Nifty 50 from being oversold has quickly turned into Overbought.

Before you read this post – Do check our new offering - Technical Traders Room – A Broadcast for Traders Monthly Rs 1200 Half Yearly 6000 Annual 11000

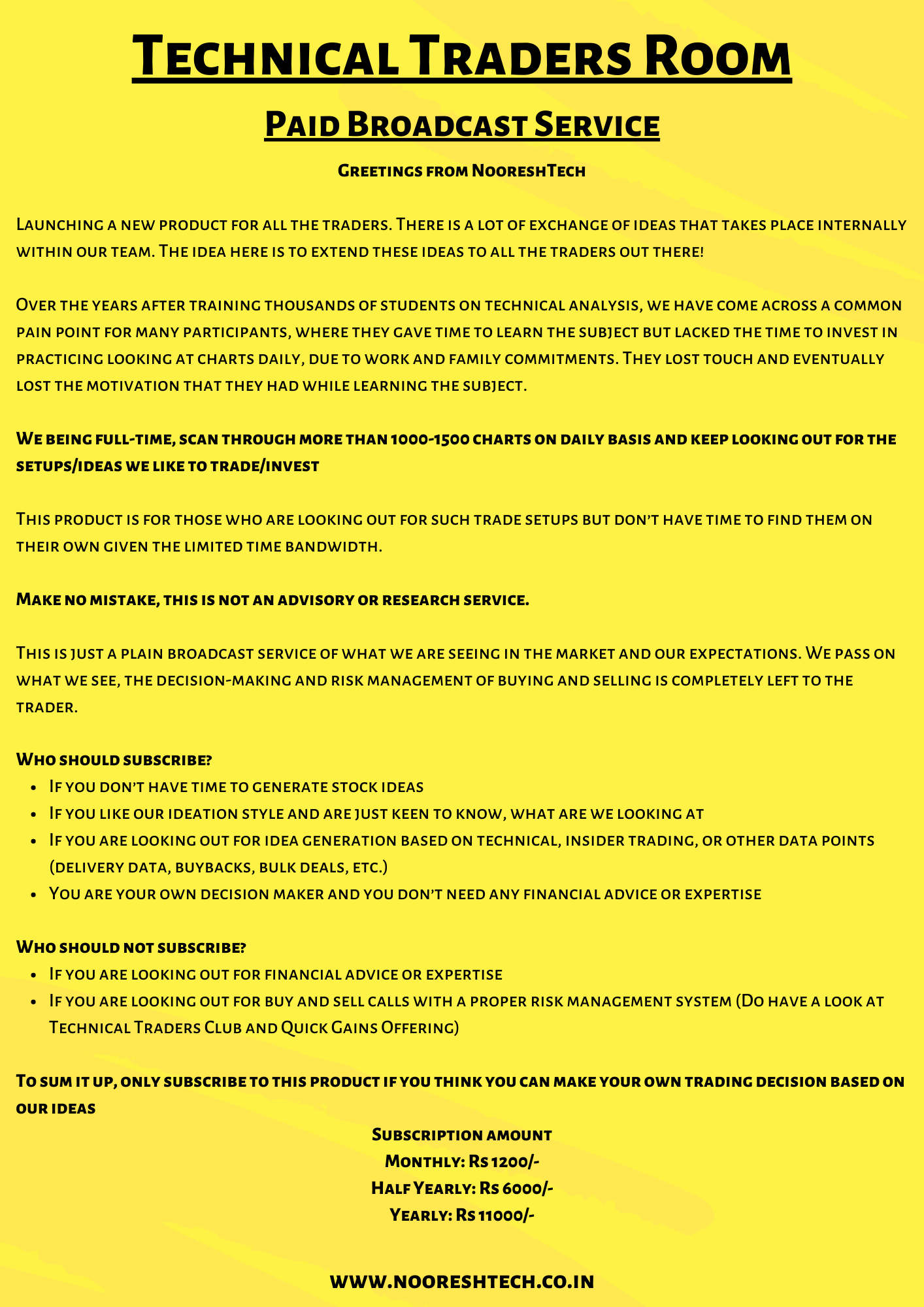

1) Nifty 50 – RSI back above 70 but with a major momentum shift.

