Most Indices have recovered 60-80% of the downfall. Some, like Banks and Financials, have hit all time highs.

With the result season over, the markets can now enter a very Selective mode, with few stocks making moves and the rest remaining in a range.

Lets look at the charts.

- Nifty50 - 24200-24400 and 25100 the decider.

2) Bank Nifty - The Leader

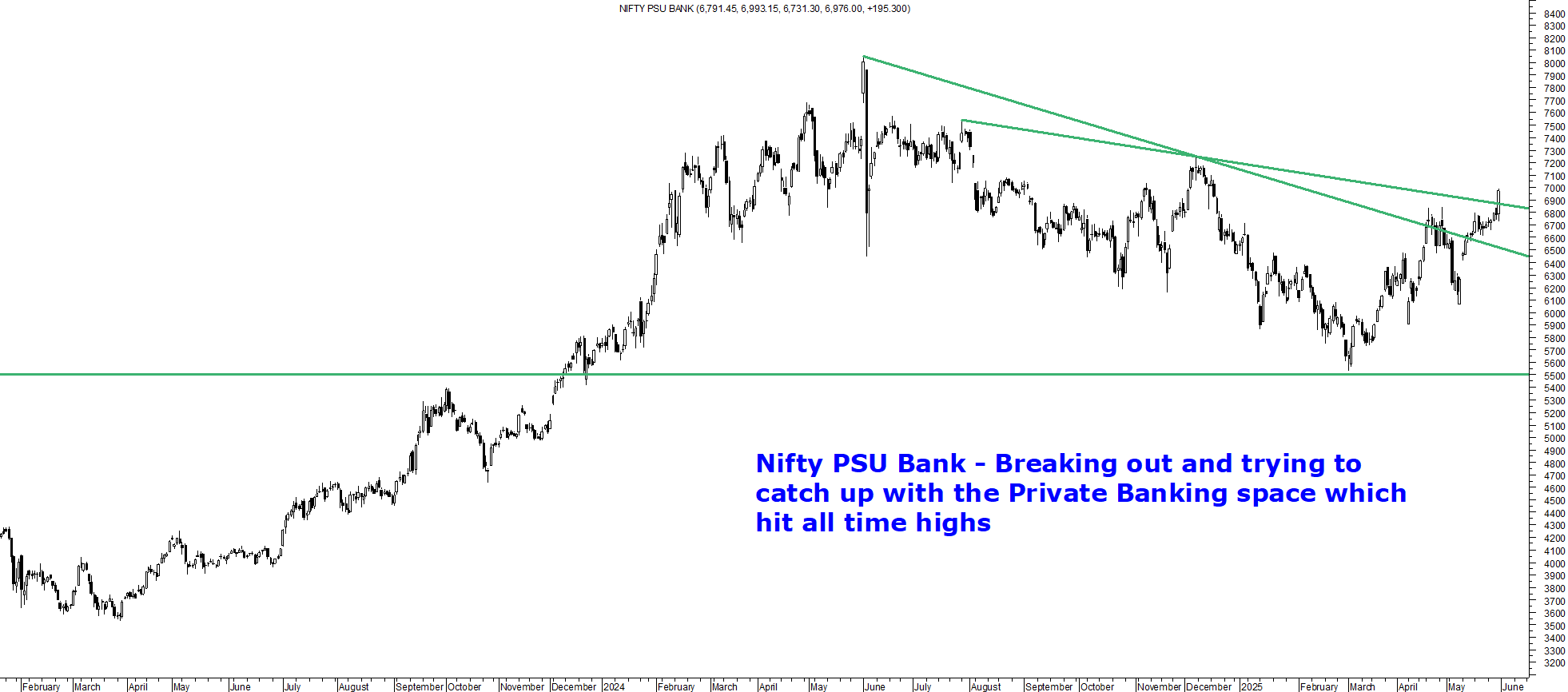

3) Nifty PSU Bank - Breaking out and trying to catch up with Pvt Banks

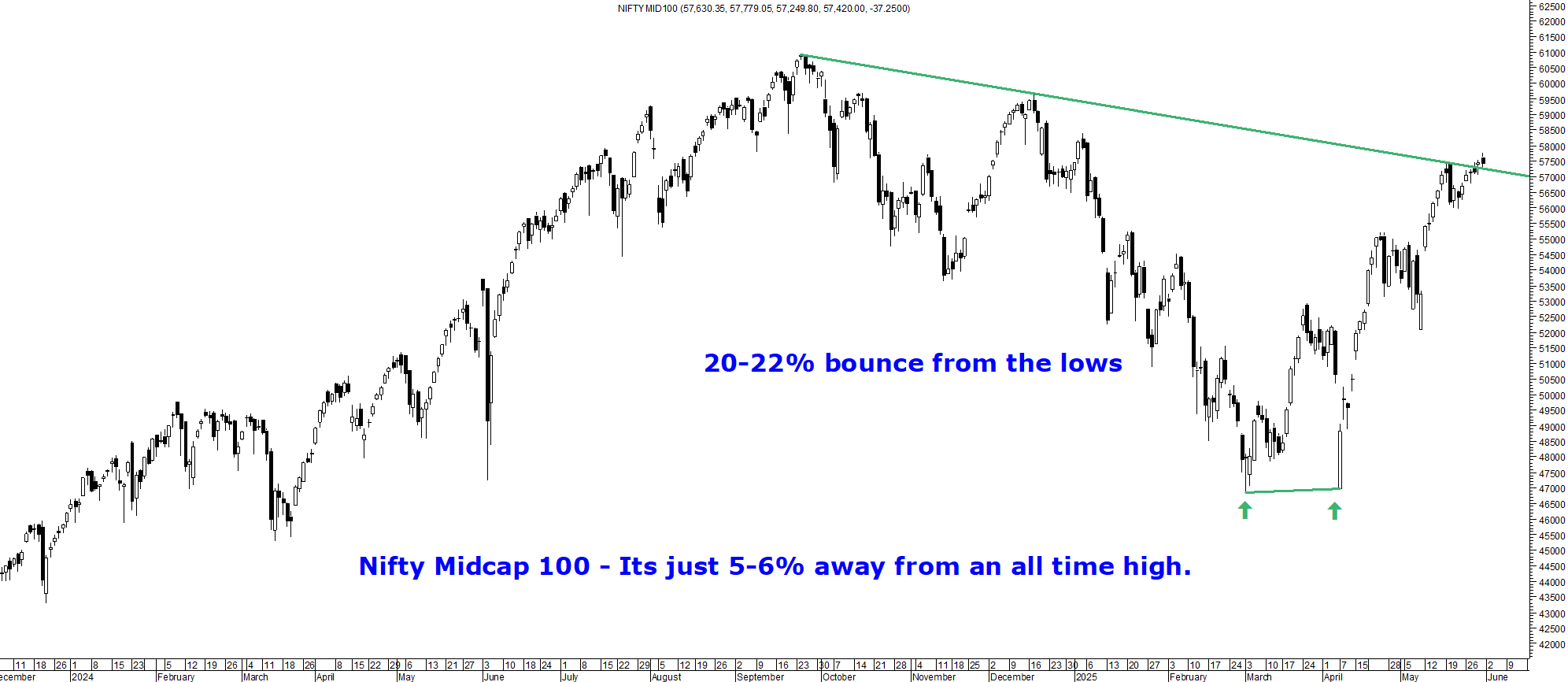

4)Nifty Midcap 100 -Best recovery. Now just 5-6% away from all time highs.

