Before I start the post.

New Technical Research Report

The Most Hated Promoter Group is Changing Long Term Trends @ Rs 2499 .

The Recommendations in the report have a holding period of 6-18 months.

Payment Link – https://www.instamojo.com/noooreshtech/the-most-hated-promoter-group-is-changing-lo/

The Report will get auto-downloaded. If any issue mail to nooreshtech@analyseindia.com or whatsapp on 7977801488

Subscribe at the earliest to receive the report right away.

Interesting Charts from Commodities, Indices, Global Indices etc.

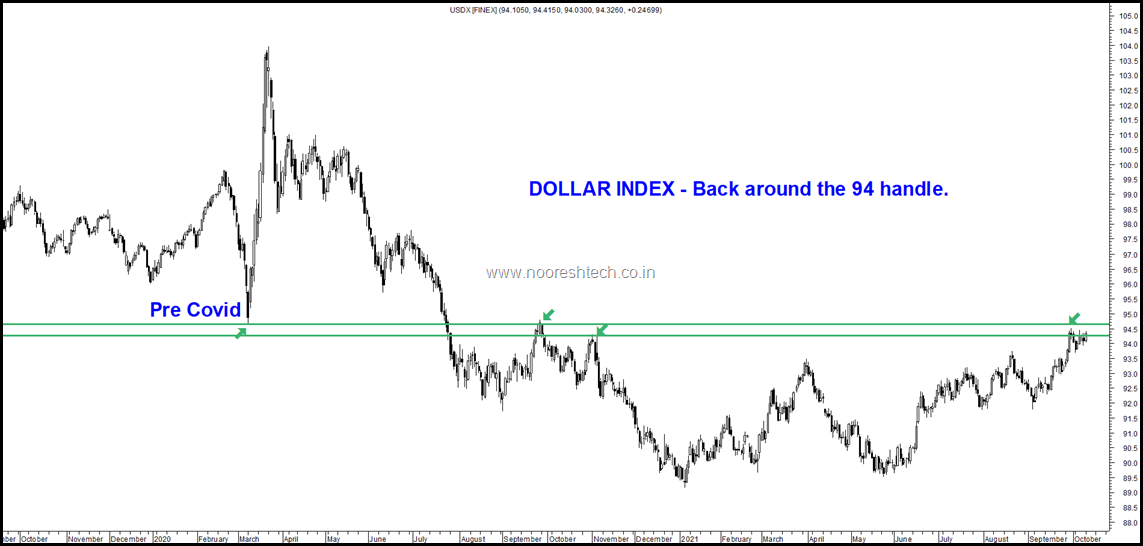

One of the classic co-relations is the Dollar Index with the Global Indices and Commodities. Similar is USD-INR with Nifty. ( Check this old video – Dollar Index and Nifty https://youtu.be/UbdRVpIQ5jQ )

1) In the last few weeks the Commodities have gone up alongwith a rising dollar. ( Due to supply constraints or more reasons etc )

It will be interesting to see how long does it last.

