Last Post : https://nooreshtech.co.in/2022/03/nooreshtech-weekly-insights-18th-march-2022.html

NooreshTech Weekly Insights - 25th March 2022

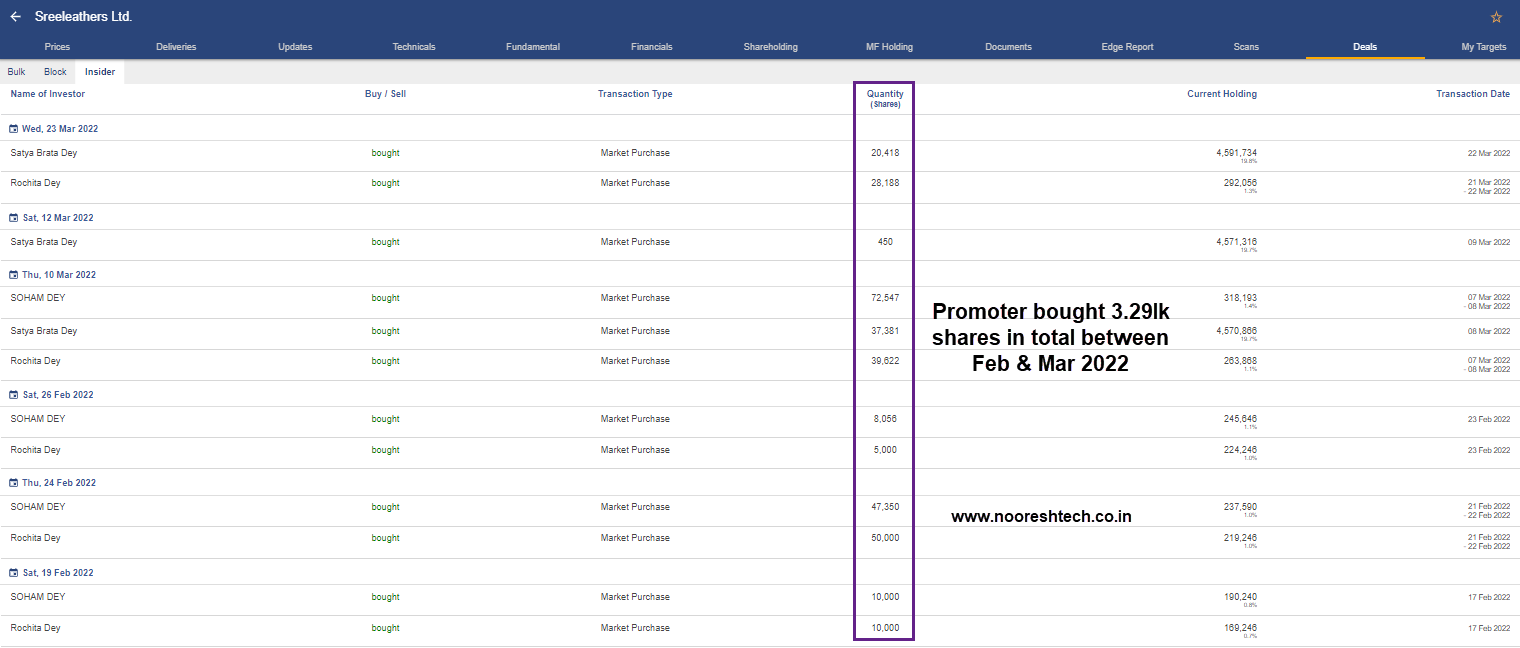

1) Insider Trading Alert

Sreeleathers Limited -

The company is engaged in footwear and accessories manufacturing and distribution headquartered in Kolkata

Promoters roughly bought 3.29lk equity shares which comes around to 1.42% equity in the month of Feb’2022 and March’2022

Promoter holding have gone up from 64.94% in March 2019 to 72.31% in December 2021, due to open market buying & buybacks

Chart

Please note: Do not consider any of the updates as Investment Advice and do your own due diligence before investing

