New iOS in Markets - Indian Options Speculators.

There has been a huge surge in Retail and Proprietary trading in Options and more specifically in Index Options.

The Data & Charts below are just Crazy and getting crazier.

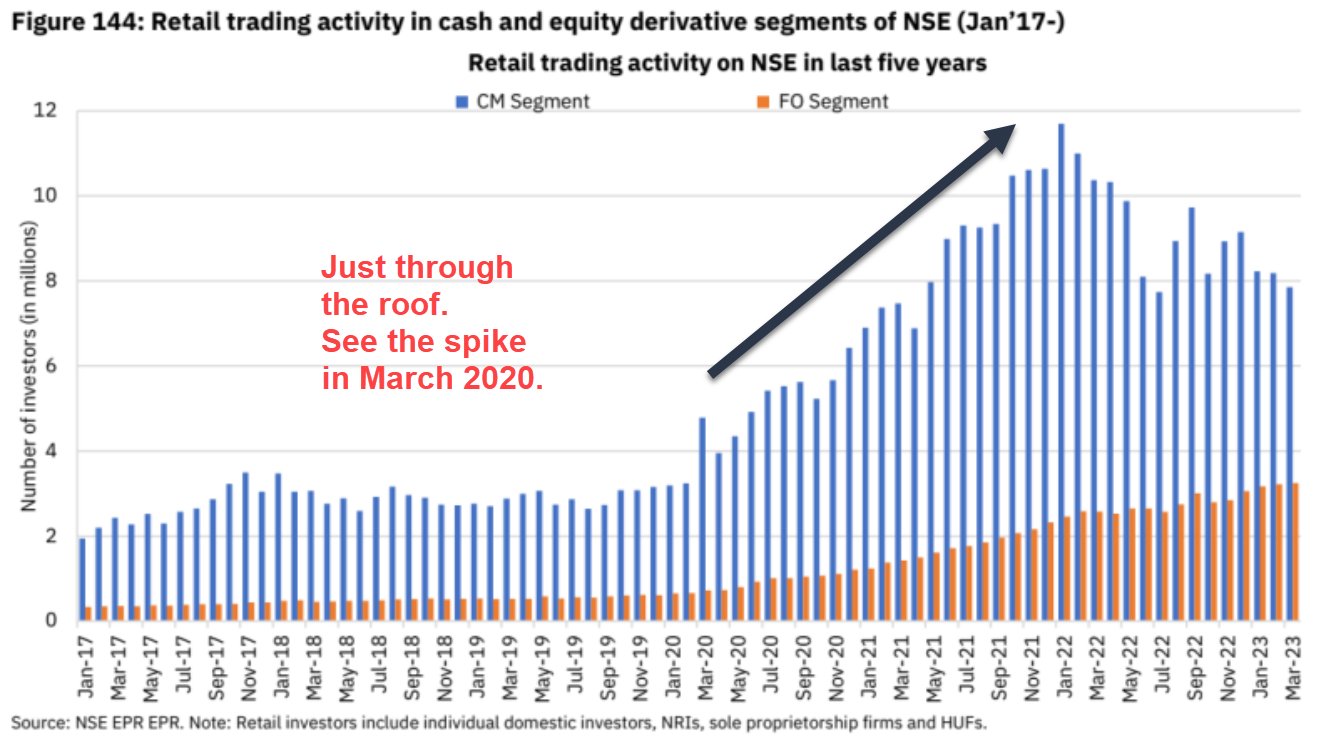

1) Retail Participation went through the roof in 2021

- Some Moderation now in 2022-2023

- Retail in Cash Market From 3 cr in Jan 20 to 11.7 cr in 2021.

- Retail at 3.2 cr participants March 23.

- 3x jump in all participation from Jan 20 !!

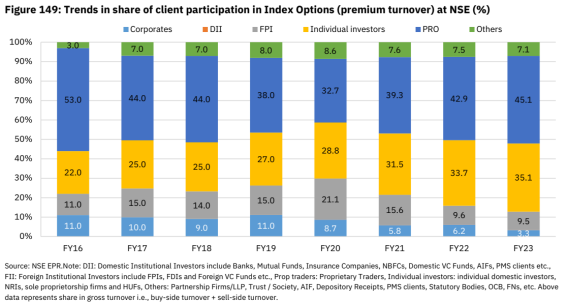

2) Everyone is an Option Trader

- FIIs are just 9.5% of Index Options Premium Turnover !!! From 21% in Fy20.

