Do read the previous post

Nifty at 40 PE. Sell Everything and Run Away !!

We try to look at the Nifty and the Markets from different perspectives in the Post.

First, we start with where the Markets are today. We look at 3 indices. We try to compare it to the 2018 peak, 2020 peak, and 2020 bottom.

1) Nifty, Nifty Midcap 100, and Nifty Smallcap 100.

Nifty 50 – 15-17% higher than pre-Covid and 30% from 2018.

Nifty Midcap 100 – 20% higher than pre covid and back to 2018 highs.

Nifty Smallcap 100 – 18% from pre covid highs and down 20-25% from 2018 highs.

Observations.

- All the three indices are up 15-18% above the pre covid highs.

- The Smallcap Index is still down 20-25% from 2018 highs.

- Up almost 100% for the Indices from March lows.

Anchoring to the March Lows

- Nifty was below 800 for 3 days.

- Nifty was below 8500 for less than 3 weeks.

- Nifty was below 10500 for less than 3 months.

The Big Problem is that we all will get anchored to March 2020 lows !!

Avoid Anchoring 2018 or 2020 and try to work on what 2021-2023 can be.

The Big Questions to Ponder on

You need not have an exact answer to the below questions. But pondering on them will give you clarity.

1) Are we in a Bull Market or Not.

Some of the simple options can be

- We are at the start of the Bull Market.

- We are in the middle of the Bull Market.

- There is a lot more to go in this Bull Market.

- We are at Top of the Bull Market.

- We are not in a Bull Market.

- This is a Bear Market Rally ( Kinda odd )

- I Do Not Know!

One needs to go to very high cash say 10% to 40% or more if the answers are from 4-6.

One needs to go to tactical cash at 2-4 to either Buy Back on Dips or Switch for New Sector/Stocks.

One needs to be looking to deploy new cash if answer is 1-3.

For answer 7 – This is best. Stick to your long-term asset allocation and thumb rules.

Our View

- My view is we are somewhere between 2-3. I would keep increasing cash tactically.

- Like right now time to increase cash as markets are overbought.

- Cash will allow us to redeploy in new leaders.

- For example March 15 to Dec 15. Nifty down 9k to 8k. Chemicals, textiles, papers up 50-100%.

- Also, look to deploy new money on dips.

Sell and Runaway is not the view but it was a good headline!

So when to deploy new cash on dips.

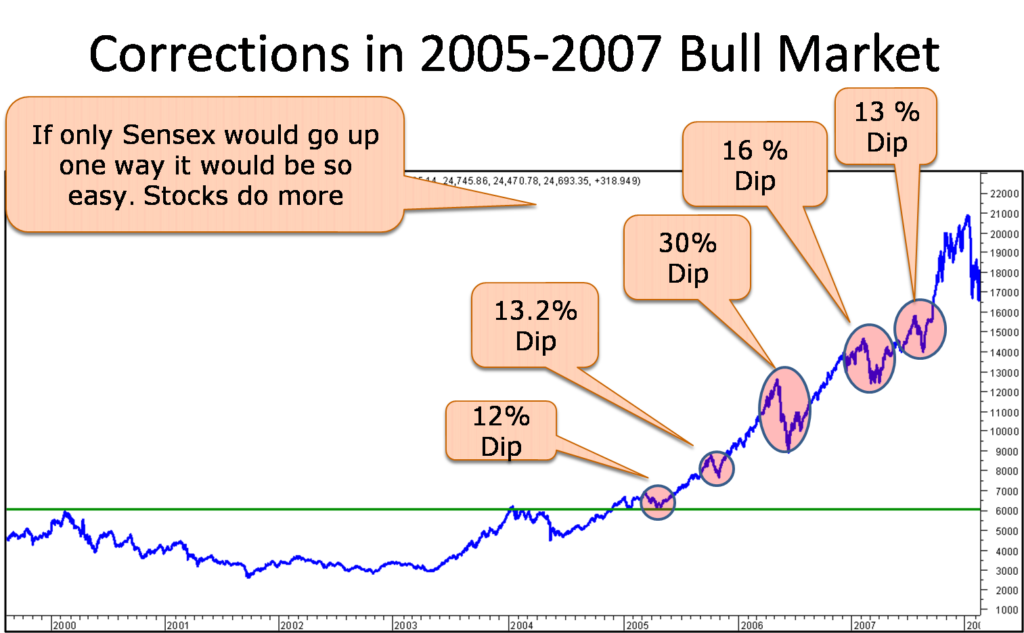

Corrections in a Bull Market. –

2005-2007 Bull Market – Many up moves were 50% too.