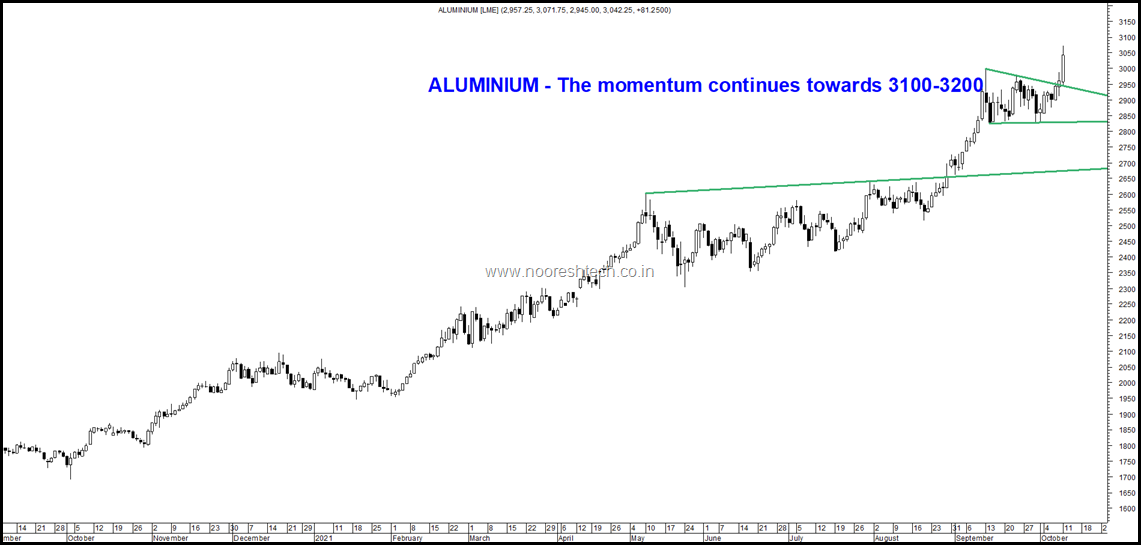

1) Aluminium – Going Bonkers.

An interesting tweet by Harsh -

#Aluminium Industry & #Power Consumption Aluminium is “solid electricity.”

Each ton takes about 14MW hours of power to produce, enough to run an average UK home for more than 3 yrs

If the 65mn tonne a-year industry was a country, it would rank as the 5th-largest power consumer

Disclosure – The author is biased towards Aluminium Stocks.

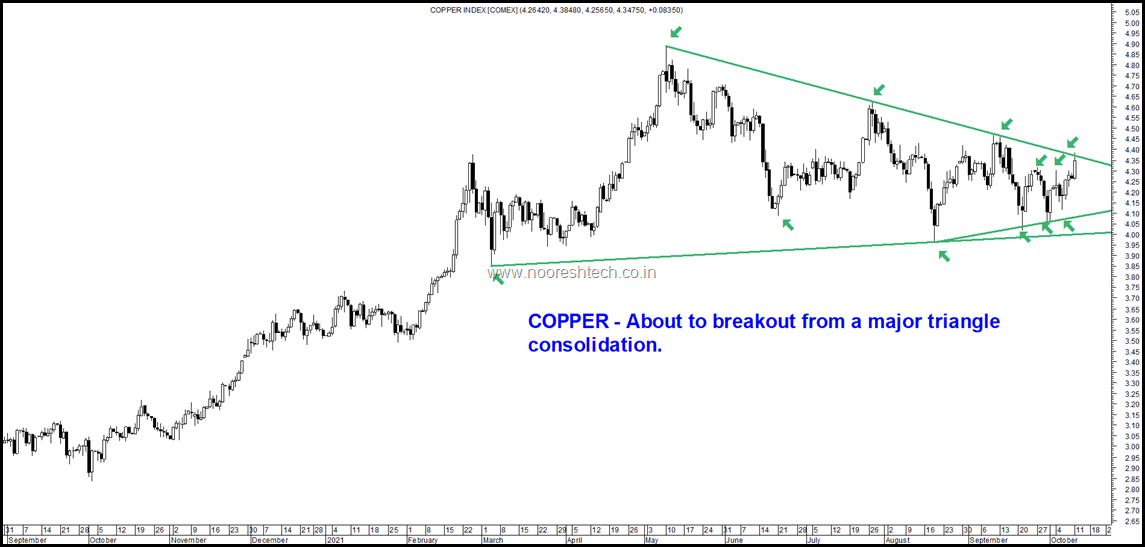

2) Copper – A big Triangle Breakout on Cards.

