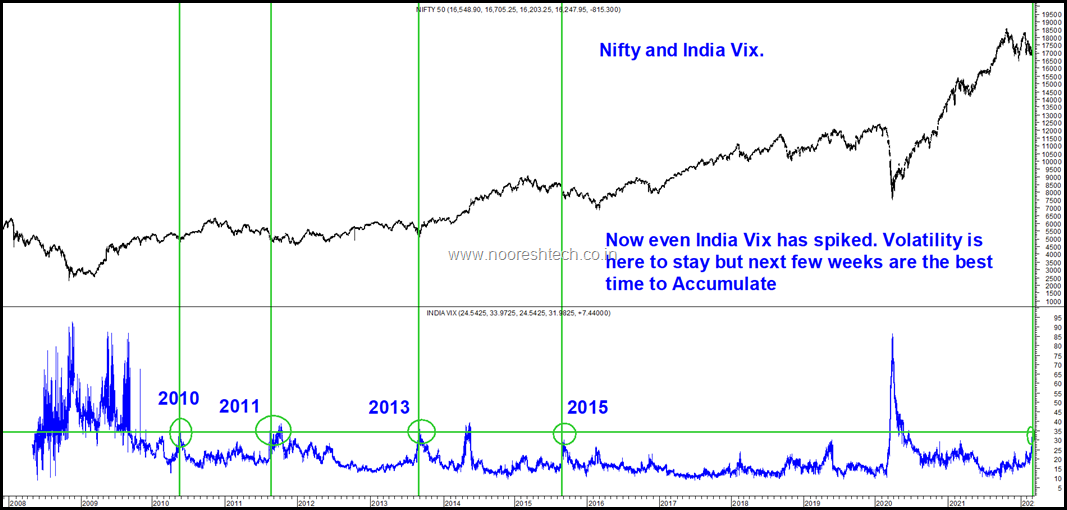

India VIx finally hits 30 +

Historically the volatility remains higher for next few weeks but in hindsight this has been the best period for Investment and durable bottoms are made.

- 2011-2013 was a major bottom made around that 30-35 mark.

- Did not consider 2014 as it was Election event.

- 2015 saw a quick bounce but did not sustain.

- Generally accumulating over the next few weeks in the volatility and fear has been a good time for somebody with a view of 6-12 months.

- For traders one needs to wait for the VIX to cool down to increase size.

Conclusion

I was bullish at 16400-16800 in the last couple of dips and stick to the longer term view in the current fall due to an event. The risk-reward is well placed for 6-18 months. Will be sharing more data points and charts in a weekend post.

Will be discussing about sectors in this session.

How to find major trend changes in sectors

Date : 27th February

Time : 11 am to 1 pm

Pricing : 500 Rs

https://rigipay.com/g/RmfdxrL5LE

Registered attendees will also be receiving the recording.