For more such insights do subscribe to our

Insider Trading Report: https://bit.ly/3wcYocO

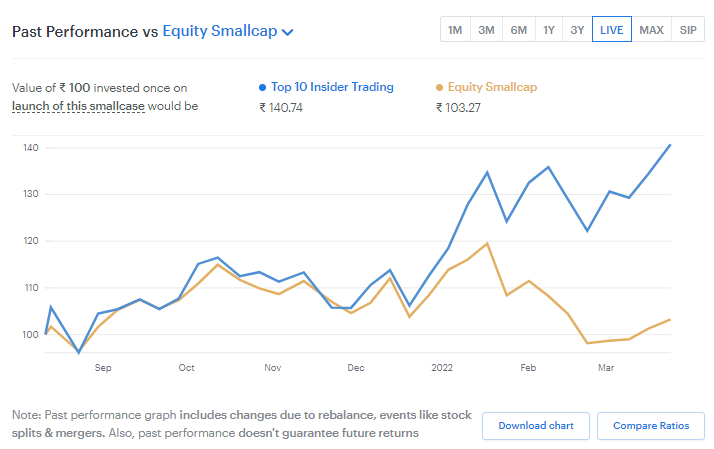

We also have a Smallcase which is based on Insider Trading

Do check out: https://bit.ly/3w1LyOK

Smallcase performance vs Benchmark : 37% outperformance from the benchmark

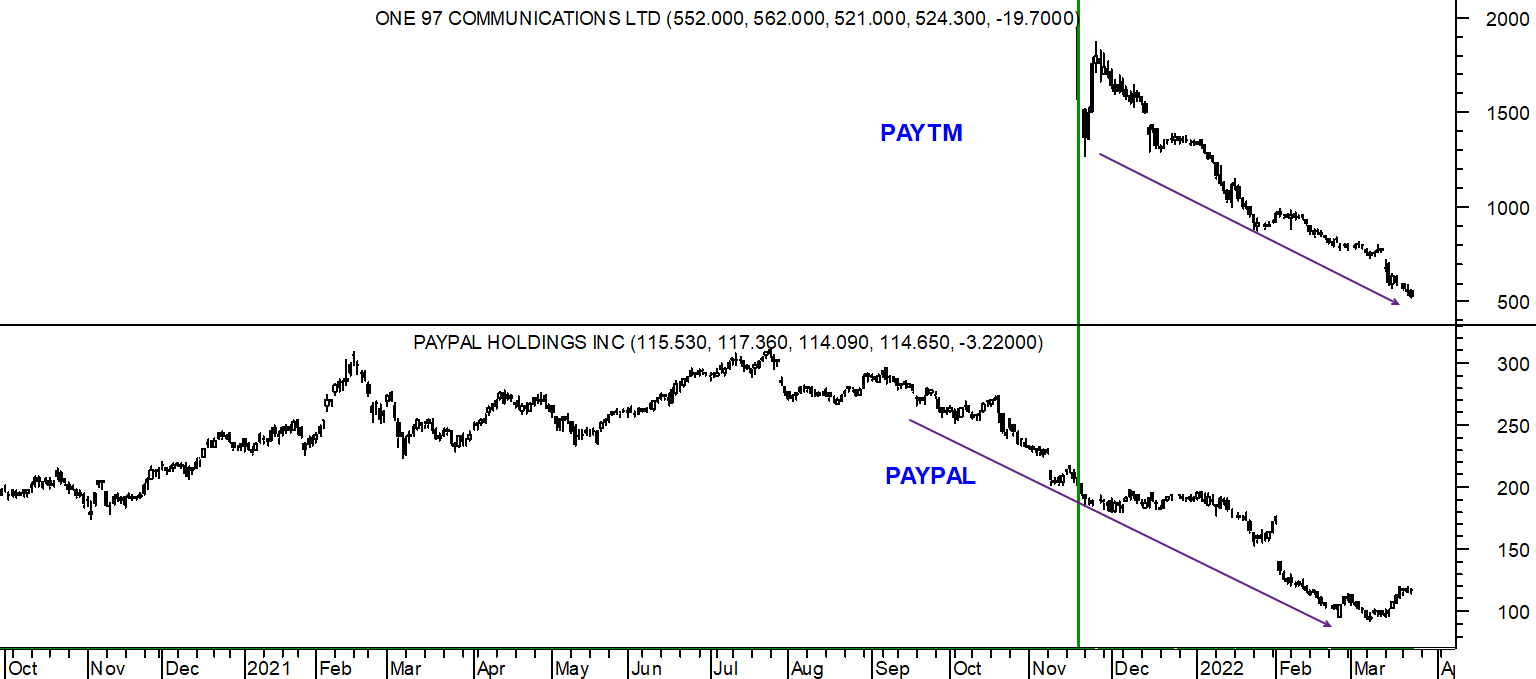

2) PAYTM & PAYPAL

Strikingly similar fall seen in US Listed Digital Payment Company – PAYPAL and Similar Company which was recently listed in India – PAYTM.

