Whenever one is uncertain about the domestic market direction, one tends to look at the global indices on how are they shaping up.

Very different moves in different indices across the world.

Let us today look at the same,

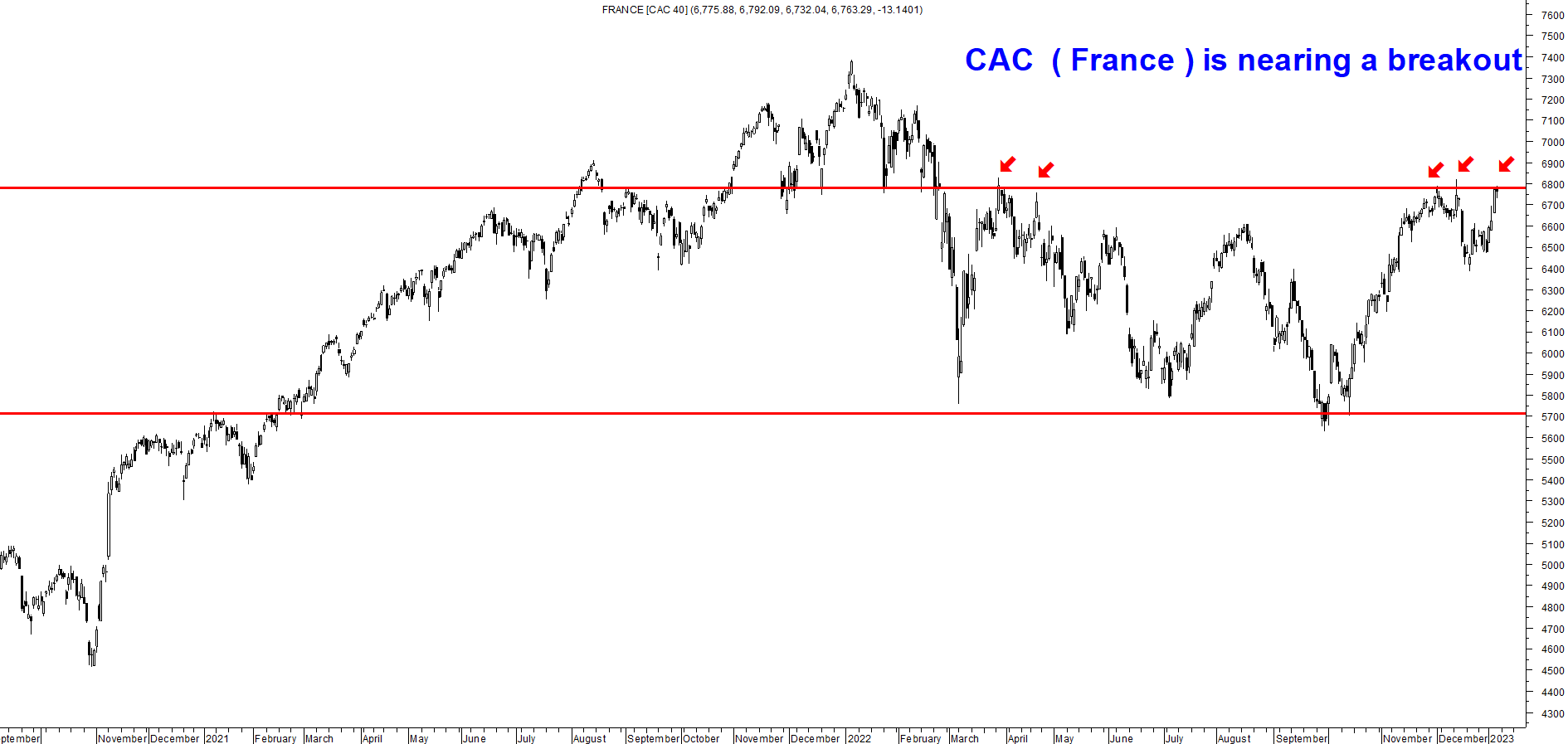

CAC (France)

- Made a top in Jan 2022, after which it is consolidating for a year

- Multiple bottoms at 5700 and multiple resistance at 6800

- Breakout above 6800 can take the index to its previous high around 7400

-

DAX (Germany)

