This is a post with no actionables but some interesting stuff to read.

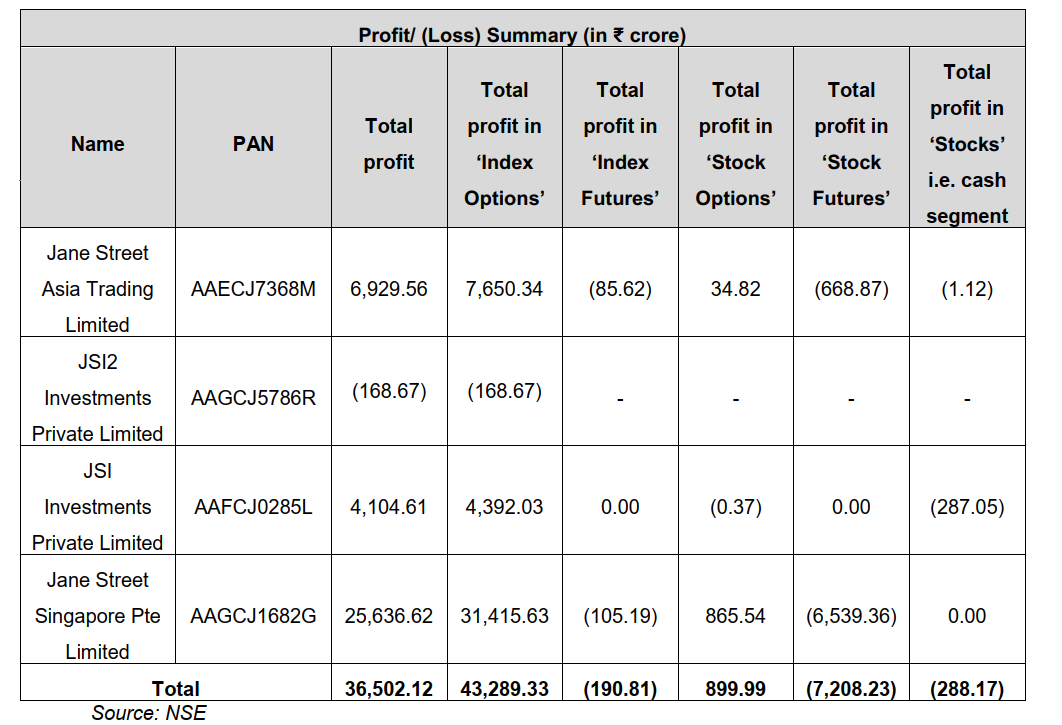

1)Jane Street - Making the Indices dance with 15k crores and profiting from it.

A couple of good explainers on this.

https://x.com/kirubaakaran/status/1940954539802480899

Read the Annexures link at the bottom. 296 pages - Super Detailed.

My amazing observations from the order

JaneStreet Sebi Order Amazing Things

Jane Street is no Plain Jane.

1) FPIs are not allowed to trade Intraday in the Cash Segment. Jane Street set up Indian entity JSI Investments Private Limited to intraday trade the Cash Segment 🙂

2) SEBI interacts in August. Jane Street opens another entity JSI2 Investments Private Limited in September 🙂

3) NSE sends a caution letter on Feb 6 2025 On 10th May 2025 Jane Streets does expiry uptick via Stock/Futures. Avoids cash Segment.

4) FPI = Foreign Portfolio Investor. ( Naah Trader) The Jane Street FPI group had only 311 cr in equity holdings at month-end between January and May 2025.

5) Jane Street had Margins !! Jane Street Group FPIs were instead holding on average INR 15,325 crores of India Government Securities. (That's a lot of money. )

6) Only 2.5% of FPIs are Algo Traders. As per data published in SEBI’s Analysis of Profits & Losses in the Equity Derivatives Segment (FY22-FY24)29 that out of 11,219 FPIs registered with SEBI as on March 31, 2024, only 2.50% of the FPIs are engaged in algorithmic trading.

7) Urgency for Order Jane Street continued to trade in a similar manner in May 2025 even after an explicit advisory was issued in Feb 2025. Order states "JS Group is not a good-faith actor that can be, or deserves to be, trusted. "

