Every time the Nifty will take a negative day in coming days, we will start hearing about the Double Dip in Nifty and how the bottom at 7511 is going to be broken in the next attempt or we need to at least test it.

So will we have a double dip all the way to 7511 or new lows or a higher bottom ?

One way I would again suggest is to play with the Nifty Calculator to try out scenarios by guessing prices for top 20 names

Where is the Nifty ?

- The Nifty is at 9800-10000.

- 7511 is now around 25% lower from the current prices.

- Either all heavyweights need to fall 25% or some of them need to fall more than 30-35% to lead the downside and some fall lesser or go higher.

Why a Double Dip back to 7511 or lower is difficult to look at for Now ?

- Banks and Financials have not recovered as much as other stocks. ( Look at the post to see other sector rotation) . 20-22% dip and it will be back to new lows. In this HDFC and HDFC Bank need to crack the most as its almost 17.54% of the 33% weight of Banks and Financials. If either of them does not do that the Double Dip turns to a higher bottom.

- FMCG has a weight of 10.58% – Hindustan Unilever and ITC have a weight of 8% and Nestle,Britannia add up the rest. Hindustan Unilever has not seen a strong recovery and a 17% drop implies a new low. ITC has seen a strong recovery it almost went back to 11k equivalent of Nifty. Can this basket fall 25-35%.

- The other big sector is IT with a weight of 14.6% and has seen a good recovery. Can it go back to new lows quickly or not ?

- Auto stocks have recovered back to February prices and will they go back to new lows. M&M an agri play is showing lot of strength and is back to February prices. Two Wheelers are back to February. Will they go back sharply down?

- Two leadership sectors have been established in terms of new 52 week highs – Pharma and Telecom. Reliance 11.88% , Bharti Airtel 3.10% and Pharma 3.69% are the names to watch for. If they do not breakdown it will be tough to break 7511 or even a retest closer to it.

- The telecom+ pharma + fmcg basket is close to 30% of the Nifty, which seems a tough nut to crack for now. When any of these names start breaking down we need to change the view to a double dip.

Lets look at the charts.

Reliance Industries

- A breakout above 1620-1630 actually suggests a possibility of 1800-2200.

- Only when it starts breaking 1400 do we know a trend change.

- After 4-5 attempts at a resistance the chances of a breakout increases.

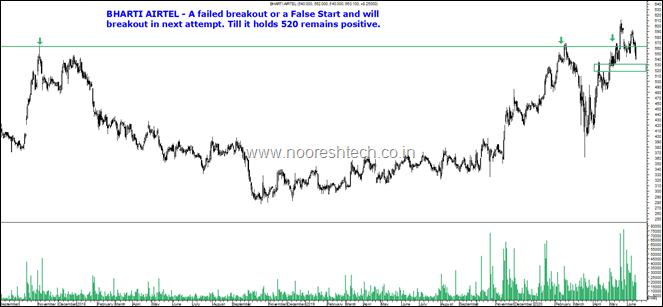

Bharti Airtel

- A failed breakout or a False start and will breakout in next attempt. Till it holds 520 it remains positvie.

Sun Pharma

- Continues to face resistance at 500-520. Till it holds 430 remains positive.

- So if we consider Nifty has to fall 25% and suppose this 30% basket of ( Telecom ( Reliance + Bharti), Pharma and FMCG ) does not fall 25% the rest of the basket will need to 30-35% or even higher. If this basket breaks out that makes the lower case Nifty much much higher than 7511.

Conclusion -

- For now a dip back to 7511 can only be looked into only if at least one of the following sectors breakdown Telecom,Pharma and FMCG give a breakdown.

- If Telecom or Pharma breakout on upside then the higher bottom could be much higher than 7511. ( A lot of broader market pharma names like Cadilla, Biocon, Granules,Natco,Unichem Labs are showing more strength than the largecaps.)

- To sum it up will keep watching these 3 sectors to show signals till then a Higher Bottom seems the ideal case.

- The case which most people are not looking at is a very range bound market for a much longer time. My personal view is we may stay in a band of 9000-10500 for quite some time. ( Will review it if 9500 breaks or 10500.)

- Again repeating that in a dip from here it would be time to look for broader market opportunities and to keep researching. Do read this post - Opportunities in Bear Markets and Consolidations post 1992, 2000, 2008 and 2020.

SPEAKER AT BEAR SUMMIT 2020

My Topic - The Next Bull - Identifying Bottoming Out Patterns after a Bear Market. For Bear Market Summit 2020. Registration Link – Has interesting set of speakers.

Do Read this post if you have not.

Opportunities in Bear Markets and Consolidations post 1992, 2000, 2008 and 2020.

ONLINE TECHNICAL ANALYSIS COURSE

The Full Course on Technical Analysis is now uploaded and can be bought digitally with 1 year access to the recordings.

The Course is divided into 4 sections

Section 1 – Introduction to Basic Technical Analysis Concepts.

Section 2 – . Technical Analysis Chart Patterns, Indicators, Trendlines.

Section 3 - Practical Technical Analysis – How to use it to invest,trade, find sectors, Full time Trading.

Section 4 – Various Softwares and Utilities.

Bonus – One Webinar for Q&A. Batch of 20 every time. Details to be sent on email.

More than 12 hours of content.

Course Fee = Rs 6000

Can buy the course from this link and go through the entire curriculum ( Course Content & Curriculum )

https://www.analyseindia.com/course/onlinetechnicalanalysiscourse/?tab=tab-curriculum

Whenever we add more videos you will get an e-mail for us.

For any queries or payment confirmation mail to nooreshtech@analyseindia.com or whatsapp on 7977801488

June 15, 2020

10945 is 200 day MA of Nifty today that means most likely 10500 can break on upper side sometime in Aug 2020 just around possible second stimulus checks in US but could be a biggest trap for bulls :-).

Looking at fundamentals and macro it looks very difficult that Nifty will close above 10 months MA on monthly closing basis for next few months. Rather possible second wave of virus and effect of recent shutdown/job losses will mean disaster of unimaginable proportion on economy. My view could be wrong.

June 20, 2020

“7511 is now around 25% lower from the current prices.”

This is a super sentence, worth thinking.