Kirloskar Group Stocks – Changing Times?

About the group

Kirloskar Group is an Indian conglomerate, headquartered in Pune. The Kirloskar group of companies was one of the earliest industrial groups in the engineering industry in India.

The group produces centrifugal pumps, engines, compressors, screw & centrifugal chillers, lathes and electrical equipments like electric motors, transformers and generators.

While Laxmanrao Kirloskar, established the group in 1888, his son Shantanurao Laxmanrao Kirloskar played a role in the leadership of the company.

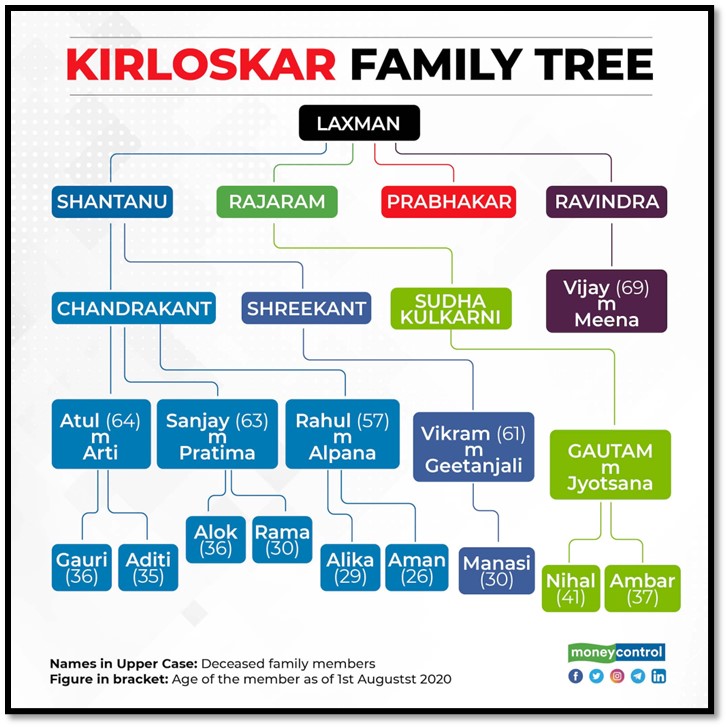

Family Tree

Family Dispute

One of India’s oldest business families is witnessing a sibling rivalry between Sanjay Kirloskar (owns Kirloskar Brothers Ltd. (KBL) a pump manufacturing company and on another side his elder brother Atul (Owns Kirloskar Engine Oils Ltd.) and younger brother Rahul (Owns Kirloskar Pneumatic Company Ltd.).

Sanjay claimed that Atul, Rahul and their spouses sold their shares in KBL to Kirloskar Industries Ltd.— breaching the terms of the DFS which they signed in 2009. Sanjay also accused that Atul and Rahul breached a non-compete agreement by acquiring La Gajjar Machineries in 2017, another pump manufacturing company. “Kirloskar Oil Engines, which acquired La Gajjar, has also used the name Kirloskar in their campaign to mislead the buyers,”

The other party Atul and Rahul claimed that DFS is a family settlement agreement, not a business settlement. “No company has adopted the DFS

HC referred the dispute to arbitration which was challenged by Sanjay in Supreme Court. SC asks the brothers to consider resolution through mediation.

Change in Management View -

On 23rd Aug, Kirloskar group gave a 3yr overview on all its businesses in an investor conference.

An otherwise conservative management, gave aggressive growth guidance for all its businesses.

Link to presentation:

https://www.kirloskaroilengines.com/documents/541738/e7503be3-d63c-f6f1-86d8-bb71a3be1013

Kirloskar Oil Engines Ltd | Mkt Cap: 3401 cr | Debt: 1965 cr

Promoted by Rahul and Atul Kirloskar

KOEL, one of the flagship companies of the Kirloskar group, manufactures and services diesel engines and diesel generator sets. The company also makes diesel, petrol and kerosene-based pump sets

Promoter’s stake is constant at 59.44% as of June 2022. Last promoter buying was in Sep 2019

Bulk/Block Deals-

FII - Nalanda India Equity Fund Ltd and Nalanda India Fund Ltd exited fully in Dec 2021.

DII - Franklin Templeton Mutual Fund bought 4.08% in Dec 2021 and later added 1.72% in recent qtrs, stands at 5.80% as of June 2022.

