What do you think about the above Headline?

- Wow nicely framed for clickbait.

- Or is that what you want to read given the roaring market.

- The economy is still not Up and Running 100% but Nifty is now very close to 100% from Covid lows.

( The Headline was supposed to be for another post but got distracted and below are my Sunday Thoughts.

The Headline seemed too catchy so keeping it. Do read the FootNote for the above headline and upcoming post)

There are other headlines.

AMCs and Fund Managers will have headlines like.

- Do not exit because Valuations are High.

- SIP your way to moksha.

- Stick to your Asset Allocations. Equity goes up & Down.

- If you sell Today will you be able to Buy? Could you do that in Covid Dip?

- Buy Asset Allocation Funds, Hybrid, Balanced, Thematic, NFO, and any other Nuanced Fund.

- Buy Quality at any Price. 15% CAGR is written in your Contract Note Right Away.

The Investment Advisers, Independent Analysts, Twitter Advisers, Disguised Brokers, PMS Fund

Managers and anyone else who is ready to take a fee may say some of the following statements.

- Momentum Investing is your Moksha – It has an Exit Strategy. Went to Cash and then 100% Equity.

- Buy PMS Funds as they have flexibility even though we charge a bomb.

- Just Write Options for the Day, for the Expiry – Why worry about anything. Daily ATM and MTM Open.

- Find a few Multiaggers go all In – What is Nifty!

- Trend Following in Indices and Stocks – 15 mins a day is all you need.

will be more such headlines.

Your Bank Relationship Manager or some Distributor or Financial Planner etc will say do not keep all assets in one basket.

Keep Equity, Equity MF, Debt MF, Bank Bonds. Liquid Funds, RBI Bonds, Invits. NCDs, AIFs, PMS, Expensive Art.

Also Old Wines, Bitcoins, Altcoins, Gold, Silver, and if Lithium ETF is available you might as well try that.

What is the Common across all?

- Above headlines work as our minds want to think in binary conditions. 1 or 0, Yes or No, Black and White.

- The other way our Mind works is that if it's too complex – I Quit you Do It.

So if you are a Salesperson for any of the above businesses. I give you the Secret Sauce.

Either make it too Complex or the Only Way to Moksha ( Yes or No – Binary ) is your Product and voila you have a Sale.

One of the Best Salesperson I met once told me.

“ It does not matter how you sold your Product if it's going to give results better than what the Buyer would have done it himself.”

Another Good Financial Product Guy said – “ I do not Lie, I let the Data do that. “

I am terrible at Selling and hope someday I get better but can look into data so will write a bit on that….

( Been Writing A Blog for too Long ( since 2005) but terrible at Selling Products )

I will put some examples on How Data Can Lie,. It's just for Fun and No Pun or Offense Intended.

( Keeping it brief else every example is a Very Long Post)

India's Equity CAGR is 17% in Long Run.

- Indian Equity Return is 15-17% Cagr over the long run. Data is absolutely correct.

How Data Lies?

- 1979 to 1992 the Sensex went up 40 times or more. This is not happening in our Lifetimes.

- We need someone 40x of Harshad Mehta - ( See Scam series or better read The book – The Scam )

- But Sensex was only started in 1985, Mutual Funds in 1992. ( First Private Sector Equity MF was in 1993 )

Time in the Market is more Important than Timing the Market.

- What happens to your returns, when you miss the top 10 Best Days of the Market. Your Returns drop from 12% to 6% etc.

How Data Lies?

- The Assumptions lie here. Any Investors in his Sane Mind would not sell all his investments for a Day ?.

- Why would you add or deduct 1-day returns and then Sum it Up?

- What would prove Time is More Important. Even if you Buy at the Worst Points in History in Long Term the returns are decent.

- That Data Sucks!

- Check this - #CAGR of #Nifty if you got the #Cycle right or Wrong.

- CAGR from 09th January 2009 is 14.3% ,

- CAGR from 9th January 2003 is 15.35% ,

- CAGR 09th January 1995 is 10.5%.

- And if you bought on 9th January 2008 the #CAGR is 6.6% !!!”

- CAGR of Sensex from Harshad Mehta peak after almost 29-30 years is sub 9% !!

Remember Timing the Market could also be about going to 10-20-30-40% cash.

But theoretically, everyone will use 100% Equity or 100% Cash for all calculations as that's Binary and Scary!

Quality bought at any P-E is always going to give you good returns.

If you bought Nestle at 290 PE , Walmart at 300 PE , Asian Paints at 100 PE – 10-20-30 years CAGR would be high double digits.

Data is absolutely right and makes so much sense.

