Last Post : https://nooreshtech.co.in/2022/04/nooreshtech-weekly-insights-8th-april-2022.html

NooreshTech Weekly Insights (29th April 2022)

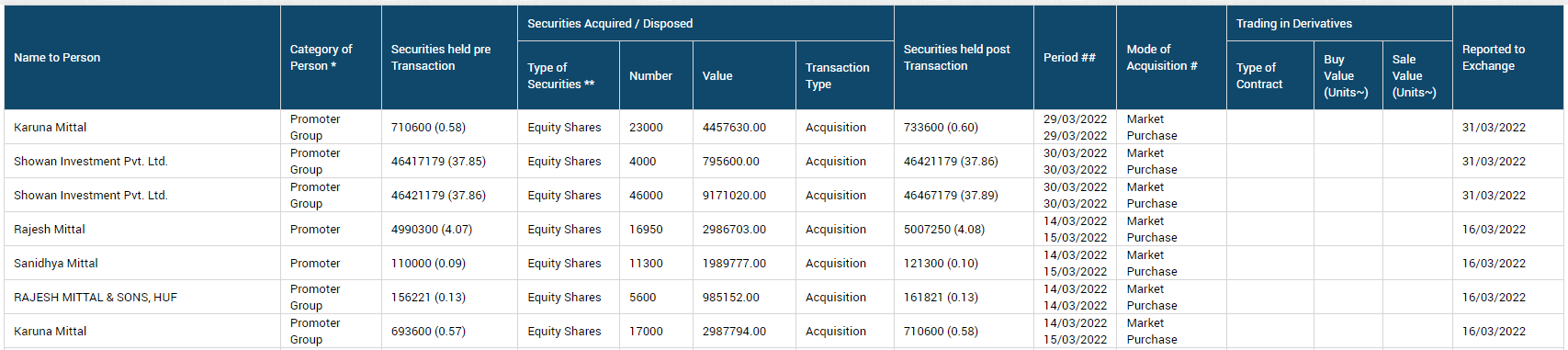

1 ) Insider Trading Alert

Greenply Industries Limited

Greenply Industries Limited is amongst the leading plywood manufacturers in India. Greenply offers a wide range of panel products including plywood, block boards, decorative veneers, doors, and film-faced plywood, among others.

Details of buying:

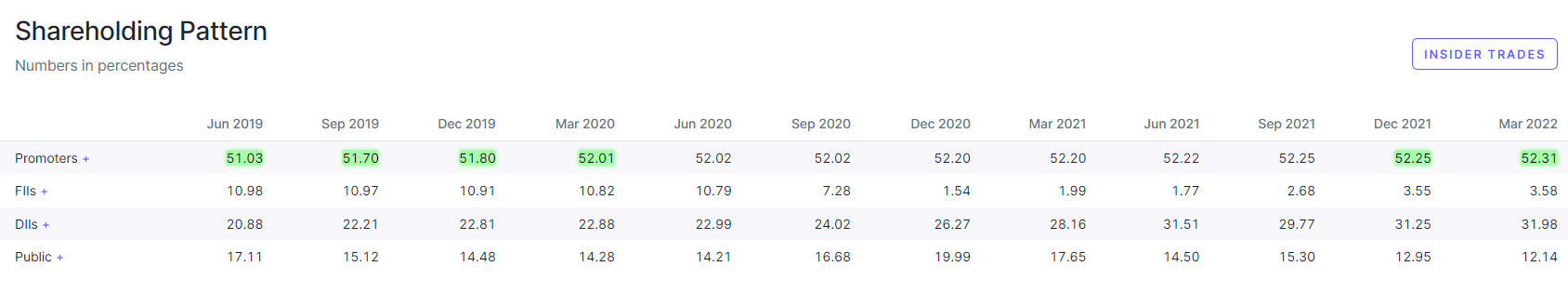

Past Promoter Shareholding

The promoters have recently bought ~1.24 lk equity shares from the open market which comes to around 0.10 % equity

Also, promoter holding has gone up from 51.03% in June 2019 to 52.31% in Dec 2021 marking an increase of 1.28%

Chart View

For more such insights do subscribe to our

NooreshTech's Insider Trading Updates on Telegram :

Whats included ?