DII - SBI Smallcap Fund holds 7.57% as on June 2022 (Reduced from 9.05%)

In a recent bulk deal, SBI Smallcap Fund sold further 33.93lk shares out of their total holding of 1.09cr as of June’22

Chart View-

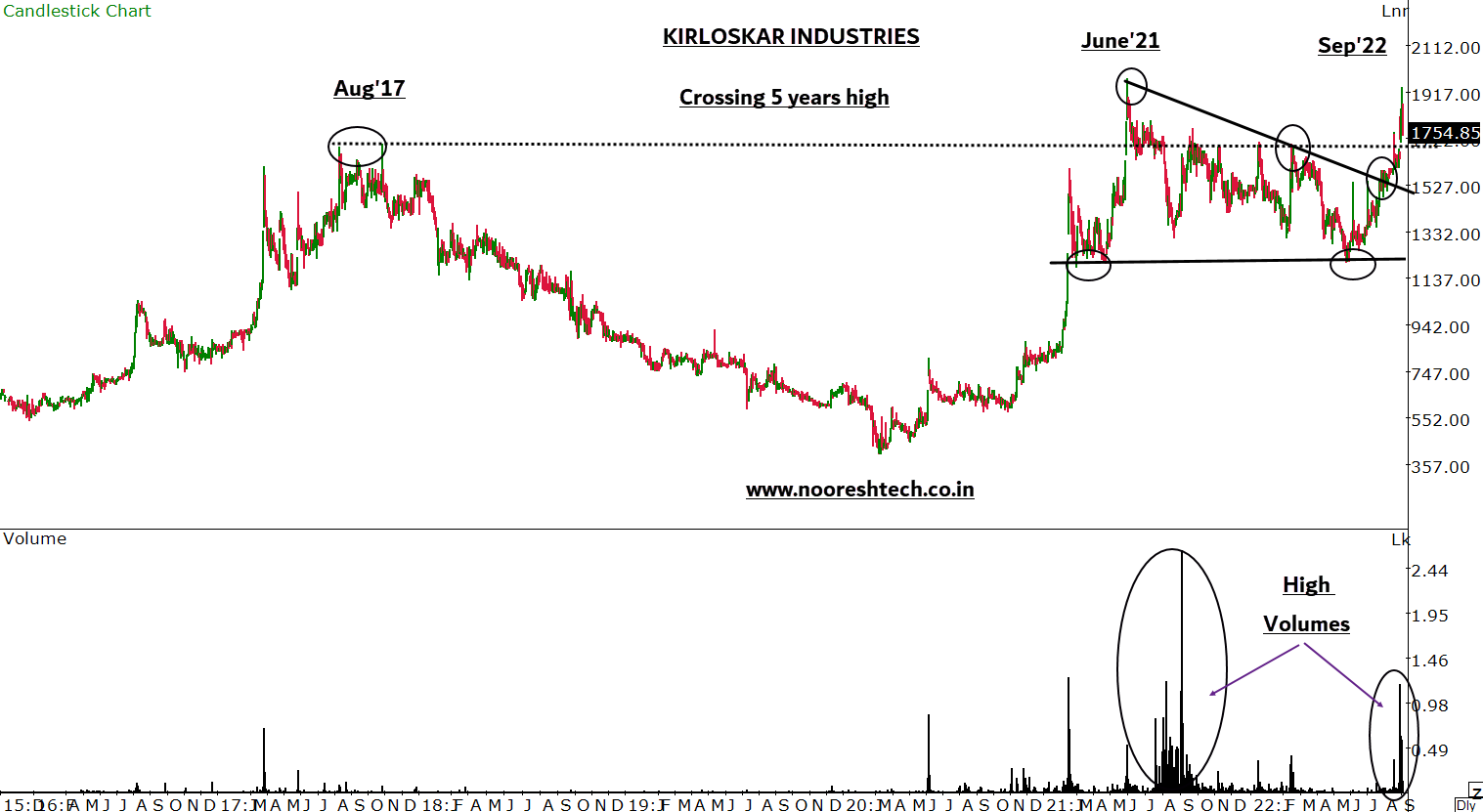

Kirloskar Industries Ltd | Mkt Cap: 1718 cr | Debt: 1157 cr

Promoted by Rahul and Atul Kirloskar

It is a holding company, holdings worth Rs. 1185 crores in other group companies as well some other companies. Kirloskar Pneumatic Company Limited (262 cr v/s 165 Cr in FY21), Swaraj Engines Limited (276 cr), Kirloskar Brothers Limited (537 cr v/s 454 Cr in FY21), Kirloskar Oil limited (108 cr)

Promoters reduced their stake from 73.11% Sep 2019 to 72.43% June 2022 due to issue of ESOP’s

Recent update -

Recently, Kirloskar Ind divested its 17.41% stake in Swaraj Engines to M&M at Rs 1,400/Sh

Bulk/Block Deals-

FII - India Capital Management Limited sold exited fully in Sep 2021 via multiple bulk deals, bought by investor Anuj Anantrai Sheth and his firm Gagandeep Credit Capital Pvt. Ltd.

Chart View-

Kirloskar Ferrous Industries Ltd | Mkt Cap: 3,423 cr | Debt: 1133 cr

Promoted by Kirloskar Industries Limited

Promoters stake has reduced from 59.41% Sep 2019 to 58.95% June 2022 due to issue of ESOP’s

KFIL manufactures pig iron and ferrous castings such as cylinder blocks, cylinder heads, and transmission parts and different types of housings required by automobile, tractor and diesel engine industries.

