Last Post : https://nooreshtech.co.in/2022/03/nooreshtech-weekly-insights-25th-march-2022.html

Highlight from previous post - Fertilizers Trade - We caught it bang on time - Post dated 11th March 2022

Link : https://nooreshtech.co.in/2022/03/new-series-nooreshtech-weekly-insights.html

Highlight :

NooreshTech Weekly Insights (1st April 2022)

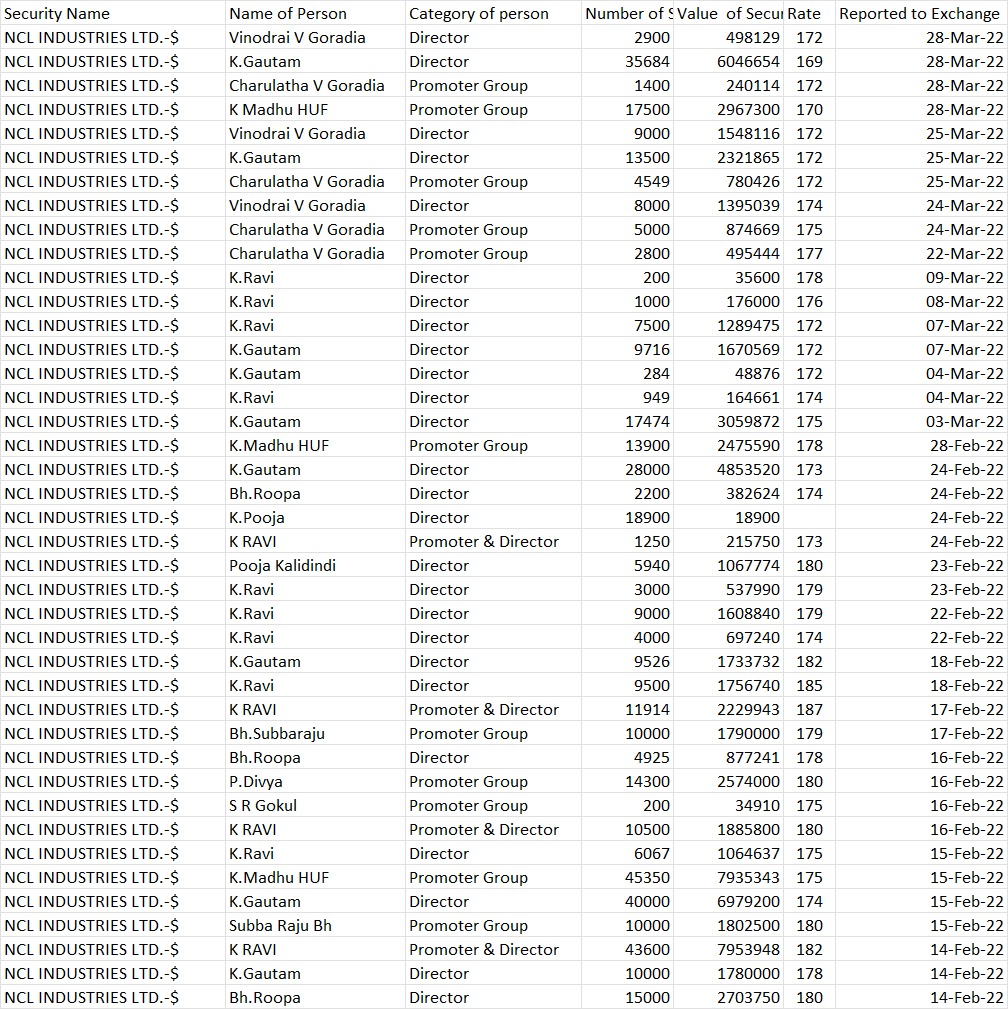

1 ) Insider Trading Alert

NCL Industries Limited

NCL Industries Ltd is principally engaged in the business of manufacturing and selling of Cement, Ready Mix Concrete, Cement Bonded Particle Boards, Doors, and operates two Small Hydro Power projects.

