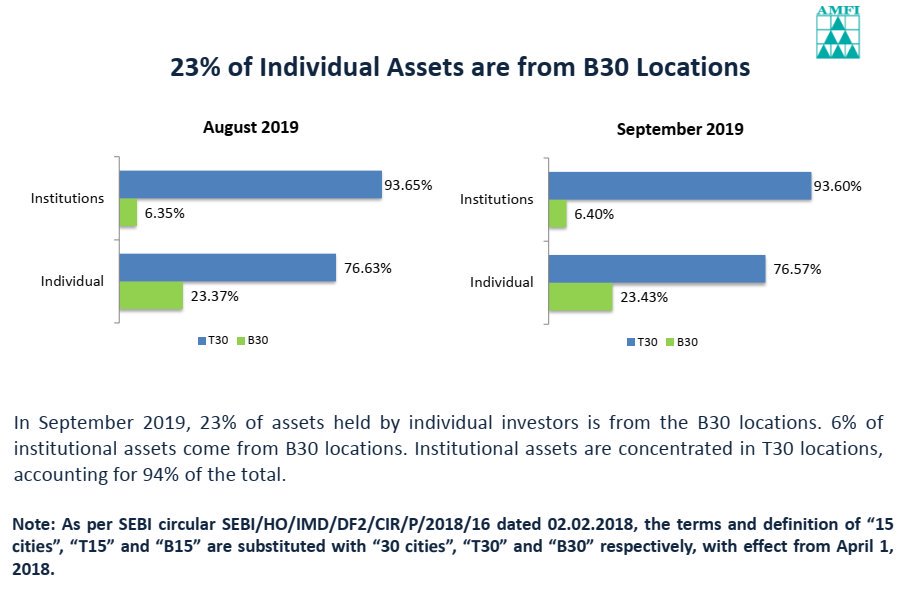

23% of Individual Assets are from B30 Locations

Mutual Fund SIPs accounts stood at 2.84 CRORE! And the total amount collected through SIP during September 2019 was ₹8,263 crore

The Total SIP Aum is now 2.88 lakh crores and 2.84 cr SIP accounts. AMFI data shows that the MF industry had added, on an average, 9.24 lacsSIP accounts each month during the FY 2019-20, with an average SIP size ofabout ₹2,900 per SIP account.

