I was going through a podcast of Nithin Kamath by Anupam Gupta ( @b50 on twitter ) on the topic of trading where he mentions how he went bust a few times in initial years.

I got a hit and realized how its very common for traders to go bust or blow up their account in the initial years. ( I have seen a couple of big drawdowns and bust scenarios too. )

During last week got a mail from couple of investors sending their portfolios to us for advise which had many stock holdings kept for 10 years and down to only 10% of purchase price. Like traders go “Bust” after making a big mistake, Investors get Lost for a long time after seeing a big crack in their portfolios.

Most of the above scenario generally happens after a good correction in markets.

1) Going Bust or Blowing an Account

A lot of people think blowing an account is like a Bankruptcy. One may have an account of 5 lakhs which goes to zero and still have assets of 100 lakhs and maybe cash flows from their jobs and businesses.

How can one lose 100 % or more of the capital deployed ?

The simplest answer to this is “Leverage” and maybe “Overtrading”.

To lose 100% capital without leverage you would need a stock to become zero i.e get delisted which has only happened in a few cases in last 10 years. While running a “Random Portfolio” we found it was tough to lose more than 75% even in 2008 !!

During my periods of couple of Bust what I noticed even though the Account went close to zero the Absolute Value of the Account was not a big number in comparison to the Savings or Earnings.

Over the years have interacted with a lot of amateurs getting into Derivatives and this is how it works.

- A Salary/Business Income of 12 lakhs with a trading account of 5-10 lakhs.

- Exposure taken of 20-50 lakhs.

- Does not exit when stocks go in opposite direction.

- Takes a much Higher Leverage.

- M2M blows up. Funds it through Salary/Business Income.

- Finally Margin Pressure.

- Broker closes position- Bust !!

Even though the account may go to zero the trader can continue with his Work.

Some reasons traders over-leverage a lot is the lower starting capital , fascination towards making quick returns and easy access to leverage through derivatives,margin funding etc.( if you have a capital of 5 lakhs and salary of say 10 lakhs making 30% returns would imply a 15% increase in yearly income which is not exciting so one wants to make a lot lot more and ends up using lot more leverage )

One of my key learnings over the years has been – As Equity as a % of Networth Increases , the chances of one being Serious and not being reckless in Trading/Investing increases and so the Discipline and Risk Management.

In the end Trading is a personal journey and one has to take it himself , your learning's from other practitioners can only guide.

Investors Get Lost

Most of the Investors get into the markets under Influence or Fascination which can come from Neighbours, Parents, Relatives, Friends , TV or etc.

The school or College curriculum does not focus on topics like Compounding, Inflation, Equities and the most important basics of Finance. I find it amazing when I meet Finance Professionals with decades of experience who have zero exposure to Equities !!

The mind set towards equity as an asset class has been evolving for the last few decades and because of which we see Investor Participation increases only in Bull Markets.

One of the classic behaviour of Retail Investors is to jump in hordes in Bull Markets and after a Bear Market get Lost for a long time.

This is how it generally works for New or Amateur Investors in the Market

- The Market goes up a lot and everyone is making money whereas other asset returns continue to drop.

- Investor starts with MF , Direct Equities and may end up even with some Derivatives.

- The Market Falls by 20% and stocks fall by 20-50%

- Investor is in a delusion that some day his stocks may come back to his buying price and keeps averaging.

- The Loss continues to widen but Investor thinks Loss is only when its Booked !!.

- Finally after portfolio being down and out the Investor loses track of his portfolio or in desperation sells out and gets Lost out of the Market.

A generation of Investors lost Money in 1992 and many never came back to markets, another generation of investors lost money in 2008 and many never came back to markets ( some have finally found a way through Mutual Funds.)

Some Investors who forget and lose track of their portfolio at times become lucky for the next generation. I have seen a few stories of some multibaggers in physical certificates which people discovered 20-30 years later alongwith majority of dud paper. .

