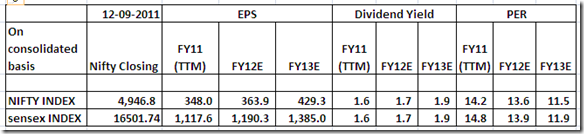

Above is a quick snapshot of Sensex/Nifty statistics – namely – EPS , Div Yield , P-E ratios.

Mind you the above numbers are consolidated and the estimated eps is as mentioned in bloomberg.

So lets take a plot of it and major swings in it.

1) Nifty Consolidated P-E stands at 14.2 as on 12/09/2011

Source - Bloomberg

2) Nifty standalone P-E stands at 17.86 as on 12/09/2011

Source NSE

I am still in the process of doing a detailed analysis which can be explained as well 🙂 but sharing the above data so to get more reviews and give a learning perspective on statistics.

Now certain questions that come up are more of statistics and may need a bit of excel/google and brokerage reports. I would request readers to find it out as well as post the same in the comments section or if somebody is doing a detailed study in doc/ppt format can mail it to me on nooreshtech@analyseindia.com . You need not answer all the questions but provide answers to at least 2 questions.

1) Why is consolidated P-E at 14 times whereas standalone given on NSE at 18 times.

2) The FY 12 EPS estimates are considering 6-7% growth whereas FY 13 EPS expects 16-17% growth from FY 12. As per earnings growth rate of last 10 years is this possible ? ( Hint - Need to do statistical analysis of growth rate )

3) What were the earning estimates for FY 08/ FY 09 as per and how bad was it . And what were FY 12 estimates a year back. ( Hint – Google it or skim through old brokerage strategic reports )

4) As per FY 13 estimates earnings will grow 23-24 % from current earnings. Is it overly optimistic / moderate / pessimistc ? and Why ?

5) What has been the mean/worst/best P-E for Nifty/Sensex for TTM and Estimated EPS.

6) How much is the difference between consolidated and standalone nos for Nifty.

7) What is the lowest dividend yield and highest dividend yield for Nifty/Sensex in conjunction with market highs and lows.

The best 3 readers who give a good reply to the above questions will receive lucrative gifts/prizes from Analyse India 🙂 . The contest ends in next 10-14 days. Also if you need some more historical data check www.nseindia.com ( Index statistics section) or mail me on nooreshtech@analyseindia.com

There are many more questions will be answered in the above in coming days also will need comments from readers. Right now making no conclusion on the stats but its an interesting time as personally i see this time to be a good research time 🙂 as many opportunities maybe on hand.

Once we are done with Nifty we will try to take this towards stock specific Statistics. Meanwhile i would suggest people to also comment on Aditya Birla Nuvo Brief Analysis

TECHNICAL ANALYSIS TRAINING SESSIONS SCHEDULE

HYDERABAD SEPTEMBER 17-18

BANGALORE SEPTEMBER 24-25

For more details mail to analyseindia@analyseindia.com with your contact details or call Kazim 09821237002, Asif 09833666151 to avail of group discounts and more .

Also if you have any further queries or would like to speak with me sms me on 09819225396 will get back post market hours.

September 13, 2011

1) Why is consolidated P-E at 14 times whereas standalone given on NSE at 18 times.

6) How much is the difference between consolidated and standalone nos for Nifty.

we have companies like tata motor and steel in nifty, which have huge global portfolio and hence report much highr numbers on consolidated level then standalone.

will look at other questions, and reply back soon.

September 13, 2011

7) What is the lowest dividend yield and highest dividend yield for Nifty/Sensex in conjunction with market highs and lows.

the highest dividend yield of 3.18% was offered in may 2003, which was also the lowest point for the markets for the trailing 3 years. In may 2003 nifty was at 950ish levels. Post this markets started rallying and finally touched the high of 6200 on nifty in dec07 /jan 08.

Whilst the lowest yields was offered by the nifty in May-Jun 2001, during this period yields hovered aroud 0.6-0.8% level. what seems surprising is that this fall in yield was seen after the markets had already fallen 17-18% from their peak in February 2001 (yield 1.1%).

Similar level of yield of 0.8% came back to haunt once again in december 2007/january 2008.

Though what can be seen for both the periods is that, post touching such incredibly low yields markets either went through correction (2008) or time correction may2001-may2003. which then prepared us for the next bull rally.

September 13, 2011

2) What has been the mean/worst/best P-E for Nifty/Sensex for TTM and Estimated EPS?

Worst P/E for Nifty is 10.68

Best P/E for Nifty is 28.47

Mean P/E for Nifty is 13.27

The Estimated EPS is 274

3) What is the lowest dividend yield and highest dividend yield for Nifty/Sensex in conjunction with market highs and lows?

Lowest Dividend yield is 0.59 on May 7th 2001 , Nifty was at 1139

Highest Dividend yield is 3.18 on May 12th 2003, Nifty was at 936

September 15, 2011

Hi Kabir,

Noted and thanks

September 15, 2011

1. Consolidated P-E also includes P-E of the subsidiaries of company and Nifty consist of such companies a lot making such a difference between consolidated and standalone P-E.

4. Its over-ally optimistic.

6. Around 17-25%

September 15, 2011

Hi Vivek,

Got your mail with the details

September 18, 2011

Hi,

can u please provide the link where we can find consolidated p/e for nifty?

You have mentioned bloomberg…….

January 20, 2012

Dear Sir,

Greetings!

Problem-Calculation of theoretical future price of nifty index.

According to cost of carry model, theoretical future price of nifty can be calculated by multiplying nifty spot price with risk free return and subtracting dividend from it. What will be the risk free return for the year 2011 say? Can we take it different from T-bill rate? According to formula (mentioned above) for calculating theoretical futures price we have to subtract dividend. How do i get daily dividend values on nifty for the whole year 2011? If the dividend value is something like 1.5 then subtracting it doesn’t make any difference.

Thanks in advance

Regards,

Sunita Narang

January 20, 2012

Hi Sunita,

May i know what do you need exactly 🙂

September 21, 2011

very good analysis by Nooresh….

September 21, 2011

Thanks for the kind words Krishna

January 21, 2012

I want to calculate theoretical future price of nifty. How can that be done using cost of carry model?

July 22, 2012

Hi,

can u please provide the link where we can find consolidated p/e for nifty?

You have mentioned bloomberg…….

Thanks

Jai

July 23, 2012

You can get it in brokerage reports or google a bit.