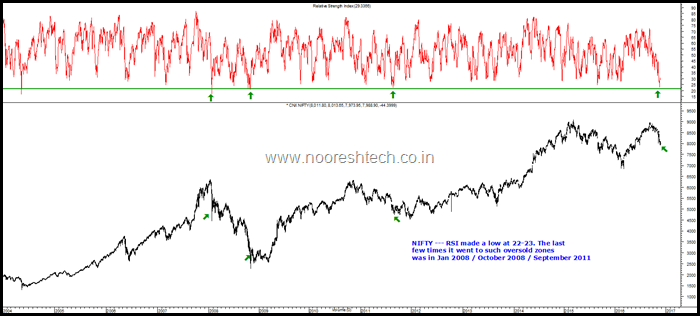

Nifty has dropped from 8950 to 7950 in the last couple of months. This may not be as sharp a drop in percentage wise as it was in 2008/2011 but the speed of the fall on relative basis makes it as oversold as those times.

Nifty - Oversold - But Bottoming out takes Time

- The previous instances when Nifty had hit 22-25 levels was in Jan 2008/ Oct 2008 and Sept 2011.

- In Jan 2008 after a strong bounce from 4450-4500 to 5500 it again retested the bottoms did a bounce again and finally broke down the trend.

- In October 2008 Nifty fell from 4200-4400 to 2200-2500 in a sharp manner. The first time it hit oversold levels of 22 it was at 3200 and made a durable bottom at 2250-2500.

- In September 2011 it hit a low of 4800 and took another 2-3 attempts in the range of 4500-4800 with positive divergences to form a durable bottom.

- Nifty has again hit 22 ? What next ?

- Here comes the tough part of trying to predict as its absolutely impossible to catch all cycles right and I would not try to attempt as cannot be lucky always 🙂 ( February bottom i got lucky )

But lets make an attempt to look at the price action

1) Nifty lows at 8450-8550 was an intermediate bottom which has been taken out on a sustaining basis. This changes the short term trend down and will change only above 8630/8750 or when we form another swing top in coming months and that is taken out.

2) Nifty is oversold but in previous instances it has taken 1-3 months also to bottom out. If that happens it can be pretty boring and in a range.

3) Very rarely have we seen a V shape recovery after such a correction. But who says it cannot happen ?

4) 61.8% retracement of the move from 6850 to 8950 comes to around 7650-7700. Lasy time in August 2013 we reversed after doing a similar retracement.

5) Technically a good setup to enter would be when we start making Positive divergences on Nifty i.e - Nifty makes another low or two and RSI inches up higher. This old video might help in understanding it ( RSI - What happens when Oversold )

6) I would prefer to wait for a divergence with a new low or a strong reversal to take a fresh trade. I dont mind missing out on the first move or entering fresh trades at a higher price point on confirmation as a trader.

As an investor now things are a bit tougher. Majority of Investors would be focusing on the Smallcaps/Midcaps.

Lets look at the smallcap and midcap index.

I had mentioned a cautious view on Sept 21st 2016 in this post - #Smallcap Indices in All Time Highs and Outperforming Nifty!! Time to be Cautious and Selective !!

Post a little dip on Surgical Strikes Announcement the Smallcap Index went up another 10% !!

Now lets look at the Smallcap Indices again.

BSE Smallcap Index

- It is down just 12-14% from the peak but if you were to compare from the day when Nifty made a top at 8950 around Sept its down only 7-8% whereas Nifty is down 10-11% !!

- So it has been a solid outperformer to Nifty on various timeframes and seems no panic here.

Now lets even look at the BSE Midcap and NIfty Midcap Index

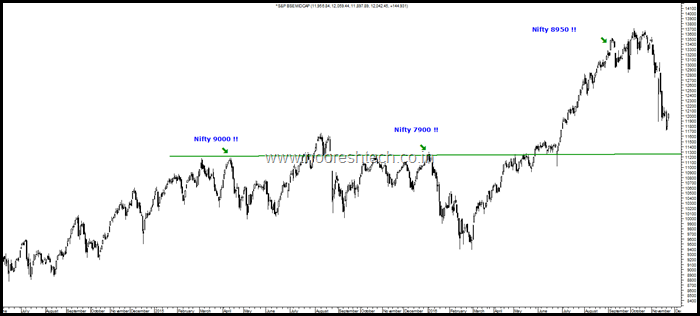

Nifty Mid100 -- What resilience and outperformance to Nifty. Still above the price when Nifty was at 9000 !!

- Still higher than the prices at 9000 Nifty in March April 2015 and 7900 Nifty in Jan 2016 !!

- Down only 12% from peaks and outperforming Nifty from the time it topped at 8950 !!

BSE Midcap Index - What Resilience and Outperformance to Nifty. Still above the price when Nifty was at 9000 !!

- Still higher than the prices at 9000 Nifty in March April 2015 and 7900 Nifty in Jan 2016 !!

- Down only 12% from peaks and outperforming Nifty from the time it topped at 8950 !!

Conclusion -

- The Midcap and Smallcaps have outperformend in last 2 years as well as over last few months even after the current correction.

- We have not seen any panic in the smallcaps/midcaps like we saw in February/March 2016.

- Its difficult to say whether resilience is a good sign or bad but definitely its not a time of pessimism in the Midcap/Smallcap space. .

- Simply put the Midcaps/Smallcaps have not fallen a lot of seen in any panic. Can it panic - I dont know but it definitely is not a pessimistic time to chip in.

- So for an investor it is this way

You did not like a stock at 100 rs as it was overvalued 3 months back but after that stock went to 150 and is now at 110 it suddenly looks value.

Is it because of a 25% drop from peak which is giving an illusion of value or fundamentals have changed ?

Is it that you are scared you dont want to miss out ?

This is a time to evaluate with a fresh perspective and not get anchored to the high and low prices as an Investor.

Strategy

-

- Technically the Short Term Trend is down with Nifty getting into oversold zones like 2008/2011 but unlike previous oversold zones the Midcaps/Smallcaps have not seen a panic and rather showing a lot of resilience.

- The strategy for a trader should be to stay with the trend which is down or wait for a Positive Divergence on Nifty to start looking for long trades. There is a time to trade and there is a time to sit and wait.

- For an Investor the strategy would entirely depend on the cash levels.

- But if you do not have a good allocation to equity as part of networth the next few weeks/months could be a good time to deploy fresh money in parts with a view of next 2-3 years.

- If the correction of 15-20% from peak has scared you as an investor you got to read the following.

- I would say i have a lot of clarity on the 2-3 year picture being rosy but the next few months are pretty confusing with markets. As a trader have a simple rule - When in Doubt , Stay Out ! - As an Investor when in doubts stay in the hunt for a good entry price !

- Also next time would try to make a video explaining the thoughts in much more detail and also elaborate on the Chor Zabardasti Bane Mor theme.

If you are looking out for customized Advisory - https://nooreshtech.co.in/quickgains-premium/platinum-plus