I will start of with the conclusion first.

Conclusion

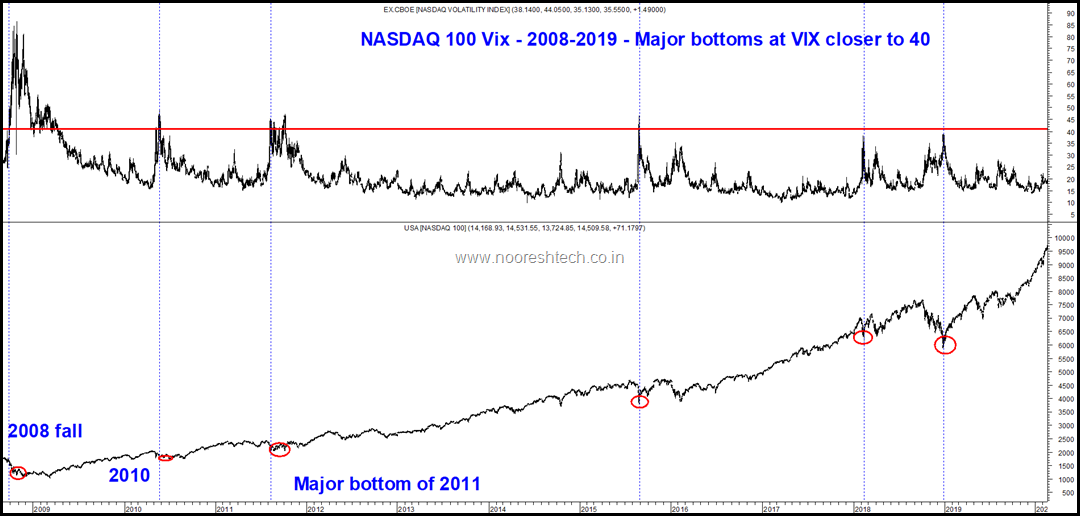

- Over the last 20 years plus of data VIX has two zones of fear.

- 35-45 zone being a general bottom in majority of the cases. Multiple major bottoms. ( Help us picked bottoms in 2011, 2013, 2015 )

- 45-80 is the Black Swan Zone. 2008 Global Financial Crisis and Covid Crisis.

- At 40 vix a major bottom is formed in a few days or max of 2-3 weeks.

- Even in case of 45-80 a bottom is done in 4 weeks but the downside is quick and recovery too but 20% + in few days is scary. ( I got it wrong in 2020 )

- Yesterday S&P 500 VIX hit 38 and Nasdaq 100 Vix hit 40 +

- The expectation is we do not see Black Swan so soon again.

- The next few days is a good time to be deploy money into equities over next few days if one has a long term view. ( Avoid Covid Beneficiaries.)

- As a trader the next few days could be very volatile. So time to wait it out if one cannot digest volatility.

Suggestions -

- Subscribe to Technical Traders Club – A good time is always in a drawdown.

- Subscribe to our Smallcases - https://nooreshtech.smallcase.com/

- A new thematic smallcase launched today which I would recommend - https://nooreshtech.smallcase.com/smallcase/NOMNM_0005

Nasdaq 100 VIX Chart since 2020 lows

Its pretty similar for S&P 500 Vix but taking nasdaq as this has been the most volatile one.

Nasdaq 100 2008-2019

A detailed video some time over the week.

We at Nooresh Tech offer you a host of services bifurcated in 3 categories

1) Research Services

Quickgains FnO https://bit.ly/3FA9Cdn

Quickgains Cash https://bit.ly/3Fz3IsT

Insider Trading Report https://bit.ly/3epIJNk

Smallcase https://nooreshtech.smallcase.com/

2) Training Services

Online Technical Analysis Course https://bit.ly/3FwMjRD

Technical Analysis for Investors (Coming Soon)

3) Free Services

Free Youtube Videos https://youtube.com/user/noorrock2002

Free Broadcast Channels https://bit.ly/3pvQ5FB

Free In App Content Android - https://t.co/8bnLJL5UrB

January 26, 2022

You have so nicely summed up what many may have taken pages and charts to conclude [myself too].

Even if the reader has no idea about the market action, the reader would be able to draw conclusions from your conclusions.

One cannot ask for more simplicity than this.

Please keep sharing your wisdom.

Thank you,

Umesh

February 6, 2022

Thanks for your comment.