How Data Lies

- One can play with different stages of DCF to justify quality but the fact is you are buying Longevity.

- Writing about how to understand longevity is tough as there is absolutely no measure for it.

- In 1930s Physicians were used in advertisements of Cigarettes and was not seen as a Sin. ( Flights Allowed cigarettes)

- Who knows in future – Noodles, Chocolates, Soft Drinks would be banned in flights,schools or would be permissible age for kids.

- We have gone from Sin Investing to ESG !!

- Remember - In the Long Term Nothing Really Changes but if it Changes then it changes Forever !!

- The Survivorship. Almost all Quality and Longevity Comparisons are with Survivors and never with the Extinct.

- How many NBFCs got listed in 1990s and how many survived ?. ( Luckily RBI did not dole out Banking Licenses. )

- How many Marts, 2 wheeler cos, scooter cos , Chemical cos went sick or fizzled out

Conclusion

- Try controlling your Mind from thinking in Binary or Linear Terms. Also do not get afraid if something seems complex.

- The decisions that come of out it are at times the worst decision you can make.

- Put a little time and it may not be as Binary or as Complex.

- It's your Money. Take your time and there is no hurry.

- It's alright to take Advisory services or let others Manage Money or Some Money for you.

- But Remember there is no Single or the Only Right Way !!

FOOT NOTE

- I wanted to write this post on Nifty, Equity after seeing a lot of discussions around 14k Nifty and 40 PE.

- The title distracted me and ended up writing something else

I was supposed to write on

- Are we in a Bull Market or Not?

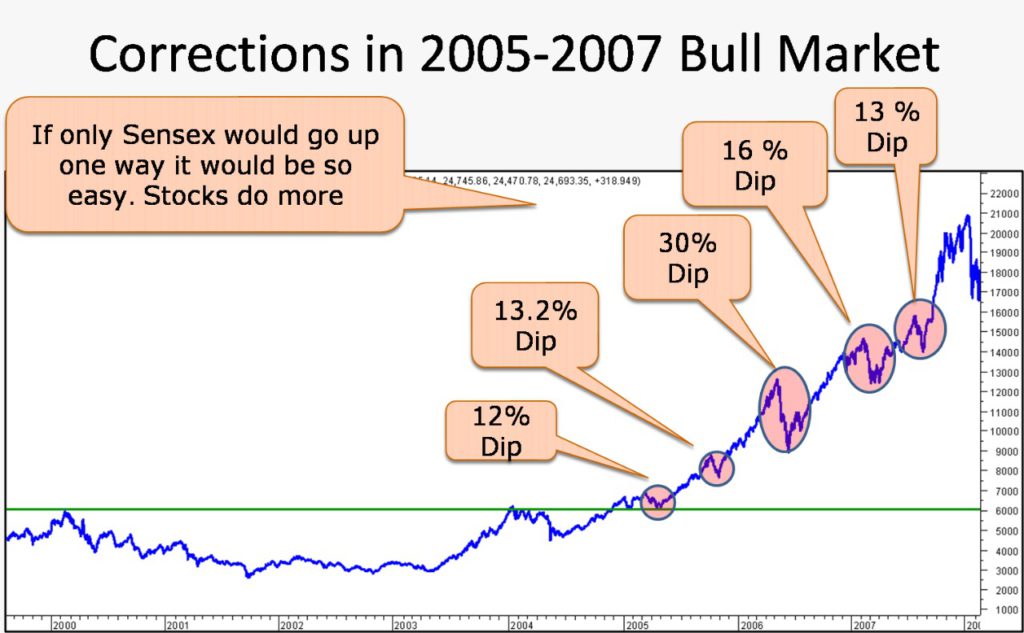

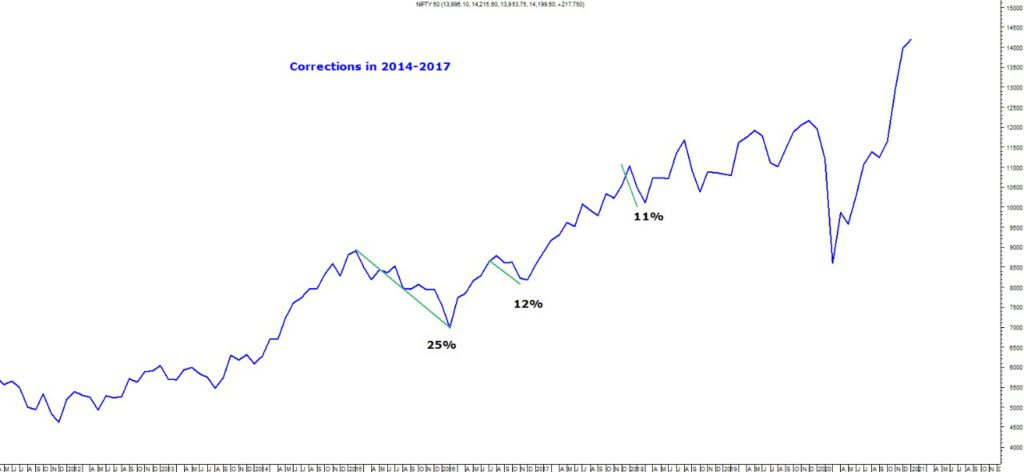

- Corrections in a Bull Market.