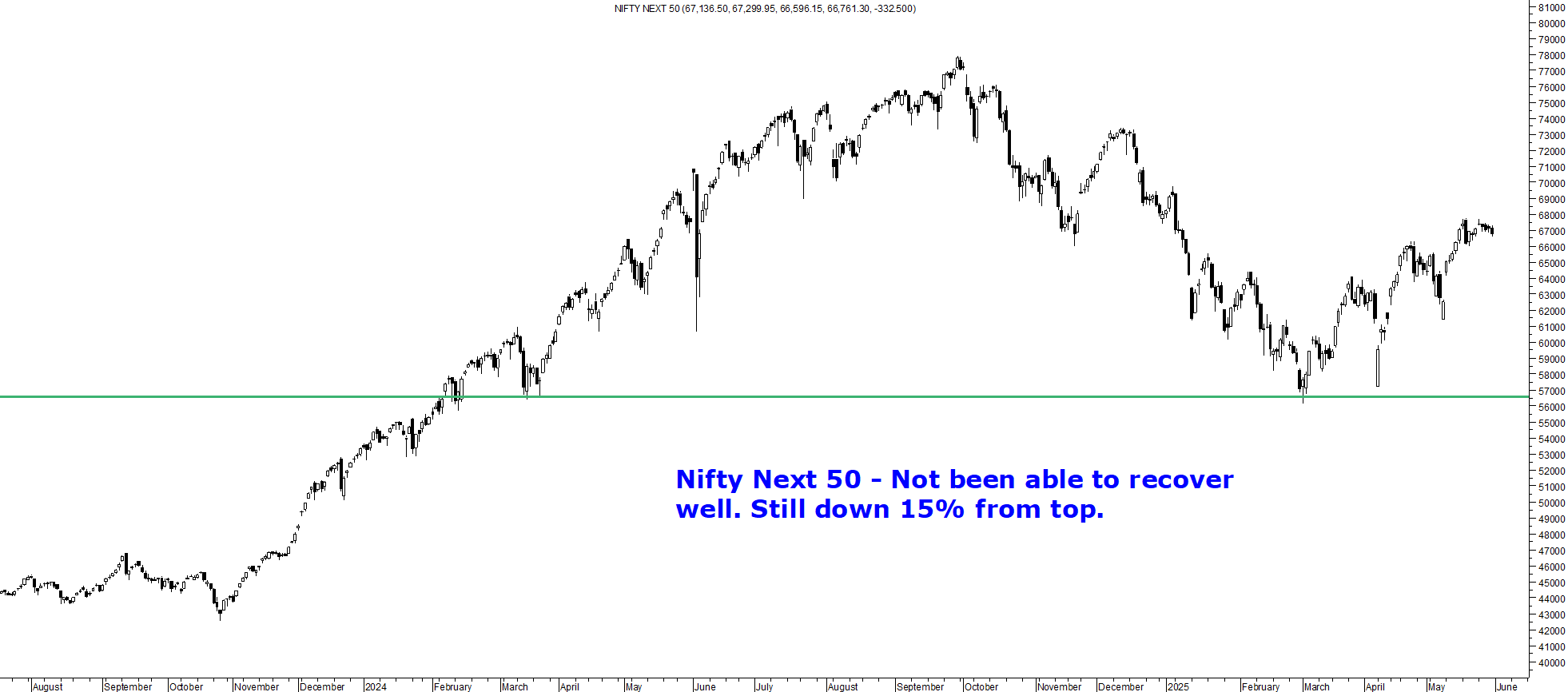

5) Nifty 50 - Weak recovery. Still down 15% from the highs.

6) Nifty Pharma - Knocking at the resistance. Could make a trending move soon.