- 45% is Domestic Prop ( Broker trading on its own behalf )

- 35% is Retail.

- Retail + pro = 80%

- Retail is almost 4x of FIIs.

- Btw FIIs own 20% of India.

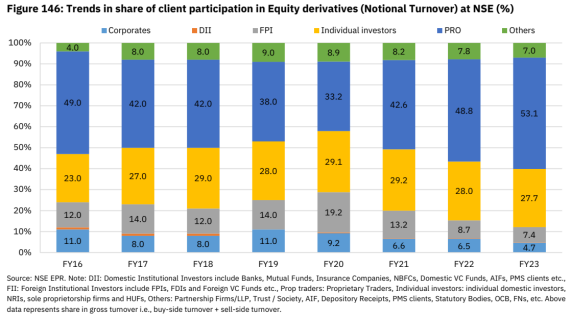

3) Pro are propping up the Trading Volumes in Equity Derivatives .

- On a notional turnover, 53% of the Volumes is PRO accounts.

- Brokers are now Traders or Traders have turned Brokers ?

- FIIS are just 7.4%

- Retail at 27%

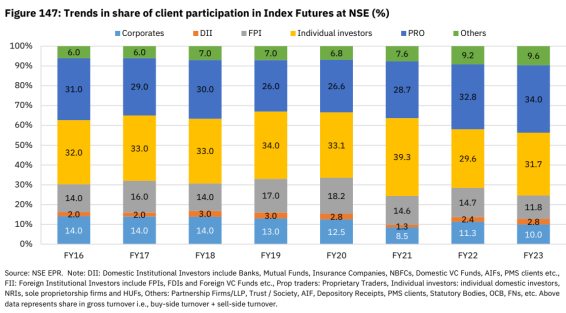

4) The Indian Options Speculator is an Indexer

- For all the talk about Index Funds & ETFs the data suggests Retail is all in on Index Futures instead.

- 31.7% of Index Futures is Retail and 34% is PRO

- FIIs at 11.8%

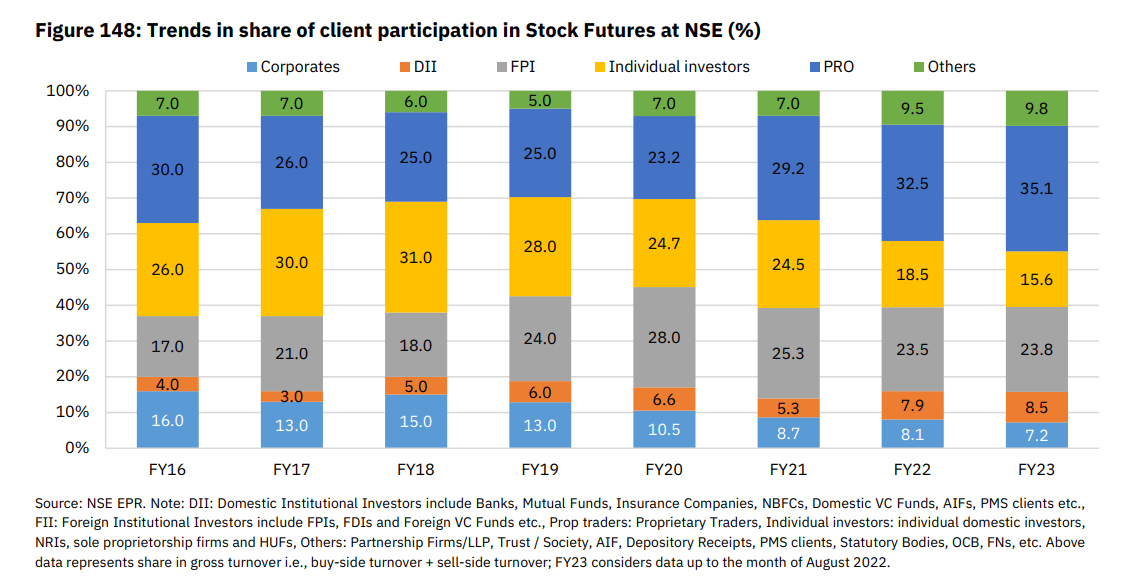

5) Retail is shifting from Futures to Options

- StockFutures sees a major cut in Retail participation.

