In our earlier post we had looked at Economy is Not Equal to Nifty50

Nifty now back at 10k from the highs of 12400 and lows of 7500.

Most of the global indices have now recovered more than 50-60% of the fall. Nasdaq has hit a new all time high. Around the world stimulus is coming from the government but in India the stimulus seems to be coming from the investors ![]()

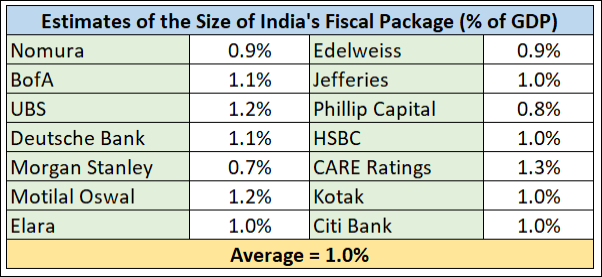

1) The 21 lakh crores stimulus is actually 2 lakh crores

Source -

Why the ₹20-lakh crore stimulus adds up to just ₹2-lakh crore direct impact

2) The Indian Investor Stimulus to Equity Markets every year at 2 lakh crores !!

a) The SIP Inflow – 1 lakh crores

How much will it be in 2020-2021 ? For now the SIP aum is now almost 1/3rd of the total Equity aum and a lot of SIPs are turning flat to negative on 2-3-5 years time frame. Will be interesting to see behaviour in current times.

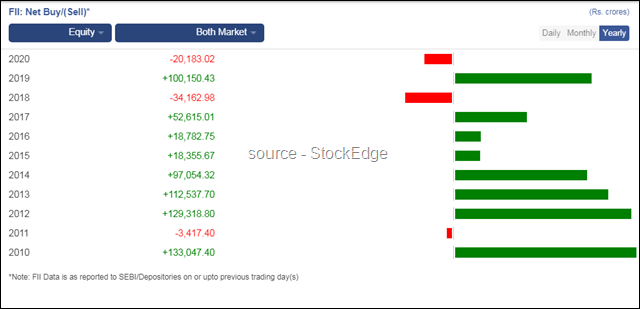

Why is this 1 lakh number big ? Compare it with FII action annually.

Above is considering even in Primary Market ( IPO) . Secondary market numbers lower. Even in 2008 the FIIs sold less than 1 lakh crores.

In March 2020 FIIs sold 65k crores and DIIs bought 55k crores. May and June FIIs turned buyers and markets have been inching up. Risk-On and Risk-Off continues without any economic or earnings growth which will lead to both turning buyers together.

b) LIC investment into Equities at Rs 70000 cr in 2020.

LIC investment into Equities at Rs 70000 cr and it generally averages more than 50000 cr a year.

c) EPFO investment into Equities

This is closer to 25000-30000 cr a year as per estimates. No direct source link but most of this money now goes into Nifty50 ETFs and now SBI Nifty50 aum has crossed 60k crore thanks to EPFO.

If this was not enough now we are seeing increased participation in Direct Equities across the world and in India.

1) United states

Young investors pile into stocks, seeing ‘generational-buying moment’ instead of risk

This website is interesting - https://robintrack.net/symbol/DAL ( Warren Buffet is selling Delta and Robinhooders buying.)

2) India

India’s lockdown mints more than a million new stock traders

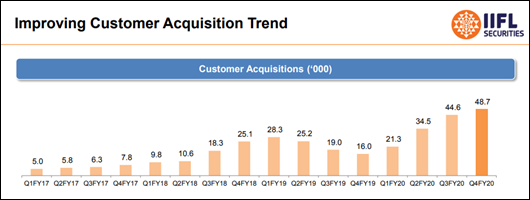

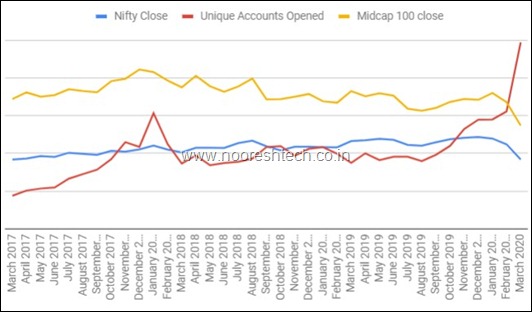

Zerodha & IIFL Securities – Unique New Accounts Breakout in March

Source – IIFL Investor Presentation

Source – Tweet

Will do a detailed post on Flows to Floats again in coming weeks. Domestic Flows have taken the Equity Ownership to almost 15% of India compared to 18-20% of FIIs. A big change in the making if we see economic recovery in coming years.

