In my posts some monts back had discussed about the possibility of the rising wedge being similar to the one formed in January. CLICK LINK TO CHECK IT

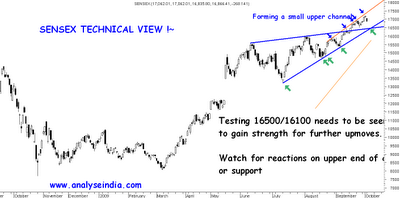

If the current breakout above 16500 the rising wedge line then this move should not last above 16500 for another 2 weeks as generally a false move doesnot last long above the breakout line.

So there could be a possibility the current rising wedge may not give similar results as January ( thats what my heading says last time )

In that case we need to see a re-testing of the breakout and also how it reacts around to those levels will be a factor to watchout in days to come.

As was earlier mentioned 16500/17200 was the band and Sensex has made a high of 17196 exact to the level discussed. Crossing above 17200 would take it to 17700-18000 band. Ideally a testing of 16500/16100 is possible in weeks to come.

Simple calculation at the current level gives an upside of similar size so risk-reward suggests to do nothing and watchout !!! But yes couple of weeks will clear out the weak implications if it continues to stay above 16k.

In my previous post CLICK TO CHECK LINK had mentioned below 9650 the index could open up to 9500-9200 zone. Dow Jones did see a little dip to 9400-9500 and is subsequently seeing some pullback from the 50 dema/ trendline support.

Important support now placed around the 9200 mark. Only a weekly close below that could dampen the current upmove.

Pullback from here would see resistance around 9700-9770. The index can test 9200 odd levels in coming weeks.

Stocks to watchout for :

GAIL :

Mutliple tops seen around 365-368 zone. Buy on crossover above 368 with volumes or on close above 375 for a target of 400 + in short term.

Bajaj Financial Services

The stock has seen a huge volume surge. Investors can look to take 1/3rd exposure at 290-300 levels and buy on declines to 250 with a long term view. Insurance sector and has seen a good declines from top. Will require patience.

Sterlite Inds:

Stock has support around around 738-740. Possible trade buy around 745 stop of 738 tgt 760 or sell below 737 stop of 745 tgt 720.

Adhunik Metals, Elnet Technology for high risk traders with 1-3 sessions view and stop of 4% .

SCHEDULE FOR TECHNICAL ANALYSIS SESSIONS :

MUMBAI OCTOBER 10th-11th --- ( mail to analyseindia@gmail.com or call Nooresh 09819225396)

Further sessions planned for other cities ( Banglore , Hyderabad,Chennai, Delhi ) after Diwali starting October last week to December. If you want a session for a group conducted in your city call Nooresh 09819225396 for more details.

For more of our services check : www.analyseindia.com

Any queries : Nooresh 09819225396 ( after market hours only )

e-mail id : analyseindia@gmail.com

yahoo : meraninooresh@yahoo.com ( after mkt hours )

Best Regards,

Nooresh

09819225396