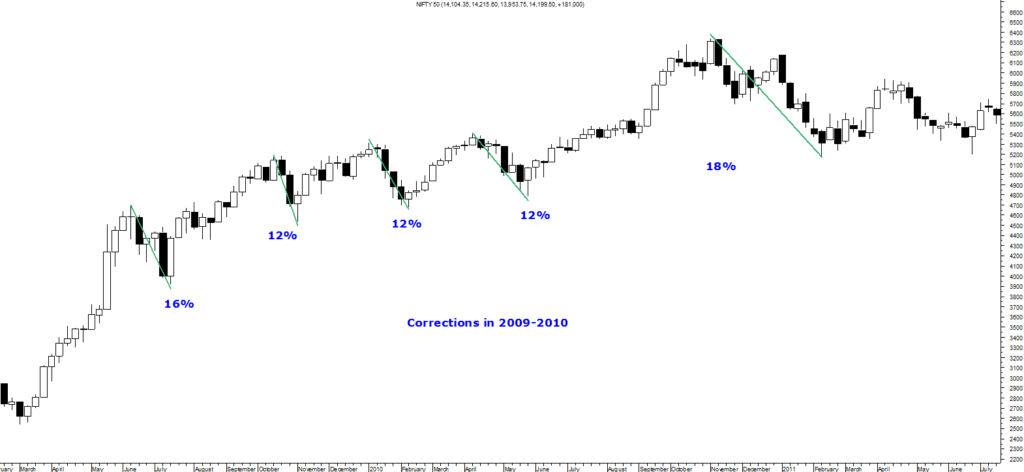

Corrections in 2009-2010.

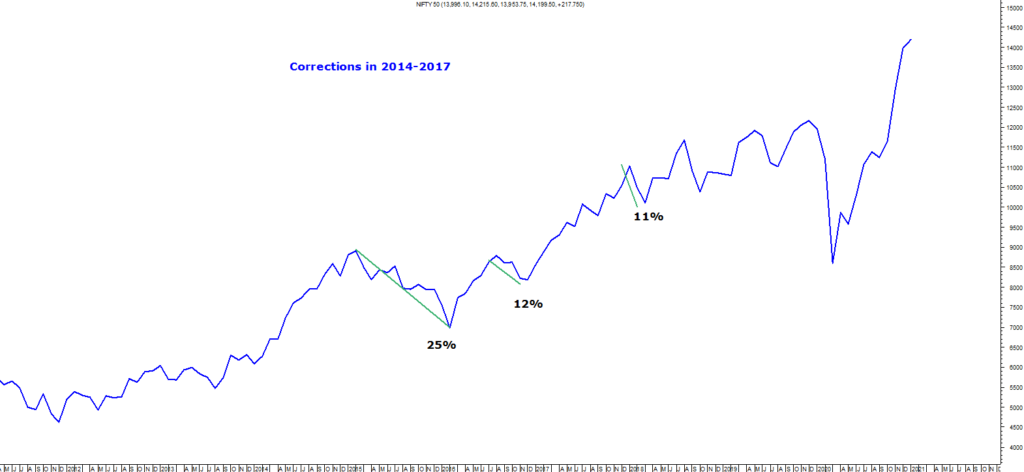

Corrections in 2014-2017. ( Remember 2017 not even a 6% drop for a year.)

- Can look at corrections in a Bull Market as either percentage basis or retracements.

- A strong bull market may only retrace 23.6% to 38.2% of the last major swing.

- Another way would be previous supports and breakouts.

- In the current stage that Buy on dips comes to 13200-12800 and 12000-12500.

- In a Bull Market, we would not expect it to crack below 11550/10800.

Nifty at 14400 and 40 PE

- The Earnings got hit due to Covid Disruption and looking at the last 12 months EPS and PE makes no sense.

- The PE may contract by a good number even if we go back to 2019 earnings.

- The structure of Nifty has changed a lot in last 10 years and the structure of PE Bands also accordingly.

- Till 2008 Nifty 12-15 PE was a Buy & at 20-25 PE was a Sell. We have not gone to 12-15 PE for 10 years now.

- P-E is also Perception to Earnings. We did not get earnings growth in 2014-2017 but Nifty went up in hope.

Nifty and India Earnings a Sher Aaya Story. Shouting for 6 years.

From a Presentation, I did a few years back – Flows to Floats

The 3 big ingredients of a Bull Market

- Huge Flows – Massive Gush of Liquidity

- Reducing Floating Stock.

- Earnings Growth and Visibility of Earnings with Higher Margins.

We had 1 & 2 in 2017 and it was a one-way run with not a 5-7% dip in Nifty and even in the World.

We are yet to see Earnings Growth come back.

The Sher Aaya Story

Remember the kindergarten Story ?

The tale concerns a shepherd boy who repeatedly tricks nearby villagers into thinking a Lion is attacking his town's flock.

When a Lion actually does appear and the boy again calls for help, the villagers believe that it is another false alarm

and the sheep are eaten by the Lion.

