This is a post on one of our advisory products.

If you are not trading in derivatives do not read any further !!

QuickGains F&O

The product is for traders with a High RIsk Profile and High Risk Apetite. Holding period of positions is 1-15 sessions generally.

1) Do u know trading in Futures & Options is considered as a high risk speculation in markets ?

2) Will you be comfortable being leveraged as much as 3x-5x of the deployed capital?

3) Are u willing to lose 15-25% of your capital deployed in a single month?

4) Are u willing to execute the stop loss of all the recommended trades as and when the stop loss gets hit?

5) Do u have minimum 20 lakh capital or more to subscribe to our Quickgains F&O service? ( considering u will be paying 3.5% fees annually of your capital employed )

If any of the answer of above mentioned question is ' NO ' then please don't subscribe to this service.

Even if the answer is “Yes” for all we need to have a chat and understand your risk profile before you subscribe for this service. You need to call Harsh 9833845334 ( after market hours ) Nooresh 9819225396 ( after market hours).

We need to assess your risk profile before we recommend the service to you.

FAQs on the QuickGains F&O

- All recommendations will be provided via whatsapp & email. We advise you to be active on both platforms during market hours because if there is a delay in one means of communication the other one helps in getting the recommendation on time. ( It requires a quick reaction to punch in the trades else slippage will be higher we would recommend you to not opt for this product.)

- Always execute stop losses and do not wait for a confirmation or re-confirmation. A stop loss hit will go as a loss trade in our performance sheet as well as we prefer to be very disciplined with stop losses.

- While making performance sheet we have a considered a portfolio size of 20 lakhs so this is the minimum capital.

- In the performance sheet we have considered 4 lots for each trading call, always trade in multiple of two with a part booking strategy which includes revising stop loss to cost.

- Max No. of Open Positions at day's close will not exceed 5 ( there can be 1-2 exception days in a month )

- Always trade on all calls as we stick to a process of finding momentum bets with small stop losses. Its tough to guess which will be the best trade. So following the exact process is required.

- All levels given are Spot levels, we do not give futures prices as there can always be difference in premium/discount at different points of time in the month. We do consider the futures price in our performance sheet.

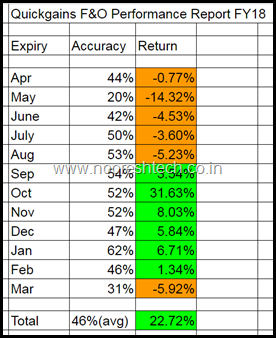

Performance

The performance sheet is just for reference for the clients to check on a monthly basis and is in no way indication of future returns.

We do not guarantee any returns and as mentioned in the start this is a product of traders with a higher risk profile and risk appetite.

A quick snapshot to show you the drawdowns are high and there can be tough times and good times both.

The sheet which is shared with clients can be accessed here - QuickGains F&O Performance Sheet for Reference

Subscription Links

QuickGains FNo - Half Yearly - Rs 41890 ( Rs 35500 + Rs 6390 ( 18% GST ) )

QuickGains F&O Annual - Rs 69620 ( Rs 59000 + Rs 10920 ( 18% GST ) )

( Inclusive of all Taxes)

If you would like to make a payment to the bank - please mail – nooreshtech@analyseindia.com for details.

QuickGains

Bank Account for Payments

Account Holders Name - Nooresh Merani

Account No - 06661530002851

IFSC Code - HDFC0000019

Branch - Seven Bunglows Branch

UPI Payment

MMID - 9240905

Mobile Number - 9819225396

Nooresh Merani

nooreshtech@analyseindia.com