We did a couple of detailed posts in March and May to show how the things were as worse as it can get.

March 24th 2020 -

Equity–Never been so Bad so Quick. What Next ?

The timing of the post could not have been better. Nifty and most stocks hit the low on that day.

Quote from the Post

“The 2020 move did some things very differently. No euphoric move in end of 2020 like in 2007. The fall has seen no relief rallies of any sort. If this is the case the historical expectation of a sideways consolidation and a retest may not happen. So the recovery can even be very ferocious.”

Stocks were priced for extinction but it was much better for a new investor to deploy capital as no scar of a quick 40% drawdown and capital. If you were investing for a few years before this, would have had much lesser cash to deploy. Those who kept their calm , will now be able to reap opportunities in the future.

May 25th 2020

Opportunities in Bear Markets and Consolidations post 1992, 2000, 2008 and 2020.

Starting todays post – Nifty up But Stocks are Down.

Today even the FM spoke about how markets are at an all time high to show that economy is doing fine.

But the fact is the Nifty is nowhere related to the actual economy. 65% of the Index is Banking + Reliance + IT !!.

:We will look at the Market – The Whole Universe of listed Stocks.

Credits to my teammate – Harsh Doshi who does most of this data work !!

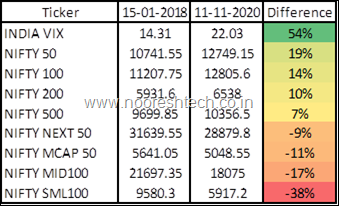

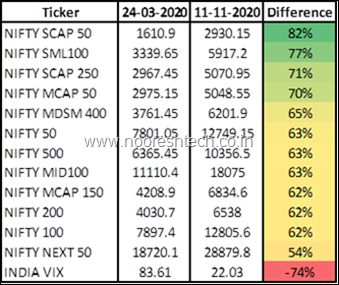

What did the benchmark do ?

Nifty was at 10730 on 15th January 2018 when Midcap and Smallcap Indices topped out.

Nifty made a top on 20th Jan 2020 hitting a high of 12430. (Closing at 12224)

Nifty made a bottom on 24th March 2020 hitting a low of 7511. (Closing at 7801)

Nifty made a new high on 2 days back on 9th Nov 2020 and is today (11th Nov 2020) trading at new highs at 12749

What did the Market do ?

In normal terms the Market is considered to be Sensex and Nifty and they do comprise almost 50-70% of Indias total market cap.

We would look at the Full Universe of all the Listed Companies on NSE.

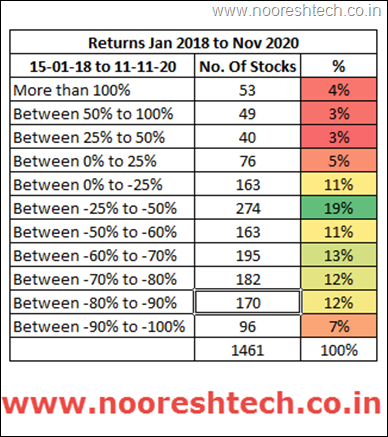

1) The Fall From peak of 2018 to November 2020

The Nifty is up but stocks are down !! – Everyone looks at the Nifty but everything apart from that is down and even a lot of stocks in Nifty are down below the 2018 prices

- Nifty is up 19%

- 15% stocks only are trading above its Jan 2018 prices (218 out of 1461 stocks)

- 85% stocks are trading below its Jan 2018 prices (1243 out of 1461 stocks)

- 74% stocks are down more than 25% from the Jan 2018 prices.

- 55% stocks are down more than 50% from the Jan 2018 prices.

Broader Market Indices

- Smallcap Index is still down 38% from January highs.

- Midcap Index is down 17%

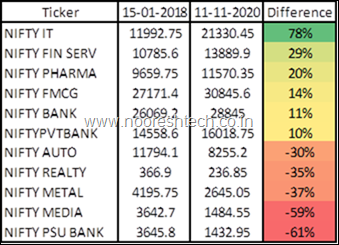

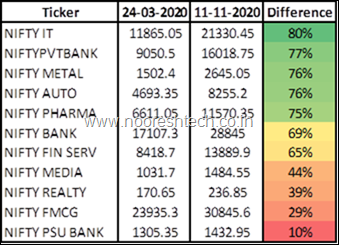

Sectoral Indices

- IT has been the big outperformer with 78% higher than 2018.

- Reliance with a 8-14% weight through 2 years is like a sector on its own is up 100%.

- Pharma is equal to the Nifty, Financial Services outperformed.

- Everything else has underperformed the Nifty.

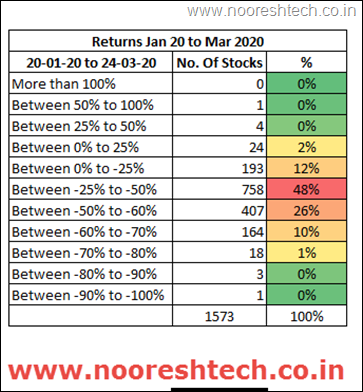

2) The Fall from 20th January 2020 to 24th March 2020.

