Just another correction.

We posted these divergence charts in the day on our App and Broadcast Group

Download - NooreshTech App (Android) https://gbolton.page.link/Ng1y

Download – Technical Traders Room Free Broadcast https://rigi.club/jc/Cj7v_tCsp9

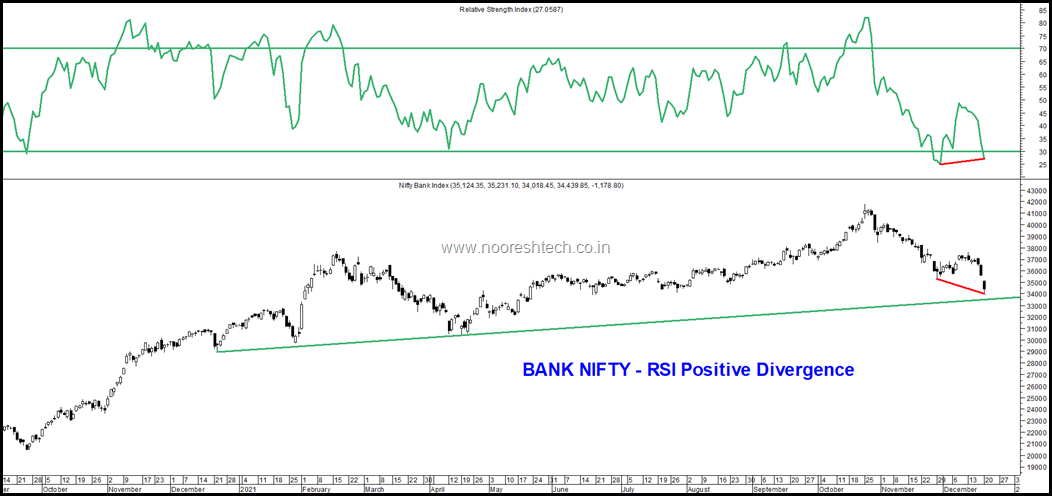

Bank Nifty

- Bank Nifty is now below the 200 dema.

- Very close to the major trendline support.

- RSI showing positive divergence. A cross above yesterdays high indicates short term bottom.

- Will it be another dip before a durable bottom. If Bank Nifty crosses 37300 eventually that negates a triple divergence possibility.

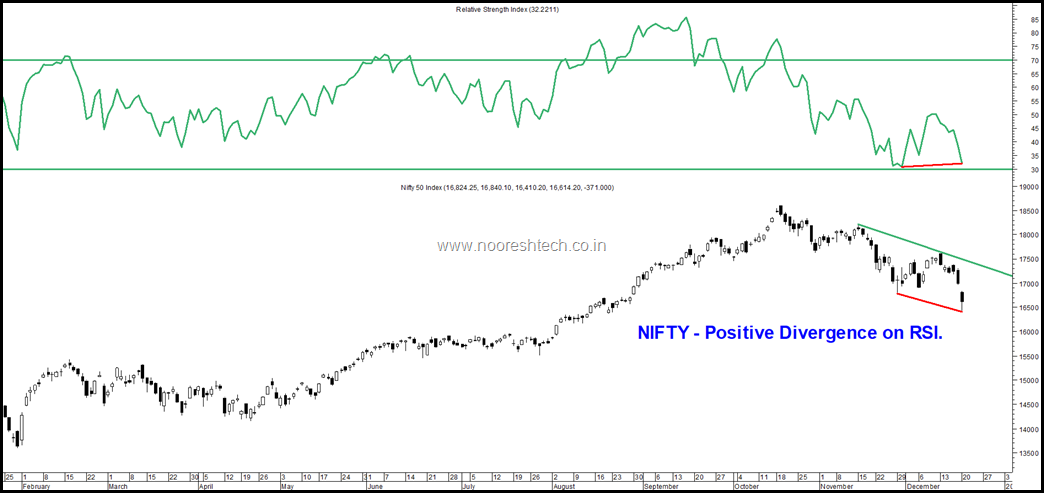

Nifty RSI

- Nifty made a low close to the 200 dma at 16250-16300.

- RSI showing positive divergence. A cross above yesterdays high would indicate a short term bottom.

- Will it be another dip before a durable bottom. If Nifty crosses 17380 in coming weeks it would negate a triple divergence possibility.

Conclusion

- If you are reading the blog for some time or been through the Online Course on Technical Analysis would have read articles previously on how RSI Positive divergences helped us catch bottoms.

- The Best Bottoms are Triple Divergences with three dips and positive RSI divergence. But its a rarity.

- Nifty and Bank Nifty have done a positive divergence.

- We never try to position for the third bottom as its a rare occurrence.

- A good time to deploy fresh cash into the markets in coming days/weeks with a longer term view as well as a bounce.

The Breadth of the Market – Just another correction.

We get back to our work of doing broader market analysis of price correction in the whole universe of NSE Stocks. A good time to read this article on the day of March 2020 bottom .

Time Period – 19th October 2021 ( Nifty Peak ) to 20th December 2021.

1) The Full NSE Universe.

| % Change | No. of Stocks | % |

| More than 100% | 35 | 2% |

| 50% to 100% | 60 | 3% |

| 25% to 50% | 105 | 6% |

| 0% to 25% | 348 | 20% |

| -15% to 0% | 730 | 42% |

| -25% to -15% | 378 | 22% |

| -25% to -50% | 86 | 5% |

| -50% to -100% | 2 | 0% |

| Less than -100% | 0 | 0% |

| www.nooreshtech.co.in | 1744 | 100% |

- 64% of the stocks are lower than the highs of 19th October 2021.

- 27% of stocks down more than 15% from 19th October 2021.

2) The Nifty Stocks.

A good no of Nifty stocks down more than 10%

3) Below 200 and 50 dema.

70% of the stocks below 50 dema and 40% of the stocks are below the 200 dema.

Conclusion

- The correction is more a reversion to mean for the broader market and not a deep correction as such. Goes with our stance that we are getting back to a stock specific market - https://nooreshtech.co.in/2021/11/nifty-50-breaks-swing-lows-but-nifty-midcap-smallcap-hold-on-back-to-2015.html

- The Smallcap Index still holding on above the recent lows.

- This may not be the time to just buy stocks because there are 20-25% down ( unless playing a small pop trade) but to focus on new leadership stocks/sectors and avoid anchoring to previous leaders.

- Time to get back to researching for finding stock specific ideas.