- Insider Trading Report - Once in a month

- Regular updates on interesting stocks based on Insider Trading

- Interesting chart setups of companies based on Insider Trading

- Any other interesting observations based on Insider Trading

To join the channel check our subscription plans :

https://rigipay.com/g/2PnhM0A8H4

We also have a Smallcase which is based on Insider Trading

Do check out: https://bit.ly/3w1LyOK

Smallcase performance vs Benchmark

2) Dow and Nifty – Need not go Inline

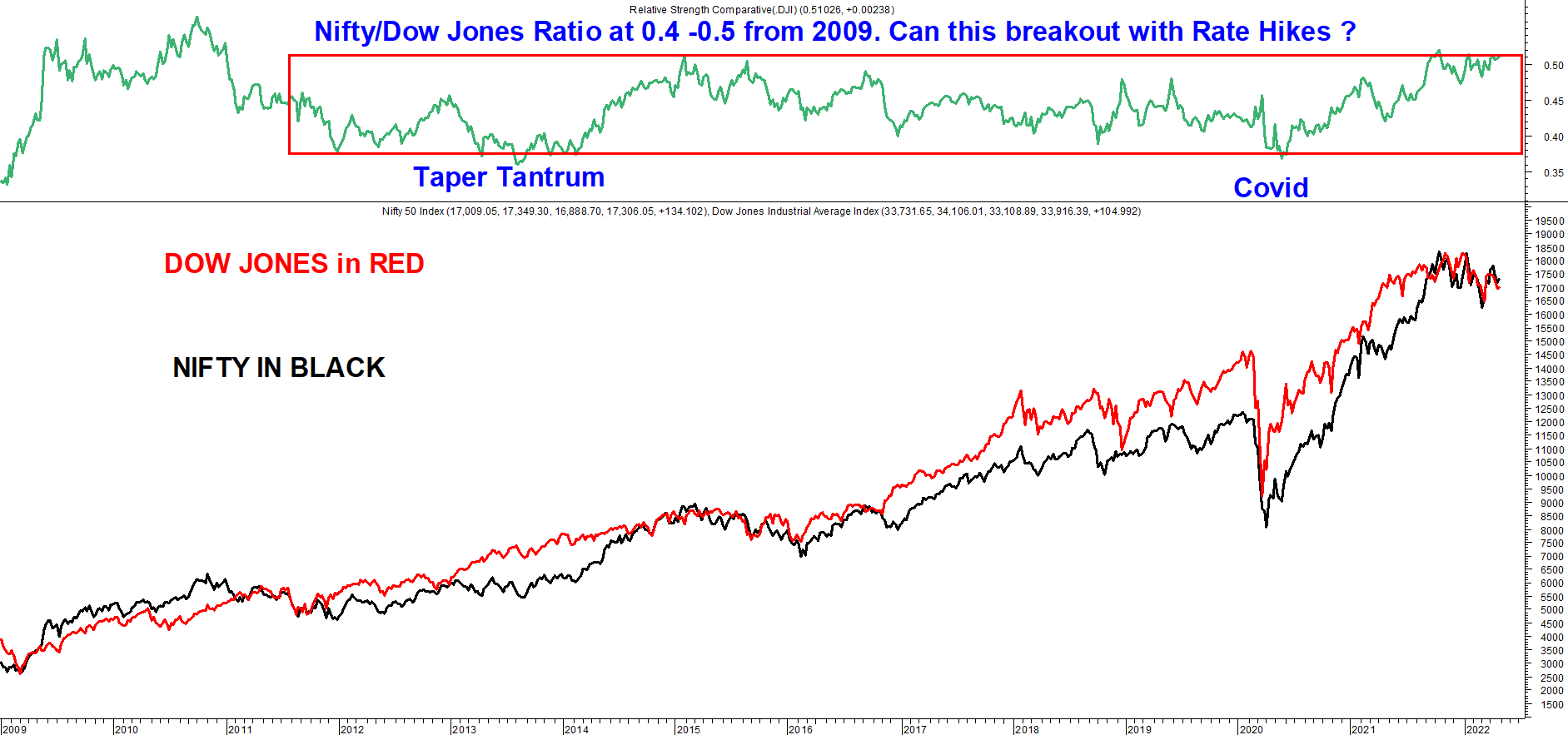

Over the last decade or so we have seen all Global Markets or at least Dow and Nifty go inline in direction. A risk-on and a risk-off happens across markets. The Co-relations of Global Indices has got stronger from the FED actions in 2009.

Lets look at this chart below.

Dow Jones and Nifty – Almost inline from 2009.

- Nifty/Dow Jones Ratio.

The top most chart is the Nifty/Dow Jones ratio. This has been around 0.4-0.5 from 2009.

The only times it has gone below 0.4 and stayed there for long was in the Taper Tantrum in 2013 and in Covid for a few weeks.

The Ratio is now sticking at the higher for quite a few weeks. Indicating a good possibility of breakout and Nifty to outperform the Dow after a long time.

- Dow and Nifty superimposed.

The Red ( Dow ) and Black ( Nifty ) almost look similar in direction across the last 10-13 years.

