At a time when NIFTY is grappling to hold 15700, Auto sector and its constituents are showing some strength in the volatile market

Let us look at the charts - Most of them have been consolidating for more than 3 years now

Nifty Auto -

- Consolidating from 2018

- Base at 9500

- Breakout above 11500

- All time high at 12100-12200

Maruti -

- More than 3 years of consolidation

- Strong base at 6500-6600

- Resistance at 8000/8500/9000

M&M -

- 3 years of consolidation

- Strong base at 800-750

- Cup and handle formation

- Breakout above 980-1000

Bajaj Auto -

- Strong base at 3100-3200

- Breakout above 4000

- All time high at 4350

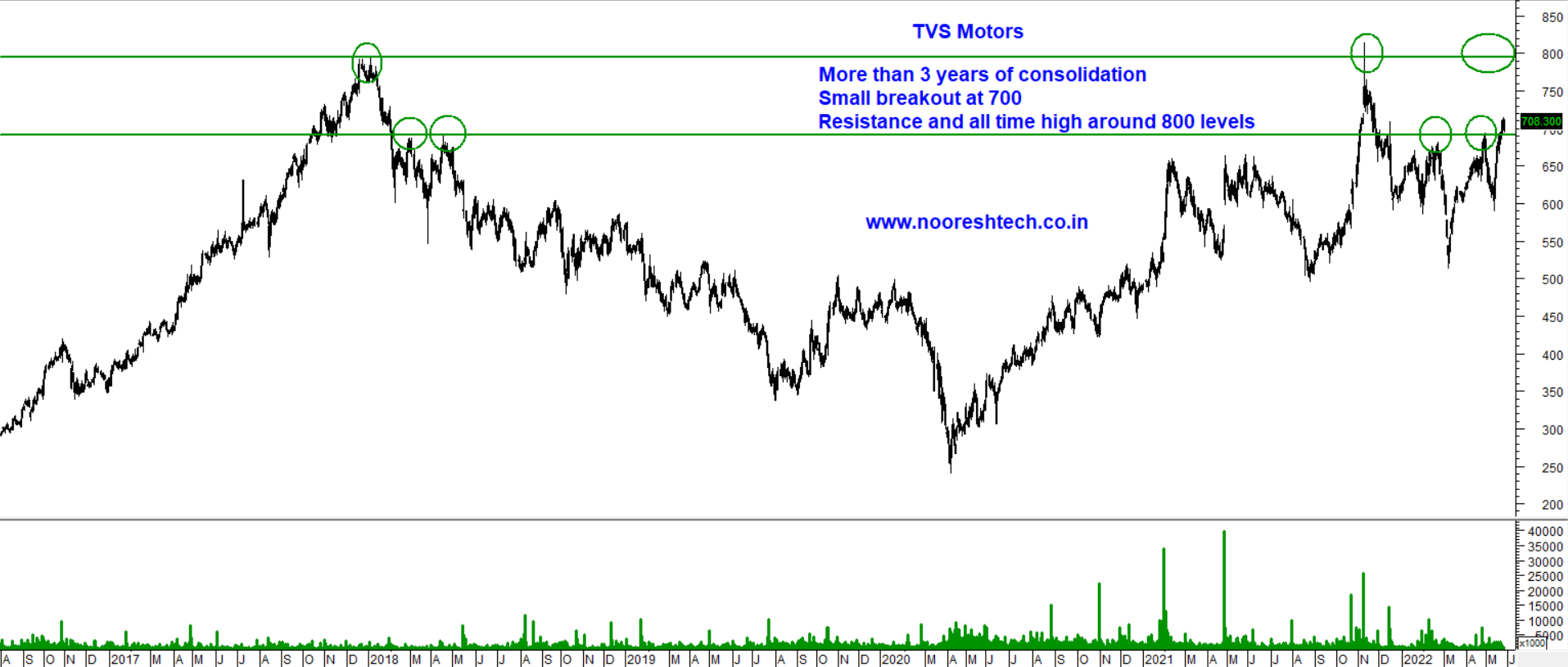

TVS Motors -

- More than 3 years of consolidation

- Small breakout at 700

- Resistance and all time high around 800 levels

Eicher Motors

- 3 years of consolidation

- Strong base at 2200-2300

- Resistance zones - 2800/3000

HeroMotoCorp -

- Underperformer amongst the peers

- Breakout above 2800, Can give a move upto 3400

Ashok Leyland -

- 3 years consolidation

- Breakout above 150-155

Also...Metals prices moving down gradually and Steel being an important component of raw material for Auto Industry...will the tides turn in favour of Autos?

Will the Auto Sector OUTPERFORM the Metal Sector going forward?

Do checkout the video:

Do share this post and comment what you feel w.r.t Auto Stocks

June 2, 2022

Hi,

I attended the webinar on big trending moves using moving averages. During the webinar it was discussed that scanner for chartink will be shared. Please share the chart Ink scanner.

Thank you