- Nifty at 14000 and 40 P-E.

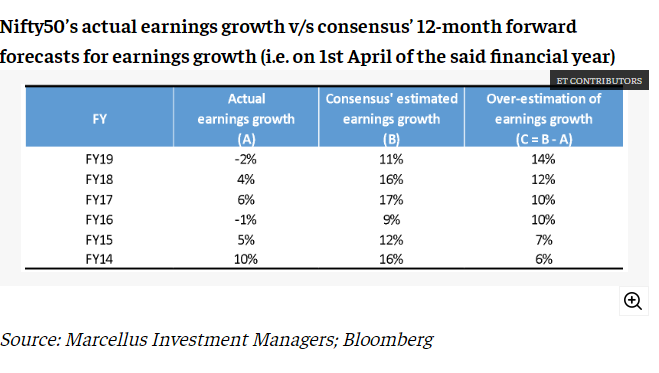

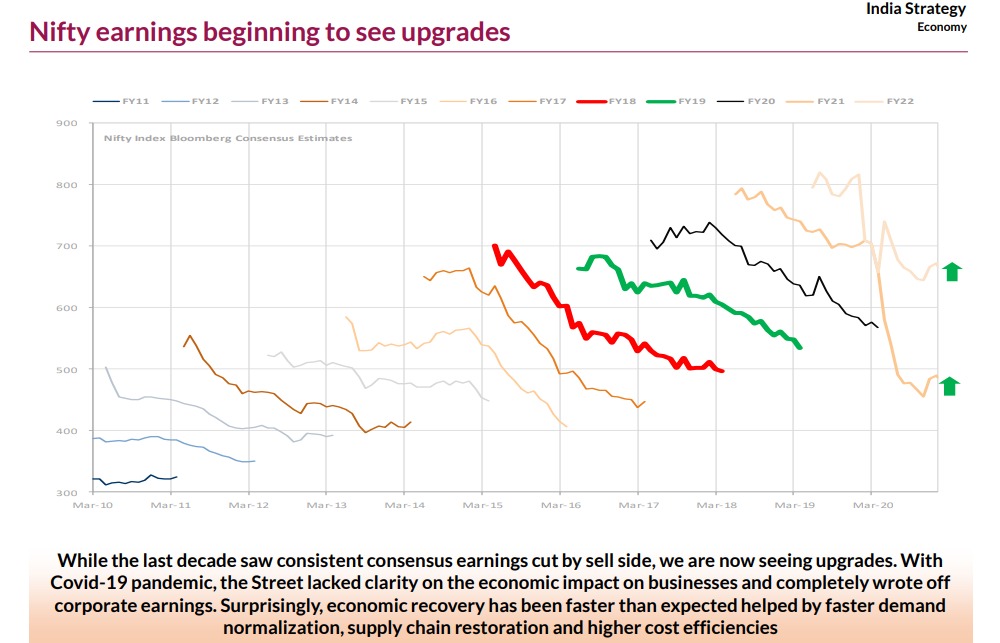

- India Earnings a Sher Aaya Story. Shouting for 6 years. Now when it comes nobody will believe the Analyst.

- Can Nifty go to 10k or 20k?

I intend to write this post today or tomorrow or in the coming few weeks.

Some Questions we will look into.

- Nifty EPS estimated at 700-800 in Fy23. Can it get a 25-30 multiple then?

- Will it come anywhere closer to 700-800 ?

- Should you worry about a 10-20% correction in a Bull Market.

- Will you be able to buy the Dips ?

- If you think it's not a Bull Market why not Sell Everything?

Will leave you with some Images which I'll use in the post.

Source - Axis Capital Report.

Product Plug

Online Technical Analysis Video Course https://youtu.be/fJYX1TP0a6I

Subscription Link - https://imjo.in/jWW5cg Rs 6000 1 year access.

January 10, 2021

Thank you. Nice analysis.

January 11, 2021

The write up is a timely one. It’s an outcome of deep thought process. It’s a good gift to the investors community.

January 11, 2021

Nice one