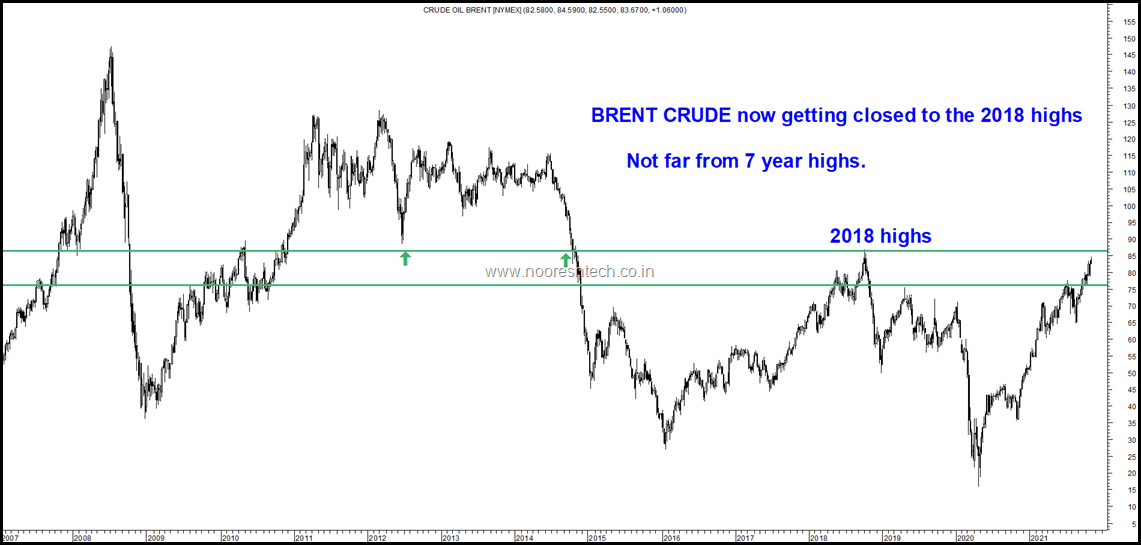

3) Brent Crude – Nearing 7 year highs.

This is happening when Crude is getting back to the 94 handle last seen in Sept 2020 and Feb 2020.

2) USD INR UP & NIFTY also UP – Does not happen often

If you look at the chart closely you would notice in a trending move USD INR clearly has an opposite co-relation. A upward bias of USD INR may not always see a sharp price correction but could be timewise correction.

The current phase is interesting with Nifty also slowly trending up with USD – INR.

Simply put need to be nimble whenever Nifty breaks 17300/17600 till then RIDE !

3) Nifty Bank – The Underperformer post Covid seems to be turning around ?

With HDFC Bank and SBI hitting new ATHs are we looking at Banking to take lead. Lends more support to Nifty.

Bank Nifty by Nifty IT – At Multi-Year Lows.

We looked at this on August 24th 2021 – Bank Nifty bottomed around that date.

#Timepass Chart - When #Banks go up #NiftyIT takes a break. Just looking at this chart of #NiftyBank/#NiftyIT. Seems either IT has to go down or Banks up going forward ? Or the tide has turned towards #IT forever ? pic.twitter.com/4IsVjXLLJW

— Nooresh Merani (@nooreshtech) August 24, 2021

Dow Jones – Back in the range – If it crosses 35k the momentum shifts to up. Till then sideways.

We had looked at this in detail as to how Dow was nearing an important support

The Most Important Charts Now –Dow Jones, Nasdaq 100 , S&P 500 and Dollar Index.

Conclusion from the post.

Now we watch for 35k on Dow and 4460 on S&P 500 for a momentum shift.

Conclusion

- The Momentum in Commodities is Strong even with a a Rising Dollar. This momentum can last a few days/weeks. A fall in dollar can accelerate it.

- The Global Indices are in a sideways zone. Watch for Dow 35k and S&P 500 4460. That would shift momentum to up.

- Indian Indices in strong momentum with new ATHs/ 52 week highs. Nifty 17300/17600 remains the trailing stop.

- Bank Nifty is showing signs of taking leadership and the underperformance could change to outperformance.

- Continue to be stock specific with a strict approach towards stoplosses and controlling leverage.

- When a lot of co-relations tend to shift the best thing to watch for is Price Action. Be reactive instead of predictive.

Do go through a recent interaction with Vivek Bajaj – The first 15 mins give you my market view - https://youtu.be/-Fs98w_51og

Smallcase Launch - Smallcase Launch–Top 10 Insider Trading, Top 10 Techno Funda, Top 10 Value & Thematic Smallcases.

Online Technical Analysis Video Course – A good time to now do it.

LinkTree - Links to all our services and products - https://linktr.ee/NooreshTech ( Do checkout )

For any queries whatsapp 7977801488 pr mail nooreshtech@analyseindia.com