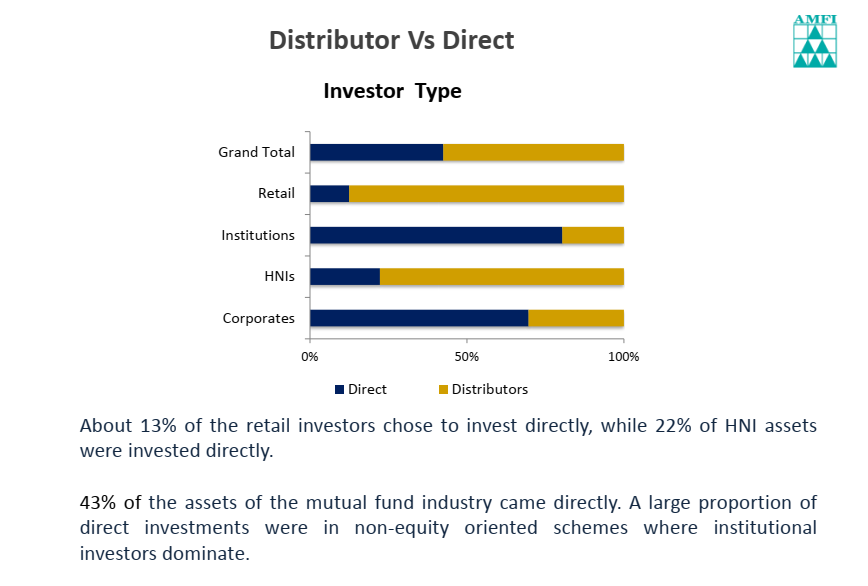

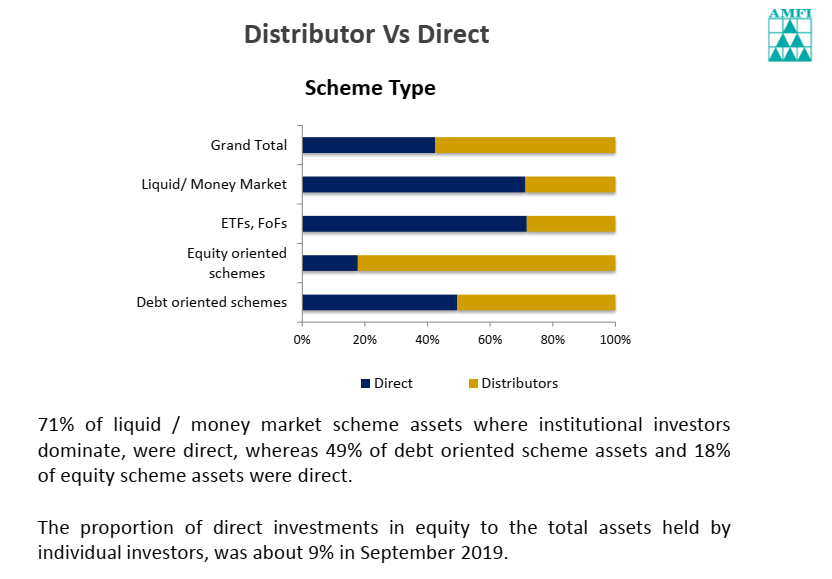

Abt 13% of the retail investors chose to invest directly, while 22% of HNI assets were invested directly. 43% of the assets of the mutual fund industry came directly. A large proportion of

direct investments were in non-equity oriented schemes where institutional investors dominate

The proportion of direct investments in equity to the total assets held by individual investors, was about 9% in September 2019.

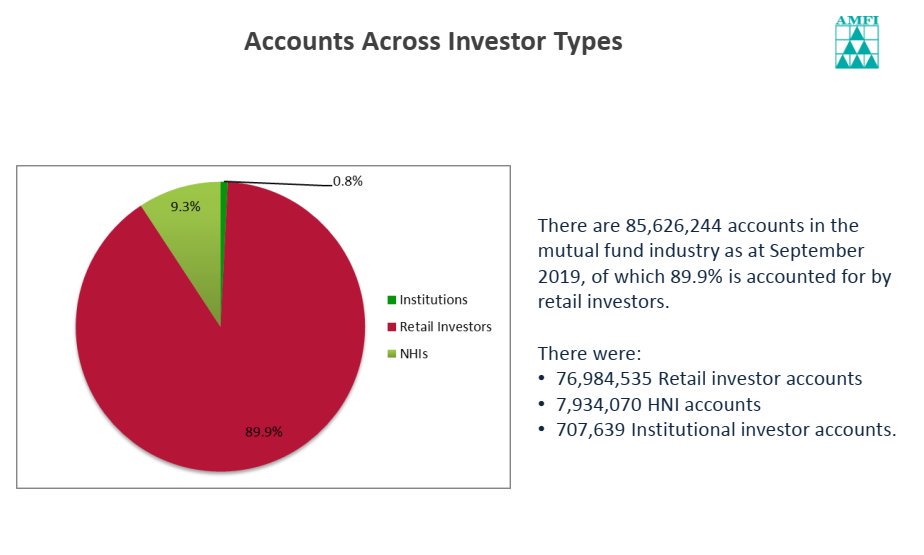

There are 85,626,244 accounts in the

mutual fund industry as at September

2019, of which 89.9% is accounted for by retail investors.

There were:

• 76,984,535 Retail investor accounts

• 7,934,070 HNI accounts

• 707,639 Institutional investor accounts.

