Before the post do checkout this latest Youtube Chat i did – AMA – What is Techno-Funda - https://youtu.be/flYZA7bAB7g

Also a 15% discount on our Annual subscription of #Smallcase - Use Code – ANNUAL15 https://nooreshtech.smallcase.com

A quote from an old article in November 2021. ( Do read the comparison to 2015. Still valid )

- Everything Going Up – Microcap, Smallcap, Midcap, LargeCaps and kachracaps seems to be over.

- It will keep getting very selective and new sectors could take leadership if we are in a similar cycle.

- One has to be extremely careful in some of the big beneficiaries of the covid related sectors – Pharma, Midcap Smallcap IT

Post that Nifty IT stocks did a quick rise into Dec-Jan 2021 and peaked out.

Since then the Nifty IT Index is down 32% and a lot of midcap IT is down 30-50%

I just updated on the above view in this tweet

Its a little scary to see a lot of impressions/likes on a tweet on IT sector compared to this Tweet on the Banks Report which has lesser likes even after 2 months and multiple RTs of mine. ( This has worked out really well. BN is up 20% from there.)

Possibly means a lot of people are either stuck or looking at so its not yet a Contra trade.

Now lets look at the current charts.

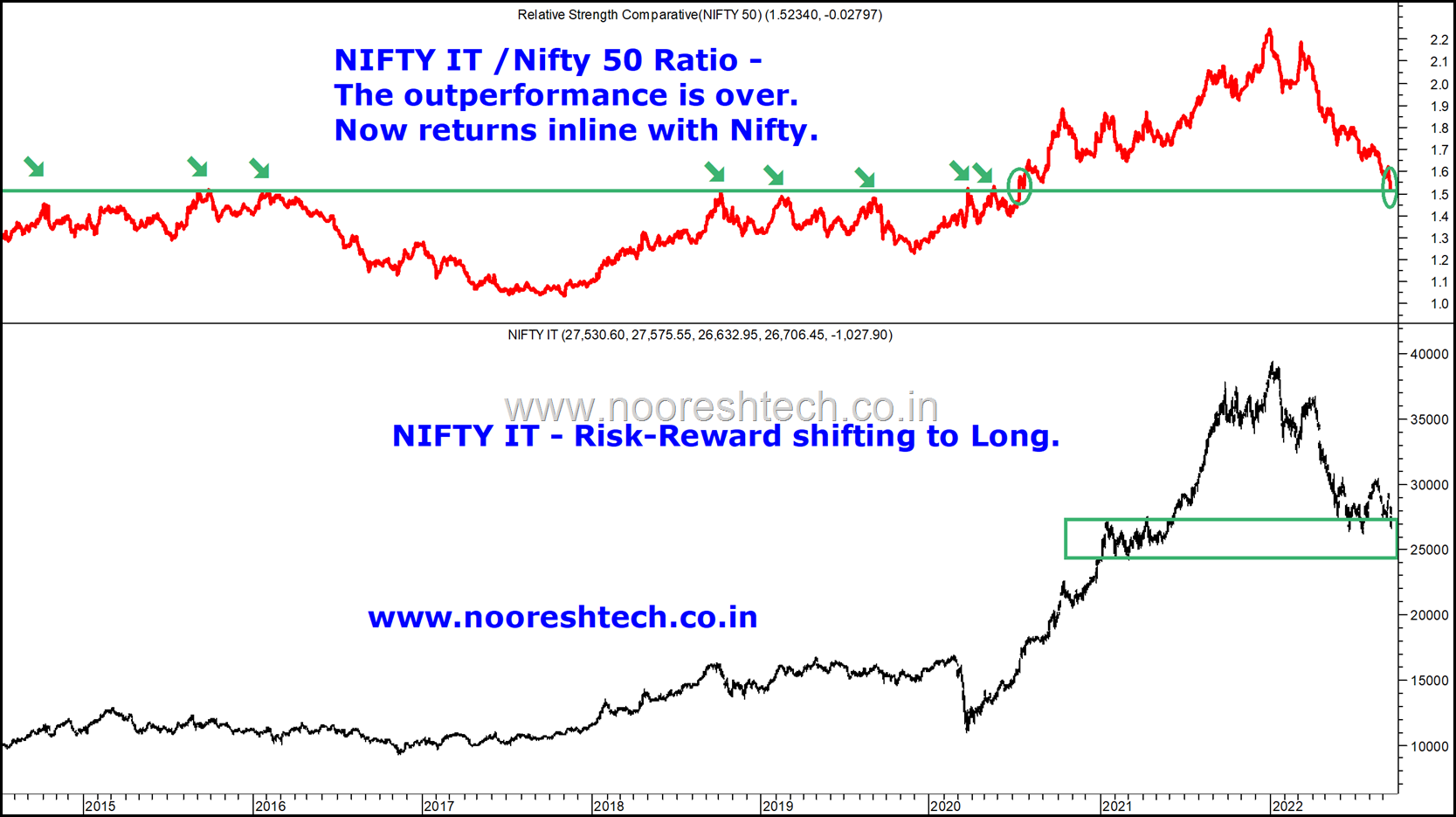

Nifty IT – Outperformance gone and now inline with Nifty

- Nifty IT from pre covid of 16800 peaked at 39440. Roughly a 135% return from pre covid highs. From the lows of 11k to 39446.

- The top chart shows the Nifty IT/ Nifty Ratio.

- From 20015 to 2020 the ratio would always top out around 1.5 and even going back from 2004 apart from a brief breakout in 2014 the IT index has always been around 1.5 ratio.

- So basically for 15 years the IT index has always been an inline or undeperformer to Nifty.

- This got blown out in 2020-2021.

- PEs went from 10-20 to 30-60 across the board.

- Now after a 30% correction the outperformance is gone.

- If you assume there are long term benefits of digitization due to Covid now is no more the time to be Bearish.

- Technically the Risk-Reward is now shifting for Longs.

Lets look at the NIFTY IT chart technically

- Now whether it bottoms at 26500-26700 or goes and tests 24500-25000 is tough to say.

- But would not expect it to cross the 30500 quickly.

- If you are a believer in the sector could look at dipping in slowly.