Details of buying :

Past Promoter Shareholding

The promoters and directors have recently bought ~4.64lk equity shares from open market which comes to around 1.03% equity

Also promoter holding have gone up from 40.33% in March 2019 to 44% in Dec 2021

Investor Dolly Khanna also owns 1.73% stake in the company

Chart

For more such insights do subscribe to our

Insider Trading Report: https://bit.ly/3wcYocO

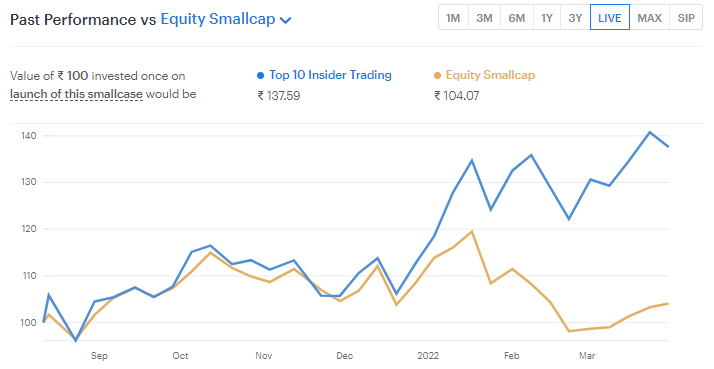

We also have a Smallcase which is based on Insider Trading

Do check out: https://bit.ly/3w1LyOK

Smallcase performance vs Benchmark

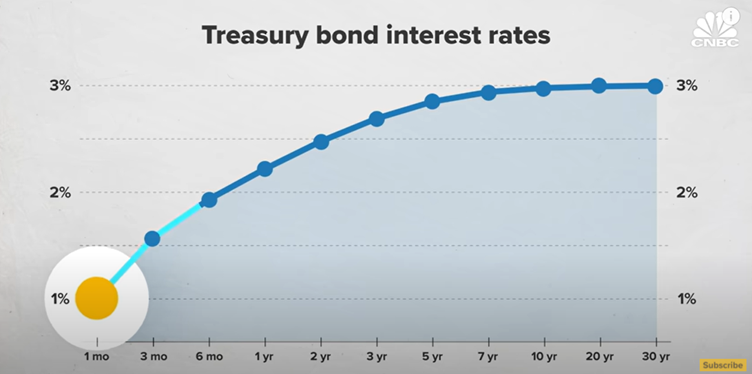

2) Inverted Yield Curve & Recession

Normal yield curve – Long term yields > Short term yields

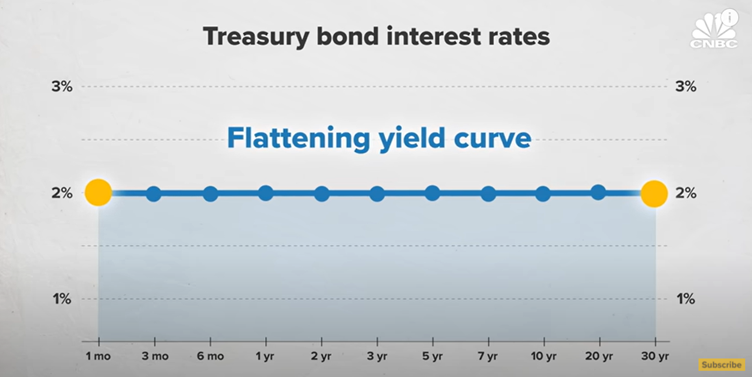

Flattening yield curve – Long term yields = Short term yields

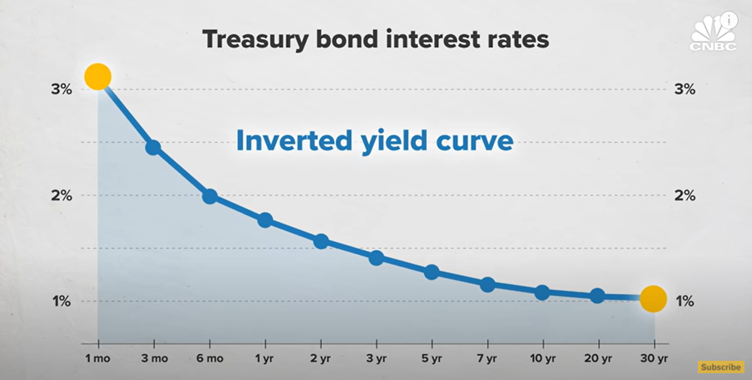

Inverted yield curve – Long term yields < Short term yields

Historically, many times when the yield curve has inverted, the economy has eventually led to a recession.

