For all the super bullish and bearish readers.

Please send me a guesstimate sheet which takes it to 16800 and 18800

This is a good time for exercise. Can mail me on nooreshtech@analyseindia.com

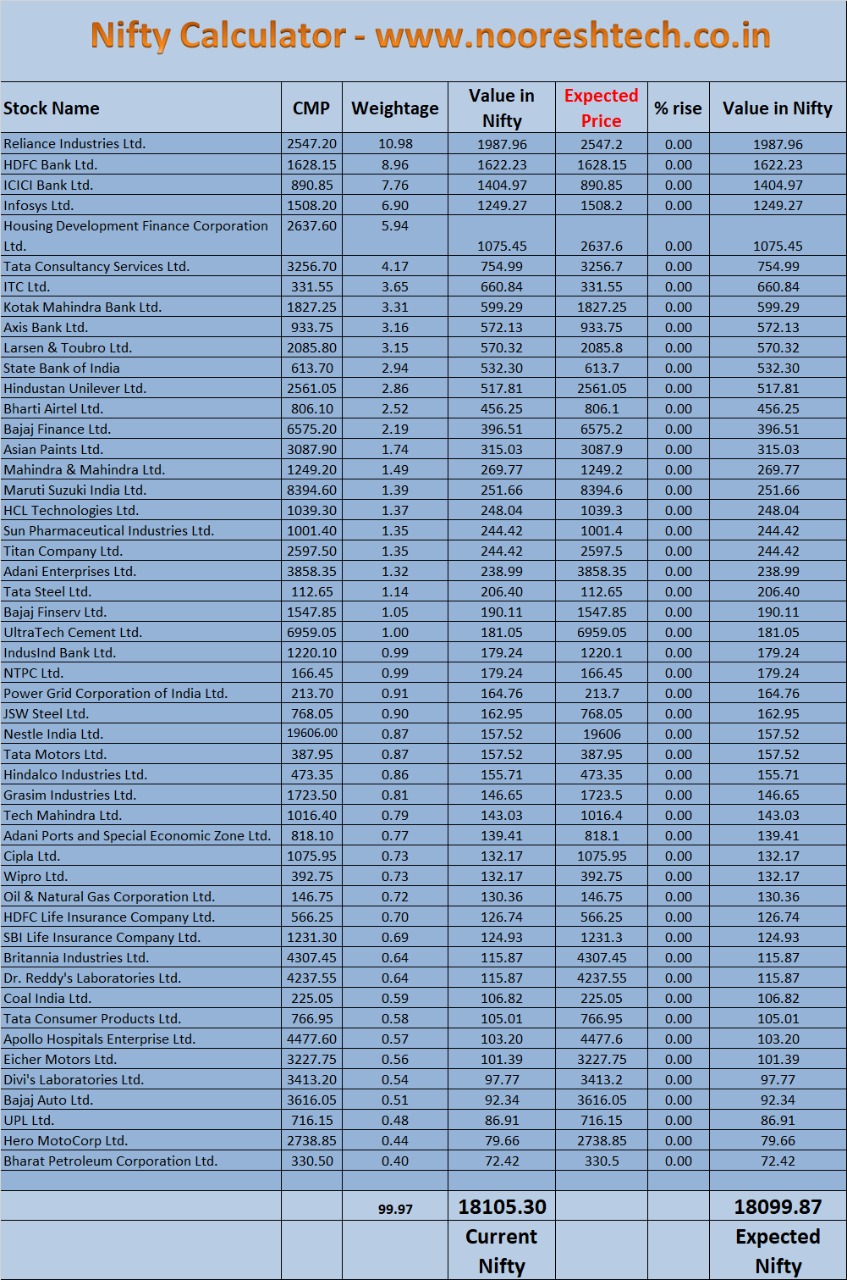

NIFTY CALCULATOR Dec 2022

Here is a sheet where the expected price is exactly same as closing prices, download the calculator below and input prices in the 'Expected Price' column and get expected Nifty level

-

Download - Nifty-Calculator-Dec 2022

Interesting Observations

- Top 5 stocks – Reliance, HDFC Bank, Infosys, ICICI Bank, HDFC = 40.54% vs 40.99% of Nifty in Nov 2022

- Top 10 stocks constitute 57.98% vs 58.15% of the Nifty in Nov 2022

- Top 20 stocks constitute 77.18% vs 77.27% of the Nifty in Nov 2022

- Reliance is the top weight at 10.98%, %, followed by HDFC Bank at 8.96%. 19.94 % of the Index.

