PSUs have been a laggard for the last many many years and some for decades.

Before I start this post. Disclosure – We have recommended a PSU Basket in Technical Traders Club buy in November and already booked a few and hold a few. It was one good 30% trade in a few names.Continue to be very positive in the long run and the view is bottoms made in Sept/October could be history. So there is a bias.

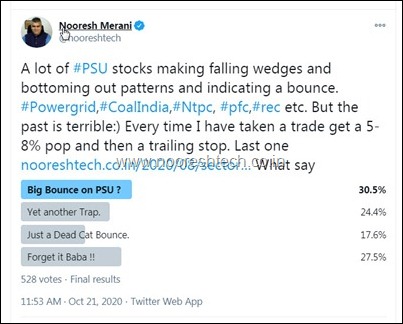

I did a poll on Twitter in the Index around 21st October

Poll 1 Results.

A good fight betwee forget it baba and Big Bounce.

Poll 2 Results

Votes increase and so the conviction in the bounce. But not a consensus.

Contra Bets are difficult. We did a video on Metal Sector as well as a Post . The sector did well but was difficult to participate fully.

Now looking at the charts of some PSUs which are showing possibility of a Multi-Year Trend Change.

BHEL – A long term trend change on cards. Stops at 30 and massive upside for a long term bet. ( Better than buying penny stocks ?)

Will it be just another pop like in 2010/2014 or a bigger move in the long run. Disclosure – Biased.

BPCL – A compressed Spring. Needs a trigger. Crossing 410-430 would mean a long term breakout and all time highs.

PoweGrid – A solid business but a flat chart for years. Finally sustaining above pre covid. ( add div). Time for a slow and steady trend change.

Bharat Electronics – A 2 year breakout on cards above 120-125. Was the best performing PSU in 2003-2007. A solid business.

The above 4 stocks look interesting for a long term time frame and stops could be deep. So please do your own research and risk management.

Analyse India – Insider Trading Report

To Subscribe

Quarterly - 699

https://imjo.in/Mzmtdt

Annually - 1999

https://imjo.in/JtdFVs

Why to look at insider trading ?

Read the Post.

https://nooreshtech.co.in/2020/04/insider-buying-a-good-way-to-hunt-for-companies-to-research.html

Youtube Video.

https://www.youtube.com/watch?v=bt5wtR4AJuA&ab_channel=NooreshMerani

Latest Insider Trading Report includes

1) List of 58 companies where promoter have bought stake from 1st November 2020 to 10th December 2020

2) Details such as

> Basic business of the company

> Market cap of the company

> Number of shares acquired by promoters

> Value of shares acquired by promoters

> Average rate at which promoter bought

> % of equity acquired

> Last 5 year change in promoter holding

> Technical chart view of the stock

> Any other observations

3) Apart from it you also get access to sheet where you can track live prices of such companies and monitor their performance on a daily basis.

To Subscribe

Quarterly - 699

https://imjo.in/Mzmtdt

Annually - 1999

https://imjo.in/JtdFVs