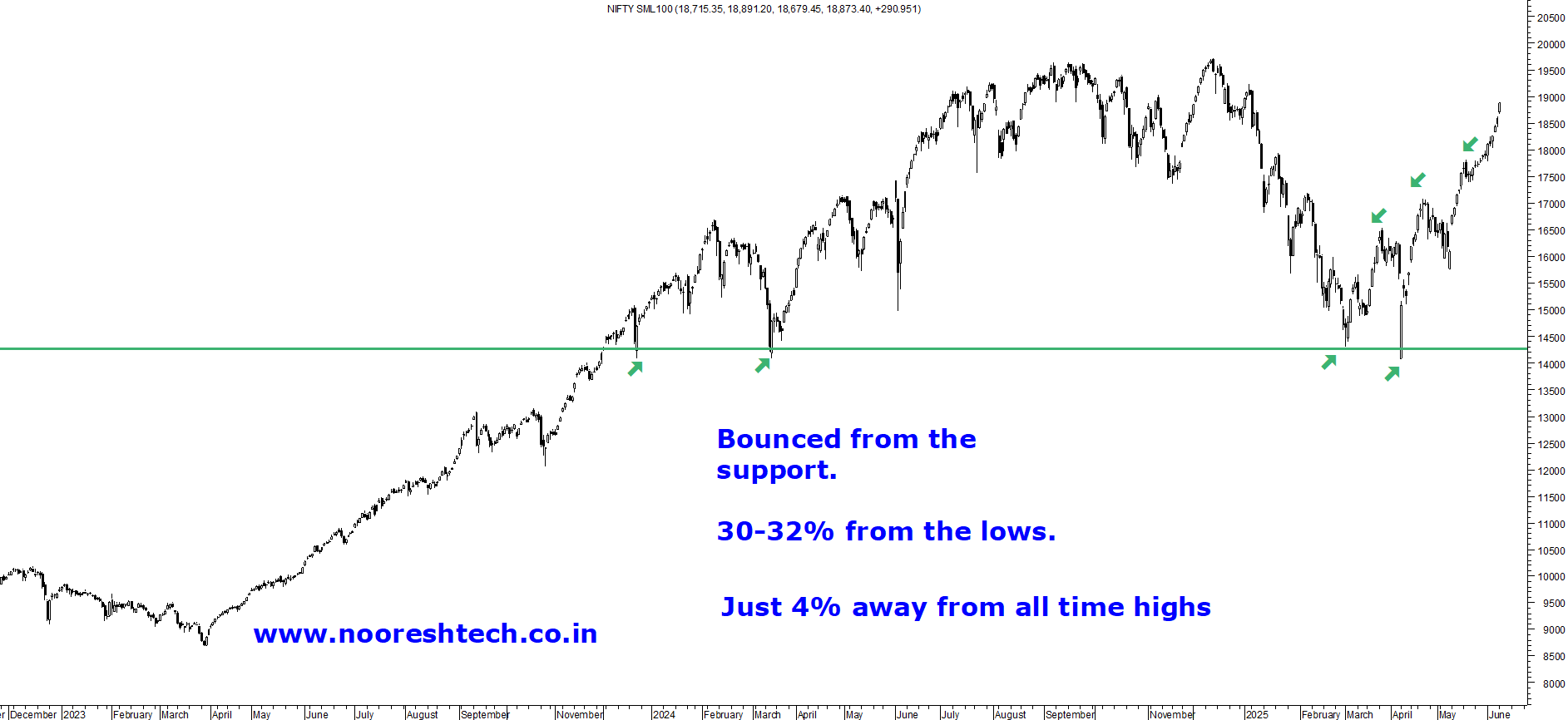

Midcaps and Smallcaps - Most now just 2-7% away from all-time highs.

Nifty Mid&Small = 4% away

Nifty MidSelect = 1% away

Nifty Mid100 = 2% away

Nifty Smallcap100 = 4.5% away

BSE Smallcap Index ( 980 stocks ) = 7% away.

A lot of Cash Drag for people who went on Cash.

Smallcap Indices are up 30-32% from the lows !!!

But Portfolios may take a little longer to make New Highs.

Why So ?