- From 31% of Volumes in 2018 to just 15.6% in 2023.

- FIIs continue to be at 23-25%

- DIIs at 8.5% thanks to the ArbitrageFunds and TaxBenefit.

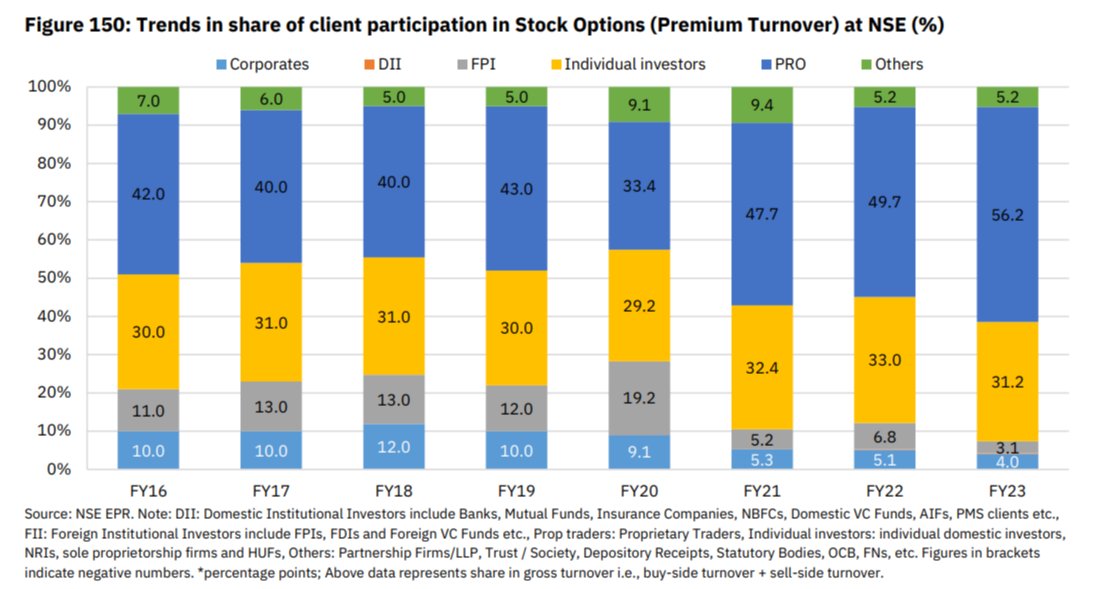

6) Stock Options is all about the PRO and Retail

- 56% of Volumes by PRO and 31% by Retail.

- FIIs are just 3.1 % .

- Repeating, FIIs are just 3.1% of Stock Options ( Premium Turnover )

