A quick update on Indian and Global Indices.

Over the last few weeks we have seen a slow drifting correction across the world.

Most leading global indices are getting back to the recent Breakout zone or Support Areas.

Lets look at the charts.

Nifty and Bank Nifty

- Nifty last all time high was around 18800-18900.

- Although Nifty has not come to the retest the Bank Nifty is back to an equivalent of 18500-18800.

- Back at the same price was it was in Dec 2022.

- 43300 remains an important support.

- Nifty saw a breakout with gaps at 18800-19000. That remains an important support.

- The Broader Indices- Nifty 500, Nifty Allcap, Nifty50 equal weight, Smallcap and Midcap Indices have a relatively stronger chart for now.

- The consolidation to continue with Sectoral Rotations.

- Risk could be global indices taking a sharper dip. ( Charts below )

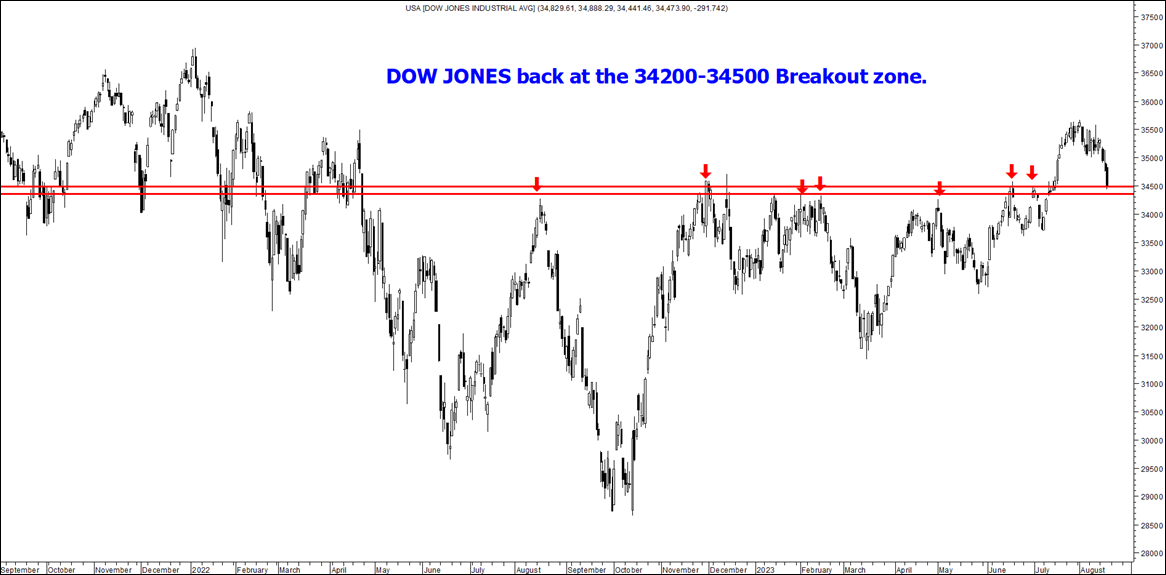

Dow Jones Index – Back to Breakout zone.

- A slow drift towards the last breakout of 34200-34500.

- Multiple tops around that band.

S&P 500 – 4320-4350 and next majorly 4200-4220 important zone.

Dollar Index – False Breakdown

- Yet another false move for Dollar Index. Has a tendency to do false breakouts and breakdowns.

- Back to testing the important zone of 103.5-105.

- This crossing 105 can be a big signal to watch for any deeper correction.

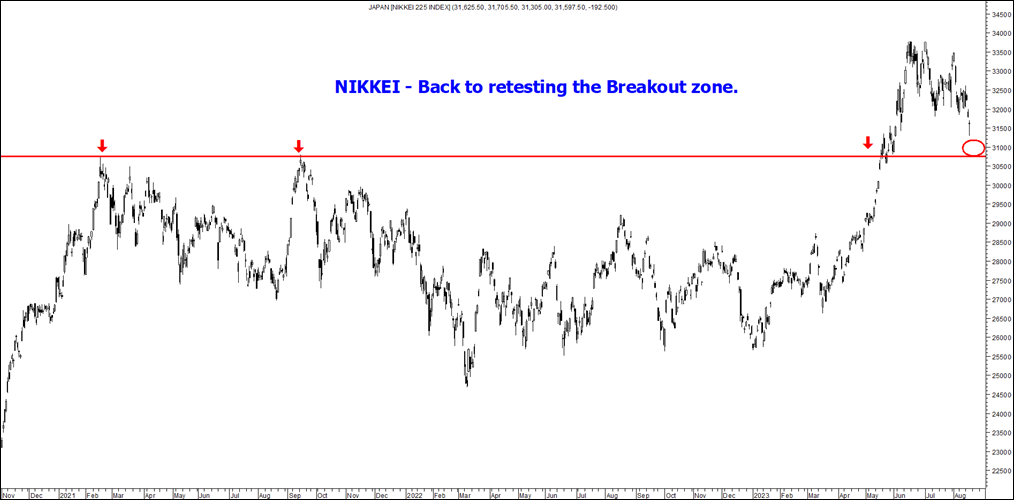

Nikkei – Back to retesting Breakout

- A very strong move from April now seeing a retest.

Nifty Total Market Cap and other Indices relatively stronger

- The heavyweights of Nifty50 Reliance, HDFC Bank, Kotak and IT stocks did not see a huge performance but have slowly drifted lower.

- The Broader Market structure relatively better.

- The Momentum has definitely taken a pause. Time for a sideways drift.

Conclusion

- Major Global Indices getting closer to retest of Breakout or Support Areas.

- The strength of the bounce over next few sessions will indicate if we can again get momentum on the upside or more sideways action.

- For Nifty its simpler a break above 19550-19650 triggers upward momentum. Bank Nifty below 43300 and Nifty below 18800-19000 is where risk of a deeper correction starts.

- Time to stick with the existing Portfolio strategy. Hold and Stock Specific.

- Longer term structure still very positive.

- Dollar Index crossing 105 is the trigger to watch for the current view to change.

A quick look at Everything that we do !! https://linktr.ee/NooreshTech For WhastApp updates, Join the Community https://shorturl.at/cewZ1 For any queries, WhatsApp us on 7977801488

Technical Analysis Training Finally Planned for October Mid.

If interested mail to nooreshtech@analyseindia.com or whatsapp 7977801488