- Whenever the Smallcap Indices take a hit of 20-25% or more a lot of Stocks may correct more. Also they would have rallied a lot lot more in the upcycle.

- Currently the Smallcaps and Midcaps and even Market as a whole had been a good trend from 2023 and even from 2020.

- Many stocks may take a little longer to go back to old highs and some winners of the previous cycles may not do so for a long long time.

- After the strong recovery one needs to start looking out for New Leaders and Shift some of existing names to these leaders.

- This continues every cycle. One needs to be ok with losing a little bit of outperformance of the upcycle.

- Refresh, Rethink and get back to work to add more alpha in the next upcycle.

People with High Cash are now in a major dilemma. How to chase such a sharp bounce and a fear to even churn existing exposure. An easy answer but difficult to do is - Think with a Fresh Mindset and be Stock Specific.

We discussed about this in January 2025. Reposting it here.

#CashCall - It's not about the Right Exit !!

A & B start at 100.

A = 30 rs cash & 70 rs invested.

B = 0 cash & 100 rs invested.

Market Correction = -25%

A= 82.5 B = 75

Market up 33.33%. Back to 100

A= 110. B = 100.

But if A ends up keeping 15% cash.

A= 105

B = 100.

5% outperformance not a big difference.

Timing of Re-Deploying Cash is more important than Timing of CashCall.

Reality is the Future Outperformance will be decided by who owns the Next Cycle Outperformers A or B.

Why do many Investors not take Big Cash Calls?

1) They don't trust their Timing Skills in Re-Deploying Capital at the Right Time.

or

2) They trust themselves to be deployed in Stocks which can Outperform the Market Returns or their ability to shift portfolio to Outperforming Stocks with Changing Cycles.

What do you think & What Strategy do you Prefer?

Another older read - Nobody Knows Beyond a Point

Conclusion

- Technical Trend is up for most Indices in India with Banking clearly being a leader. Old Post on Financials

- Global Indices like US have made a good bounce back. Europe is at all time highs. Dollar Index still around 99-101.

- This continues to be a stock specific market.

- Good Price Action and Momentum in a lot of Stocks. Checkout our Momentum Product -

NooreshTech Research Services Overview

1. Technical Traders Club – Techno Funda Investing

- Two model portfolios: Trading Ideas (3–6 months) & Smallcap Folio (6–18 months)

- Maximum 10–12 open positions per portfolio

- Ideal for investors with a medium to long-term view

- Updates via WhatsApp, Email & Telegram

- Subscription: ₹15,340 (6 months) | ₹25,960 (12 months)

- Payment & Details: https://shorturl.at/Rz2fS

2. The Idea Lab – Momentum Trading

- Momentum-based short-term trades (15 days to 3 months)

- Maximum 30 open positions, equal weight approach

- Based purely on technical analysis

- Ideal for traders with a short to medium-term view

- Telegram-only updates

- Subscription: ₹1,770 (Monthly) | ₹4,720 (Quarterly) | ₹8,850 (Semi-Annual) | ₹17,700 (Annual)

- Payment & Details: https://shorturl.at/Lsd7M

3. Smallcases – Equal Weight Portfolios

- Top 10 Promoter Buying: Focused on stocks with strong promoter buying

- Top 10 Techno Funda: Combines Technical & Fundamental analysis

- Breakout & Trail Momentum : Momentum Trading - 20 stocks, 5% each

- Low churn, equal-weight portfolios

- Invest directly via the Smallcase platform

- Ideal for long-term investors

- Payment & Details: https://shorturl.at/bQenu

4. Option Strategies by NooreshTech ( NEW )

- Limited Risk Option Strategies across Index and Liquid Stock Options.

- Holding period: Typically between 1 to 4 weeks.

- Capital & Positioning: Min Capital: ₹10 lakhs

- Max Open Positions: 5-8 open positions

- Ideal for those who understand derivatives risks and seek moderate, consistent returns.

- Telegram-only updates

- Subscription: ₹10,620 (Quarterly) | ₹17,700 (Semi-Annual) | ₹29,500 (Annual)

- Payment & Details: https://shorturl.at/ZYlYy

Support & Queries:

- WhatsApp: 7977801488

- SEBI Registered: Nooresh Merani (INH000008075)

- Disclaimer : https://shorturl.at/kgosD