The current move has beaten all historical records. Did not expect it to be 2008 but the ferocity of the move and the nature has broken 2008 records.

The move is a case of liquidation and panic with no logic as there has been not even a few days of relief rally. We had a lot of relief rallies in 2008.

Maybe No relief rally because this was a liquidation move with barely much of short participation and so no short covering

So where does it stop ? Nobody knows.

There have been a lot of firsts in everything in this move. When was the World in Lockdown ever for so long?

There are a lot of comparisons as to how this is going to be like the greatest economic depression, in that case Equity will be least of your concerns. All asset classes and cashflow modes will be destructed. Its easy to say many banks will fold up but your #FDs will not be at risk, your #RealEstate will be up, your Salaries will keep coming. If you believe in doomsday ( Buy an Island or a Bunker)

Two Binary Scenarios.

1) The covid-19 shutdown can last 1-2-3-6 months and if one believes the world will survive than it will take its own time for the economy to settle down and get back to its earlier state in 6-18 months. Can be faster also.

2) The covid-19 will create the biggest economic depression and most of us will get the virus. In that case all will sink in different problems. No solution to it ( Unless you can buy a self-sustaining island/bunker)

I have no expertise on the medical side to have a clue but would like to believe the scenario is 1.

( My simple guess is April 1st week onwards New cases should reduce around the world.)

The mortality rate of covid-19 would be low but it has killed most of the stock prices in various ways. Nifty is at 7500-8000 but apart from the top 15 stocks most are now at 4000-6500 Nifty. Stock prices can go to any levels if there is no buyer/liquidity or a margin seller. Not all businesses shut of easily. If the business can survive the stock will to over a period of time.

The questions am asking is if India and the world survives the #Covid19 scare will TVMedia be at 30k cr mkt cap with hardly any debt, StainlessSteel 40-45% of it for 9000 cr enterprise value. Just some examples and one can do it for powergrids,powersector,cigarettes, hotels, metals, pharma etc. Panic Selling has no Logic and anything is possible due to automated margin/redemption selling. Buying Panics are rare so you may get your chances. So read now maybe buy later.

The fall has never been so bad and so quick. This after a slow laborious upmove in last many years. Unlike 2008 when Benchmark Indices had gone from 3-7x the preceding Bull Market was nowhere close.

Its never been so bad so Quick

A lot of these numbers were starting to improve from end of 19 to Jan 2020 and then Covid hit us and things have gone crazy.

( Data used – Only NSE Stocks.Even if some stocks missing due to error from data vendor or BSE also taken the % fall numbers are similar to the following observations. )

