The last part of our Random Portfolio Exercise.

Do read the 1st two parts.

-

Random Portfolio Test– It either Humbles or Humiliates! Part 1 of 3

-

Random Portfolio up 200% from March 2020 Lows–Everyone can say Maine Bola Tha. Part 2 of 3.

The Total Performance Exercise.

In this exercise we look at almost all the stocks listed on NSE. ( Above 5 rs filter taken.)

The last couple of posts which are must read. This exercise gives a lot of confidence on where to focus.

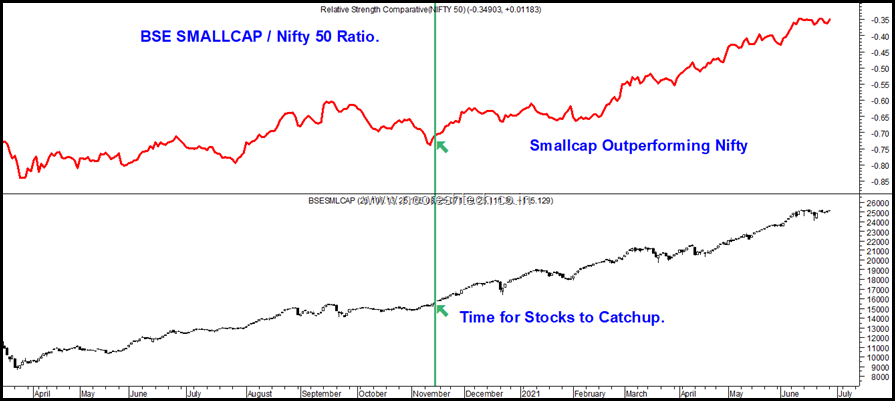

From the date of the above post the Smallcap Indices are up 50-60% and Nifty is up 25%. Also this was the day when Nifty hit a new all time high.

This chart sums it up. How Smallcaps/Midcaps have outperformed the Nifty.

The data of the universe as it was in November 2020.

1) The Fall From peak of 2018 to November 2020

The Nifty is up but stocks are down !! – Everyone looks at the Nifty but everything apart from that is down and even a lot of stocks in Nifty are down below the 2018 prices

- Nifty is up 19%

- 15% stocks only are trading above its Jan 2018 prices (218 out of 1461 stocks)

- 85% stocks are trading below its Jan 2018 prices (1243 out of 1461 stocks)

- 74% stocks are down more than 25% from the Jan 2018 prices.

- 55% stocks are down more than 50% from the Jan 2018 prices.

2) Equity–Never been so Bad so Quick. What Next ?

The timing of the post could not have been better. Nifty and almost all stocks made a low on 24th March 2020.

The data gave the confidence that it could not get any worse.

This was 2008

- 87% of stocks were down more than 50%.

- 79% of stocks were down more than 60%

- 60% of stocks were down more than 70%.

This was 2020.

- 79% of stocks are down more than 50%

- 70% of stocks are down more than 60%

- 56% of stocks are down more than 70%

Everything has doubled or tripled from those zones. The more important thing was to just sit and not panic in March 2020 as not everyone had enough cash.

How does it look in June 2021.

The universe of 1419 stocks only NSE Listed stocks above 5 rs as on 15th Jan 2018.

1) % of Stocks Below 2018 Highs

- 64% of the stocks are still below 2018 highs.

- 48% of the stocks are still 25% or more below the 2018 highs.

- 28% of the stocks are still 50% below 2018 highs.

% of Stocks Above 2018 highs.

- 10% of stocks are up more than 100% above 2018 highs.

- 17% of stocks are up more than 50% above 2018 highs.

- 19% of stocks are up 0-50% from 2018 highs.

The Data.

| 15th Jan 2018 to 21st June 2021 |

% |

| 149 | 10.5% |

| 241 | 17.0% |

| 284 | 20.0% |

| 238 | 16.8% |

| 147 | 10.4% |

| 116 | 8.2% |

| 99 | 7.0% |

| 84 | 5.9% |

| 61 | 4.3% |

| 1419 | 100.0% |

2) Pre Covid to Now – 20th Jan 2020 to 21st June 2021.