( One of the reasons I like Broking companies for long term now is that the next shift could be direct equity participation and most broking companies are at cheap valuations. A company like Emkay Global is below cash or a IIFL securities has a large Real Estate Rental, BSE has more cash than market cap and a big building and CDSL shares, Motilal Oswal & ICICI Securities are solid brands. NAM India a good asset management co.) Disclosure – Biased and Invested. Do your own research.

Conclusion – There is a lot of liquidity chasing Equities and most of if it is coming through the Institutional Route – Mutual Funds, LIC, EPFO . This is leading to the flow finding relatively better placed sectors and will continue to do so till Flows do not shift to Redemptions. SIP and Mutual Funds Inflow data for May-September will give more insights. Sector Rotation is going to be the way forward to look for ideas.

SECTOR ROTATION

( Source of data – NSE and collated by my team mate Harsh Doshi )

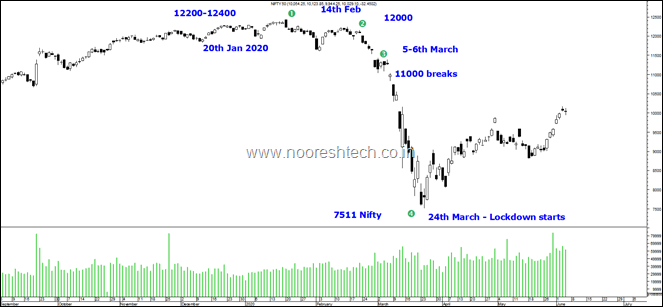

We will look at the sectors from the peaks and troughs in the Nifty chart.

1) All time highs 20th January 2020. 2) 14th February 3) The Big Gap down from 5th March breaks 11k. 4) 7511 Bottom post lockdown start

Format of the data is falls from the 1st 3 dates to 4th June 2020 and recovery from the lows of 24th March to 4th June 2020

We did this another data driven article on 24th March 2020 – Do read

Equity–Never been so Bad so Quick. What Next ?

Excerpt from the post

The 2020 move did some things very differently. No euphoric move in end of 2020 like in 2007. The fall has seen no relief rallies of any sort. If this is the case the historical expectation of a sideways consolidation and a retest may not happen. So the recovery can even be very ferocious.

Shorts need to be extremely careful. This is not the time to panic and sell. It will take a lot of guts to buy equities today. But this is the time when multi-fold returns happen over next few years , if we survive the covid-19

The SectorWise Data

In the current post we are only looking at Nifty 50 stocks. Will mostly write another post with data on all other stocks in NSE universe.

The Nifty Performance

| 20-01-2020 | 12-02-2020 | 05-03-2020 | 24-03-2020 | |

| NIFTY | -17.64% | -17.54% | -10.71% | 28.98% |

1) Banking and Financial Services – Hit on all time frames and a meek recovery.

One thing is clear the sector most hit from Covid19 and Lockdown is Banks and Financials due to the leveraged nature of the business.

| FINANCIAL SERVICES | 20-01-2020 | 12-02-2020 | 05-03-2020 | 24-03-2020 |

| AXISBANK | -43.68% | -45.77% | -39.59% | 35.10% |

| BAJAJFINSV | -44.78% | -45.91% | -40.47% | 17.53% |

| BAJFINANCE | -41.92% | -49.42% | -44.31% | -2.52% |

| HDFC | -25.21% | -24.69% | -16.37% | 21.96% |

| HDFCBANK | -18.54% | -18.15% | -11.21% | 33.16% |

| ICICIBANK | -33.28% | -35.04% | -29.27% | 20.35% |

| INDUSINDBK | -67.54% | -66.15% | -59.78% | 38.42% |

| KOTAKBANK | -14.30% | -19.15% | -16.04% | 20.27% |

| SBIN | -44.30% | -45.38% | -39.38% | -4.53% |

2) Automobiles – Did not fall much but What a Recovery and now close to where they were at 11k + Nifty !!

