Every week, I manually review almost all the NSE stocks one by one and create a list of stocks that look interesting. This further gets tracked for breakouts and filtered into The Idea Lab & Technical Traders Club

Below is a list of a few interesting large-cap charts.

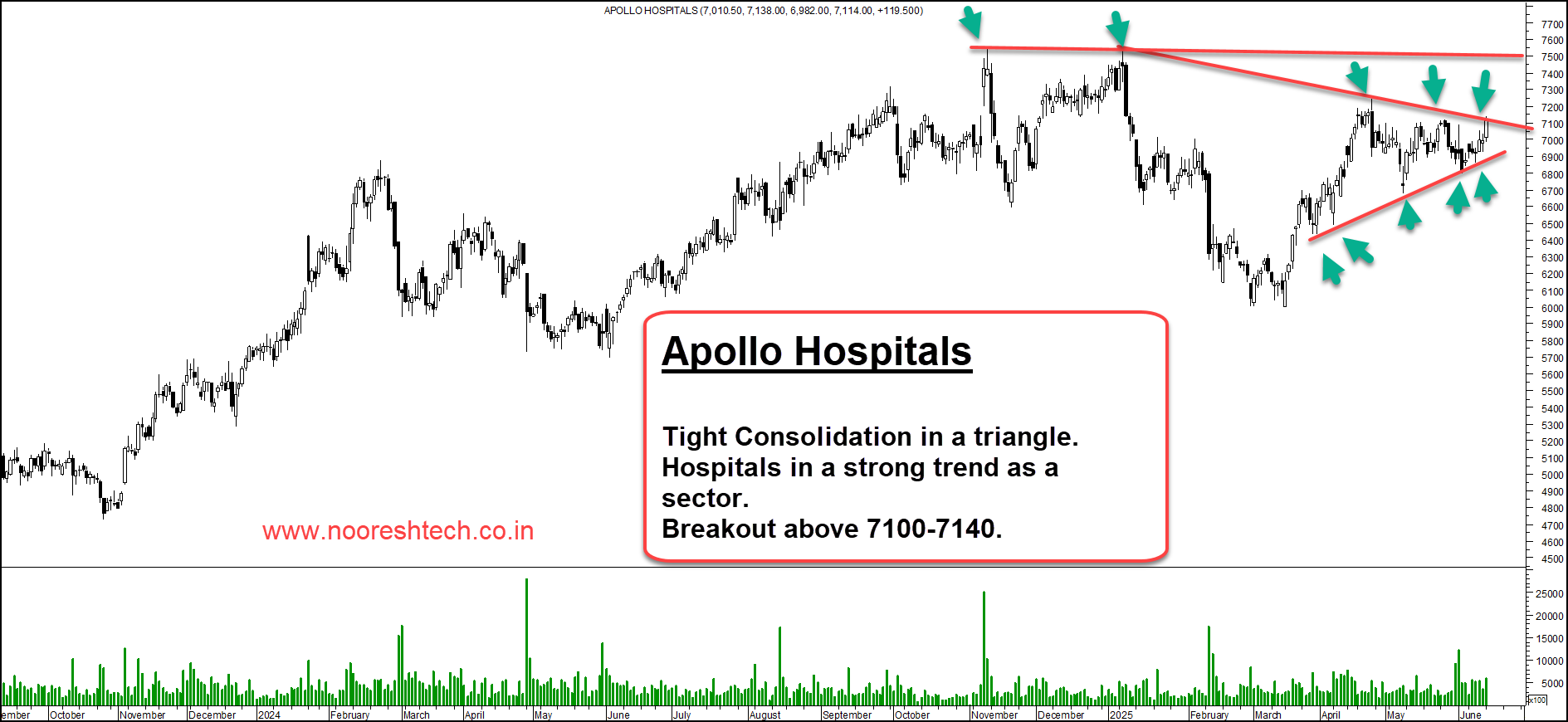

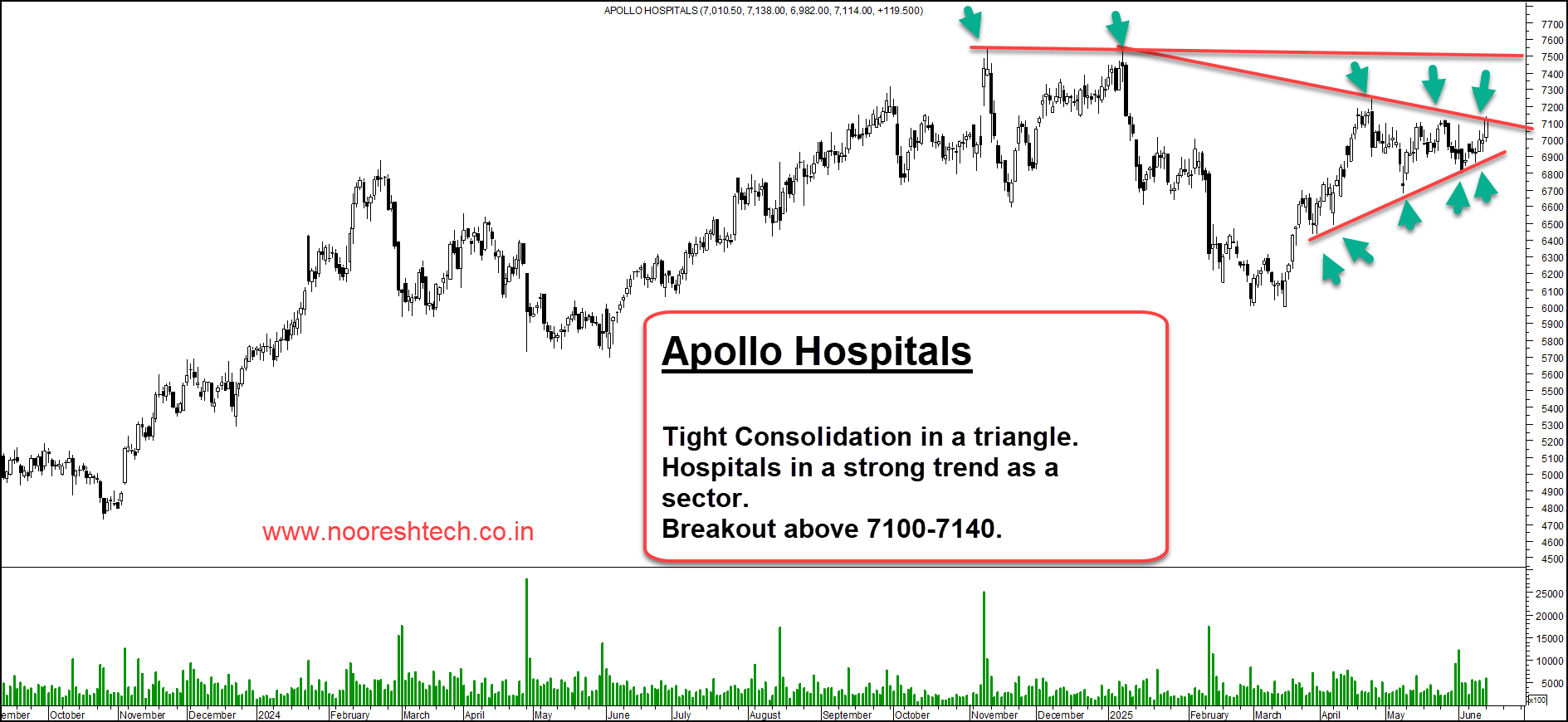

- Apollo Hospitals

Hospital as a sector has been in a strong trend with many midcaps/smallcaps making new all time highs.

2) Chola Finance

A lot of Financials - NBFC , Housing Finance, Gold Finance, Small Finance Banks etc are setting up strongly.

3) Indus Towers

The company has formed a committee to evaluate the proposals and then make a suitable recommendation to the board. This is one trigger apart from Vodafone Idea being the perpetual one.

4) ONGC

Crude base shifting from 50-70 to 60-80 a positive ?

5) Shriram Finance

Very similar to Chola Finance in structure and other financials.

Mr. Nooresh Merani SEBI Registered Research Analyst INH000008075 Read Full Disclosure on

NooreshTech Research Services Overview

1. Technical Traders Club – Techno Funda Investing

- Two model portfolios: Trading Ideas (3–6 months) & Smallcap Folio (6–18 months)

- Maximum 10–12 open positions per portfolio

- Ideal for investors with a medium to long-term view

- Updates via WhatsApp, Email & Telegram

- Subscription: ₹15,340 (6 months) | ₹25,960 (12 months)

- Payment & Details: https://shorturl.at/Rz2fS

2. The Idea Lab – Momentum Trading

