This is a nice chart posted by one of our team members at Analyse India.

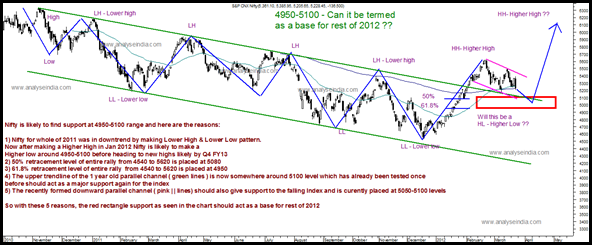

Nifty is likely to find support at 4950-5100 range and here are the reasons:

1) Nifty for whole of 2011 was in downtrend by making Lower High & Lower Low pattern.

Now after making a Higher High in Jan 2012 Nifty is likely to make a

Higher low around 4950-5100 before heading to new highs likely by Q4 FY13

2) 50% retracement level of entire rally from 4540 to 5620 is placed at 5080

3) 61.8% retracement level of entire rally from 4540 to 5620 is placed at 4950

4) The upper trendline of the 1 year old parallel channel ( green lines ) is now somewhere around 5100 level which has already been tested once

before should act as a major support again for the index

5) The recently formed downward parallel channel ( pink | | lines) should also give support to the falling Index and is curently placed at 5050-5100 levels

My view is pretty 5150-5200 remains the base in short term but over the next 1 year 4950-5100 is a very important zone.

The strategy is yet again simple – Buy the dips 🙂 book part in rise to increase cash for dips.

Yesterday got stopped out in the intra trade on siemens but sticking on with a positional view.

TECHNICAL ANALYSIS TRAINING WORKSHOP

BANGALORE ———- 24-25th MARCH.

Few seats left. For more call Kazim 09821237002. Mail toanalyseindia@analyseindia.com .

If you have any more queries sms me on 09819225396

Happy Investing,

Nooresh

March 23, 2012

Sir,

There are still 4 gaps left in nifty from the move of 4500 – 5600 rally . The last gap near 4640 levels. Normally gaps get covered . Is these gaps measured gaps since according to u markets are very bullish so it might take lot of time to cover the gaps. Even the biggest gap of nifty at 3800 is still not covered… Will it take lot of time for it cover?

Thanks and regards

chaitanya

March 23, 2012

I have written many https://nooreshtech.co.in/2011/04/sensex-and-a-study-of-gaps-an-observational-study.html

There is no rule which says gaps should be covered 🙂

We have a gap at 9900 also 🙂 as well as at 900 Sensex 🙂 levels.

Just look for more then 3 consecutive gaps as a signal to book profits.

So gaps are just observational studies and no rules.

March 23, 2012

A very timely and informative post! Thank you.

March 23, 2012

🙂

March 23, 2012

Nooresh,

I have heavily invested in Sterlite Tech and GMDC based on the technicals from 43 & 203 resp.

They have fallen down and wondering should I book loss or continue to hold as investments and what levels to book profits?

Pls do help Sir

March 23, 2012

Hi Arun,

Even we are holding on to Gmdc 🙂 taking a knock. I remain bullish on long term and averaging on dips.

Sterlite tech can keep a stoploss of 38 as its a speculative trade. We booked out at 46 on spike.

March 24, 2012

Thanks a lot sir for sharing valuable information on gap theory.

Regards

chaitanya