Nifty & India Earnings – Sher Aaya Story in Images.

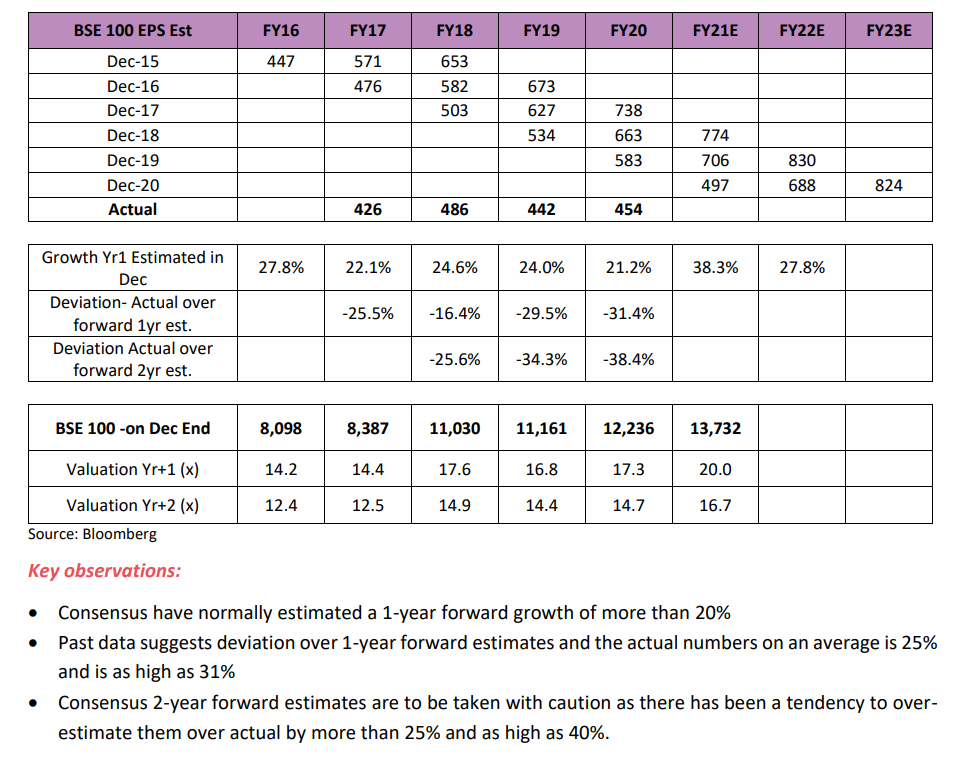

20% Earnings Growth Aayega !!

1) From IDFC MF Note.