- Momentum-based short-term trades (15 days to 3 months)

- Maximum 30 open positions, equal weight approach

- Based purely on technical analysis

- Ideal for traders with a short to medium-term view

- Telegram-only updates

- Subscription: ₹1,770 (Monthly) | ₹4,720 (Quarterly) | ₹8,850 (Semi-Annual) | ₹17,700 (Annual)

- Payment & Details: https://shorturl.at/Lsd7M

3. Smallcases – Equal Weight Portfolios

- Top 10 Promoter Buying: Focused on stocks with strong promoter buying

- Top 10 Techno Funda: Combines Technical & Fundamental analysis

- Breakout & Trail Momentum : Momentum Trading - 20 stocks, 5% each

- Low churn, equal-weight portfolios

- Invest directly via the Smallcase platform

- Ideal for long-term investors

- Payment & Details: https://shorturl.at/bQenu

4. Option Strategies by NooreshTech ( NEW )

- Limited Risk Option Strategies across Index and Liquid Stock Options.

- Holding period: Typically between 1 to 4 weeks.

- Capital & Positioning: Min Capital: ₹10 lakhs

- Max Open Positions: 5-8 open positions

- Ideal for those who understand derivatives risks and seek moderate, consistent returns.

- Telegram-only updates

- Subscription: ₹10,620 (Quarterly) | ₹17,700 (Semi-Annual) | ₹29,500 (Annual)

- Payment & Details: https://shorturl.at/ZYlYy

Support & Queries:

- WhatsApp: 7977801488

- SEBI Registered: Nooresh Merani (INH000008075)

- Disclaimer : https://shorturl.at/kgosD

June 17, 2025

Your charts and analysis is outstanding.