As i write this post Nifty50 today made a high of 10800+ and is now down just 12-13% from the all time highs.

Even in a market scenario with no pandemic, this would be considered a normal correction. We had a 11% dip in June 2019 to September 2019.

This is the case around the world but only difference is World has given stimulus and supports to Businesses, whereas in India it is the Indian Equity Investor who is giving the Stimulus.

(Remember this = 1 lakh cr SIP, 70k CR LIC, 30k Cr = 2 lakh crores.) If this was not enough there is a big surge in Direct Equity Participation. Do read this post - Liquidity effect greater than Covid19 for Nifty50, leading to Sector Rotation.

Nifty50 – The Covid19 Gaps

- The 1st major gap happened at 11536 around 28th February. 2nd gap at 11244-11035.

- 9th March gap at 10827-10750 and next on 12th March 2020 was when Nifty50 broke 10k mark.

- Nifty today has tested the gap at 10827.

- Any move beyond 10800-11000 is almost like selective Amnesia to Covid19.

The Polarization in Nifty50

| Nifty5 | 41.55% |

| Nifty10 | 62.69% |

| Nifty20 | 79.43% |

Keeping reference points at 1st Gap of 11536-11400 and 11244-11035

The Performance of Nifty5

| RELIANCE | 12.45 |

| HDFCBANK | 10.65 |

| HDFC | 6.99 |

| INFY | 6.21 |

| ICICIBANK | 5.25 |

Reliance and Infy !! Whoa

- Reliance at 1850 is 15% higher than previous all time high of 1609 and 35% up from 28th February 1st gap down.

- Infosys is back to the price it was on the 1st gap down. So its at 11400-11500 equivalent of Nifty

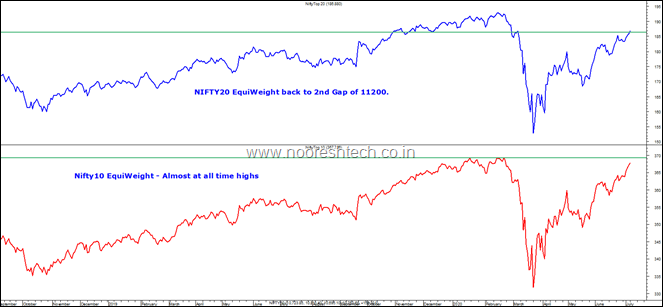

NIFTY10 and NIFTY20 EQUIWEIGHTS

Have started making a lot of EquiWeight Sectoral Indicators something which my friend Sumit Verma uses for Nifty10 and Nifty20.

Nifty10 and Nifty20 EquiWeights

- Look at this Nifty10 EquiWeight just a few points away from ATH

- Nifty20 is back to an equivalent of 11200-11300.

- Reliance is up 15% from previous all time highs, Bharti ATHs, TCS 2% away from ATH. M&M above pre Covid times.

- ITC and Hindustan Unilever are higher than pre Covid prices.

Nifty50 Technical View

- Nifty has broken just above the Rising Wedge and even Global Indices did breakout of such wedges before pausing.

- RSI is finally above 70 and overbought but not a clear Negative Divergence.

- This could well be a time to Shorts in Part at every rise just the opposite of 8500 lows in March. A pause and dip back to 10250.

- Resistance zones to build shorts 10800 gap and 11035-11200 if it comes.

- If not Short this may well be a time to be very strict on Stoplosses for existing longs and caution on new long positions in terms of sizing.

- Broader Market selective Momentum may lose momentum once Nifty breaks lows at 10250. Till then one can be selective in broader markets.

- Be Selective, Be Alert and Be Disciplined.

Do read our older posts in March

-

Equity–Never been so Bad so Quick. What Next ?

-

Opportunities in Bear Markets and Consolidations post 1992, 2000, 2008 and 2020.

Insider Trading Quarterly Report–Interesting Ideas to Research @Rs 699 per Quarter or Rs 1999 for a Year

Read the post -

Payment links

Quarterly Report Payment Link - https://imjo.in/Mzmtdt

For Annual Subscription – Insider Trading Quarterly Report - https://imjo.in/JtdFVs

ONLINE TECHNICAL ANALYSIS COURSE – Video Course

Can buy the course from this link and go through the entire curriculum ( Course Content & Curriculum )

https://www.analyseindia.com/course/onlinetechnicalanalysiscourse/?tab=tab-curriculum

July 7, 2020

Very useful