- · Nifty was down (36%)

- · 71% of the stocks were down more than Nifty (1119 out of 1573 stocks)

- · 26% of the stocks were down less than Nifty (415 out of 1573 stocks)

- · 98% gave negative returns (1544 out of 1573 stocks)

- 86% of the stocks fell more than 25%

- · Only 2% stocks gave positive returns (29 out of 1573 stocks)

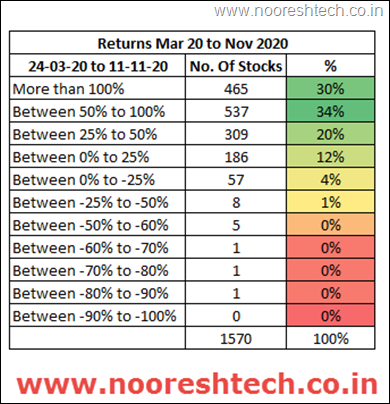

3 ) The Rise from March Lows

24th March 2020 to 11th November 2020

- Nifty is up 63%

- 52% stocks were up more than Nifty (817 out of 1570 stocks)

- 43% stocks gave return less than Nifty returns (680 out of 1570 stocks)

- 95% gave positive returns

- 5% stocks gave negative return despite huge rise (73 out of 1570 stocks)

Broader Market Indices

- Smallcaps are just a little better but everything else seems to be inline with Nifty.

Sectoral Indices

- FMCG which did not fall much in the March drop is lagging in the bounce.

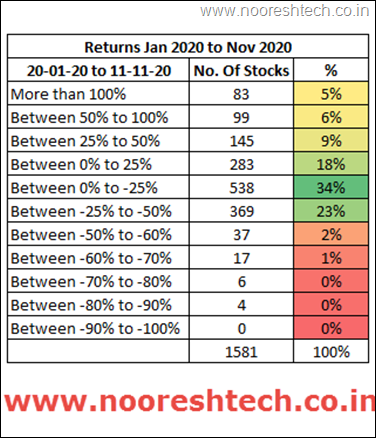

4) January 2020 to November 2020 –

Consider you hibernated through the crisis and now see Nifty up 4% only to realize that your portfolio has recovered but not enough as 60% of stocks are still lower than January 2020.

20th Jan 2020 to 11th November 2020

- Nifty is up 4%

- 40% stocks only are trading above its Jan prices (610 out of 1581 stocks)

- 60% stocks are trading below its Jan prices (965 out of 1581 stocks)

- 0.4% stocks or only 6 stocks are at par with their Jan prices

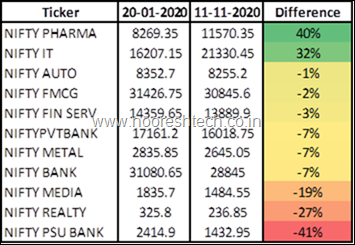

Sectoral Indices

- Nifty is a survivorship cum momentum index and by logic is the case with most indices.

- Pharma up 40% and IT up 32% and Reliance up 25-30%.

- Rest everything is still negative.

Conclusion

- 85% of stocks are below the 2018 highs. 74% of the stocks are down more than 25% from January 2018.

- The above statistic itself tells you the structure of the market is extremely narrow. Even in Nifty most of the move can be attributed to a handful of stocks.

- The Smallcap Indices are close to a breakout. After a few flip flops could eventually be trending higher.

Nifty Smallcap 100

BSE Smallcap Index

What Next – My Thoughts

- Recent Performance of sectors,stocks, themes ends up becoming a belief or faith for most of us. For example FMCG/Pharma were supposed to be laggards due to underperformance in 2004-2007 and ended up being best performer in next 5 years. Real Estate, Infra, PSUs,Capital Goods, Commodities were the best performing names in 2003-2007 and have done nothing for the next 10-12 years

- The market tends to start breaking a lot of such beliefs in every new cycle. I specifically call it Belief and not Consensus. Consensus changes very quickly with prices but something which becomes a belief is tough to move from.

Belief = an acceptance that something exists or is true, especially one without proof.

- A classic example was in 2017 – All of us whether technicals, fundamentals or even an individual saw Jio- a new product and a price breaking a 8 year high. Everyone traded but the last 8 year performance of Reliance and 3-4 year performance created one big Belief – Large Money is made only by Investing in Smallcaps !!

- Reliance is a 4x and is the Largest Company in India.

- What are the few top new belief or faith. ( Long term Return 5-10-15-20 years )

According to me these are the Top 3 Beliefs which may be challenged and can get broken.

- Smallcaps/Microcaps in the end lose money. Long Term Return is equivalent to LargeCaps. Do not buy Microcaps/Smallcaps.

- Quality Companies, Super Growth Cos can be bought at any Valuations. In the Long run they give Returns.

- PSU companies, Utilities, Cyclicals are wealth Destroyers and not to be touched forever.

Look for reasons,research for above beliefs to be challenged and be open minded. Outsized returns will come in betting against the above.

My Personal Biased or Bruised View - The most hated space for investing today is Microcaps – Most outsized returns can be made here in next 1-3-5 years and will take care of last 3 years of pain. A lot of businesses have survived compared to what we thought in March 2020. Many of them will thrive in coming years. The struggle would be to keep riding them when things get better.

Other Beliefs to be Challenged.

- Value Investing is Dead.

- Index Investing, Passive Investing is Nirvana.

- Real Estate is a low return Asset Class and will not beat even Inflation.

- Growth at Cost of Profitability is the Only way to do Business.

- Only Large Scale Businesses Survive every one else will Die. Bigger the Better.

Would love people to add to this list. Reply in comments or mail it to me nooreshtech@analyseindia.com

November 13, 2020

Respected sir

Please send me newsletter as any knowledge shared by you is invaluable.

Thanks

November 14, 2020

Please send the news letter.

November 15, 2020

..

December 9, 2020

Your articles & charts are awesome. simple explanation & crisp to the point & clear stance.

mostly we get vague answers..

kudos to ur term, will join ur batch soon..