Do read the disclaimer and please do your own research and risk management.

In our recent Technical Trades March report had covered a stock Aegis Logistics.

It was mentioned a couple of times in Technical Traders Club

The stock after making a new all time high and crossing 2010 consolidated for quite a few months. The trade initiation was at the retest of breakout at 420.

When you get into multi-year highs and all time highs we do get such pleasant surprises.

The stock has moved from 420 to 620 in a matter of weeks.

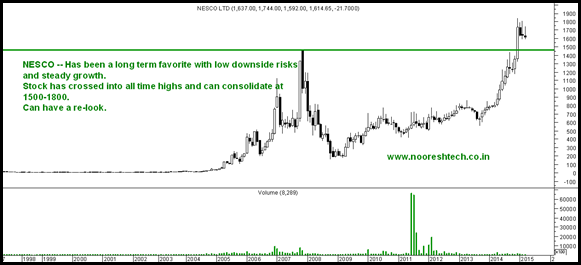

Another stock which has been my favorite for long term and i continue to like as a safe bet NESCO has hit all time highs. An earlier post few years back – NESCO a steal at 800 cr mkt cap

Technical View:

The stock had made a high of 1500 in the bull market of 2008 on back of the Real Estate buzz.

It can now consolidate at 1500-1800 for quite some time.

The long term trend continues to be strong and validated with new all time highs.

The company has made significant progress since.

Huge land bank and annuity income from rent.

Debt free co and currently at 2200 cr mkt cap and a recurring income of 100-120 cr going ahead with no further expansion ( can see quite a bit in next 2-4 yrs )

Needs a fresh look with a fresh mindset and no anchoring bias.

Will like to get views on NESCO

We are conducting an interesting two day workshop in Bangalore at the end of this month. Do attend to learn more about the way to invest.

The Investing Lab-Bridging Theory and Practice–Training Program Bangalore 28-29th March 2015 !!

Do book your seat at the earliest –

https://www.payumoney.com/store/buy/til

Disclosure : Have been an investor from lower levels and biased. Recommended in Big Value 2.0 at 1000-1100.

DISCLOSURE

•Nooresh Merani

•Securities covered above: Aegis Logistics, NESCO

•SEBI Registration disclosure – Registration for RIA under Process

•Financial Interest:

•Nooresh Merani and his family/associates/ analysts do have exposure in the securities mentioned in the above report/article.

•Nooresh Merani and his family/associates/ analysts do not have any financial interest/beneficial ownership of more than 1% in the company covered by Analyst.

•Nooresh Merani and his family/associates/ analysts have not received any compensation from the company/third party covered in the above report/article ever.

•Nooresh Merani and his family/associates/ analysts has not served as an officer, director or employee of company covered in the report/article and has not been engaged in market-making activity of the company covered in the report/article.

•The views expressed are based solely on information available publicly and believed to be true, assessed on Technical Analysis and view of the Author . Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

•Also read the detailed disclaimer – https://nooreshtech.co.in/disclaimer