Although i prefer to use RSI more for RSI divergences and catching bottoming out but today we look at the current situation from a momentum perspective.

- Nifty has been in a channel after topping out in end of 2021.

- The last couple of times Nifty topped with RSI 70.

- The current break into overbought looks similar to a momentum shift last seen in August 2021 and November 2020. ( Shown with Green Vertical lines and circle.)

- Such a momentum shift generally indicates a major bottom is done.

- Can this be a start of a bigger trend?

- Even if its not a bigger breakout such a shift is start of a lot of sectoral/stock and thematic trends.

- One may now start focusing lesser on Index but focus on finding new themes/sectors/stocks which may outperform even in an Index correction/consolidation.

We did pick the leading sector correctly right at the bottom – Banking. Check this detailed presentation done on 24th June 2020 -

Future of Nifty50–Banking on Banks–Free Detailed Presentation.

The sector continues to look a leader alongwith Autos ( Older post on Autos in May )

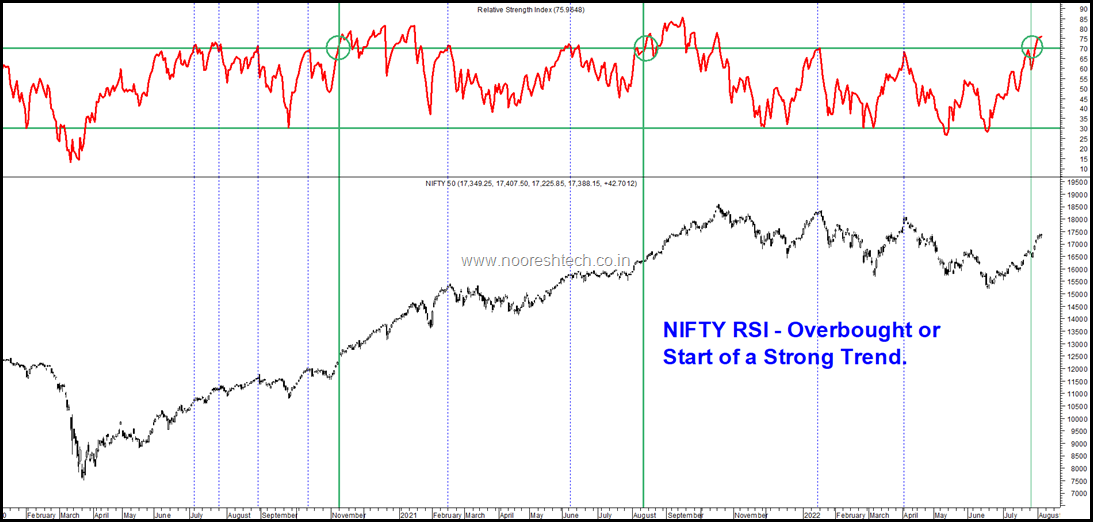

Nifty50 Equal Weight – New Leadership needed for Breakout.

- A clean channel breakout on the Nifty50 Equalweight.

- The chart below in red is the RS with the Nifty50.

- The last time it gave a breakout was when Reliance Topped and rest of the names in Nifty50 did well.

- The last two tops coincided with a top in IT.

- If this breakout has to continue who takes leadershio – Banks and Financials/Auto/Cap Goods or happens alongwith some recovery in IT and Reliance ?

- Will get answers when BankNifty can also take out major highs. Autos/FMCG have already done so. Cap Goods coming close.

3) Nifty Mid100 – Nearing the channel resistance. A dip before it breaks out or right away ?

4) Brent Crude – Almost back to Russia invasion of Ukraine price. About to break the 94-97 supports.

Now some interesting charts from the Nifty50 which are poised to show fresh leadership. So not posting any Auto names ( clear ATHs & 52 week highs in M&M and some others. )

5) ICICI Bank – Back near to all time highs.

6) SBI – Back near to all time highs.

7) Sun Pharma – Sade Sati to get over ?

8) Reliance Inds – Some more time sideways before it breaks out on one of the sides ?

Technical Traders Room -

Subscription Link : https://rigi.club/jcp/l7BZLqDa7i

Please note after subscribing, you will be added to Telegram and Rigi Channel in 24 hours

Whatsapp us at 7977801488 - NooreshTech for any queries