- Made a top in Jan 2022, after which it is consolidating for a year

- Multiple bottoms at 12000-12500 and multiple resistance at 14500

- Breakout above 14600 can take the index to its previous high around 16200

-

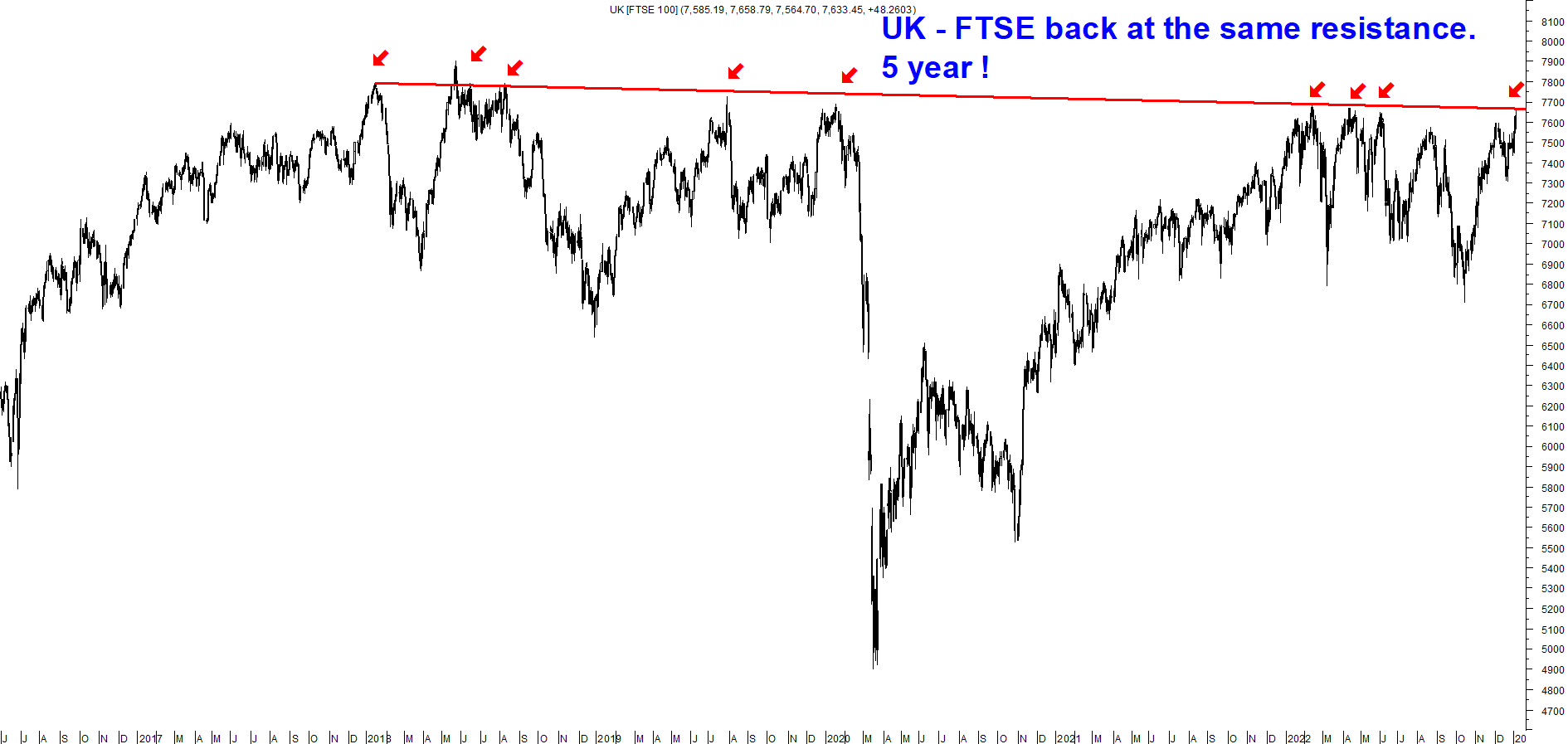

FTSE (UK)

- FTSE resisting at the same tops since 2018

- 6-7 tops around the same highs of 7700-7800

- A breakout above 7800 can be a multi year resistance breakout

-

CAC, DAX and FTSE the economies which were supposedly worst affected by the Russia-Ukraine War are at a cusp of breaking out !!

Lets us now look at US Indices,

Nasdaq 100 (US IT Bellwether)

- It has made a top in Dec 2021

- Since then, the index has corrected sharply from 16900 levels to 10500 levels, down roughly ~37-40% from the peak

- All the outperformance since covid have been wiped off

- Small support at 10500 zones, if it breaks, index can fall to pre covid highs and 2 year return of index will be zero

- Will it hold the support or break - need to watch the 10500 levels

-

Dow Jones Industrial Average (USA)

- Made a peak in Jan 2022

- Since then, slowly drifting down, making a low of 29000 in Oct 2022

- Sharp bounce since then and multiple resistance at 34500 zones

- Right now in a very tight range from 32500 to 33500

- A move above or below the above levels will decide the direction

-

DXY (Dollar Index)

- Dollar Index measures the strength of dollar against the leading world currencies

- It had seen a breakout in June 2022 where it went up from 103 odd levels to 114-115 levels

- After the peak in Sep 2022, it has retested the same breakout zones of 103 where it is taking the support again

- 100-103 becomes a key level to watch out for !!

-

-

Hong Kong – Up 40% from November lows. Still down 30% from 2021 and still below April-June 2022 highs.

China – A short term bounce but going nowhere.

Nifty (India)

- Now coming to Nifty, the index recently attempted to break of its Sep 2021 highs, however the breakout failed

- Immediate support at 17800

- If it breaks, the index can go to 16800

- Fresh breakout above 18600-700

-

Thank you for reading the article.

Market Kya Lagta Hai

Yesterday we came out with a Research Report - Market kya lagta hai? where we have highlighted few trends in Domestic Indices, Sectors and Stocks

Do buy it for 1499/-

https://www.instamojo.com/noooreshtech/market-kya-lagta-hai-trends-in-indices-secto/

Charts and view shared in the report:

- Nifty 50

- Nifty 500

- Nifty Mid 100

- Nifty Smallcap 100

- BSE Smallcap

- Nifty Bank

- Nifty PSE

- Nifty IT

- Nifty Auto

- Nifty Infra

- Nifty Metal

- Few Ratio Charts

- Sector on Radar: Sector 1 and Top Picks

- Sector on Radar: Sector 2 and Top Picks

- Sector on Radar: Sector 3 and Top Picks

- Few other stocks from smallcap / midcap space

- In total we have covered 14 stocks (Targets, Stoplosses along with the Technical Charts )