For all the super bullish and bearish readers.

Please send me a guesstimate sheet which takes it to 18000 or 20000

.

.

This is a good time for exercise. Can mail me on nooreshtech@analyseindia.com

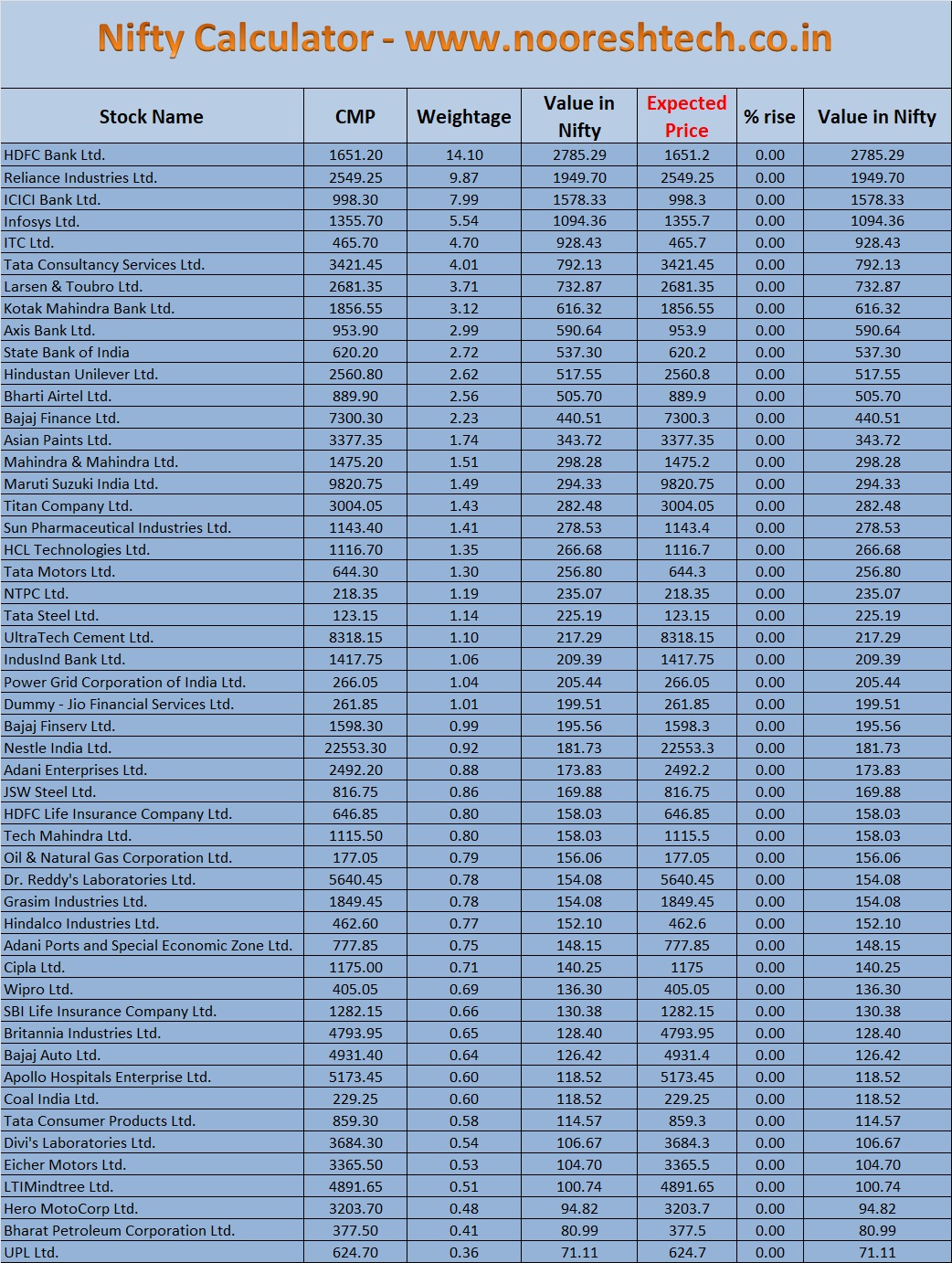

NIFTY CALCULATOR JULY 2023 - Download - Nifty-Calculator-JULY-2023 -

Here is a sheet where the expected price is exactly same as closing prices, download the calculator below and input prices in the 'Expected Price' column and get expected Nifty level

.

.

Interesting Observations

- Top 5 stocks – Reliance, HDFC Bank, Infosys, ICICI Bank, HDFC = 42.2% vs 38.59% of Nifty in July 2023

- Top 10 stocks constitute 58.75% vs 57.26% of the Nifty since last month

- Top 20 stocks constitute 76.39%vs 76.77% of the Nifty since last month

- HDFC bank Ltd is the top weight at 14.1% (After merger of Hdfc twins), followed by Reliance at 9.87%. 23.97%of the Index.

- Reliance + HDFC= 23.97%of Nifty (Hope you get why Nifty does not depict GDP. 24% of India’s GDP is not equal to Reliance +HDFC)

- Bottom 25 stocks have less than 1%weight and total weight at 17.08% (Better than last month)

- Reliance had a demerger of Jio Financial services which is right now 1% of Nifty till its listing.