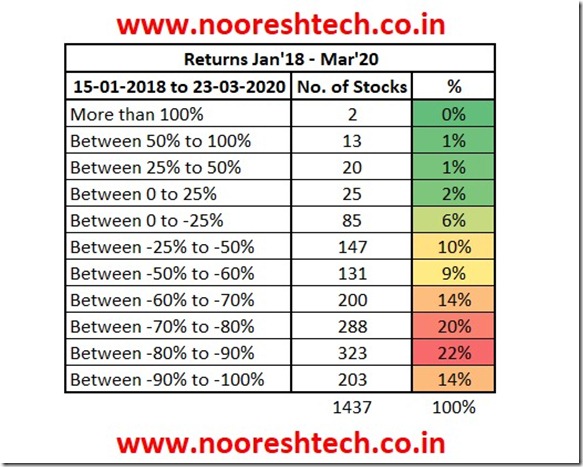

1) 15-01-2018 to 23-03-2020

- 79% of stocks are down more than 50%

- 70% of stocks are down more than 60%

- 56% of stocks are down more than 70%

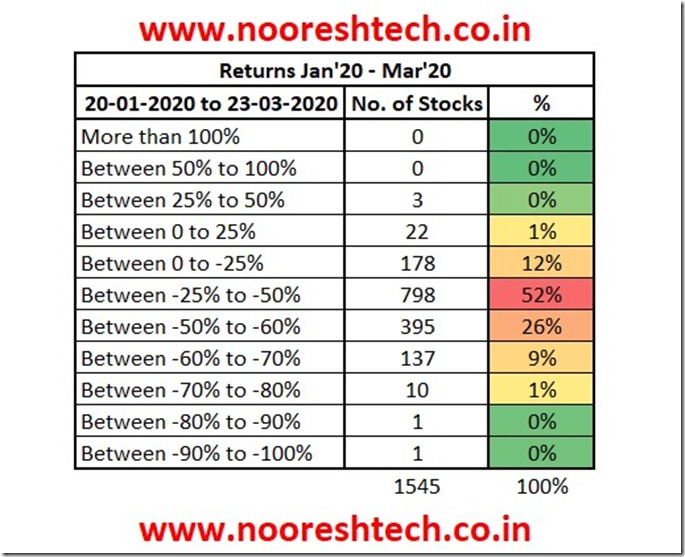

2) 08-01-2020 to 23-03-2020

- 36% of stocks are down more than 50%

- 88% of stocks are down more than 25%

- 64% of stocks are down more than 40%

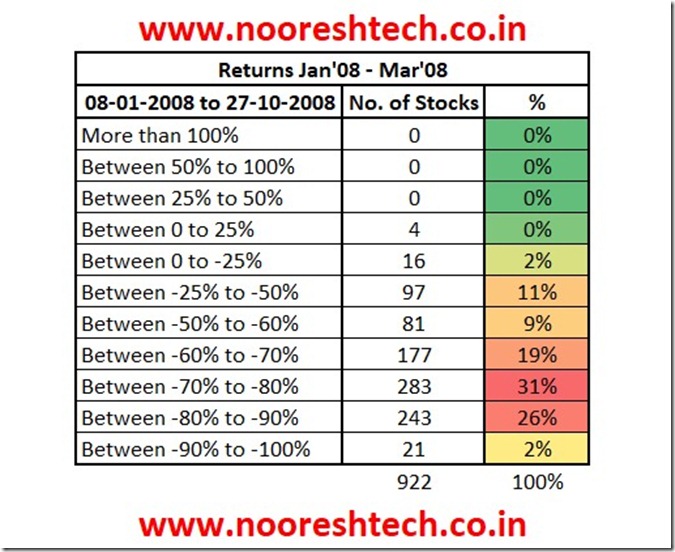

3) 2008 – How bad was that ?

- 87% of stocks were down more than 50%.

- 79% of stocks were down more than 60%

- 60% of stocks were down more than 70%.

Remember 2008 was after a 7x move from 2003-2007 and 3x move from 2005-2007 ( after new ATH)

A lot of CAGR returns from 5-10-15-20 years will not be able to beat the Fixed Income Return

If you notice whenever it has been this bad when 5-10-15-20 years.

So if one removes the top 15 stocks and looks at all the parameters of pain it is already 2008 !!

( 87% of stocks down 50% in 2008 is now 79% of stocks down 50% )

The 2020 move did some things very differently. No euphoric move in end of 2020 like in 2007. The fall has seen no relief rallies of any sort. If this is the case the historical expectation of a sideways consolidation and a retest may not happen. So the recovery can even be very ferocious.

Shorts need to be extremely careful. This is not the time to panic and sell. It will take a lot of guts to buy equities today. But this is the time when multi-fold returns happen over next few years , if we survive the covid-19![]()

Focus on surviving the next few months financially and mentally. There were be loads of opportunities and one has to keep faith in human civilization which has survived wars and what not.

If the world is going to end then Meet you on the other side !!

Ending Note – Its tough to write this post given the terrible times and mistakes. The market will try to throw you out and if you survive the hit financially and mentally ,the next few years it may give you many chances. So trying to conserve Mental Capital by not reading doomsday ( I used to read a lot of zerohedge in 2009. Now there are way too many of them.). Would love to write about how stocks are priced for extinction ( not able to as not much capital to buy them) .

March 24, 2020

Waiting for next post

March 25, 2020

Good insight.

But markets..will fluctuate..that is inbuilt.

The road is too rough,travel very slow,or sit on the sidelines,till the visibility clears

April 2, 2020

2008 or any other fall,recession was may be 20, 30%etc.This time it is 100% lock down. So lock down period uncertain,after that factories will take its own time to start. Totally different uncertain