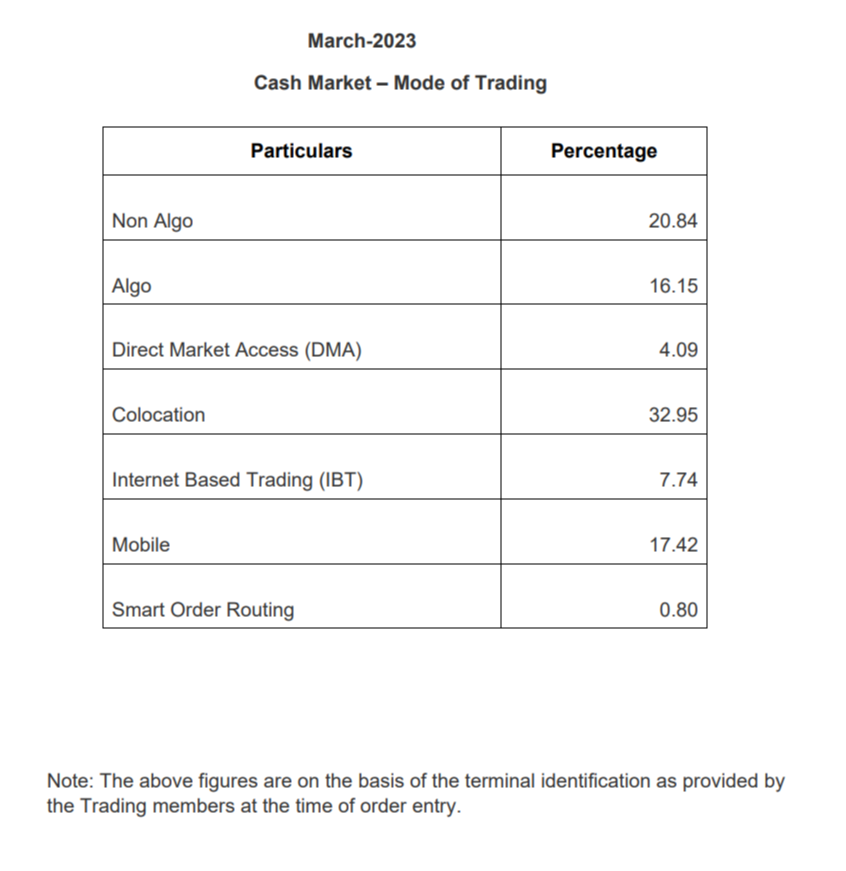

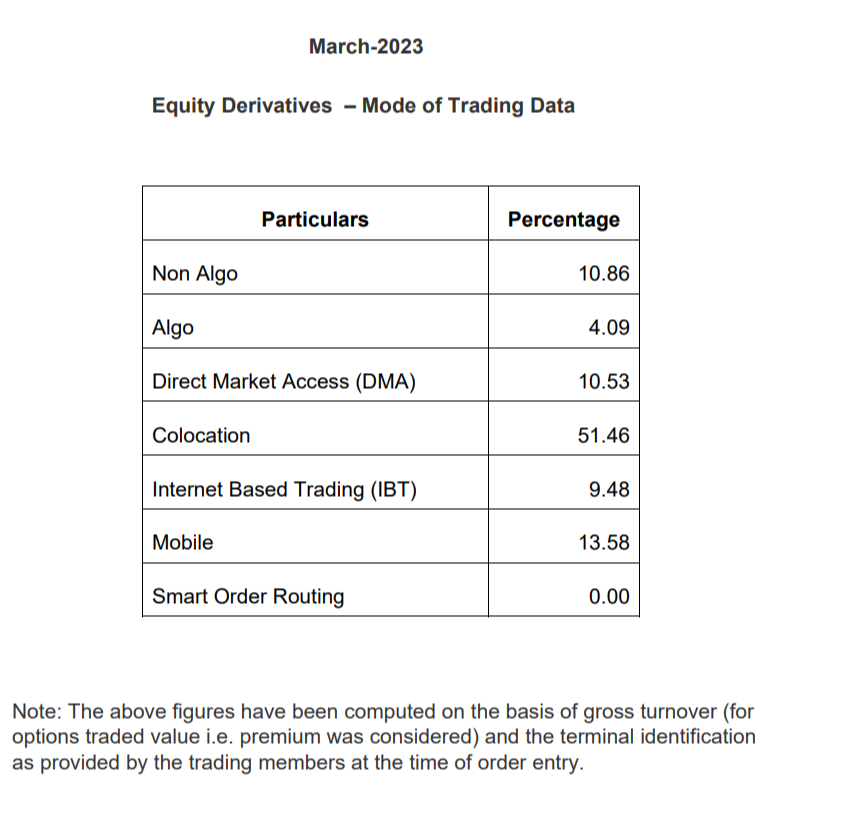

7) The Machines are fighting it out.

- 51.5% of Volumes of Equity Derivatives and 33% of Cash Market is via Co-Location.

- 17% of trades via a Mobile in cash Market. It peaked at 25% in 2021 !!

