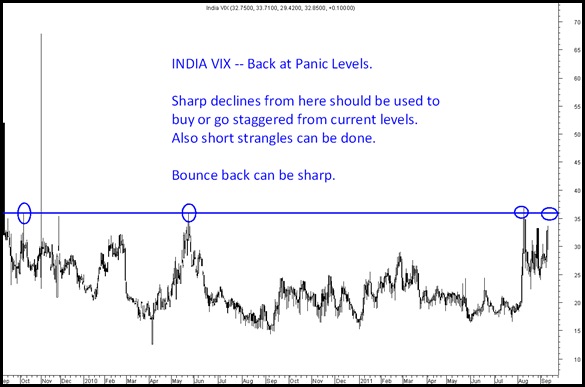

The VIX made a high of 36-37 in previous panics as shown in chart.

ATM vols of 4900 around 31%

OTM vols put 4600-4700 at 36-37 %

OTM Vols of calls at 28-29%

The markets are pricing in sharp moves to the extent of 5-7% indicating lot of fear and hedging taking place on back of possible global announcements or RBI hit.

The last two two times INDIA VIX was above 32 was on 09/08/2011 – Nifty was 4950-500 it bounced to 5195 and next on 26/08/2011 it traded at 32 – Nifty was at 4720-4750 it bounce back to 5150 +.

So panic is at high watch if there is a sharp correction one can look for stock specific buying. Nifty support points 4850/4720 in panics.

Possible bounce back candidates if there is further drop of 3-5% in following stocks SBI, M& M , Maruti, LnT , Metals like – Hindalco/Sterlite/Tata Steel and Infrastructure stocks.

Buying staggered or on declines should be with a view to exit on bounces.

Only time Index has traded above 38-40 vols has been in 2008 Lehmann collapse period.

Haapy Investing,

Nooresh Merani

September 14, 2011

dear sir,

as per my technical knowledge rajesh expo is one of thebest for now regarding breakout. above 115 it will reach 124-135 check at ur end & confirm.

Thanks,

He$H. . .

September 15, 2011

yes Hesh good pick on tech but funda for the stock is odd

September 24, 2011

I was trying to find more info on India VIX but was unable to find a good website – then I came across http://www.niftyvix.com – it’s quite useful website