Is it just a coincidence?

Also the BSE IPO Index topped out near the same time when PAYTM hit its listing – i.e. 18th Nov 2021

Was Paytm Listing a Bad Omen? or the Correction is Global?

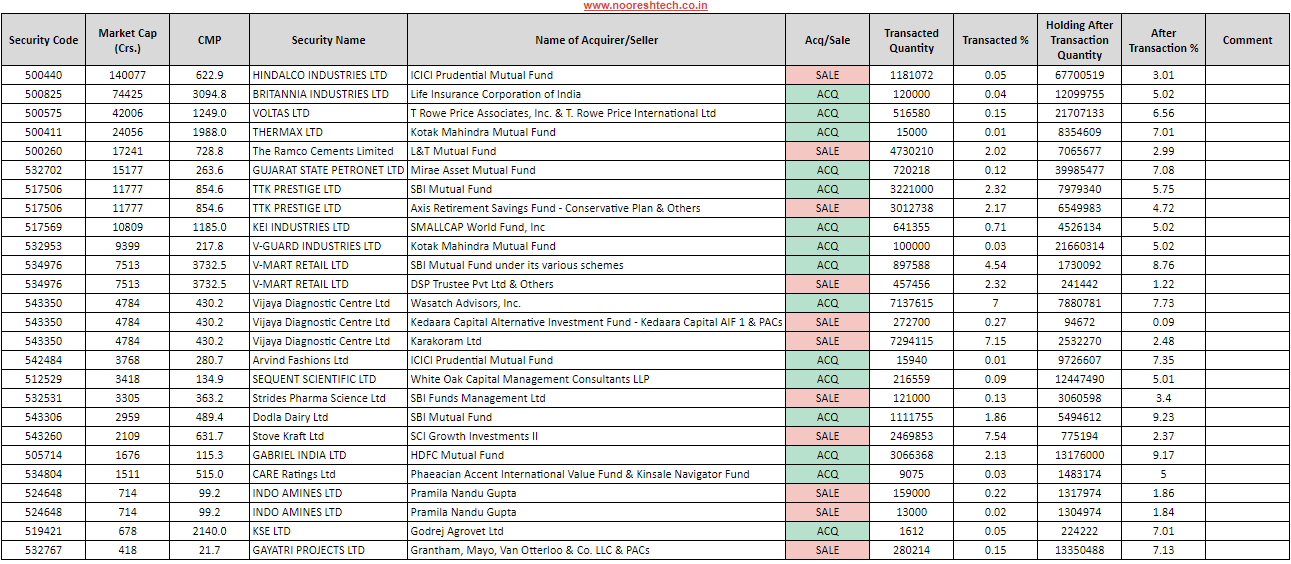

3) Important SAST Deals (Non-Promoter) – March 1st to 23rd March 2022

Substantial Acquisition of Shares and Takeovers - Any acquirer, who together with PAC, holds shares entitling them to 5% or more of the shares in a target company, shall disclose every acquisition or disposal of shares

