In the last few months we have continously heard about how this Bull Market is here to last and how great it has been. ( There were hardly any believers of the Bull Market in March 2014 when we came out with this report - Indian Elections - Do they Change Market Trends )

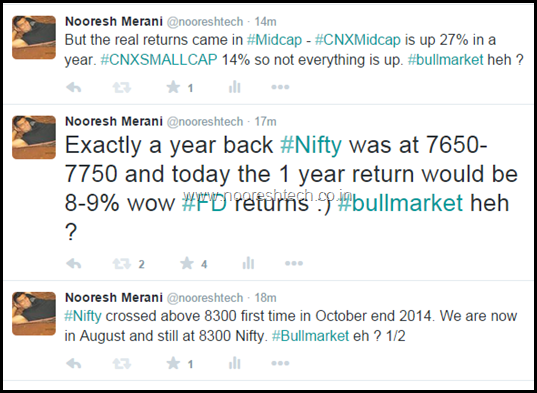

Is this really a Bull Market with Last 1 yr Return in Nifty being 8-9% ?

I would say most of the BULL MARKET syndrome is due to recent memory. A lot of stocks are up 2-10-30 times from the lows of 2009/2011/2013 which is in our memory but many of the stocks are still below the highs of 2007-2008 and struggling.

Also major part of this stock specific run came in early part of 2014 when Nifty moved from 6000-6500 to 8500 quickly. Recently we saw a 10-15% jump in the Midcap / Smallcap Indices with a lot of unworthy names seeing a mad run. Some of them have already started cooling off. That has again created another Bull Market Syndrome.

I believe and we are still in a consolidation post the first move of 6300 to 9000 and waiting for the next trend. So the dip is again an opportunity but you need to select the right stocks.

Now let us look at some more interesting data. This data is thanks to Prashant Krish .

Nifty has crossed above the highs of 2008 and 2010 of 6350 and is at 8350 so how many stocks have really crossed the highs of 2008. I was curious as to how this Market has been very selective in terms of crazy moves and punishing at the same time for a lot others.

The results are very interesting !!

The scan - No of stocks above the highs of 2008 bull market.

NSE - No of liquid stocks which came in filter - 1212

| Above 2008 highs | 432 | 35.64356 |

| Below 2008 highs | 780 | 64.35644 |

Still almost 64% of the listed stocks are below 2008 highs.

BSE - No of liquid stocks which came in filter - 2528

| Above 2008 highs | 723 | 28.59968 |

| Below 2008 highs | 1805 | 71.40032 |

Still almost 71% of stocks are below the highs of 2008.

This has been a market where there have been some multibaggers which have gone crazy. So for every Eicher Motors or Ajanta Pharma which are up 30/90 times from 2008 there are many others who are down 30-90% down from 2008 highs.

There could be a little discrepancy in the filter of liquid stocks but can easily say 60% of the listed stocks are still below 2008 highs and we call this a Bull Market !!

Here is the excel sheet.

If you would like to learn Technical Analysis in a classroom session.

The next session is planned for Delhi on August 22-23 2015

We launched NooreshTech Android App a month back. It has already been downloaded by more than 1500 people and we have got good reviews for the same. But many of you suggested an app for iPhone & iPad user.

We have also launched the first version of the iOS app - " NooreshTech iOS App " . It is live on Apple App Store. Download it from here

August 13, 2015

Interesting article and analysis. It can also be noted that only 72 stocks (NSE) have multiplied by more than 5 times whereas over 348 have lost more than 80% of their 2008 highs. Out of 432 stocks about 180 have not even doubled in past 7 years. But only thing is list does not constitute new stocks and contains some highly illiquid / inactive stocks. Also for many stocks huge movements happened in last couple of years and if compared with 2009-10 highs, the ratio may be little different. Also fundamentals are reflected in prices!

August 13, 2015

very good article