- Reliance + HDFC Twins= 25.88% of Nifty (Hope you get why Nifty does not depict GDP. 25% of India’s GDP is not equal to Reliance +HDFC)

- HDFC Twins together constitute 14.90% of Nifty (Better than last month)

- Bottom 26 stocks have less than 1% weight and total weight at 28%

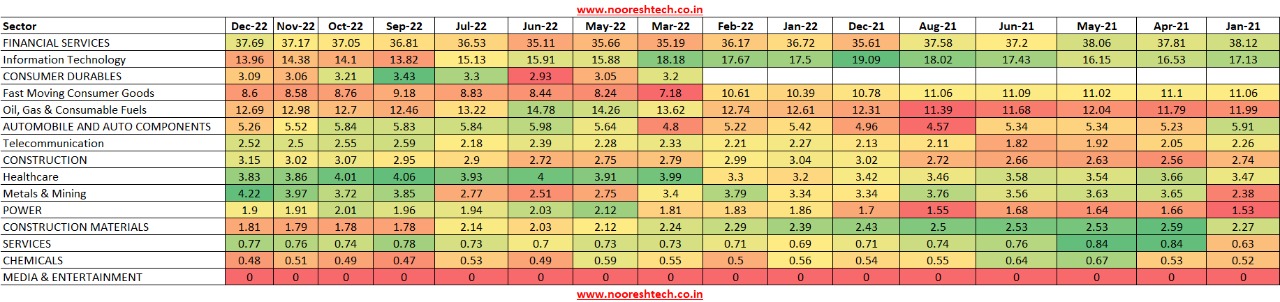

Sectoral Observations

-

Weightage Changes

- Banks and Financials are now increasing from recent low of 35.19% in March 2022 to 37.69% now. It has seen a bottom of 33.16 in July 2020.

- Power decreased to 1.90% from 2.01% (Oct 2022).

- Media at 0.

- Oil and Gas from 16.18% in July 2020 to 12.69%. 'Oil and Gas' is now renamed as 'Oil, Gas and Consumable fuels'. Coal India is now classified under Oil, Gas, and Consumable fuels. Earlier it was classified under Metals. IOC out from the index which was classified under Oil and Gas.

- Metals have increased from 2.77% in July 2022 to 4.22% . Coal India is now classified under ‘Oil, Gas and Consumable Fuels’. Earlier it was under Metals.

- IT weights increased from 14.48% in April 2020 to 19.09% in Dec 2021. Its weight reduced from 19.09% in December 2021 to 13.96% in Dec 2022.

- Automobile at 5.26%.

- Consumer Durables weight decreased to 3.09% from 3.43% (Sep 2022).

- Healthcare at 3.83%

Some changes in classification :

- Consumer goods sector is now divided into Consumer Durables and FMCG.

- 'Oil and Gas' now renamed as 'Oil, Gas and consumable fuels'. Coal India now classified under Oil, Gas and Consumable fuels. Earlier it was classified under metals. IOC out from index which was classified under Oil and Gas

- 'Automobile' Sector renamed as 'Automobile and Auto Components'.

- 'Metals' renamed as 'Metals and Mining'. Coal India no longer classified under this sector.

- 'Cement and Cement Products' sector renamed as 'Construction Material'.

- 'Pharma' sector renamed as 'Healthcare' and Apollo hospital is included in the index under this sector.

'Fertilizers and Pesticides' sector renamed as 'Chemicals'.

Do check this video on Nifty Calculator - https://www.youtube.com/watch?v=QbmhiLXYx2k

What is a Nifty Calculator?

-> As per the weightage given by NSE for Nifty stocks we have created the Nifty Calculator.

-> Change the expected price and the expected Nifty will change accordingly

-> Create 3 different sheets for yourself–

Pessimistic (where you put the worst possible prices you think. Default 10% down)

Optimistic (the best prices possible. Default 10% up)

Neutral/Rational/Technical / Fundamental (prices on any reasoning)

Please Note as weights change every day by a small margin this will not give an accurate estimate but will be approximate.

How to Guess?

- Everyone has a view on Nifty based on Macro, PE, Valuations, Technicals, Waves, etc. Try to grill it down to the constituents. It should be a reflection of your actual guesstimate.

- Just estimating wild scenarios on the top 20 stocks is enough given the 75-80% weight.

- Start with changing the default fall to 5-10-15-20-40-80 or rise to 5-10-20-40-80.

- Then change stocks that you think may not do the default move.

- Also do remember there is not a direct correlation between the economy with the Nifty.

Things to Note

- One of the reasons we keep posting this is to make an actual unbiased guess every month/quarter.

- There have been numerous warnings as to how markets are overheated. Understanding the constituents allows you to realize how Nifty is not supposed to reflect the Economy.

- Nifty is now at the middle from a recent low of 16747 and 18887 the highs.

- Putting in the numbers looks like we are going to stay sideways for some time. What’s your call?

Thank you for reading the article

Market Kya Lagta Hai

We came out with a Research Report - Market kya lagta hai? where we have highlighted few trends in Domestic Indices, Sectors and Stocks

Do buy it for 1499/-

https://www.instamojo.com/noooreshtech/market-kya-lagta-hai-trends-in-indices-secto/

Charts and view shared in the report:

- Nifty 50

- Nifty 500

- Nifty Mid 100

- Nifty Smallcap 100

- BSE Smallcap

- Nifty Bank

- Nifty PSE

- Nifty IT

- Nifty Auto

- Nifty Infra

- Nifty Metal

- Few Ratio Charts

- Sector on Radar: Sector 1 and Top Picks

- Sector on Radar: Sector 2 and Top Picks

- Sector on Radar: Sector 3 and Top Picks

- Few other stocks from smallcap / midcap space

- In total we have covered 14 stocks (Targets, Stoplosses along with the Technical Charts )