An inversion takes place when the difference between the long term and short term yields turns negative or falls below the Zero level

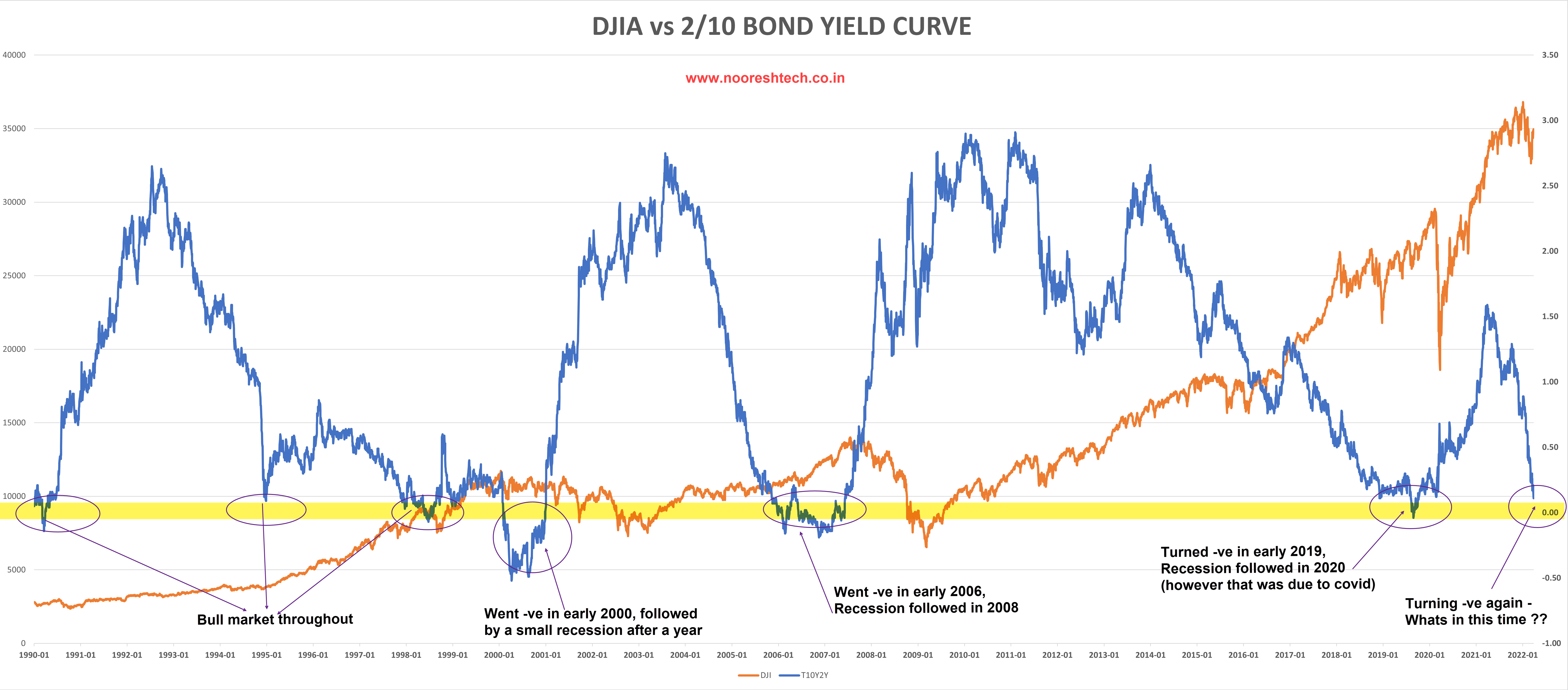

Lets see where we stand now : DJIA VS 2/10 bond yield curve

Looking at the above image, can we say the inversion predicts the recession accurately? –

Well, if it does, the timing is not great!!

Many times when the inversion happens, it is followed by a sharp market rally and inversion also corrects itself in the meantime!!

Some of the maddest part of bull rallies in past were during the inverted yield curve period, Say 1995-1999 or 2006-2007