- 83% of stocks are above Pre Covid highs of 20th Jan 2020.

- 27% of stocks are up more than 100% above pre covid highs.

- 17% of the stocks are below precovid highs.

The Data

| 20th Jan 2020 to 21st June 2021 |

% |

| 8 | 0.6% |

| 16 | 1.1% |

| 58 | 4.1% |

| 160 | 11.4% |

| 244 | 17.3% |

| 256 | 18.2% |

| 279 | 19.8% |

| 245 | 17.4% |

| 141 | 10.0% |

| 1407 | 100.0% |

3) From Bottom of Covid – 24th March 2020 to 21st June 2021.

Do remember not to get anchored to lows of March 2020. It was for few days and not a lot of volumes got traded at those prices.

- 42% of stocks are up 200% or more from lows of March 2020.

- 74% of stocks are up 100% or more from lows of March 2020.

- 2% of stocks are below lows of March 2020.

| 24th Mar 2020 to 21st June 2021 |

% |

| 2 | 0.1% |

| 4 | 0.3% |

| 4 | 0.3% |

| 12 | 0.9% |

| 30 | 2.2% |

| 78 | 5.8% |

| 217 | 16.3% |

| 425 | 31.8% |

| 563 | 42.2% |

| 1335 | 100.0% |

4) From All time Highs of Nifty to Now. 9th November to 21st June 2021.

This shows why we need to stop anchoring to Nifty.

- 95% of stocks are up 25% or more from November 2020.

- 59% of stocks are up 50% or more from November 2020.

- 29% of stocks are up 100% or more from November 2020.

| Stock Performance | 9th Nov 2020 to 21st June 2021 |

| Below -75% | 2 |

| -50% to -75% | 3 |

| -25% to -50% | 11 |

| 0 to -25% | 47 |

| 0 to +25% | 233 |

| +25% to +50% | 303 |

| +50% to +100% | 443 |

| +100% to +200% | 329 |

| Above +200% | 87 |

| Total | 1458 |

Conclusions & Learning's.

- Getting anchored to the lows of 2020 or highs of 2018 or the Nifty can cloud your rational thinking.

- Its never too late in a trend. Even when Nifty was at an all time high in November 2020 the broader universe was interesting and even today is.

- 55% of stocks were down 50% or more & 75% of stocks down more than 25% from Jan 2018 highs in November 2020.

- Even today 64% of stocks are below 2018 highs and 48% still down 25% or more from 2018 highs. ( Mind you this does not make the stocks above 2018 highs expensive but they can be more interesting too.)

- There are still a lot of opportunities in the Broader Markets.

- We learnt a new lesson in 2018-2020 ( pre covid.) Index can keep making new highs and everything under the sun can be down !

- Are we going to learn an opposite lesson of above and stock specific performance can continue irrespective of Nifty.

- The Nifty is very concentrated and does not give you the right picture of where the Total Stocks in the Universe of NSE are placed.

- The Total Performance Exercise gives us a great perspective on the Current State of the Market – i.e the Total Investible Universe.

- There are still a lot of opportunities in the broader markets not just in the 64% of stocks down but across the board. Do not get anchored to the Past. Future is always a pleasant surprise in a growing economy.

If you did like the post – Share and Comment. Can also mail me on nooreshtech@analyseindia.com or whatsapp on 7977801488

Free Technical Analysis Ebook ( if you have not read yet.) – Analysis that Works

Online Technical Analysis Training Video Course – 1 year Access.

LinkTree - Links to all our services and products - https://linktr.ee/NooreshTech ( Do checkout )

Technical Traders Club - https://nooreshtech.co.in/quickgains-premium/technical-traders-club

June 29, 2021

I think majority of the stocks below their highs, majority will be PSU stocks, esp PSU banks which has destroyed much of investors wraith..