The Fascination of Retail Investors to buy on the way down is amazing. Lets see this data.

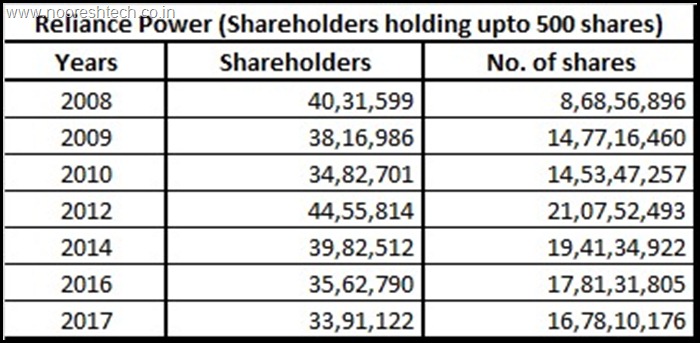

1) Reliance Power – Retail Shareholders never lost faith or Got Lost ?

Between 2009-2012 the number of shareholders went up. ( 2008 –2009 increase in number of shares because of Bonus)

There has been a steady increase in number of shares all through 2008-2018 and finally number of retail shareholders has only reduced in 2016-2017 meaningfully.

A lot of brokers have been paying AMC fees for some new IPO accounts who have gone lost and SEBI rules do not allow them to share the shares without client approval.

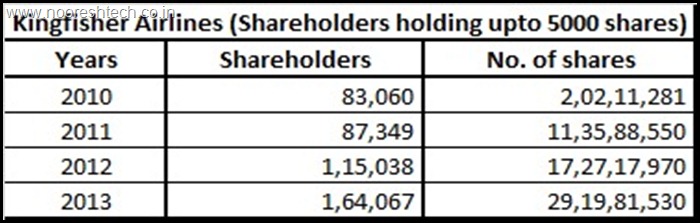

2) Kingfisher Airlines – Retail Shareholding Doubled on the way Down

Between 2011 to 2013 the Retail Shareholders almost doubled and so did the No of Shares while the stock fell 70-90% in the period !!!

2) Pharma – Retail Shareholders keep increasing in last two years.

| SUN PHARMA | SHAREHOLDERS | |

| Retail Shareholders (2008-2017) | No. of Shareholders | No. of Shares |

| March 31, 2015 (1L) | 1,60,009 | 7,70,66,666 |

| March 31, 2016 (2L) | 4,16,627 | 12,55,74,216 |

| March 31, 2017 (2L) | 5,42,995 | 14,32,60,121 |

No of Shareholders doubled as well as No of Shares in last 2 years in which Sun Pharma fell by 50%

| LUPIN | SHAREHOLDERS | |

| Retail Shareholders (2008-2017) | No. of Shareholders | No. of Shares |

| March 31, 2015 (1L) | 1,07,440 | 2,29,42,985 |

| March 31, 2016 (2L) | 1,65,073 | 2,64,54,618 |

| March 31, 2017 (2L) | 2,10,803 | 3,11,33,056 |

Shareholders almost doubled and no of shares 50% higher while Lupin down 50% or more.

| DR REDDY | SHAREHOLDERS | |

| Retail Shareholders (2008-2017) | No. of Shareholders | No. of Shares |

| March 31, 2015 (1L) | 69,341 | 1,17,98,852 |

| March 31, 2016 (2L) | 1,00,409 | 1,31,72,928 |

| March 31, 2017 (2L) | 1,22,588 | 1,36,90,700 |

Dr Reddys although no of shareholders increased but no of shares has not increased by much. Maybe due to retailers dislike to high priced shares.

The data clearly tells you how Retail Interest increases on the way down in many stocks and new Investors come in only after a Big Rally ( CDSL new accounts have a direct co-relation to IPOs )

The Conclusion

Retail Traders go Bust Via Leveraging and Retail Investors get Lost via Averaging !!!

So find a way to control both !!