4) INDIA VIX - Still not out of the Woods

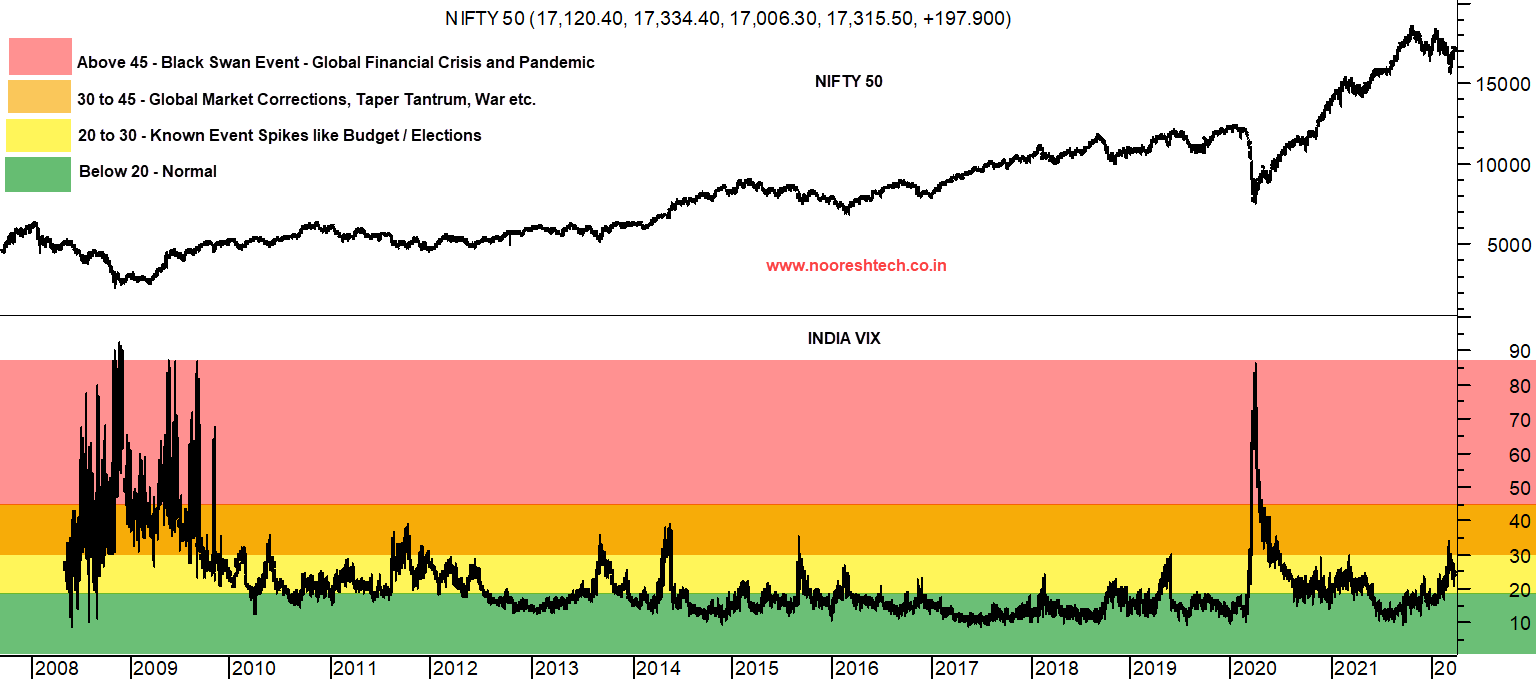

In the above image, we have tried to divide the India VIX into various zones

What we have observed is since 2012, when the India VIX stays below 20 zones, that is the time when market is in a normal trading zone,

A spike to 20 to 30 levels are seen in known events like Budget / Elections etc.

A spike to 30 to 45 zones is seen in events like Global Market Corrections, Taper Tantrum, War etc. &

A spike beyond 40-45 zones is seen in a Black Swan Event like Global Financial Crisis and Pandemic

Right now, the VIX is at 23.43, which means we are still not out of the woods, until it drops back below the 20 zones

Last time we wrote was on 25th February 2022 when the VIX touched a high of 32-34 zones, since which VIX has fallen to current levels of 23-24

Do let us know in the comments section if you have a take on any of the above observations!!

Happy Weekend !!

Our Services

1) Research Services

Technical Traders Club

https://bit.ly/3JhePcx

Quickgains FnO

https://bit.ly/3FA9Cdn

Quickgains Cash

https://bit.ly/3Fz3IsT

Insider Trading Report

https://bit.ly/3epIJNk

Smallcase

2) Training Services

Online Technical Analysis Course

https://bit.ly/3FwMjRD

3) NooreshTech Content

Free Blogpost

https://nooreshtech.co.in/

Free Youtube Videos

https://youtube.com/user/noorrock2002

Free Broadcast Channels (Interesting Charts)

https://bit.ly/3pvQ5FB

https://bit.ly/3mAFdEy

Free In App Content - NooreshTech

Android - https://t.co/8bnLJL5UrB

iOS - https://t.co/0ZBnD8LV02 -

Enter the org code - "bvuod"