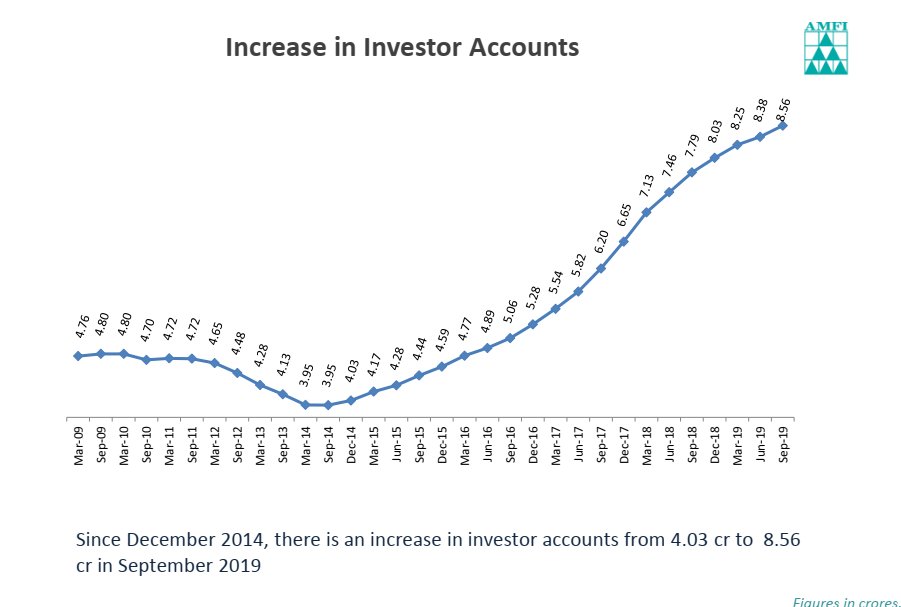

Since December 2014, there is an increase in investor accounts from 4.03 cr to 8.56 cr in September 2019

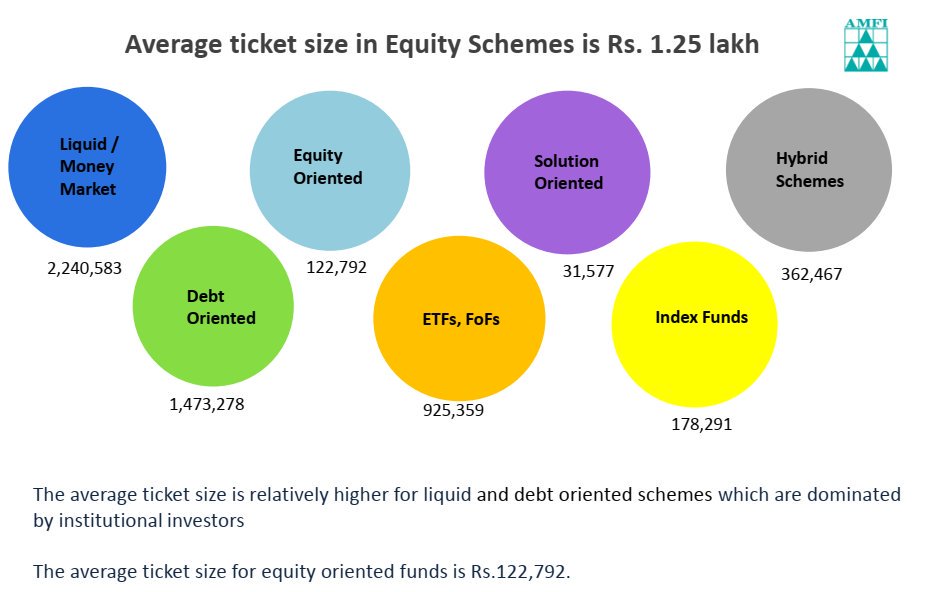

The average ticket size for equity oriented funds is Rs.122,792.