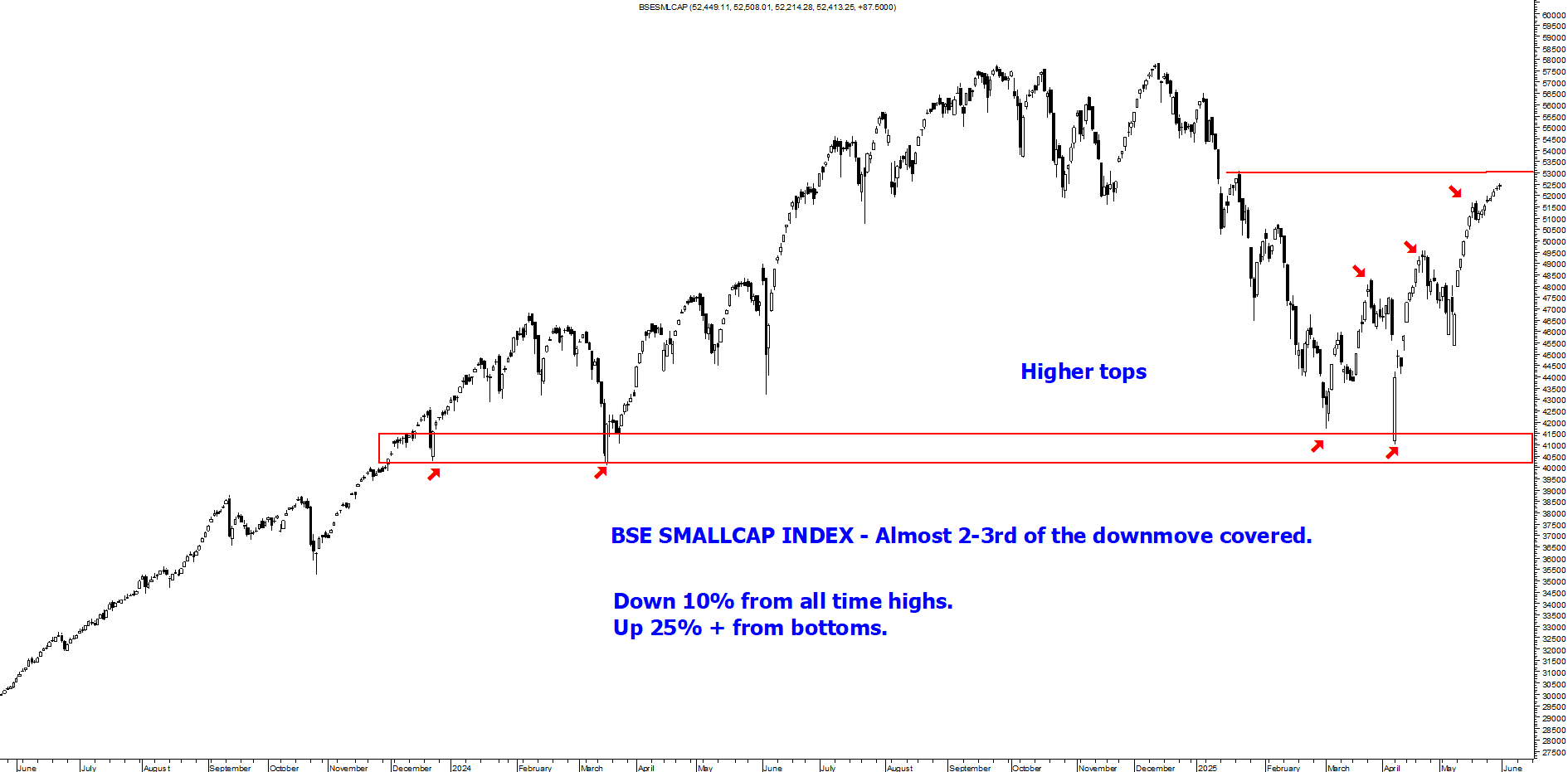

7) BSE Smallcap Index - Almost 2-3rd of the fall recovered. Up 25% from bottoms down 10% from all time highs.

NooreshTech Research Services Overview

1. Technical Traders Club – Techno Funda Investing

- Two model portfolios: Trading Ideas (3–6 months) & Smallcap Folio (6–18 months)

- Maximum 10–12 open positions per portfolio

- Ideal for investors with a medium to long-term view

- Updates via WhatsApp, Email & Telegram

- Subscription: ₹15,340 (6 months) | ₹25,960 (12 months)

- Payment & Details: https://shorturl.at/Rz2fS

2. The Idea Lab – Momentum Trading

- Momentum-based short-term trades (15 days to 3 months)

- Maximum 30 open positions, equal weight approach

- Based purely on technical analysis

- Ideal for traders with a short to medium-term view

- Telegram-only updates

- Subscription: ₹1,770 (Monthly) | ₹4,720 (Quarterly) | ₹8,850 (Semi-Annual) | ₹17,700 (Annual)

- Payment & Details: https://shorturl.at/Lsd7M

3. Smallcases – Equal Weight Portfolios

- Top 10 Promoter Buying: Focused on stocks with strong promoter buying

- Top 10 Techno Funda: Combines Technical & Fundamental analysis

- Breakout & Trail Momentum : Momentum Trading - 20 stocks, 5% each

- Low churn, equal-weight portfolios

- Invest directly via the Smallcase platform

- Ideal for long-term investors

- Payment & Details: https://shorturl.at/bQenu

4. Option Strategies by NooreshTech ( NEW )

- Limited Risk Option Strategies across Index and Liquid Stock Options.

- Holding period: Typically between 1 to 4 weeks.

- Capital & Positioning: Min Capital: ₹10 lakhs

- Max Open Positions: 5-8 open positions

- Ideal for those who understand derivatives risks and seek moderate, consistent returns.

- Telegram-only updates

- Subscription: ₹10,620 (Quarterly) | ₹17,700 (Semi-Annual) | ₹29,500 (Annual)

- Payment & Details: https://shorturl.at/ZYlYy

Support & Queries:

- WhatsApp: 7977801488

- SEBI Registered: Nooresh Merani (INH000008075)

- Disclaimer : https://shorturl.at/kgosD