Automobiles have been the biggest surprise in terms of recovery as well as stocks like Hero Moto Corp is just 5% from the price where it was when Nifty hit an all time high. Two Wheelers have done well. Maybe the markets expect Two Wheelers to recover the fastest.

| AUTOMOBILE | 20-01-2020 | 12-02-2020 | 05-03-2020 | 24-03-2020 |

| BAJAJ-AUTO | -10.32% | -11.53% | 2.95% | 43.69% |

| EICHERMOT | -17.89% | -9.00% | -1.31% | 23.47% |

| HEROMOTOCO | -4.78% | -5.07% | 11.45% | 41.37% |

| M&M | -14.47% | -8.64% | 1.21% | 80.33% |

| MARUTI | -24.51% | -20.15% | -11.65% | 25.36% |

| TATAMOTORS | -49.36% | -42.23% | -21.47% | 44.06% |

3) Cements – Not as much of a fall and a decent recovery.

Cement sector price moves have been pretty range bound. The market-men talk about how the world needs to learn from the Cement sector in terms of controlling cement prices.

| CEMENT & CEMENT PRODUCTS | 20-01-2020 | 12-02-2020 | 05-03-2020 | 24-03-2020 |

| GRASIM | -22.64% | -20.86% | -12.13% | 49.41% |

| SHREECEM | -6.50% | -12.39% | -6.23% | 27.39% |

| ULTRACEMCO | -13.69% | -13.42% | -8.31% | 27.76% |

4) FMCG & Consumer Goods – Expensive valuations now moving towards Vanity.

Stocks like Britannia ITC Nestle are higher than what they were at 11k + Nifty. ITC , Britannia has been the biggest surprise in terms of recovery. . India does not have any FANG type stocks and the only ones where earnings may not collapse crazily seems to be consumer goods and so the space continues to keep getting expensive. Till how long ? Remember Hindustan Unilever had a 12 year zero return ( ex of div)

Asian Paints continues to baffle most. The joke is Market thinks people may not pay loans but will definitely get their house painted. A good short ?

ITC limited did not see a re-rating for a long time and now is higher than 5th March prices whereas it should take a sales hit due to lockdown more than a Britannia. Relatively cheaper a reason for attractiveness now ?

| CONSUMER GOODS | 20-01-2020 | 12-02-2020 | 05-03-2020 | 24-03-2020 |

| ASIANPAINT | -7.15% | -9.35% | -8.42% | 12.57% |

| BRITANNIA | 12.86% | 11.91% | 12.25% | 48.45% |

| HINDUNILVR | 2.79% | -6.19% | -4.40% | 4.57% |

| ITC | -18.69% | -7.67% | 4.60% | 31.40% |

| NESTLEIND | 12.91% | 6.81% | 5.01% | 29.15% |

| TITAN | -17.13% | -22.43% | -21.82% | 20.62% |

5) IT - Did not fall but recovery also has been meek but most stocks not far from the highs of 11k-12k Nifty

IT has been one sector in India which has done really well in terms of Cash Flow generation and Distribution to Shareholders but has always been considered a few steps away from Disruption and Inflection. For example TCS may beat Hindustan Unilever on most parameters of growth, return ratios but will never command similar valuation coz of risk of disruption . Not the worst impact and that's why not a sharp fall and a slow steady recovery.

| IT | 20-01-2020 | 12-02-2020 | 05-03-2020 | 24-03-2020 |

| HCLTECH | -4.49% | -8.35% | -2.36% | 27.32% |

| INFY | -8.71% | -10.18% | -7.03% | 18.95% |

| TCS | -5.72% | -5.74% | -3.71% | 20.14% |

| TECHM | -28.91% | -32.65% | -26.83% | 9.88% |

| WIPRO | -14.78% | -13.54% | -7.99% | 19.85% |

6) PHARMA – The Big Gainer from the Sector Rotation

The biggest gainer in the sector rotation has been Pharma. This is seen across microcaps to largecaps. Pharma sector topped out in 2015 with some exceptions like Divis ipca etc which recovered very fast in 2018-2020. The recovery has been the sharpest in Pharma and most names are much much higher than the 20th January Nifty highs. Can it be a leader sector going forward ?

| PHARMA | 20-01-2020 | 12-02-2020 | 05-03-2020 | 24-03-2020 |

| CIPLA | 33.54% | 43.51% | 45.53% | 69.88% |

| DRREDDY | 29.51% | 23.99% | 24.43% | 38.64% |

| SUNPHARMA | 5.94% | 14.85% | 17.60% | 42.07% |

7) Telecom – Strong getting Stronger

After almost a 10 year hiatus the sector has been gaining strength in last 2-3 years and now the two biggies Bharti Airtel and Reliance are close to all time highs. Can it continue leadership.

| TELECOM | 20-01-2020 | 12-02-2020 | 05-03-2020 | 24-03-2020 |

| BHARTIARTL | 8.44% | 2.23% | 4.70% | 36.53% |

| INFRATEL | -1.28% | -10.01% | 2.00% | 54.28% |

| RELIANCE | 0.61% | 4.85% | 17.58% | 63.41% |

Not putting data for Oil and Gas, Metals, Construction, Power services as lower weightage and the fall has been in line with the Index.