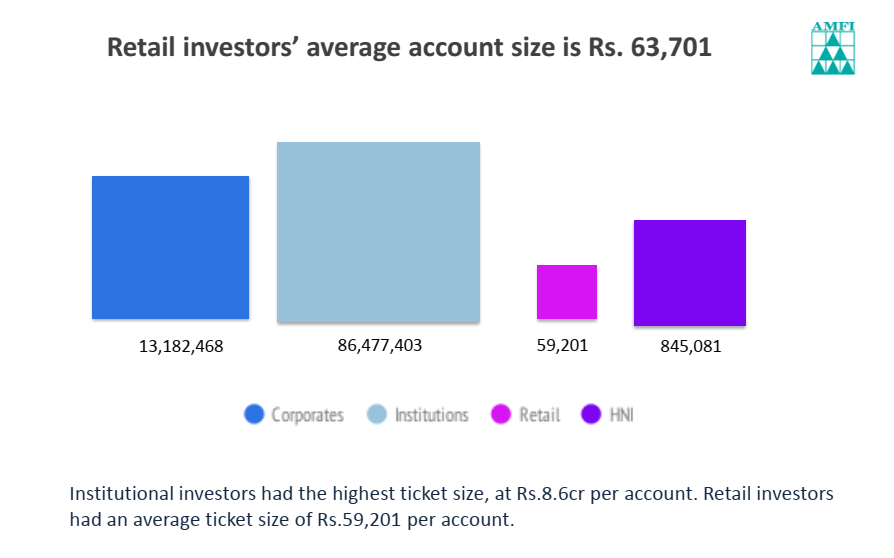

Institutional investors had the highest ticket size, at Rs.8.6cr per account. Retail investors had an average ticket size of Rs.59,201 per account.

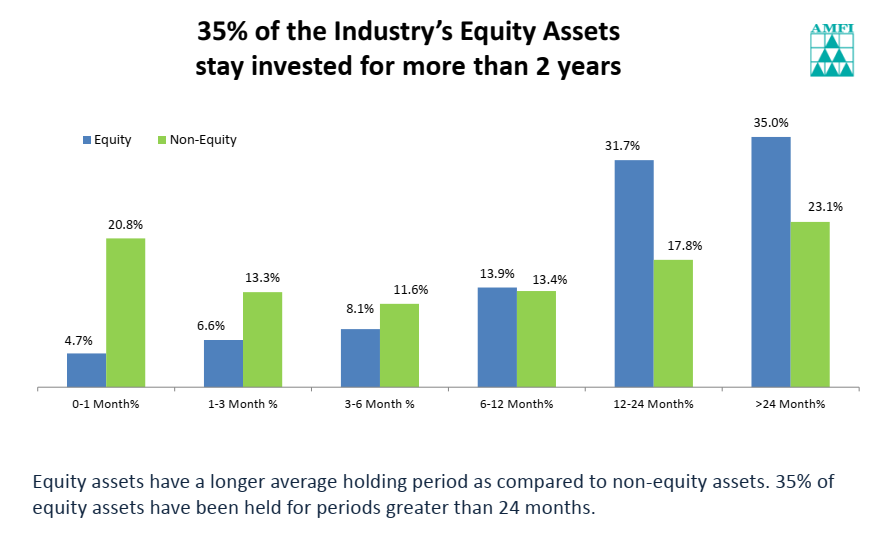

Equity assets have a longer average holding period as compared to non-equity assets. 35% of equity assets have been held for periods greater than 24 months.

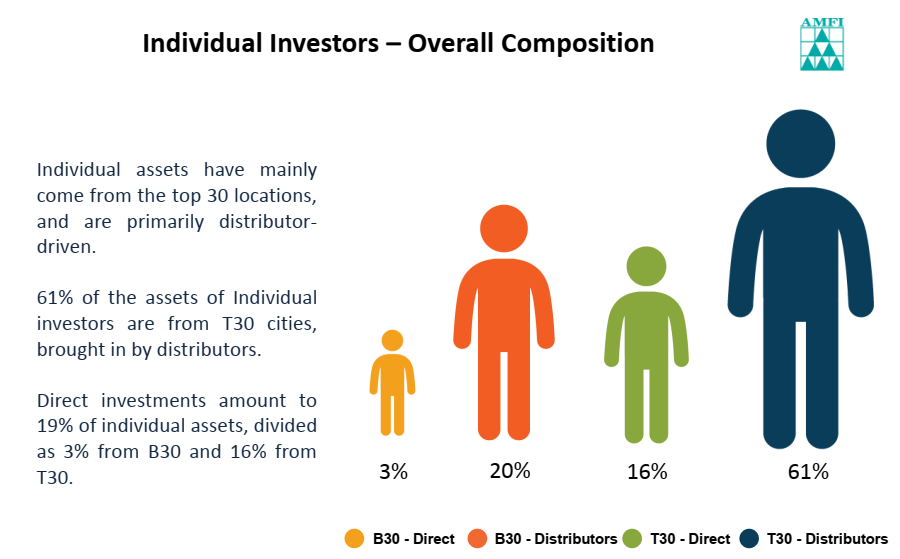

61% of the assets of Individual investors are from T30 cities, brought in by distributors. Direct investments amount to 19% of individual assets, divided as 3% from B30 and 16% from T30.