Over the last 2-3 sessions have been tweeting about the risk of VIX going up with the Index. This combination can at times lead to a sharp short covering move which is 6-10% on the Index. Derivative analysis tells

Just posting previous charts. The risk is of a big move in Nifty and Midcaps but just that we were heavily bullish at 5500-5600 ( read this report – Equities – Get ready for a bright future ) gives us a bias to go long on Nifty at 6100 so would prefer stock specific.

Dislcosure: No position on Nifty but we have picked up a lot of PSU banks and trading long in stocks for past few days and may do in the future.

The last rise in Sept 2012 when we had initiated a major buy report – Forget the Past.

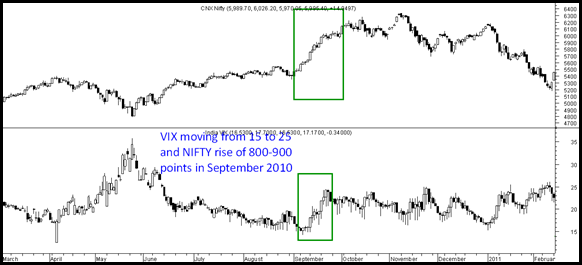

The major rise in 2010 which was 800-900 points.

The most important part is in this period we see huge moves in midcaps.

One stock recommended today is Aegis Logistics which we expect a sharp jump. Even JP associates can be a big gainer.

We would soon be putting out our top PSU Banks list. For now have initiated a strong buy on BOB at 708

Nooresh Merani

www.analyseindia.com ( For all our services )

Twitter – https://twitter.com/nooreshtech

Facebook – https://www.facebook.com/nooreshtech