical analysis

- Ideal for traders with a short to medium-term view

- Telegram-only updates

- Subscription: ₹1,770 (Monthly) | ₹4,720 (Quarterly) | ₹8,850 (Semi-Annual) | ₹17,700 (Annual)

- Payment & Details: https://shorturl.at/Lsd7M

3. Smallcases – Equal Weight Portfolios

- Top 10 Promoter Buying: Focused on stocks with strong promoter buying

- Top 10 Techno Funda: Combines Technical & Fundamental analysis

- Breakout & Trail Momentum : Momentum Trading - 20 stocks, 5% each

- Low churn, equal-weight portfolios

- Invest directly via the Smallcase platform

- Ideal for long-term investors

- Payment & Details: https://shorturl.at/bQenu

4. Option Strategies by NooreshTech ( NEW )

- Limited Risk Option Strategies across Index and Liquid Stock Options.

- Holding period: Typically between 1 to 4 weeks.

- Capital & Positioning: Min Capital: ₹10 lakhs

- Max Open Positions: 5-8 open positions

- Ideal for those who understand derivatives risks and seek moderate, consistent returns.

- Telegram-only updates

- Subscription: ₹10,620 (Quarterly) | ₹17,700 (Semi-Annual) | ₹29,500 (Annual)

- Payment & Details: https://shorturl.at/ZYlYy

Support & Queries:

- WhatsApp: 7977801488

- SEBI Registered: Nooresh Merani (INH000008075)

- Disclaimer : https://shorturl.at/kgosD