My earlier articles on this topic

1) Nifty 2016 is a very different animal from Nifty 2008 !!

2) The Ship of Theseus Paradox – Nifty 2008 and Nifty 2016

3) This Time its Different–Nifty 50

A very recent article where we looked at how its Never been so bad for Equities -

Equity–Never been so Bad so Quick. What Next ?

In this article when we look at the Nifty structure today and even the structure of the Indian Market we realize the Nifty50 is a different India itself.

The Nifty Calculator for April 2020.

You can download the calculator for Nifty from this link – Nifty Calculator April 2020

Try guessing Nifty – Read this post

Nifty is a different India

Over the years and decades we have seen Nifty running away from the representation of the Economy of India.

Nifty is a Free-Float Market Cap Index so more weights to companies with lower promoter shareholding makes it Bank and Financials Heavy.

After the current crisis it seems Nifty represents an altogether different India or just a fraction of India.

Let us see some data points.

1) Top Heavy

- Top 5 stocks = 42.5% of Nifty

- Top 7 stocks = 52.1% of Nifty

- Top 10 stocks = 62.6% of Nifty

- Top 20 stocks = 80% of Nifty

- The Bottom 20 = 11% of Nifty

Top 7 stocks are 52.1% of the Nifty !!!

I2) Group Heavy

- Reliance Industires = 11.54%

- HDFC and HDFC Bank = 18.63%

30% of the weight by Reliance and HDFC group

3) Sector Heavy

- Banking and Financial Services = 36.2% of Nifty ( Down from 40% in 2019 )

- Information Technology = 14.5% of Nifty

- Consumer Goods = 13.1 % of Nifty

63.8% of Nifty is in above 3 sectors.

4) Other Sectors do not matter.

- Telecom at 3.16% ( need to add a good bit of Reliance)

- Pharma at 3.11 %

- Metals 2.62%

- Automobile 5%

- Power 2.11 %

The Total Indian Market Capitalization

Total BSE Market Capitalization = 1,23,83,500 cr.

Top 10 stocks = 33.5%

Top 20 Stocks = 44.5%

Top 30 stocks = 51.5%

Top 50 Stocks = 61%

Almost 51.5% of the marketcap in top 30 names where 2000-2200 stocks trade everyday and almost 3000 stocks available for trading on BSE.

Conclusion –A lot of Dilemma

- How much percentage of GDP of India does the Nifty capture ? ( My guess 20-40% ) so how do you use MarketCap/GDP indicator

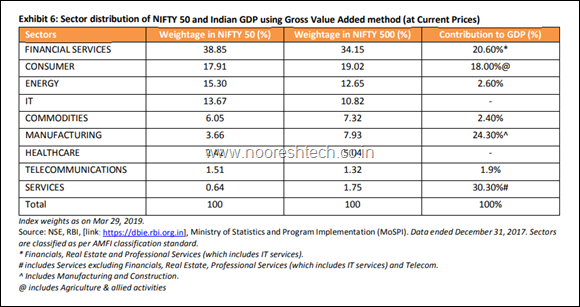

This data from Nifty50 White Paper by NSE.

Try taking into account listed and unlisted !!

- For a long time Financials have dominated the Index. Earlier problem was how to value it on P-E when its generally looked at in terms of Book Value.

- Now if a few banks take big write-offs in coming year the E evaporates. How do you calculate trailing P-E for Nifty? ( When small PSU Banks did big write-offs … Smallcap Index P-E was 90-100)

- Consumer Goods at 13% of the Nifty have very high P-E. Distorts the overall P-E of Nifty

- Power, Metals, Construction, Cements do not even command 10% of the Nifty. The biggest drivers of Jobs and GDP.

- The categorization of companies by SEBI has made the Mutual Funds only on the top liquid names and the polarization continues to increase with the Covid19.

- For example EPFO buys on Nifty50 ETF and to the tune of 20-30k crores annually.

- The difference in Valuation for a a large cap and smallcap is at a new record. Even if its same sector.

- Even for a Technical Analyst the dilemma is one stock with a good or bad news can change the extreme short term picture of Nifty !!

- Stop looking at Nifty to make a guess on Economy of India !!

- The broader market companies beyond the top 50-100-200 companies have been decimated and a lot of companies are available below liquidation value ( forget even Replacement Cost.) and there are no buyers for the same given the Covid19 scare. The volumes continue to dry down for rest of the market. Lots of opportunities will spring up which can be bought in near future or when markets turn. There is never panic buying or margin buying on the way up so keep researching and tracking.

- Another dilemma is Broader Market topped out in 2018 but Nifty topped out only in 2020. Will we see Nifty bottom out first or Broader Market bottom out first ?

- Apart from Nifty and the markets the biggest dilemma is towards the reaction to Covid19 and the fall started with the Medical Scare and will it end with a Medical Discovery or it will end with a long drawn painful period of consolidation which this time may not just impact us financially, mentally but even socially.

Personal Thoughts

- The Broader market has been already hit badly with 80% of the stocks down more than 50% from highs and it can get even worse before it gets any better. How much part of the pain is over is anybody's guess but it is definitely not the start of the pain so we are at least some or big way through.

- A Bear market and Bad Economic Scenario hits you in more ways than just the Equity Portfolio. So prepare yourself for hits from unexpected corners and keep faith.

- I stay in a locality with high cases and a city which has the maximum cases in the country. I do not know what is more scary for me the Equity Portfolio, Business or the scare of Covid19.

- I do not have a clear view on the market or on the World at this point of time and we all had similar dilemmas in previous bear markets and bad economic cycles. We have seen markets go through subsequent legs of fall or a good consolidation after the first 30-40% drop. So do we have another leg of fall or consolidation is anybody’s guess.

- History only shows that humanity finds a way to survive,adapt and thrive over the long term. When things are normalizing or closer to normalizing the Market indicates it through price action.

- These are times when you focus on yourself, your family, hobbies and to learn to new things, read new things. This has been my way to cope up with hits in 2008/2013. Being worried but not depressed in 2008-2009 or in 2013 helped in getting back up with full strength when there was clarity in 2009 and 2014. ( My list of mistakes in 2018-2020 are terrible and long.). Hopefully will be able to bounce back like previous times

- Wish you Best of Luck & Prayers for Everyone's safety !!