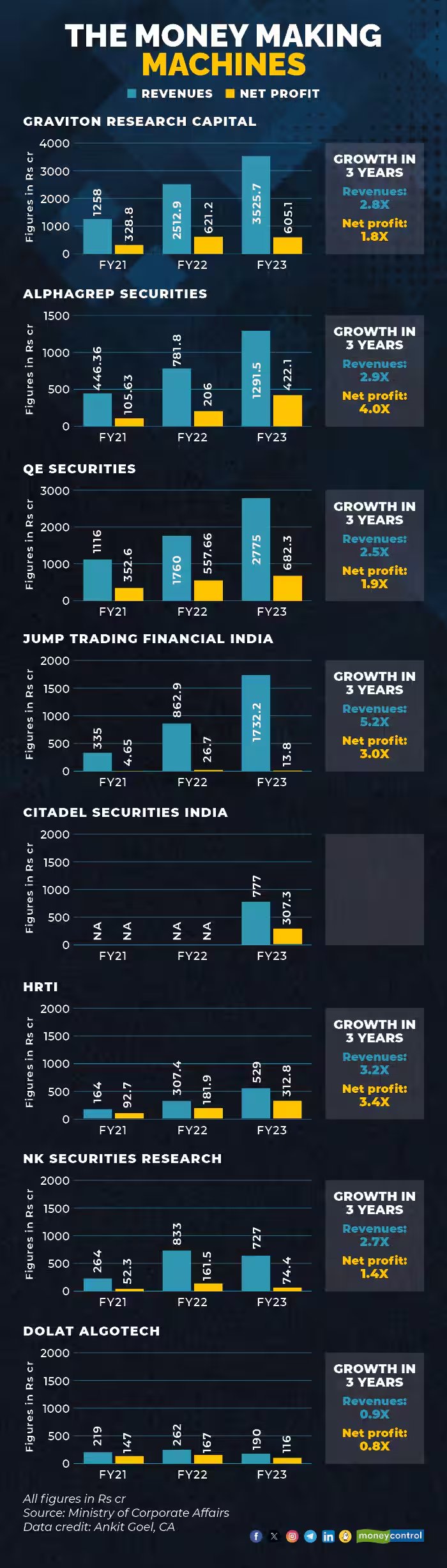

2) Algo Trading Firms/HFTs are almost like a Tax on every order.

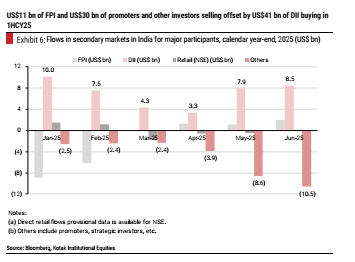

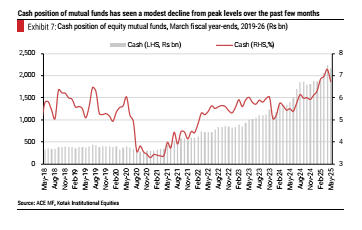

3) DIIs buying out Promoters and FPIs

4) Myth - Benchmark Indices like #Nifty50 , #Sensex, #BankNifty are reflection of the Economy!!

NooreshTech Research Services Overview

1. Technical Traders Club – Techno Funda Investing

- Two model portfolios: Trading Ideas (3–6 months) & Smallcap Folio (6–18 months)

- Maximum 10–12 open positions per portfolio

- Ideal for investors with a medium to long-term view

- Updates via WhatsApp, Email & Telegram

- Subscription: ₹15,340 (6 months) | ₹25,960 (12 months)

- Payment & Details: https://shorturl.at/Rz2fS

2. The Idea Lab – Momentum Trading

- Momentum-based short-term trades (15 days to 3 months)

- Maximum 30 open positions, equal weight approach

- Based purely on technical analysis

- Ideal for traders with a short to medium-term view

- Telegram-only updates

- Subscription: ₹1,770 (Monthly) | ₹4,720 (Quarterly) | ₹8,850 (Semi-Annual) | ₹17,700 (Annual)

- Payment & Details: https://shorturl.at/Lsd7M

3. Smallcases – Equal Weight Portfolios

- Top 10 Promoter Buying: Focused on stocks with strong promoter buying

- Top 10 Techno Funda: Combines Technical & Fundamental analysis

- Breakout & Trail Momentum : Momentum Trading - 20 stocks, 5% each

- Low churn, equal-weight portfolios

- Invest directly via the Smallcase platform

- Ideal for long-term investors

- Payment & Details: https://shorturl.at/bQenu

4. Option Strategies by NooreshTech ( NEW )

- Limited Risk Option Strategies across Index and Liquid Stock Options.

- Holding period: Typically between 1 to 4 weeks.

- Capital & Positioning: Min Capital: ₹10 lakhs

- Max Open Positions: 5-8 open positions

- Ideal for those who understand derivatives risks and seek moderate, consistent returns.

- Telegram-only updates

- Subscription: ₹10,620 (Quarterly) | ₹17,700 (Semi-Annual) | ₹29,500 (Annual)

- Payment & Details: https://shorturl.at/ZYlYy

Support & Queries:

- WhatsApp: 7977801488

- SEBI Registered: Nooresh Merani (INH000008075)

- Disclaimer : https://shorturl.at/kgosD