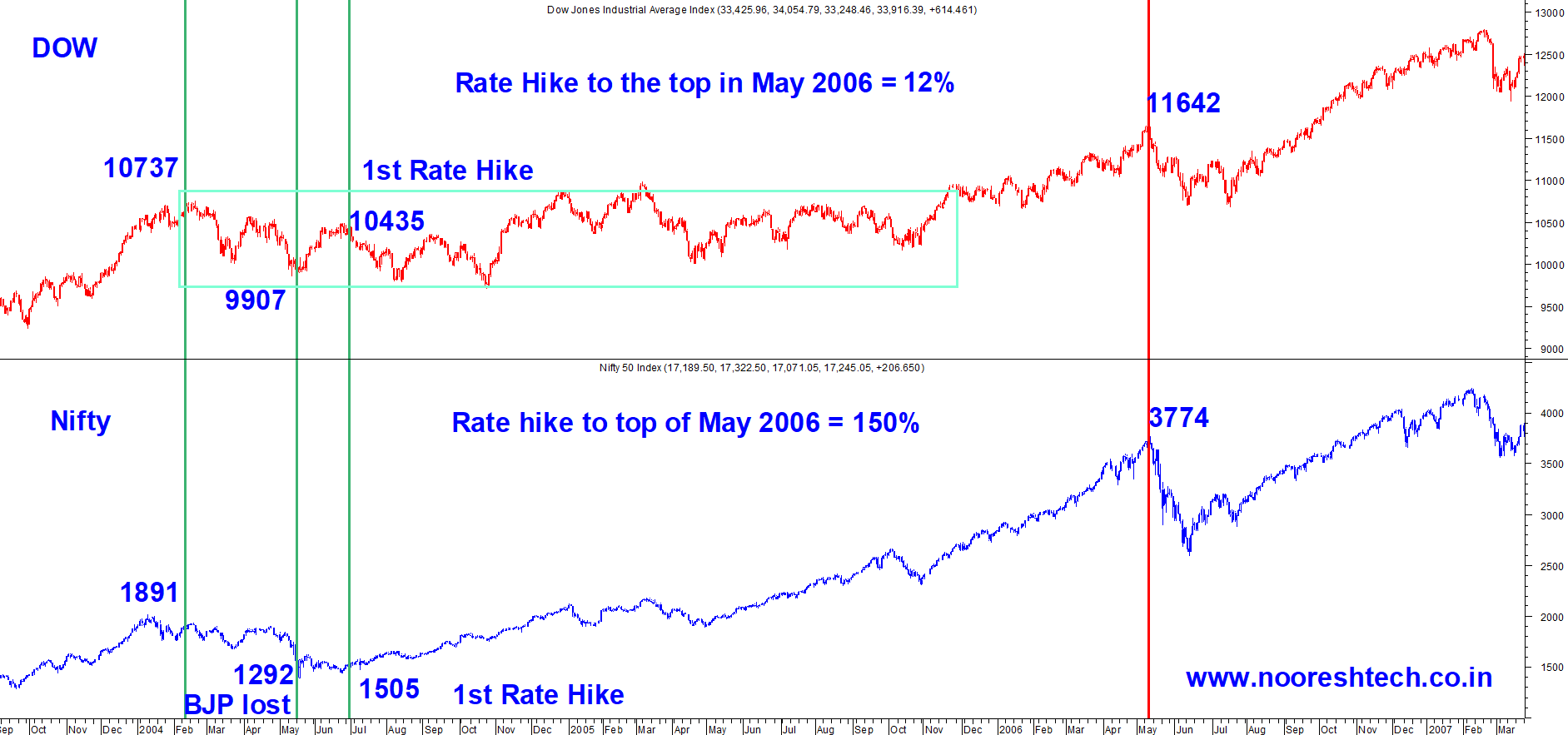

The Big Outperformance of Nifty and Emerging Markets 2004-2006

All the Global Markets were in a slump in 2000-2003. We saw an initial bump up in 2003 and a correction in 2004.

Post 2004 it was all about Emerging Markets outperformance.

Remember the term coined BRICS (Brazil Russia India China and South Africa) .

Post the top in 2008 the best performing market has been India. China is yet to cross 2008. The only other viable emerging market now seems to be Brazil.

Lets look at the chart of Dow and Nifty in 2004-2006

- The 2004 correction

India did see a deeper correction compared to rest of the world. BJP lost the elections. Interestingly almost all markets were down in May 2004. Almost all of them bottomed out around 17th May 2004 ( the lower circuit day in india ). This proves that undue weightage given to Indian Elections and events and lesser to global trends. ( This helped me be Long going into 2014 Elections with a strong global trend.)

- Rate Hike to the 2006 peak.

Over the last decade or so we have seen US markets to be the Mother Market and rest following it. But back in 2004-2007 it was pretty different.

Dow up 12% and Nifty up 150%. From the First FED Rate Hike.

Can we see an outperformance in Nifty to US in coming years. May not be as large as 2004-2006 but even a third of that would be good.

