In many of my interactions with amateur analysts, traders and investors have heard about this word GAPS. The above phenomenon a GAP is not a technical study but is conveniently used by analysts for their own interpretations or to justify a view.

Now let us look into what is a gap and how/why is it formed.

GAPS -

Meaning – A gap is an area on a price chart in which there were no trades.

Why/How – The trading hours of markets are only 6-8 hours in the day but lot of events take place beyond that and the stock prices do not get trading hours to discount the event. So this leads to a price gap.

For example – Elections in India lead to a 20% circuit gap or a Fed decision overnight leads to gap down move.

Before i get into types of Gaps let me first tell you there is no technical or quant analysis or any other analysis which gives you a set of rule saying Gaps are to be filled or not filled and if filled then in X no of days.

Types of Gaps -

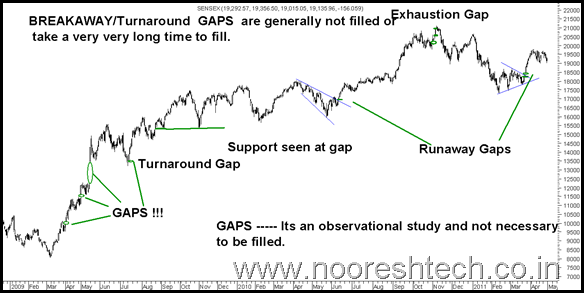

Common – These are normal gaps seen in terms of trading momentum and are generally filled. These may not be linked to any event or technical breakout.

Example – If u see the exhaustion gap before that there are two gaps ( common gaps ).

Brekaway Gaps - A gap which is generally a follow up to a consolidation range and the stock or index breaks out from the range. This can also be associated with a game changer event.

Breakaway Gaps may not get filled even if they do it takes a very very long time. Like we saw a gap 19500 in January 2007 which got filled in Diwali 2010 🙂

Example – Election Gap and the current one seen at 18373 which led to the breakout.

Turnaround Gaps – These are very rare and is purely out of observation and may happen after a continous fall or rise after which it leads to a sudden burst of demand and supply.

Not necessary to be filled but such gaps should provide strong support.

Shown in chart.

Exhaustion Gaps – After a good upmove and successive 2-3 gaps in few sessions leads to the markets getting overbought or oversold in quick time. Such a move is not sustainable and usually 3rd or 4th is an exhaustion gap and is a characteristic top in the short term.

Example – Gap around Diwali 2010.

Now after so much of useful or useless theory the bottomline is every gap has to be analyzed in individual circumstances but many a times traders and analyst give random analysis on gaps 🙂 as they have never observed or analyzed markets but end up following a set of rules 🙂 which dont work half of the time.

All of 2009 i kept reading so many people forcing a view that election gap has to be filled and 12k has to come. My counter argument there is a gap at 19500 and 18k also 😛 which should get filled first. So there is no analysis 🙂 to confirm when a gap is filled but if one analyzes the reason for a gap you would get a clearly probable move.

So let us look into the current gap up moves

The last two major breakaway gaps

First was at 16990 from where the rally to 21k started.

The next we saw is recently at 18270 and 18373 which led to the breakout.

Conclusion on Observational Study of Gaps -

If its a breakaway gap then 18200-18400 zone should not be filled or provide maximum support and one may look to buy just closer or above this zone. This will give a good risk-reward entry and the markets will continue their current upmove.

Also if that gets filled and broken on downside then as per observational study next level is 17k 🙁 which i dont think is a possibility in near term.

All in all we did get into a lot of technical theory 😛 which may not really be useful but a good read 🙂 ----The practical technical analysis is how to find momentum trades and turnarounds which we attempt to do profitably in our analysis posted on this blog 🙂

Cheers,

Nooresh

As an attempt to discuss more we are organizing a webinar a different platform to discuss technical analysis and how it is to be used.

All you need is a microphone/speaker and a broadband internet connection.

Attend 'FREE WEBINAR'

on

Magic of Tehnical Analysis plus get Hot Recommendations from Nooresh.

TO REGISTER MAIL TO freetrial@analyseindia.com

Limited Entries . Register NOW!!!

May 2, 2011

Thanks Nooresh 🙂

March 24, 2012

Thanks a lot sir for valuable information on gap theory.

Regards

chaitanya

March 26, 2012

Welcome chaitanya