What is an Insider ?

Insider Trading means trading in the shares of a company by the persons who are in the management of the company or are close to them on the basis of undisclosed price sensitive information regarding the workings of a company, listed on a recognised Stock Exchange(s), which they possess but which is not available to others. Insider trading in India is regulated by the Securities and Exchange Board of India (“SEBI”).

Insider Buying

Why do we look at Insider Buying ?

- Insider Buying has to be disclosed on the exchanges and it is very difficult for Insiders to sell their holdings in the open market as it may be taken negatively by the market.

- So a large quantum of buying by an Insider from open Market is a good signal to research the company.

- The Market Cap of the Company can be large but the cashflow to the promoter is through Salary and Dividends which is just a few percentage points of the total market cap.

- Once the money is invested by the promoter it can be taken out only via selling the shares some time in the future or through dividends and salary.

- Insider Buying can be done through Open Markets or through preferential warrants. Preferential Warrants are a little tricky ( needs a whole post for it). Preference is for open market buying or open market buybacks.

What to be careful about.

- As per market-men , The managements in India supposedly have an unofficial shareholding in the company which many a times gets converted to official holdings.

- Prefer to look for open market buying, open market buybacks ( promoters not participating) and carefully in preferential allotments.

- Some tips – percentage of daily volumes, odd number of shares etc.

Some old Examples

- In 2011-2013 down cycle – Aarti Inds promoters bought 5% of equity from open markets, Ceat Limited promoters bought 5% of equity. Many more like that.

- You just need a couple of great ideas in such times while researching hundreds of them.

Insider Buying 2020.

In this series we will list out a lot of stocks where Insider Buying is going on. These are not recommendations but just an academic exercise to find stocks to research.

There are a lot of stocks in the list and but will write a few posts. .

Its a team work between my team mate Harsh Doshi and me.

You can download the full excel here and will be posted every few weeks for any new interesting insider trades, bulk deals, preferential allotments etc –

A small product offering designed by Harsh – Base Price min Rs 300 Rest - Pay as you want for next 2 months. Will decide cost as after improvisations as per feedback -

Insider Trading Excel and Quick Snapshots on Interesting Companies

For any more details check the above link or whatsapp on 7977801488

If you have a view on any of the stocks covered below do mail us on nooreshtech@analyseindia.com

Stock Number 1 - Action Construction Equipments.

1) Last 4 years.

| Stock Name | Dec-15 | Dec-16 | Dec-17 | Dec-18 | Dec-19 |

| Action Construction Equipment Limited | 68.09 | 73.1 | 68.91 | 68.95 | 72.25 |

2) Last quarter

| No. of shares bought (net) in Q4FY20 | Value of securities bought Q4FY20 | Total no. of shares | % equity bought in Q1FY20 |

| 151645 | 10910019 | 113483196 | 0.13% |

Comments

- Promoter sold 4.19 % stake in Dec 2017 to 68.91 % and has increased the stake subsequently to 72.25% in Dec 2019

- The promoter sold the stake at 135 and buying from 85 to 35.

- Interesting stock to research. Maybe able to survive the down cycle with manageable debt.

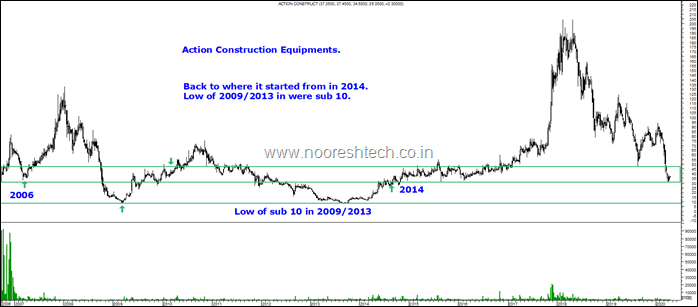

Last 10-15 year chart.

- Back to where it started from in 2014.

- 40 was also the price in 2006-2007.

- Lows of 2009/2013 at sub 10.

Conclusion

- A cyclical stock which could be back to the lows after a great cycle and maybe bottoming out over next few or many months.

- The debt is manageable and could be an interesting company to study.

Stock Number 2 – Astec Lifesciences

1) Last 4 years.

| Stock Name | Dec-15 | Dec-16 | Dec-17 | Dec-18 | Dec-19 |

| Astec Lifesciences Limited | 62.28 | 63.56 | 67.08 | 67.33 | 69.55 |

2) Last Quarter

| Mar-20 | No. of shares bought (net) in Q4FY20 | Value of securities bought Q4FY20 | Total no. of shares | % equity bought in Q1FY20 |

| 350845 | 144102024 | 19565555 | 1.79% |

Comments

- Godrej group bought the promoter stake at 190 and then further increased with an open offer at 246 and continues to increase the stake over the last 4-5 years.

- Last quarter has seen an increase of 1.79% which is at a faster rate since 2016.

Last 5-10 year chart

- 250-300 seems to be a major support zone of last 5 years.

- The Open offer was at 246.

Conclusions

- Godrej Group is a decent management and even after holding at 65-68% stake continues to add indicates the faith in the long term prospects of the company.

- Maximum the promoters can buy is upto 75%. Post current quarter closer to 71%. Next two quarters to watch.

- An interesting company to study the business prospects.

In our next post will cover

AlphaGeo – 3-4% stake increase in 3 years and 0.43% last qtr. Market Cap equal to cash but no clarity on future business.

AstraMicro – Promoter increasing stake but owns only 10% of the company.

KRBL – A veteran value investor Anil Kumal Goel – pledge invoked stock falls to 90 and back to 180.

April 15, 2020

I tried to pay..but found difficulty.

Paying in a day, 500/-

My mob. 9327976737

And WhatsApp no. 7016241473

June 30, 2020

There is error in payment – kindly check

tried to pay 500 twice but failed to process the transaction

mobile – 9999455777