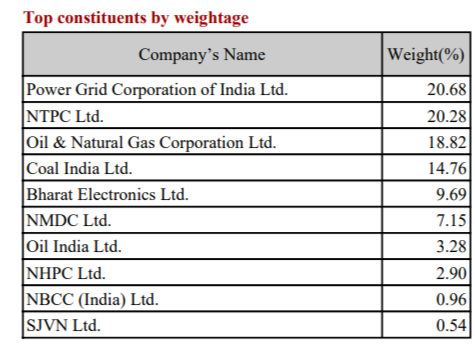

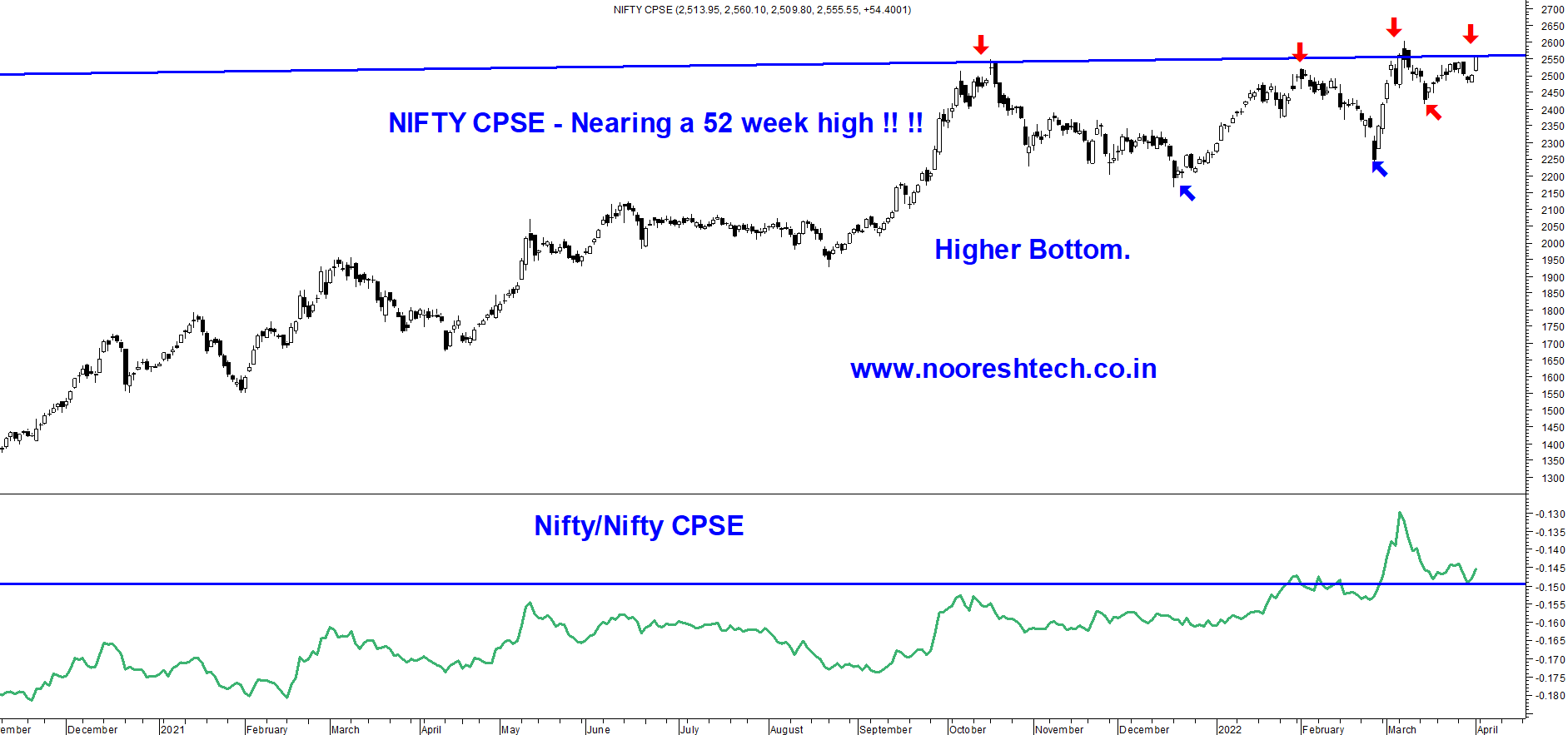

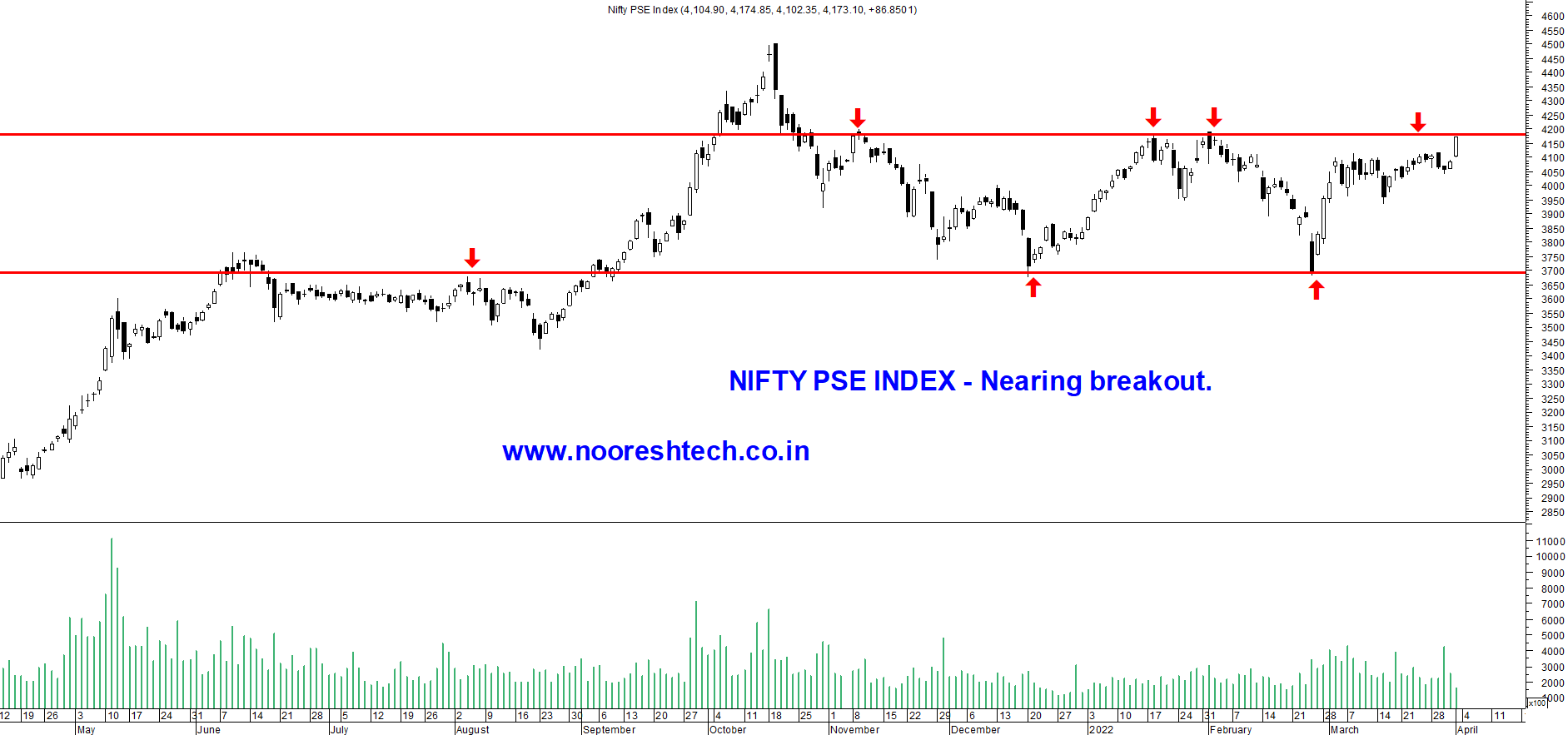

3) NIFTY CPSE & NIFTY PSE - Taking the lead

#NIFTYCPSE & #NIFTYPSE - Taking lead.

Nearing 52-week highs in many names in the basket.

Quite a few thematic bets are possible in the #PSU basket.

.