Bulk/Block Deal-

Further Promoters (Not in active management) – Nihal, Jyotsna and Ambar sold 30,98,640 Qty or 2.24% stake in Aug 2022 through bulk deal, out of which 15 Lakh shares bought by DII Nippon India Mutual Fund.

DII HDFC Small Cap Fund increased its stake from 4.63% Sep 2019 to 6.44% June 2022.

DII – DSP Smallcap Fund exited 3.32% stake in March’22 qtr

Chart View –

Kirloskar Pneumatic Company Ltd | Mkt Cap: 3,521 cr | Debt: 1.24 cr

Promoted by Rahul, Atul and Kirloskar Industries Limited

Promoters have reduced stake from 53.87% Sep 2019 to 53.63% June 2022 due to issue of ESOP’s

The Co. is engaged in the business of Compression & Transmission segments. It also undertakes O&M services for Compression Packages and has also entered logistic services by operating RoadRailer trains for end to end transportation of goods.

Bulk/Block Deal-

Promoters (Not in active management) – Nihal, Jyotsna and Ambar have sold 93,60,775 shares or 14.51% stake in Aug 2022 through multiple bulk deal.

All 14.51% stake bought by Major DII’s like Tata Mutual Fund, Aditya Birla Sun Life Mutual Fund, ICICI Prudential Life Insurance Company Limited , Franklin Templeton Mutual Fund, L&T Mutual Fund. and Valuequest Investment Advisors and Investor Jagdish Master

Chart View-

Kirloskar Electric Company Ltd | Mkt Cap: 265 cr | Debt: 142 cr

Promoted by Vijay Kirloskar

Promoters haven't reduced/added their stake since Dec 2019, total stake stands at 49.51% as of June 2022.

Kirloskar Electric Company Ltd, established in 1946, is an electrical engineering company that produces AC Motors, DC Motors, Transformers, Switchgear and Electronics through nine manufacturing units. It caters to core sectors like power generation, transmission and distribution, transportation, and renewable energy, sugar, steel, cement, and allied industries

Bulk/Block Deal-

No Major deal happened recently

Chart View-

Kirloskar Brothers Ltd

Promoted by Sanjay Kirloskar.

However, Kirloskar Industries holds 23.91% stake

Promoters stake stand at 65.95% till date, no changes in recent.

Kirloskar Brothers is a part of the Kirloskar Group engaged in the business of engineering and manufacturing of systems for fluid management.

The core businesses include large infrastructure projects (Water Supply, Power Plants, and Irrigation), Pumps, Valves, Motors and Hydro turbines.

Bulk/Block Deal-

No Bulk/Block deal in recent time.

DII Nippon Life India Trustee Ltd and The New India Assurance Company Limited holds 5.39% and 1.23% respectively.

Chart View-

Conclusion:

We can see a host of changes happening in Kirloskar group specially in companies promoted by Atul and Rahul Kirloskar i.e. Kirloskar oil engines, Kirloskar ferrous, Kirloskar Pneumatic and Kirloskar Industries

Some of the changes:

- Non active promoter group exiting the business and shares getting bought by good institutional buyers

- Kirloskar Industries exiting non-core business by exiting Swaraj Engines

- Kirloskar oil engines buying full stake in La Gajjar Machineries deepening and widening its reach and leveraging KOEL's expertise in channel, service, manufacturing and R&D to build a world class organization.

One must read the companies in more detail to understand changes happening in individual companies.

Download and share above article in PDF ---> Kirloskar Group

Join our Premium service – ‘Technical Traders Room’

If you know how to read charts and are unable to sit through and scan good breakouts and trade opportunities, we have got you covered

Read more: https://nooreshtech.co.in/2022/08/why-technical-traders-room.html

Subscribe: https://rigi.club/jcp/l7BZLqDa7i

Coupon Code: Don’t forget to use the code’MAIL15’ to get a 15% discount

(Valid till 30th Sep only)

Technical Analysis Training Mumbai–October 15-16.

1) Free Access to Online Course 1 year. (Rs 6000 )

2) Free Refresher

3) 2 months Technical Traders Rooom

4) 10-12 batch size

Fees Rs 16000

Payment Link https://bit.ly/3DCU5vm

For more details https://nooreshtech.co.in/2022/09/technical-analysis-training-mumbai-october-15-16.html

September 28, 2022

There is also G G Dandekar Machine Works Ltd which is into rice planting machines. diversified into planting of other crops via a partly-owned subsidiary.

Company has entered into a new business – real estate development by purchasing parts of a single office building near Kothrud in Pune. The property will be rented out.

Marketcap is around Rs 33 cr. but holdings in listed companies and value of cash on books are much more. There is also a land parcel in Bhiwandi on which a school stands. In addition, manufacturing plant is located in own premises at Nagpur.

however labour trouble has shut down in the manufacturing of rice planting equipment.

disclosure: holding and biased.