To sum it up its almost 50-50 for underperformance on all time frames. Banks and Financials, Oil and Gas, Metals, Construction form the 20-25 stocks which have been hit. Given the highest weight of Banks and Financials we can conclude ex of Nifty we are back to 11k-11.5k !!

| Sector | Returns 20-01-2020 to 03-06-2020 |

Returns 12-02-2020 to 03-06-2020 |

Returns 05-03-2020 to 03-06-2020 |

Returns 24-03-2020 to 03-06-2020 |

| Nifty | -17.6% | -17.5% | -10.7% | 29.0% |

| Stocks outperforming Nifty | 22 | 24 | 25 | 26 |

| Stocks underperforming Nifty | 28 | 26 | 25 | 24 |

Conclusion

- The large caps in Nifty which may be relatively less impacted by Covid19 and Lockdown have recovered in a big way. But these companies are relatively better to the rest and not at an advantage.

- Consumers, Auto, Paints look overheated and one needs to avoid or even look for short ideas when price action changes.

- Even the Nifty at 10100-10200 looks stretched, but price action yet to reverse.

- Leadership status of Banks and Financials is now gone and Telecom,Pharma,IT showing signs of leadership.

- As a whole a lot of largecaps are no more interesting as buy ideas with risk-reward not being great. Like March end was not a time to sell , this is not a time to buy.

- One can only look at selective bets in the broader markets as there the falls have been sharper and recoveries could be really sharp. Many range breakouts seen giving trading opportunities and in some cases could be major bottoming out.

- Worst Strategy - Multibaggers in bull market, ‘safe leaders’ in bear market?! Time to keep researching microcaps,smallcaps,midcaps, new sectors.

Will try to make a post on broader market behaviour if possible( very time consuming.)

SPEAKER AT BEAR SUMMIT 2020 ( Free )

My Topic - The Next Bull - Identifying Bottoming Out Patterns after a Bear Market. For Bear Market Summit 2020. Registration Link – Has interesting set of speakers.The access is free for a specific time period. Do register.

Do Read this post if you have not.

Opportunities in Bear Markets and Consolidations post 1992, 2000, 2008 and 2020.

ONLINE TECHNICAL ANALYSIS COURSE

The Full Course on Technical Analysis is now uploaded and can be bought digitally with 1 year access to the recordings.

The Course is divided into 4 sections

Section 1 – Introduction to Basic Technical Analysis Concepts.

Section 2 – . Technical Analysis Chart Patterns, Indicators, Trendlines.

Section 3 - Practical Technical Analysis – How to use it to invest,trade, find sectors, Full time Trading.

Section 4 – Various Softwares and Utilities.

Bonus – One Webinar for Q&A. Batch of 20 every time. Details to be sent on email.

More than 12 hours of content.

Course Fee = Rs 6000

Can buy the course from this link and go through the entire curriculum ( Course Content & Curriculum )

https://www.analyseindia.com/course/onlinetechnicalanalysiscourse/?tab=tab-curriculum

Whenever we add more videos you will get an e-mail for us.

For any queries or payment confirmation mail to nooreshtech@analyseindia.com or whatsapp on 7977801488

DISCLOSURE Nooresh Merani

Securities covered above: All mentioned in the above post

SEBI Registration disclosure - Investment Adviser ( INA000002991)

Financial Interest:

Nooresh Merani and his family/associates/ analysts would have exposure in the securities mentioned in the above report/article.

Nooresh Merani and his family/associates/ analysts do not have any financial interest/beneficial ownership of more than 1% in the company covered by Analyst.

Nooresh Merani and his family/associates/ analysts have not received any compensation from the company/third party covered in the above report/article ever.

Nooresh Merani and his family/associates/ analysts has not served as an officer, director or employee of company covered in the report/article and has not been engaged in market-making activity of the company covered in the report/article.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

Also read the detailed disclaimer - https://nooreshtech.co.in/disclaimer