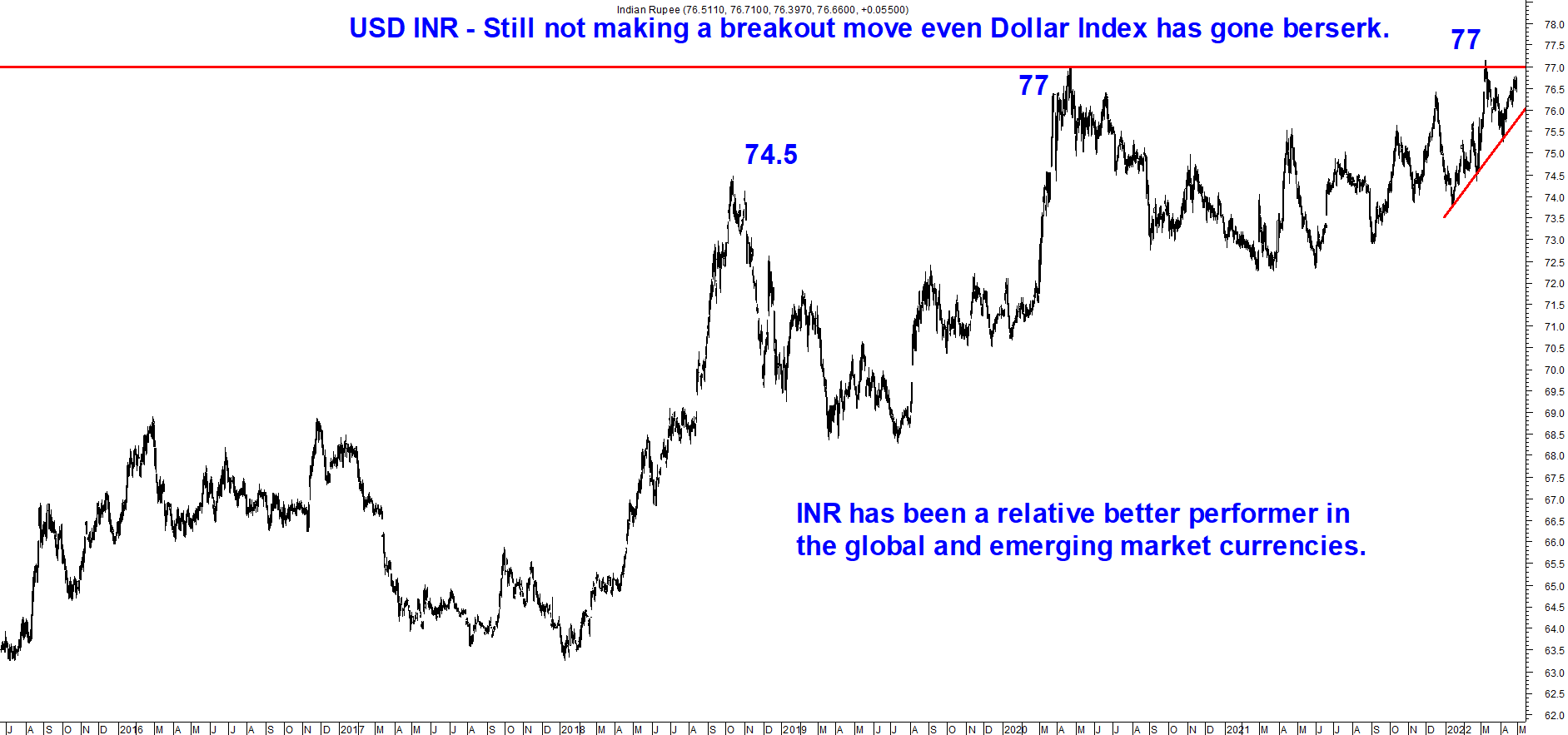

3) Global Currencies

Dollar Index going back to 2003/2017 but USD-INR relatively better in such times.

Indian rupee has been depreciating against the USD forever now. But of late the relative strength in comparison to under Global and even Emerging currencies is interesting.

Dollar Index – At a 5 year breakout and back to 2003.

Japanese Yen – Going Bonkers

USD-INR – Not as bad but above 77.5-78 would be a breakout. A very important resistance.