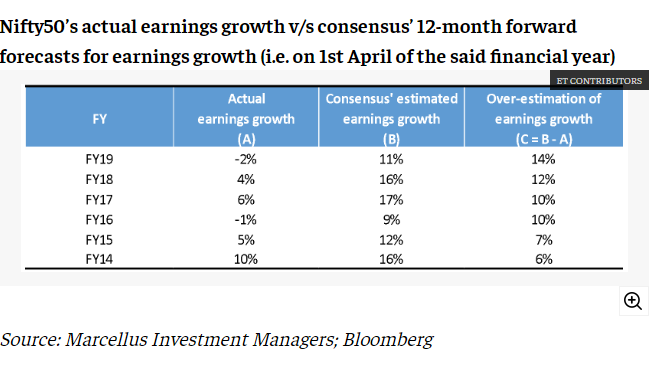

2) From Marcellus

Overestimation by 10-15%

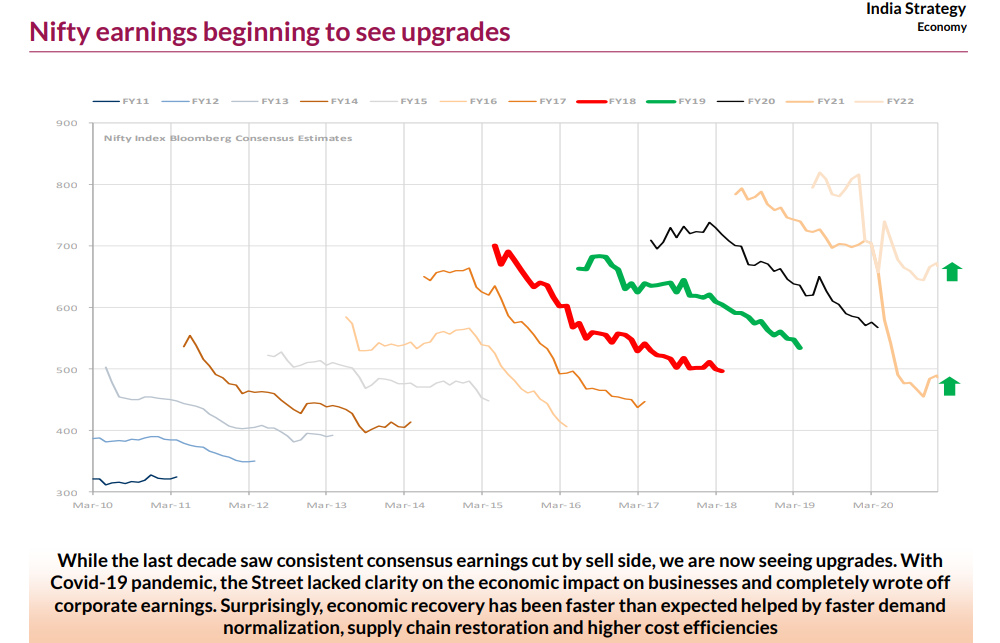

3) Axis Capital – Earnings Upgrades.

Hope Building up in upgrades just like 2014. Will India deliver ?

Our View

- One of our Follow Up Reports Indian Elections – Do they change Trends in 2014 remember using a 500-500-550 EPS in 2017-2018 and a 20-25 x multiple and how 10-12k makes sense.

- Although our reasons for calling a breakout in March 2014 was mainly technical.

- We did go to 11k but Nifty EPS has not gone to 550 even by 2019-2020.

- Forecasting Earnings is not our cup of Tea but historically Indian Earnings have come up in a Rising Inflation, Rising Commodity Prices, Lower Interest Rates, Stable INR.

- It seems like if Niftys and Indian Co Earnings have to come there was never a better time than now since 2003-2008 !!

Firmly in the Camp of Sher Aayega but Koi Nahi Maanega !!

If earnings are to come back there will be corrections but eventually we could head higher over next 1-4 years.

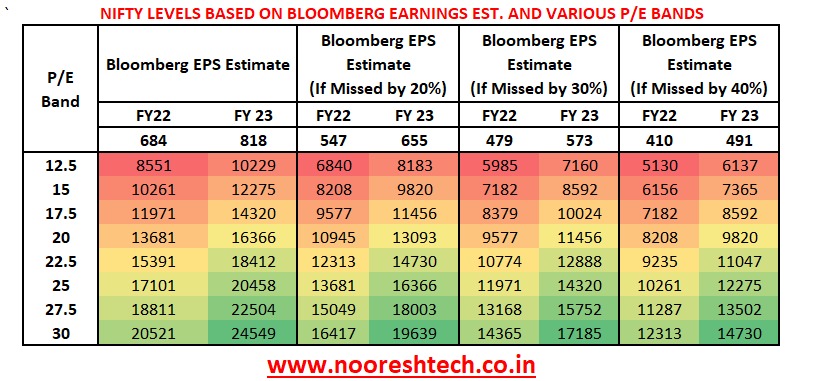

The Earnings Matrix.

The Bloomberg Consensus EPS estimate for Nifty for Fy 22 is 680 + and 800 + for Fy 23.

- Look at possible upsides from the perspective of 6% FD Rates and 1-3% rates for Foreign Money.

- Our view is we may be closer to the estimates than ever in the last 6 years.

- If I were to Guess – My view is we may go closer to 20k than 10k in the coming years.

- 7th time Lucky maybe.

Conclusions

- If you think we are at the Peak of the Bull Market or it is just a Bear Market Rally ( odd at ATH) then increase cash big time.

- Our view is we are in the middle of the Bull Market and will keep increasing some cash for either buying on dips or to switch into new leading sectors or new ideas.

- Like for now, the Nifty is overbought, Smallcaps, and Midcaps are overstretched.

- Our cash will increase as we keep getting stopped out on the way down.

- If you are a Long Term Investor ( 3 years plus) you need not worry about 10-20% correction.

- What you need to think is how will I be able to buy on dips and buy on new leaders or new finds.

- Do not get anchored by 2020 prices else you may not be able to buy anything.

- Just like if you would have got anchored in 2008/2013/2016.

- Keep researching for new sector new ideas. Also, remember there is no rule that all stocks go down with Nifty.

- One of the best periods for the midcap/smallcap ideas was when Nifty went from 9000 to 8000 in 2015.

To sum it up – Our View is.

Increase Cash Tactically to Buy on Dips or Switch to New Sectors/New Ideas.

Keep the Mental Framework ready to digest a 10-20% correction and be able to deploy new cash in it.

Keep Researching for interesting stock ideas, sectors, etc. Opportunities will keep knocking.

January 11, 2021

The observations are 100% right. Thanks.

January 12, 2021

Good assessment of the markets..

January 21, 2021

Good article, Nooresh ?. Slowly learning to not anchoring myself to March2020 lows. Already lost a few great opportunities because of that.

January 21, 2021

Nice article

Very educative