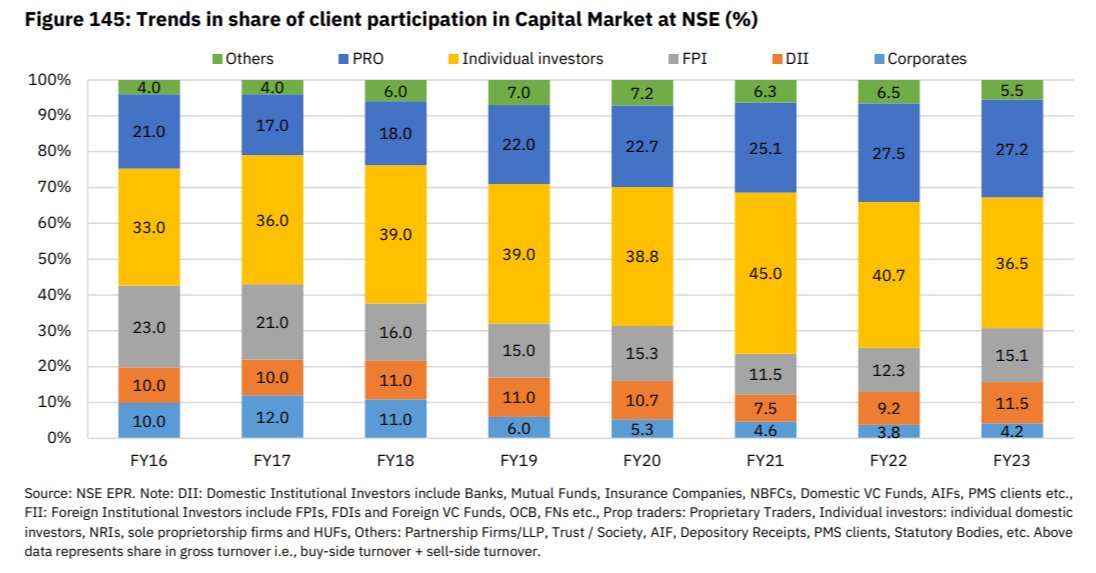

8) Capital Market still has FIIs DIIs and Retail slugging it out.

- PRO is 27%

- Retail is 36.5% from a peak of 45% in FY21.

- FIIs at 15%

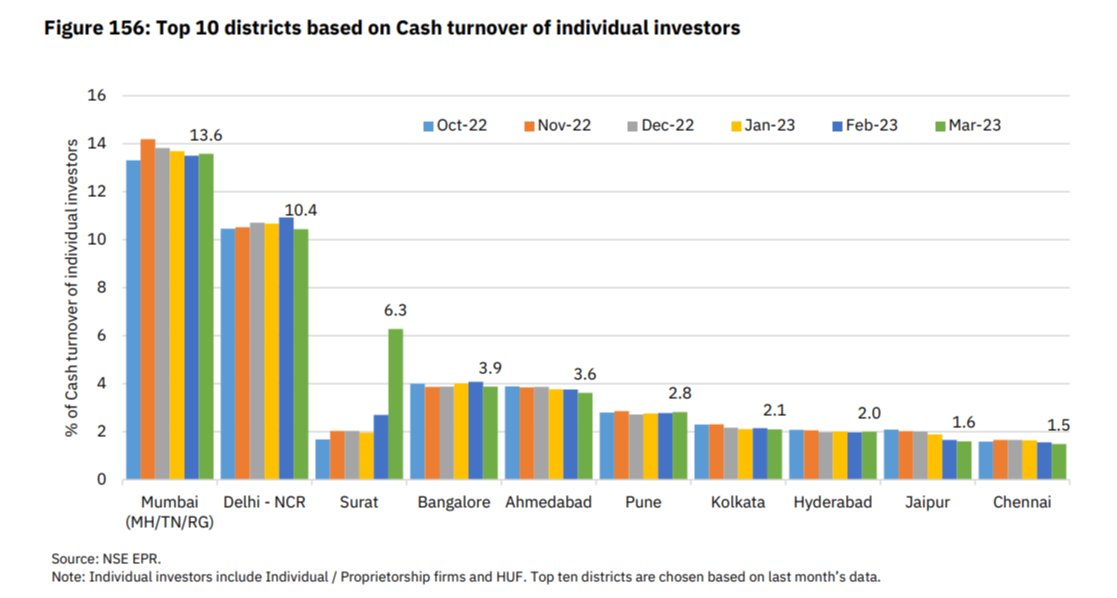

9) Couple of odd ones

- SURAT just beat the Rest of India in terms of Cash turnover of Individuals in March 23 with 6.3% of Volumes !!!