Conclusion

-

Time to be more Optimistic about India over the next few months/years 😀

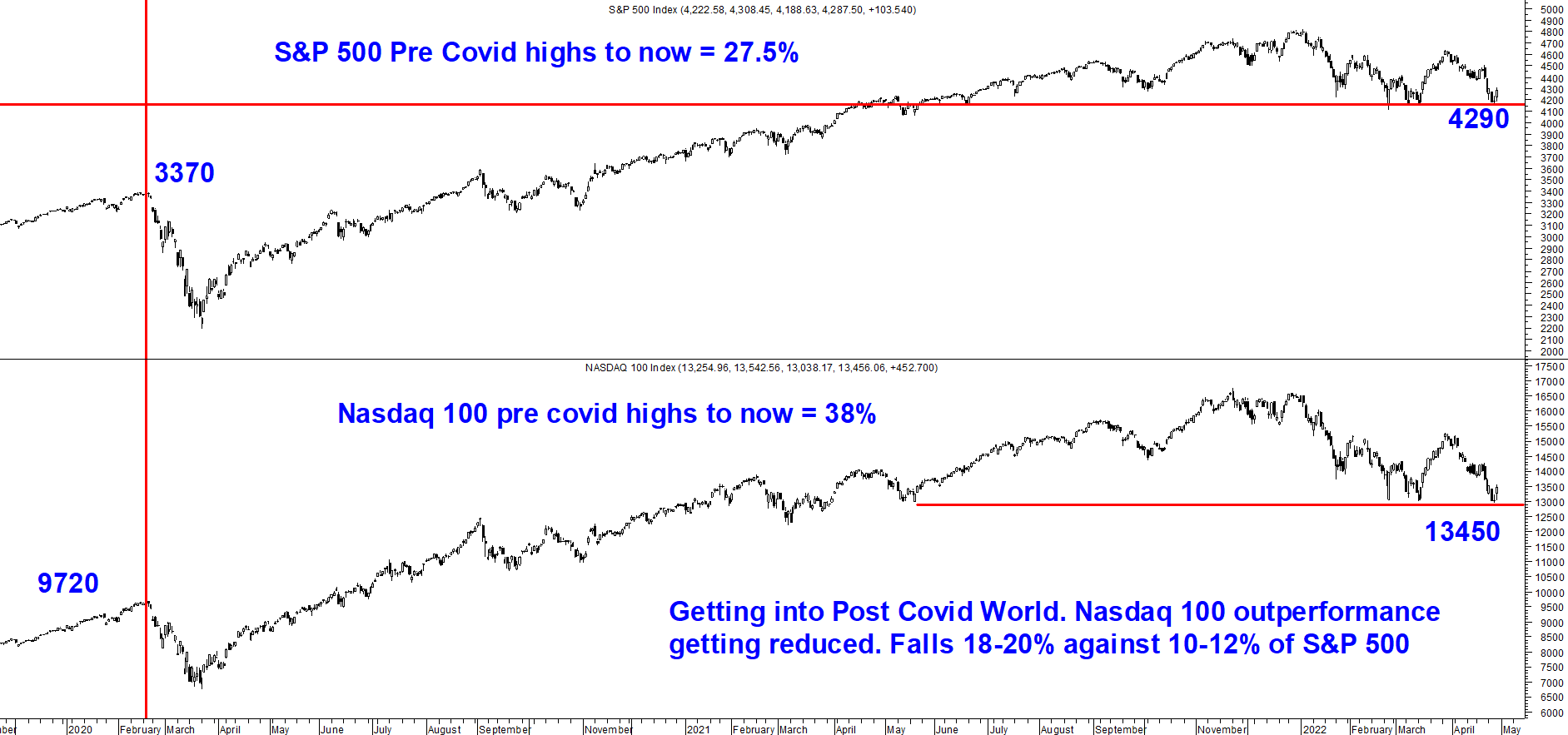

4) Post Covid World - Nasdaq outperformance fading

We have covered other aspects of Post Covid Theme in our earlier Weekend Insights

Opening Up Theme - https://nooreshtech.co.in/2022/03/nooreshtech-weekly-insights-18th-march-2022.html

Happy Weekend !!

Our Services

1) Research Services

Technical Traders Club

https://bit.ly/3JhePcx

Quickgains FnO

https://bit.ly/3FA9Cdn

Quickgains Cash

https://bit.ly/3Fz3IsT

Insider Trading Updates

https://rigipay.com/g/2PnhM0A8H4

Smallcase

2) Training Services

Online Technical Analysis Course

https://bit.ly/3FwMjRD

3) NooreshTech Content

Free Blogpost

https://nooreshtech.co.in/

Free Youtube Videos

https://youtube.com/user/noorrock2002

Free Broadcast Channels (Interesting Charts)

https://bit.ly/3pvQ5FB

https://bit.ly/3mAFdEy

Free In App Content - NooreshTech

Android - https://t.co/8bnLJL5UrB

iOS - https://t.co/0ZBnD8LV02 -

Enter the org code - "bvuod"