Nifty Technical View

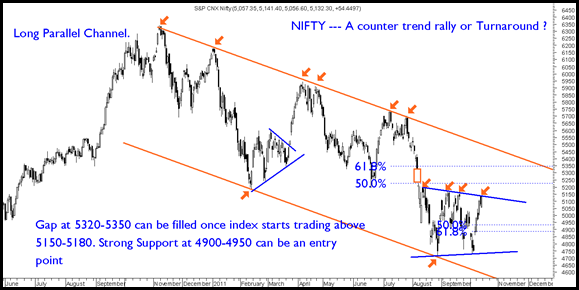

- Nifty is still in a downtrend with lower top lower bottom but a close above 5170 will be first indications of a turnaround or a strong counter trend rally just like the previous one in March from 5180 to 5950 levels.

- Such a counter trend rally can retrace 61.8% (5350) or an extension 73.6% (5460). Considering the fact that 200 dema/ Trendline resistance/Gap is all placed at 5320-5350 zones, so it becomes an important target level.

- We have seen a quick move after a double bottom at 4720-4730 with strong positive divergences and such counter trend rallies can be swift.

- One of the major indications for a counter trend rally is a faster retracement (Rising leg takes lesser time then the falling leg). The last fall from 5170 to 4720 took 10 sessions and right now we are at 5170 in 7 sessions. Move above 5170 in next 2 days will indicate a faster retracement. Faster retracement is a precedent to a turnaround.

- On the downside 4900-4950 (50-61.8%) is an important support level now which can be an entry point for this counter trend rally.

Investors should continue to keep with the strategy to get into quality stocks on dips.

October 17, 2011

Sir can sell nifty @ cmp with sl of 5170. ??

October 17, 2011

Hi Nooresh,

Whats your view on Anant Raj Industries? Is largely operates under Build and Lease model instead of sell model. Quoting around 50. Do you see it going to 150 in next 3 to 4 years. I’m a long term investor.

Many Thanks

Gaurav

October 17, 2011

your analysis right on your view. But as of my view simply if nifty close above 5200 for continuous 3 days then more upside expected till 5435-5550-5700. Near 5700 profit booking expected. 4720-4675 MAJOR Support.

Thanks,

He$H. . .