Well i was looking into this company Well Pack Papers and Containers a few days back but research on Bombay Burmah Trading Corporation did not allow me to look into the details so i asked a good friend of mine Neeraj Marathe a diehard deep Value Investor to help me out.

Here is what we came out with 🙂

(By the way in the few days stock added another 50 crores of market cap ![]() since the chart was made.)

since the chart was made.)

Well Pack Paper Containers

The paper sector is an extremely cyclical sector. The valuations that paper companies command are a testimony to this fact. Paper companies rarely get high multiples.

With this in mind, how much would you value a paper company, given that

· The company does not manufacture any type of specialized product.

· Its FY10 sales are about Rs.20 cr.

· Its FY10 PAT is about Rs.0.39 cr (39 lakhs).

· Its 3 year sales CAGR has been -2% (yes, its negative growth)

· Its 3 year PAT CAGR has has been -16% (yes, negative again)

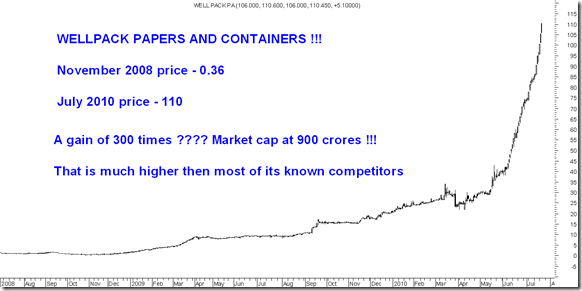

Now, what if I tell you that over the last 3 years, the price of this company’s shares has gone up by 300 times or 3000 % and that today, its market cap is about Rs.950 cr!!!! Effectively, it is trading at 46x market cap to sales, 550x EV to EBIDTA and 2300x PE ratio!!

To add more perspective to this, West Coast Paper has a market cap of Rs.560 cr, TNPL has a market cap of Rs.850 cr.

Now this is hilarious. Why on God’s green earth should a company get this kind of valuation? Does it have hidden assets, like land? Nope! Does it have a super-dooper massive capex plan, which will make it one of the largest paper companies in India? Nooo it doesn’t. Then what is the deal here?

Now some more Hilarious Stuff:

As i kept digging deep there were more surprises in store

Also just see the list of bonus and split to keep the absolute price to not look exaggerated. ( Adjusted lowest price comes to 0.36 paise)

3:4 Bonus and 10:1 split in March 2010.

Dividend History – Nil ![]()

Now another interesting thing is the large volumes !!!

The stock trades 30 lakh shares everyday which in value terms is 30 crores or more!! ![]()

Another surprise the stock is in trade to trade ( T2T ) segment which means one cannot trade intraday in the stock.

The total shares in the company is 8 crores roughly. Public holding is 1/4 or roughly 25% which implies 2 crore shares in public hands.

The company trades 30 lakhs of deliverable quantity everyday – Circular Trading ??? ![]()

Bottomline: Well this is the art of market ![]() allowing a stock to move 200-300 times:).

allowing a stock to move 200-300 times:).

The last time I covered a similar company was JAYBHARAT TEXTILES AND REAL ESTATE which later got into SEBI Net but still quotes at 10000 Crores market cap J (though it went down 50%) – Read the full story through this link ![]()

Next week i would prefer to relax with overheated markets so might get time to write more on Market Manipulations and Stuff which doesnot give returns but valuable insights about the Market ![]()

Cheers,

Nooresh

July 24, 2010

Thank you ,

learning alot from you.

July 24, 2010

Nooresh,

Tum konse mitti se bane ho ?????? Kaha se dhund ke nikalte ho yeh sab…..No other analyst or advisor ever try to find out such stuff. Your’s this research is as good as ur analysis…. Good to see that u r making other investors aware of this kind of manipulation…..Keep up the good work and keep rocking.

Regards

Akshay

July 26, 2010

Thanks Nooresh, your blog, always helps us to make money on the stocks recomanded or not to fall in the pit by these stocks (WellPack Papers)..

Keep it going..

July 26, 2010

Nooresh

Another such stock Dalal Street Investment. Jan 2008 Price Rs.2000 and July 2010 price Rs 20000. Average qty traded daily is 1. What is SEBI doing??

July 26, 2010

Haha..Nooreshbhai,

Feels like we are idiots working hard over technicals n fundamentals huh?

July 26, 2010

Hehe Yes 🙂

July 26, 2010

Hi Nooresh,

Your analysis on the stock is really good as usual. There is nothing in the stock to invest in.

I have a feeling that some money can still be made in the stock as it has been continuously going up. One could expect to make 15-20% form here also and then exit. The strategy is risky though.

Whats your view about that?

Regards,

Sanjay

July 26, 2010

Hi Sanjay,

Well it depends if u trade on feelings and high risk 🙂 . I am very conservative with money 🙂

The stock could even double from here or go 50% down but i see no reason to buy it 🙂

Regards,

Nooresh

July 26, 2010

Hi,

Pls can you see regarding the SVC Resources Ltd. which had also zoomed by 1000 % in 12 months and had 3-4 Lacs volume everday and had not fallen its previous day closing intersting naa… Pls look the chart share your views.

Rgs,

Vinay

July 26, 2010

Hi Vinay,

Will need to check that.

Regards,

Nooresh

July 27, 2010

Hi nooresh,

check this link i think 13rs price on 1st nov.,2008.

https://www.bseindia.com/stockinfo/stockprc2.aspx?scripcode=531249&fromDate=01/10/2008&toDate=01/10/2008&strDMY=D

December 8, 2010

Sell SVC resources. It is a fraud company. They are fooling the people.

July 16, 2016

new lest in bse and nse