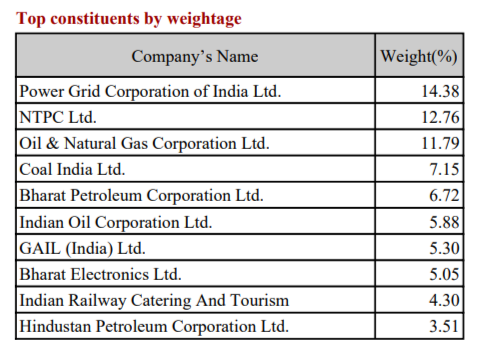

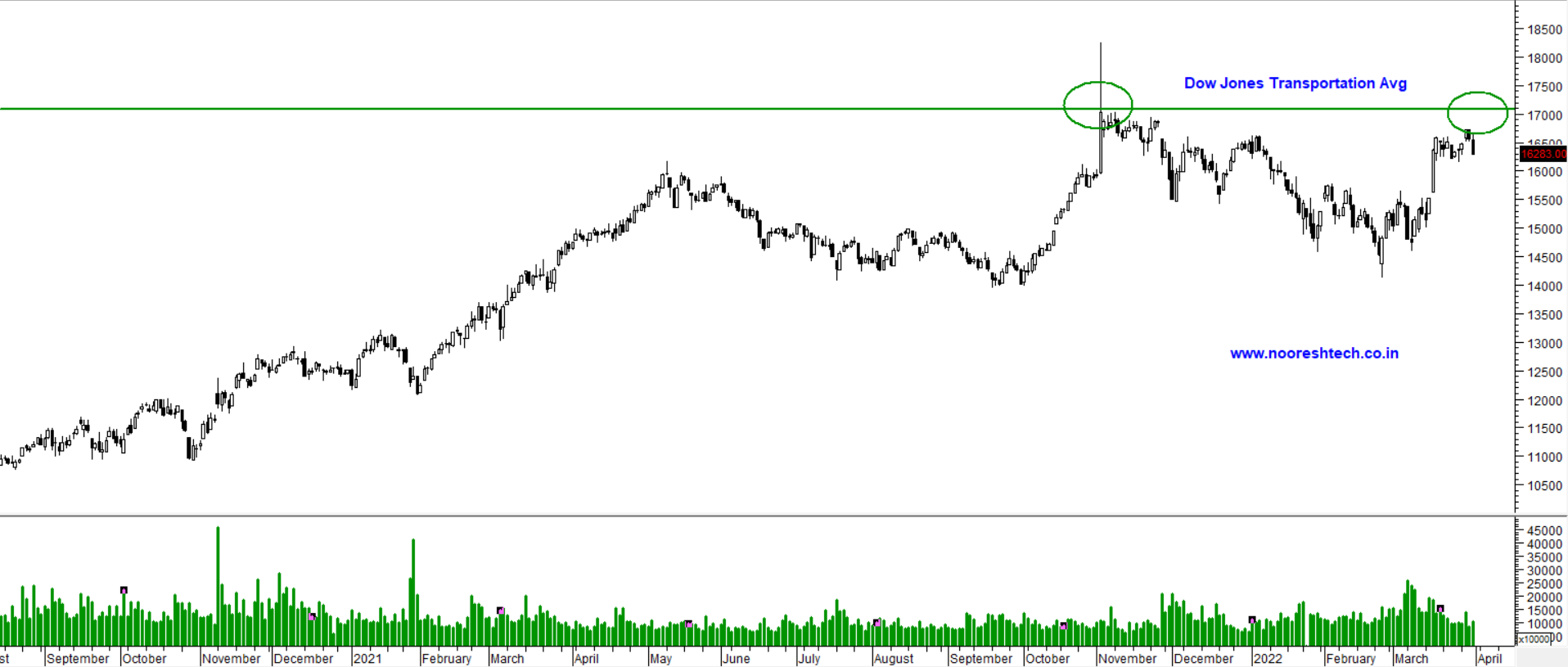

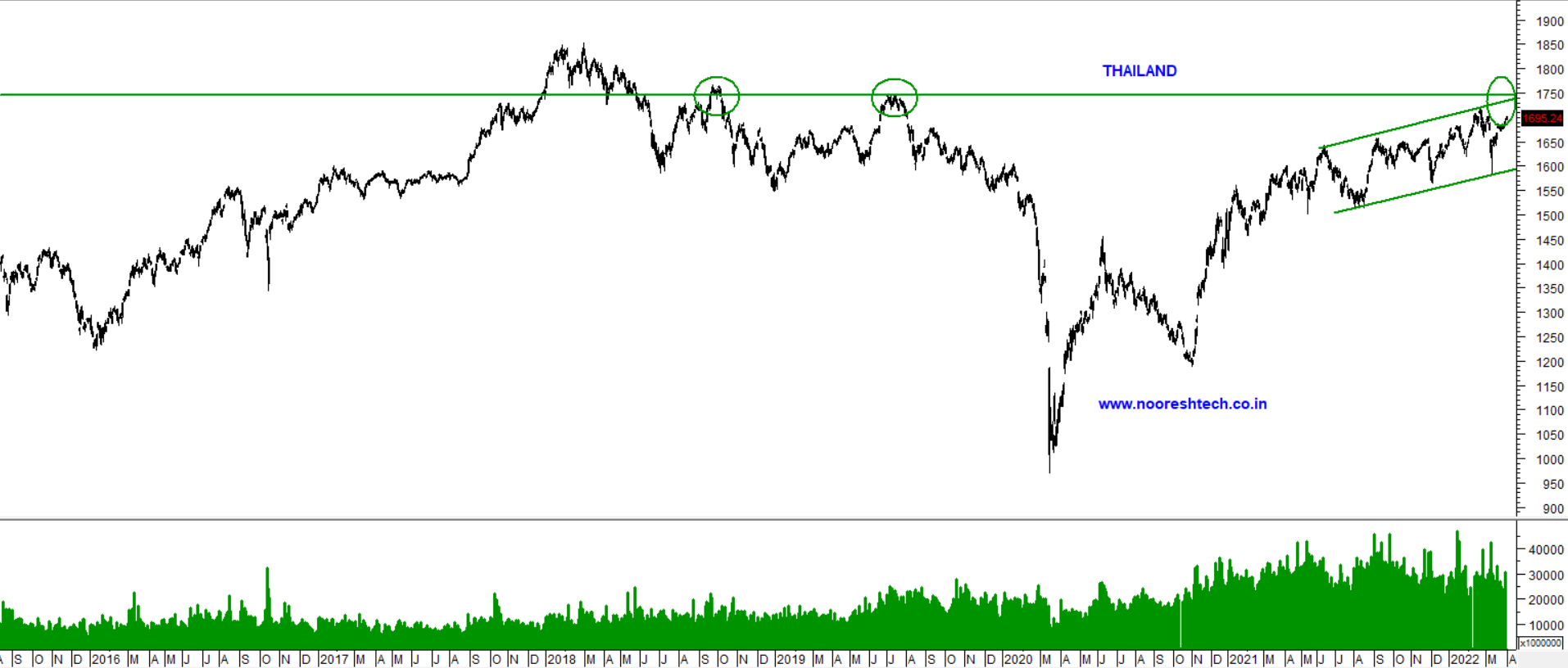

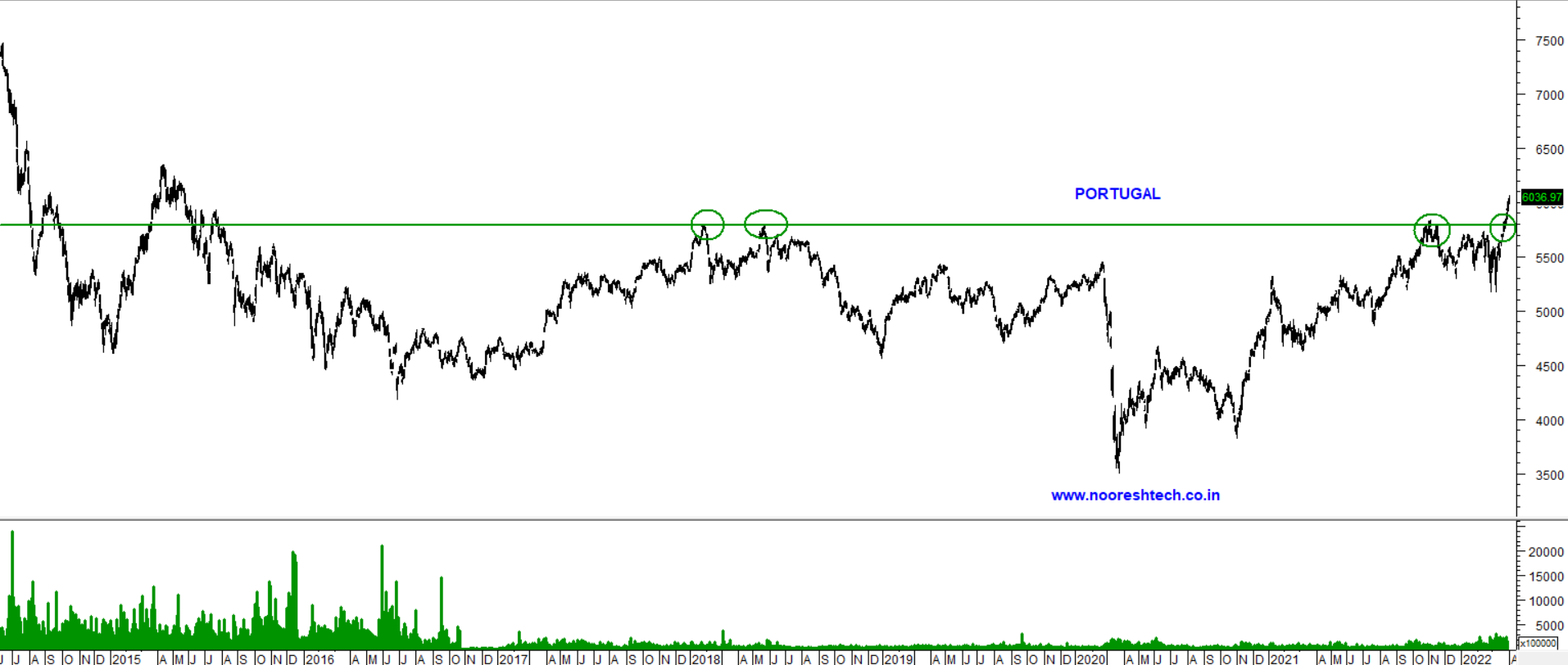

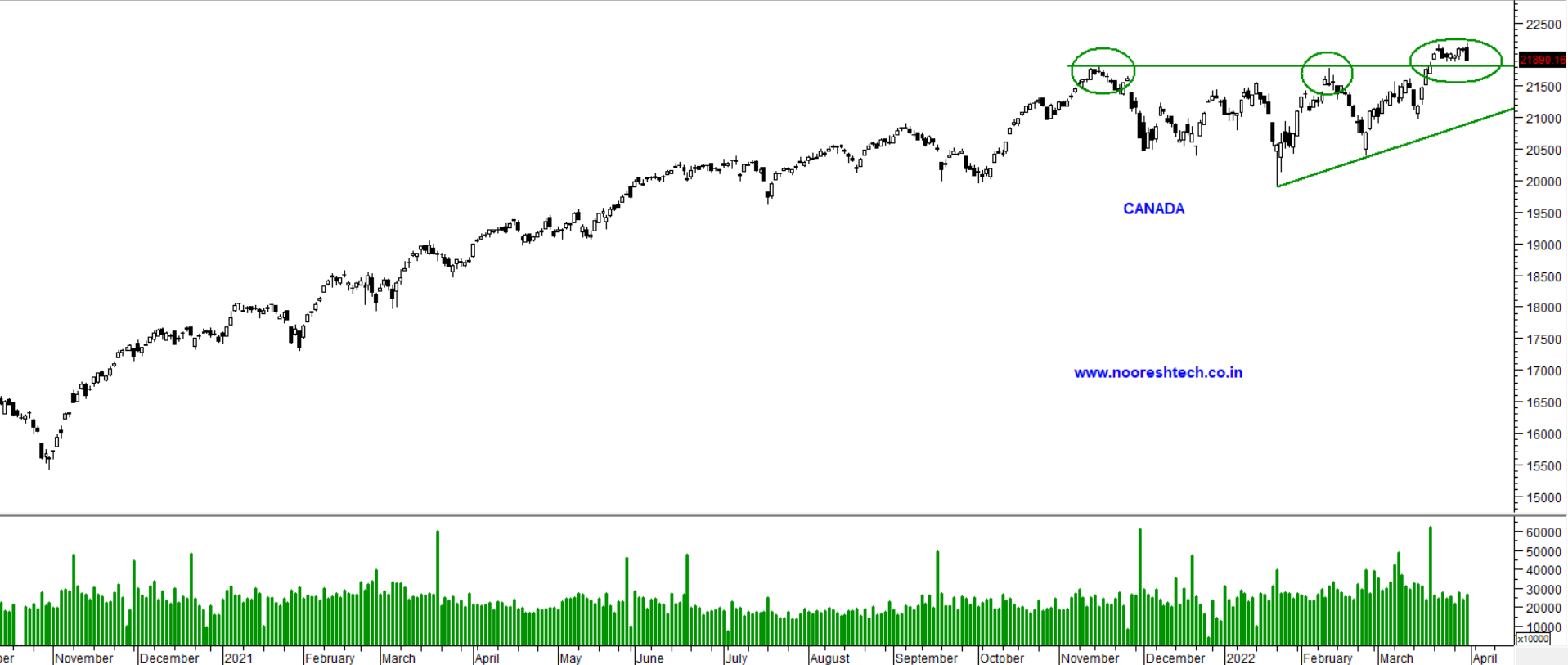

4) World Indices showing Relative Strength

While some part of the world indices are grappling with the news of Russia Ukraine War, some other part of world is showing some super relative strength and are making new highs !!

Markets Near their 52 week Highs -

- Australia,

- Dow Jones Transportation Avg,

- UK FTSE 100,

- Thailand

Markets which have made a New All Time High or New 52week Highs -

- Chile,

- Portugal,

- Mexico,

- Indonesia,

- Canada

Do let us know in the comments section if you have a take on any of the above observations!!

Happy Weekend !!

Our Services

1) Research Services

Technical Traders Club

https://bit.ly/3JhePcx

Quickgains FnO

https://bit.ly/3FA9Cdn

Quickgains Cash

https://bit.ly/3Fz3IsT

Insider Trading Report

https://bit.ly/3epIJNk

Smallcase

2) Training Services

Online Technical Analysis Course

https://bit.ly/3FwMjRD

3) NooreshTech Content

Free Blogpost

https://nooreshtech.co.in/

Free Youtube Videos

https://youtube.com/user/noorrock2002

Free Broadcast Channels (Interesting Charts)

https://bit.ly/3pvQ5FB

https://bit.ly/3mAFdEy

Free In App Content - NooreshTech

Android - https://t.co/8bnLJL5UrB

iOS - https://t.co/0ZBnD8LV02 -

Enter the org code - "bvuod"