- Mumbai continues to be the largest

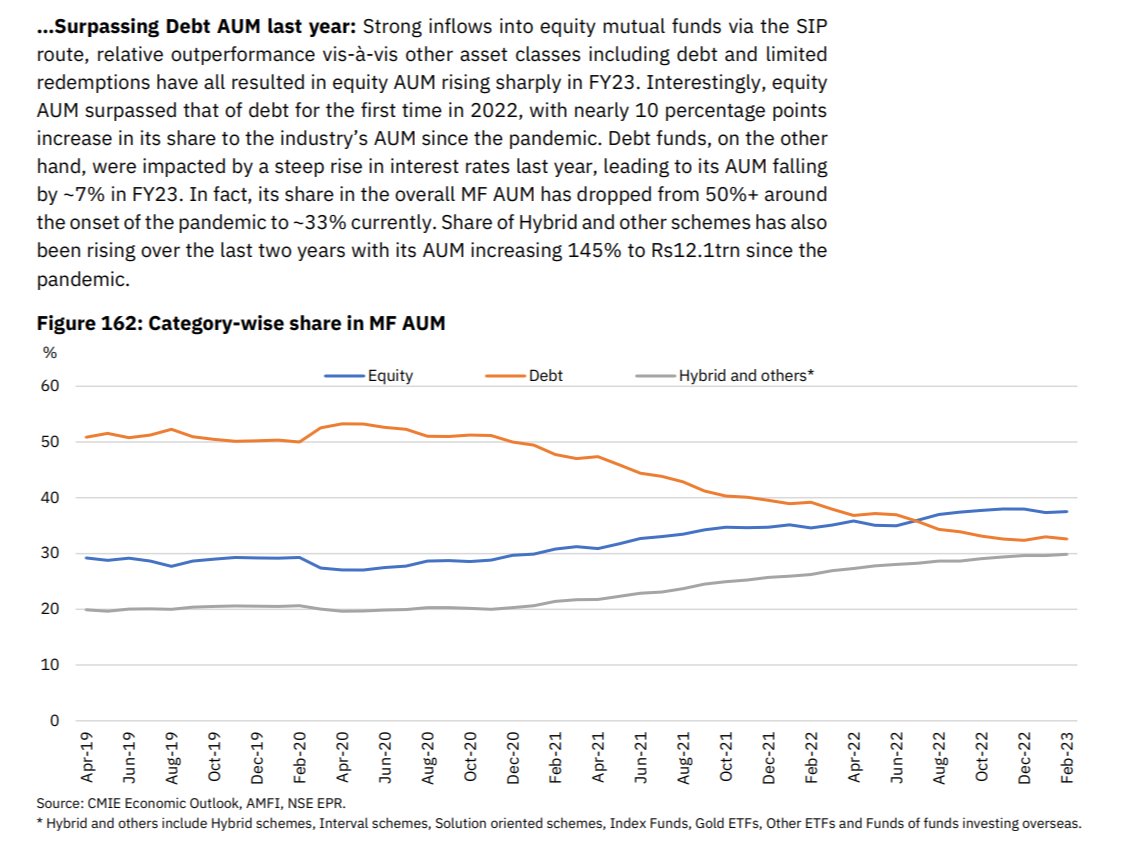

- Equity Market AUM crosses Debt Market in Mutual Funds

10) Retail participation is increasing in a big way. More in Option Selling

- Mind you Leverage is the toughest way to make money and the easiest to Lose it All.

- I just hope a lot of Retail does not have to learn this lesson in a tough way with Volatility going berserk.

A lot of things are not in your Control.

Outages can be everywhere.

- Broker

- Exchange

- Bank

- War

A lot can create volatility. Remember a 15 min Lower circuit in 2012 due to a Freak order by a Broker.

Control your Size and Leverage. Be conservative.

Link to our premium services

Technical Traders Room : https://nooreshtech.co.in/2022/07/technical-traders-room-a-broadcast-for-traders.html

Insider Trading Updates : https://t.co/kf7GKzYJIU

Technical Traders Club : https://nooreshtech.co.in/quickgains-premium/technical-traders-club

Quickgains Cash & FnO : https://nooreshtech.co.in/quickgains

Smallcases : nooreshtech.smallcase.com