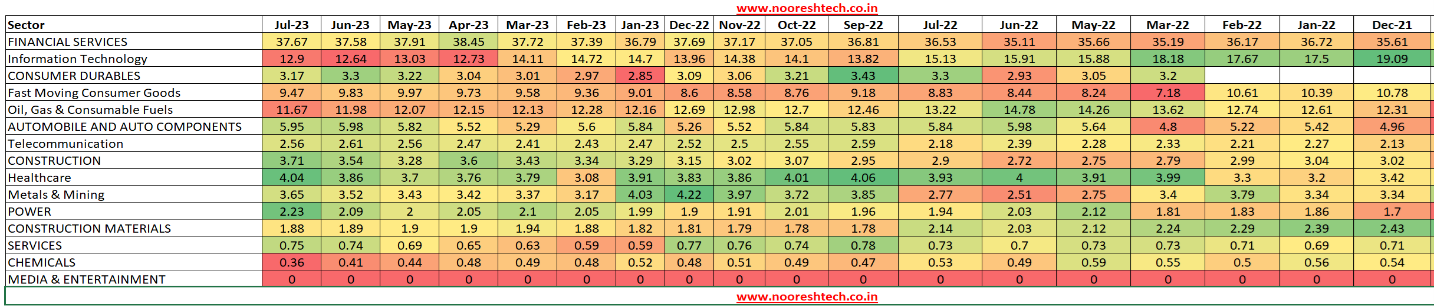

Sectoral Observations

.

.

Weightage Changes

- Banks and Financials are now decreased from recent high of 38.45% in Apr 2023 to 37.67% now. It has seen a bottom of 35.11% in June 2022.

- Power at 2.23% increased from 2% last months.

- Media at 0.

- Oil and Gas from 14.78% in June 2022 to 11.67%. 'Oil and Gas' is now renamed as 'Oil, Gas and Consumable fuels'. Coal India is now classified under Oil, Gas, and Consumable fuels. Earlier it was classified under Metals. IOC out from the index which was classified under Oil and Gas.

- Metals from 4.03% in Jan 2023 to 3.65% . Coal India is now classified under ‘Oil, Gas and Consumable Fuels’. Earlier it was under Metals.

- IT weights decreased from 19.09% in Dec 2021 to 12.9% in July 2023. Which is a bottom from past 4 years.

- Automobile at 5.95% slightly higher from last month

- Consumer Durables weight decreased slightly to 3.17% in July 2023 from 3.3% in July 2023

- Healthcare at 4.04% increasing continuously from three months.

- Construction material is at 1.88% constant from past few month

- FMCG now at 9.47% decreased from high of 9.97 May 2023.

Some changes in classification :

- Consumer goods sector is now divided into Consumer Durables and FMCG.

- 'Oil and Gas' now renamed as 'Oil, Gas and consumable fuels'. Coal India now classified under Oil, Gas and Consumable fuels. Earlier it was classified under metals. IOC out from index which was classified under Oil and Gas

- 'Automobile' Sector renamed as 'Automobile and Auto Components'.

- 'Metals' renamed as 'Metals and Mining'. Coal India no longer classified under this sector.

- 'Cement and Cement Products' sector renamed as 'Construction Material'.

- 'Pharma' sector renamed as 'Healthcare' and Apollo hospital is included in the index under this sector.

- 'Fertilizers and Pesticides' sector renamed as 'Chemicals'

Do check this video on Nifty Calculator -

https://www.youtube.com/watch?v=QbmhiLXYx2k

What is a Nifty Calculator?

-> As per the weightage given by NSE for Nifty stocks we have created the Nifty Calculator.

-> Change the expected price and the expected Nifty will change accordingly

-> Create 3 different sheets for yourself–

Pessimistic (where you put the worst possible prices you think. Default 10% down)

Optimistic (the best prices possible. Default 10% up)

Neutral/Rational/Technical / Fundamental (prices on any reasoning)

Please Note as weights change every day by a small margin this will not give an accurate estimate but will be approximate

How to Guess?

- Everyone has a view on Nifty based on Macro, PE, Valuations, Technicals, Waves, etc. Try to grill it down to the constituents. It should be a reflection of your actual guesstimate.

- Just estimating wild scenarios on the top 20 stocks is enough given the 75-80% weight.

- Start with changing the default fall to 5-10-15-20-40-80 or rise to 5-10-20-40-80.

- Then change stocks that you think may not do the default move.

- Also do remember there is not a direct correlation between the economy with the Nifty.

Things to Note

- One of the reasons we keep posting this is to make an actual unbiased guess every month/quarter.

- There have been numerous warnings as to how markets are overheated. Understanding the constituents allows you to realize how Nifty is not supposed to reflect the Economy.

- Nifty is now at the middle from a recent low of 16747 and 18887 the highs.

- Putting in the numbers looks like we are going to stay sideways for some time. What’s your call?

Thank you for reading the article