How to find major trend changes in sectors

Date : 27th February

Time : 11 am to 1 pm

Pricing : 500 Rs

https://rigipay.com/g/RmfdxrL5LE

Registered attendees will also be receiving the recording.

We will be looking at how to identify major trends with a lot of old examples and end the session with the setup in some of the interesting sectors and sub sectors to keep on radar in coming months for leadership.

We may also take a few questions for 15-30 mins.

I personally think this is very important topic for all of us. Do register and would love the feedback post the webinar.

Sunday Thoughts - My Favorite Chart & Favorite set of Questions to Ponder on .

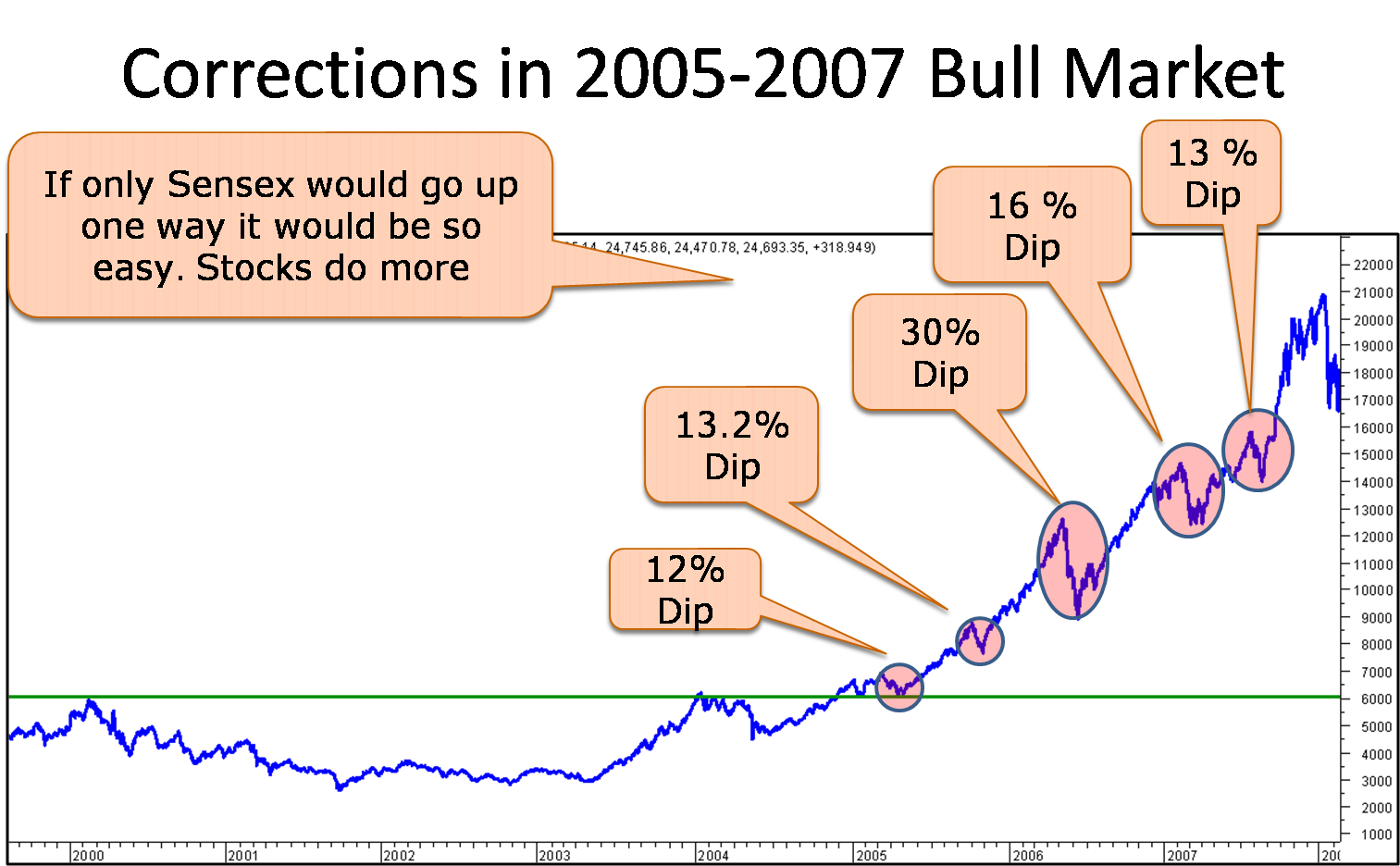

1) The Bull Market of 2005-2007 chart

This is chart which shows the best of the Bull Markets also have corrections – some quick , some deep, some extremely painful ( 2006)

This old post is a good read to understand market cycles.

Smallcap Index–What is a Shakeout , Correction & Crash. What is the Setup Now–Sunday Thoughts ?

2) The Simple Questionnaire – Snippet.

This snippet from another old post - Nifty Earnings–The Perfect Sher Aaya Story. is something which should be bookmarked for re-reading.

The Big Questions to Ponder on

You need not have an exact answer to the below questions. But pondering on them will give you clarity.

1) Are we in a Bull Market or Not.

Some of the simple options can be

- We are at the start of the Bull Market.

- We are in the middle of the Bull Market.

- There is a lot more to go in this Bull Market.

- We are at Top of the Bull Market.

- We are not in a Bull Market.

- This is a Bear Market Rally

- I Do Not Know!

One needs to go to very high cash say 10% to 40% or more if the answers are from 4-6.

One needs to go to tactical cash at 2-4 to either Buy Back on Dips or Switch for New Sector/Stocks.

One needs to be looking to deploy new cash if answer is 1-3.

For answer 7 – This is best. Stick to your long-term asset allocation and thumb rules.

My View – We are still between 2-3 and corrections of 10-15% on Index and 20-25% on broader indices should be a time to deploy fresh cash and be ready to digest near term pain.

Happy Investing,

Nooresh Merani

DM – https://twitter.com/nooreshtech

whatsapp – 7977801488