- The reason one is not super bullish is because once a sector loses leadership it takes a long time to gain it. Also there are other better opportunities.

- But one can now look out for either a reversal signal in some large cap IT names or a quick panic fall in midcap smallcap IT.

- So basically would still avoid Midcap IT but look at reversals in large names.

Just looking at a few charts the confusion remains whether it bottoms right now or there is another 10-15% down tick left.

Wipro – 400 or 350?

Tech Mahindra – Whattay fall. 950 a strong support.

HCL Tech – 800 or 900.

TCS – 2950-3000 or 2600-2650. Remember pre covid highs and 2018-2020 high was around 2300.

Infosys – 1350-1400 or 1250 ?

Conclusion

- One of the market assumptions is IT is not a cyclical sector so would not expect a 50-70% fall from peak.

- The current re-rating was a market cycle.

- So ideally would expect a bottom in the index at 30-40% down from peak and then a good consolidation.

- One of the major reasons for me to not focus on the sector is there is strong leadership in other sectors and broader markets.

- Whether it bottoms out at current levels or another 10-15% lower is tough to say. If you like the sector its a good time to start dipping in largecaps.

- Still an avoid on Midcap/Smallcap IT unless there is a panic quick fall.

- Its still not a contra trade as a lot of people are either stuck or hopeful or looking at it. ( Not many were interested in Banks when they bottomed in June.)

- But simply put No More Bearish and ready to be opportunistic on a reversal signal.

TECHNICAL ANALYSIS TRAINING MUMBAI October 15-16

Planning a Mumbai Session finally after a long time. For details on topics - https://nooreshtech.co.in/technical-analysis-training/classroom-training

Additional Features

1) Free Access to Online Course for 1 year

2) Free Refresher whenever the course is conducted next.

3) 2 months access to Technical Traders Room.

Fees Rs 16000

If interested or any queries email to nooreshtech@analyseindia.com

or make payment to following account and email

ICICI BANK ACCOUNT DETAILS

Account Name - Nooreshtech

Account no - 041205000842

Bank - ICICI BANK

IFSC CODE – ICIC0000412

Why Technical Traders Room? - https://nooreshtech.co.in/2022/08/why-technical-traders-room.html

Also checkout our homepage www.nooreshtech.co.in for all our services free and paid.