Sensex Technical View:

In the last 4-5 years it seems 15000-15500 is a magnet. In 2010 we had a good time buying the dips to 15k all the time but did not expect same reactions to continue in 2011 end to 2012.

There are 8-10 times or many arrows which tell you there are numerous tops and bottoms in this band of 15000-15000 or + –200 points from this band.

The current move has been very surprising as the move in January seemed like a breakout and we may just retrace 60-70% of the fall but the current momentum on the downside is very strong and for now 15500-15700 and then 15100 will be the magnet area.

We are into highly oversold levels for some time. Our earlier expectation was RSI may bottom around 26 and it could be a bottom around 4900-4950 and some hopes were at 4800 which did give a small bounce that if fizzling out.

What seemed like a normal correction is turning out to be a panic bottom to be formed. In panics there is no logic and it can drift sharply down for a few days.

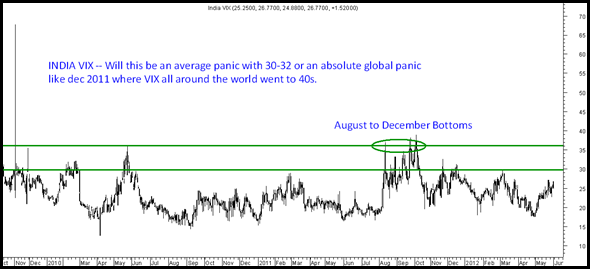

Finally INDIA VIX has started rising and panic has set in. So will this be a normal panic with a 30-32 top or something like a december 2011 which was global and every VIX around the world touched 40s.

Although its difficult to expect a move like 2008 where VIX even went to 60-70 and index fell by 30% in a month. But movement people start talking that it would be better for markets to bottom.

Conclusion --- Sensex 15000-15500 will be a band to watch although we are on the buy side from much higher levels and down 10-15% on the portfolio but that is more of a longer term approach. On the short term trading side its been very silent for a month !! Just sitting back and watching. The simplest thing to do is avoid leverage book losses also in case it is a margin position just to keep your mind cool. When the things turn you will get your chance to go heavily leveraged and re coup everyting.

No Pain No Gain.

No situation is permanent.

Happy Investing,

Nooresh Merani

June 4, 2012

hello sir,

dont u think that our currency has bottomed out? coz there are divergences on charts dollar index is overbought.

June 9, 2012

Nooresh, can you also make comparative study of various indices like mid cap index, bankex etc w.r.t 15000 level in past 4 year to where value is.

June 10, 2012

Yes will look into them too. Though midcaps are at 6 year zones.